@HilajoPaul That’s something of which @LordsEconCom could make great play. So this is a LOAN charge? It’s applied to LOANS? But you’re charging income tax? Is that normal? No? So you’re arguing it’s not really a loan? So explain the IHT charge to us then? So it’s because of a loan write-off?

@HilajoPaul @LordsEconCom Let’s start again so Rangers deems income tax is due & this is accepted in Hoey, but the tax isn’t collectible from the individuals you pursue? So you created a charge on the loans that you say aren’t really loans but Rangers is basis for that? You’re still pursuing those people?

@HilajoPaul @LordsEconCom Ah, you’re only pursuing the people who did fully declare their loans/non-loans to you throughout. But you previously assessed them on their loans & the Courts said NO. So you pursued the wrong people on the wrong basis? But you want them to pay anyway?

@HilajoPaul @LordsEconCom The individuals you are pursuing, you can’t tax them using the Supreme Court ruling nor using the #loancharge, so now you are pursuing them under ToAA, explain that one to me? So you say it’s simultaneously their income & also the income of someone else? How did the Court rule?

@HilajoPaul @LordsEconCom Ah, so the Upper Tier Tax Tribunal didn’t agree with you either. You what? A discretion. Spell that for me. So now you say that you had a discretion all along to tax whom you like? Does that mean you never needed a #loancharge? So was it just for fun? Were the deaths unnecessary?

@HilajoPaul @LordsEconCom Okay so let’s get on to the post DR ‘loans’, if that’s what they are for a Loancharge to apply? They’re not? Okay so these non-loans aren’t repayable? Some are being recalled? How is the litigation of post DR loans going if not Rangers? It’s never started? Due to the #loancharge!

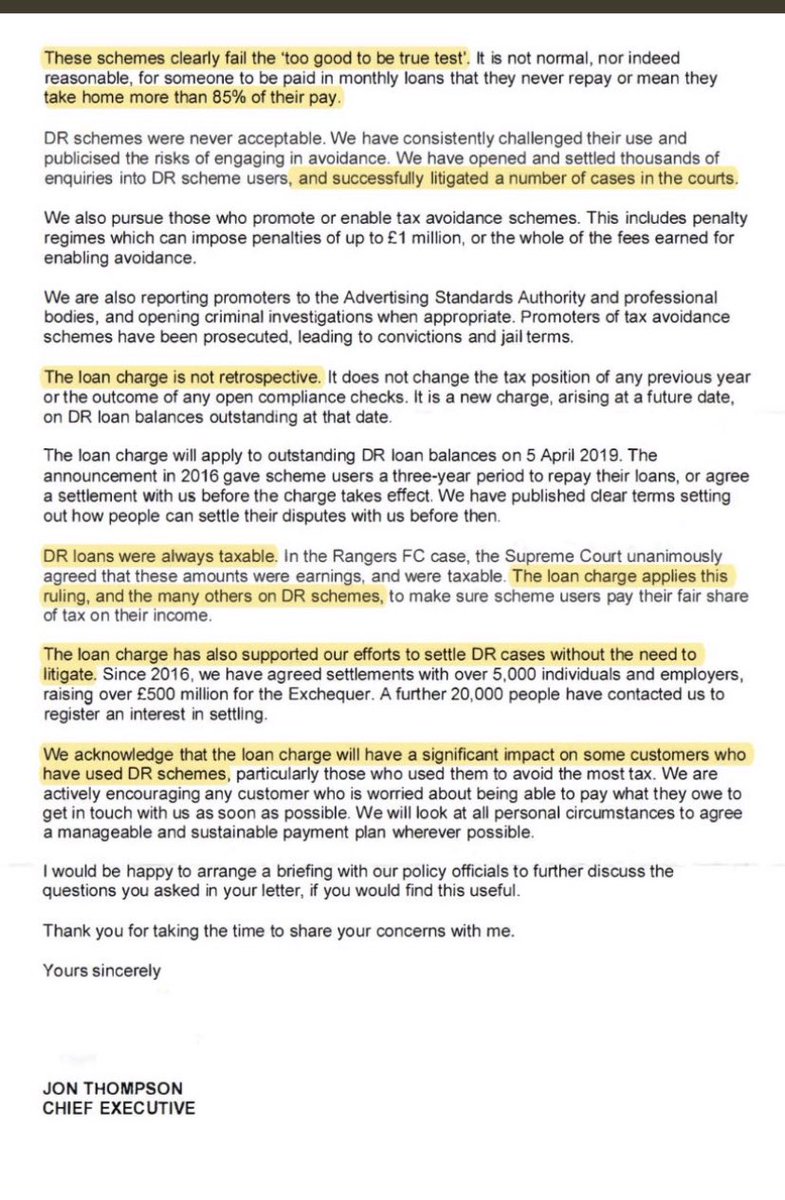

@HilajoPaul @LordsEconCom But you surely have a basis for this charge Mr Harra? You told Parliament that loans were not repayable & that it was always income & that Rangers proved that & this was just applying the ruling & was supported by many other cases…..No? Nasty Promoters you say? Hoodwinked huh?

@HilajoPaul @LordsEconCom Do you have a basis for this new retrospective #loancharge Mr Harra?

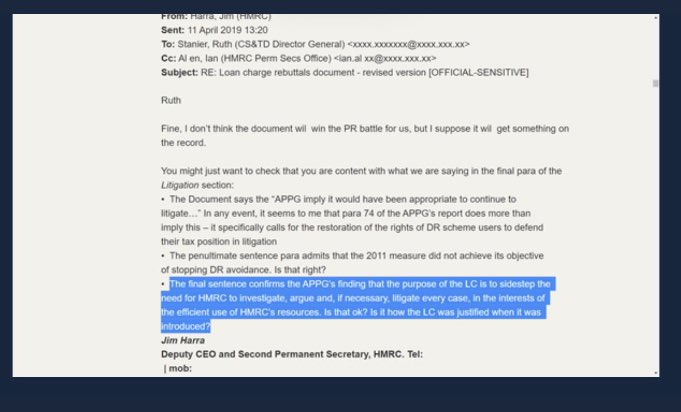

Yes it’s to sidestep the need for HMRC to investigate, argue & if necessary litigate. In other words to do their job & respect the legal rights taxpayers understood they had. The #loancharge is simply expedient

Yes it’s to sidestep the need for HMRC to investigate, argue & if necessary litigate. In other words to do their job & respect the legal rights taxpayers understood they had. The #loancharge is simply expedient

• • •

Missing some Tweet in this thread? You can try to

force a refresh