Filling my stock portfolio with steady compounders and sharing my analysis at https://t.co/mV9yIz8OeO

31 subscribers

How to get URL link on X (Twitter) App

2/ The dinner that changed everything:

2/ The dinner that changed everything:

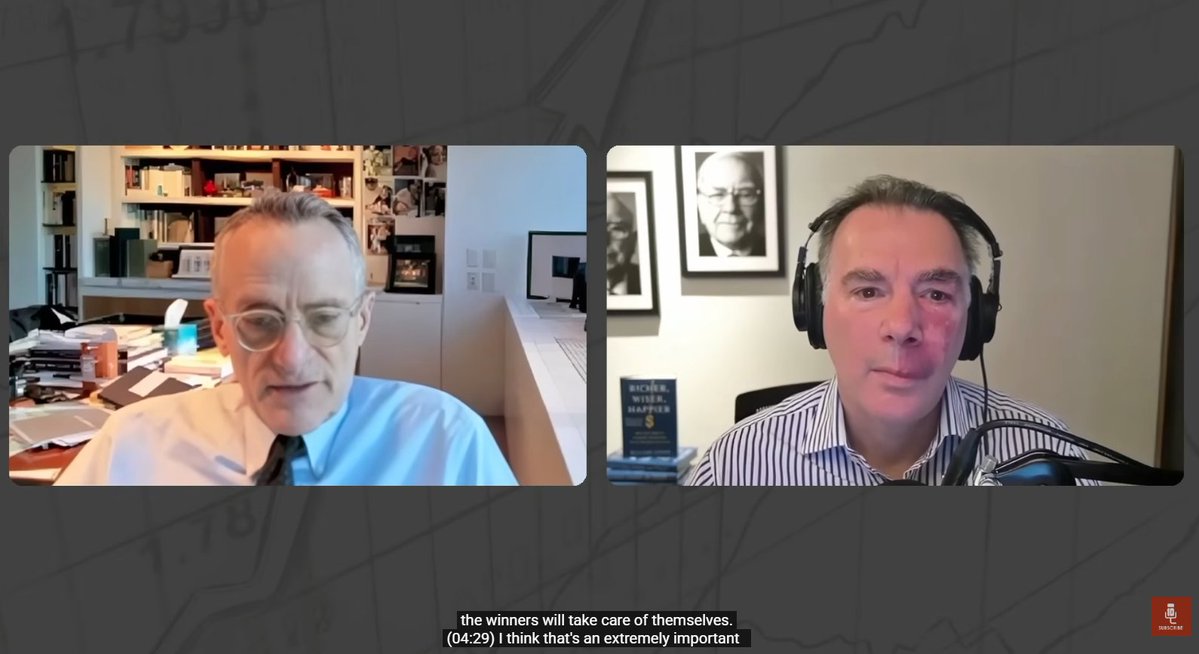

First, the big one: Gemini 3 confirmed pre-training scaling laws are still intact.

First, the big one: Gemini 3 confirmed pre-training scaling laws are still intact.

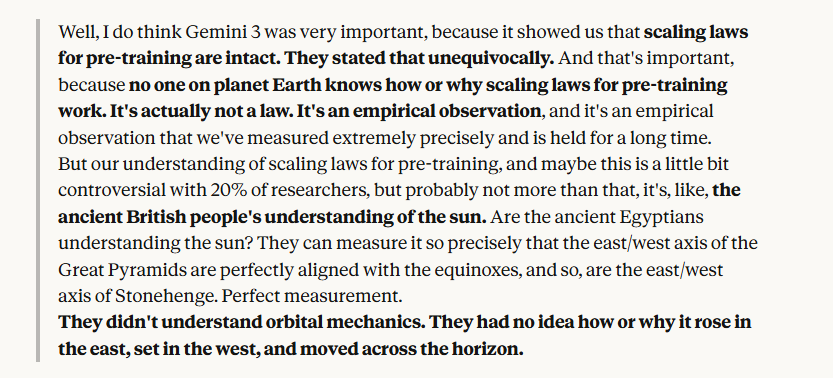

Chipotle's average check: $18

Chipotle's average check: $18

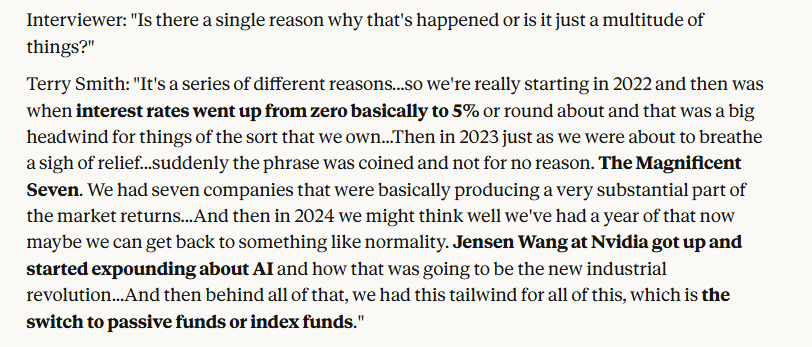

Smith breaks down the underperformance into distinct phases:

Smith breaks down the underperformance into distinct phases:

1/ Consumer spending deteriorated suddenly mid-September and it's persisting into Q4.

1/ Consumer spending deteriorated suddenly mid-September and it's persisting into Q4.

1. Risk Before Returns

1. Risk Before Returns

Bill Nygren's 3 pillars for beating the market for 3 decades:

Bill Nygren's 3 pillars for beating the market for 3 decades:

1/ The Keeper Test

1/ The Keeper Test

To start, I want to state that I don't agree with everything said. Some views are simply reframing to make the policies more palatable.

To start, I want to state that I don't agree with everything said. Some views are simply reframing to make the policies more palatable.

1. Adopt a mindset for longevity

1. Adopt a mindset for longevity

1/ Periods of high profitability leads to reckless investments.

1/ Periods of high profitability leads to reckless investments.

Most of the time, the best stocks can only be bought when they are most heavily criticized.

Most of the time, the best stocks can only be bought when they are most heavily criticized.

1. Respect the capital

1. Respect the capital

Proxy statements provide insights not found in annual reports.

Proxy statements provide insights not found in annual reports.