In less than 2 years, Disney+ notched 104m subscribers and is prob worth $100B+ as a standalone entity.

How did Disney build a Netflix competitor so fast? By acquiring a tech firm spun out from MLB (yes, Major League Baseball) for $2.6B.

Here's the story 🧵

How did Disney build a Netflix competitor so fast? By acquiring a tech firm spun out from MLB (yes, Major League Baseball) for $2.6B.

Here's the story 🧵

1/ It starts in 2000: the height of Dotcom.

MLB Commissioner Bud Selig wants to consolidate digital rights and create websites for the league's 30 teams.

To make sure the project is "fair" to every team, he creates an independent arm: MLB Baseball Advanced Media (BAM).

MLB Commissioner Bud Selig wants to consolidate digital rights and create websites for the league's 30 teams.

To make sure the project is "fair" to every team, he creates an independent arm: MLB Baseball Advanced Media (BAM).

2/ To fund BAM, Selig asks for a $4m commitment ($1m per year for 4 years) across all 30 teams = $120m.

The first big project -- MLB .com -- is outsourced to a consulting firm. It's a complete disaster.

Lesson learnt: BAM will now create everything in-house.

The first big project -- MLB .com -- is outsourced to a consulting firm. It's a complete disaster.

Lesson learnt: BAM will now create everything in-house.

3/ In 2001, Japanese sensation Ichiro Suzuki (the OG Ohtani) joins the Seattle Mariners.

BAM creates an audio streaming product so that Japanese fans can listen to games lives.

They spend millions on the product but it totally flops...getting less than 1k subscribers.

BAM creates an audio streaming product so that Japanese fans can listen to games lives.

They spend millions on the product but it totally flops...getting less than 1k subscribers.

4/ With these failures, BAM looks doomed.

Running low on cash, the unit catches a break: MLB gives BAM ticketing rights.

BAM then tells TicketMaster "pay up or no baseball". The ticket giant ends up giving BAM $10m, which it uses on its next bet: streaming video.

Running low on cash, the unit catches a break: MLB gives BAM ticketing rights.

BAM then tells TicketMaster "pay up or no baseball". The ticket giant ends up giving BAM $10m, which it uses on its next bet: streaming video.

5/ On August 26th, 2002, the MLB streams its first ever game: New York Yankees vs. Texas Rangers.

This is 3 years before YouTube is launched.

30k people watch at a pathetic speed of 280 kilobits per second (one BAM exec calls is like "watching a flip book").

This is 3 years before YouTube is launched.

30k people watch at a pathetic speed of 280 kilobits per second (one BAM exec calls is like "watching a flip book").

6/ Even so, fans LOVE it.

For the 2003 season -- 4 years before Netflix streams -- MLB TV debuts and 100k fans pay $80 for access to live stream games.

BAM is now stable and only takes $77m (of the $120m commitment) from team owners before paying a dividend.

For the 2003 season -- 4 years before Netflix streams -- MLB TV debuts and 100k fans pay $80 for access to live stream games.

BAM is now stable and only takes $77m (of the $120m commitment) from team owners before paying a dividend.

7/ With a cash cow in place, BAM starts innovating.

It figures out how to handle live audiences at scale, video quality and key issues that every streaming service will eventually face:

It figures out how to handle live audiences at scale, video quality and key issues that every streaming service will eventually face:

8/ By mid-2010s, BAM is the fastest and most cost-effective streaming provider.

BAM builds for the WWE ('14), NHL ('15), PGA ('15), Playstation ('15) and HBO Now ('15).

HBO thought it would cost $900m over 3yrs (BAM did it for $50m in 3.5 months).

BAM builds for the WWE ('14), NHL ('15), PGA ('15), Playstation ('15) and HBO Now ('15).

HBO thought it would cost $900m over 3yrs (BAM did it for $50m in 3.5 months).

9/ To reach its full potential, MLB spins out BAM as "BAM Tech" in 2015 (sales = $900m, employees = 800+).

Enter Disney: the media conglomerate knows streaming is the future and needs expertise.

In August 2016, it buys 1/3rd of BAM for $1B with the option to buy more.

Enter Disney: the media conglomerate knows streaming is the future and needs expertise.

In August 2016, it buys 1/3rd of BAM for $1B with the option to buy more.

10/ In August 2017, Disney drops another $1.6B ($2.6B total) to own 75% of BAM Tech.

It then announces it will launch streaming for: 1) ESPN (sports network); and 2) its outrageous IP catalogue (Marvel, Star Wars, Pixar, Classics).

BAM Tech becomes Disney Streaming Services.

It then announces it will launch streaming for: 1) ESPN (sports network); and 2) its outrageous IP catalogue (Marvel, Star Wars, Pixar, Classics).

BAM Tech becomes Disney Streaming Services.

11/ At first, many are critical of the Disney deal.

Former CBS head Les Moonves says "We didn’t buy BAM Tech for a zillion dollars. We [built streaming] internally."

As it turns out, timing is everything: Disney+ launches in November 2019, months before a global pandemic.

Former CBS head Les Moonves says "We didn’t buy BAM Tech for a zillion dollars. We [built streaming] internally."

As it turns out, timing is everything: Disney+ launches in November 2019, months before a global pandemic.

12/ With the stay-at-home orders in place, Disney+ is among the big COVID media winners.

By March 2021 (1.5 years from launch), Disney's streaming service reaches 100m subs.

A *much* faster pace than Netflix or AMZN Prime, all powered by the artist formerly known as BAM Tech.

By March 2021 (1.5 years from launch), Disney's streaming service reaches 100m subs.

A *much* faster pace than Netflix or AMZN Prime, all powered by the artist formerly known as BAM Tech.

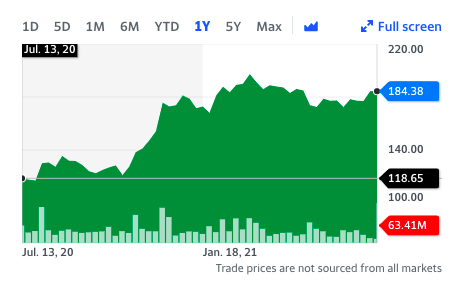

13/ Today, Disney+ has ~104m subs.

Of course, you can't actually *separate* Disney+ from its parent. But using the same "market cap-per-sub" ratio as Netflix gives Disney+ a standalone value of $119B.

While that is ~35% of Disney's total value...

Of course, you can't actually *separate* Disney+ from its parent. But using the same "market cap-per-sub" ratio as Netflix gives Disney+ a standalone value of $119B.

While that is ~35% of Disney's total value...

14/ ...it's not an outrageous value guessimate.

Consider this: $DIS is up 55% of the past year, from $212B to $330B. That's a $118B market cap gain even as its parks, cruise and theatre businesses have been mostly shuttered.

Consider this: $DIS is up 55% of the past year, from $212B to $330B. That's a $118B market cap gain even as its parks, cruise and theatre businesses have been mostly shuttered.

15/ And lets not forget that -- last fall -- Disney frickin' reorganized the entire company around its direct-to-consumer streaming business.

16/ The latest data point.

Disney released the Marvel film "Black Widow" over the weekend. It had the largest COVID-era box office domestic opening in the US: $80m.

The film also came streamed on Disney+...where it pulled in nearly as much money: $60m.

Thank you BAM Tech.

Disney released the Marvel film "Black Widow" over the weekend. It had the largest COVID-era box office domestic opening in the US: $80m.

The film also came streamed on Disney+...where it pulled in nearly as much money: $60m.

Thank you BAM Tech.

17/ If you enjoyed that, follow @TrungTPhan for other business breakdowns and some really dumb memes:

https://twitter.com/TrungTPhan/status/1414100900591906819?s=20

18/ Sources

NYT: nytimes.com/2017/10/08/bus…

Matthew Ball Thread:

The Diff: diff.substack.com/p/disneys-pivot

The Verge (core article): theverge.com/2015/8/4/90908…

NYT: nytimes.com/2017/10/08/bus…

Matthew Ball Thread:

https://twitter.com/ballmatthew/status/1117886864495525888?s=20

The Diff: diff.substack.com/p/disneys-pivot

The Verge (core article): theverge.com/2015/8/4/90908…

19/ Other thoughts:

◻️ Between 2009-19, Disney spent $80B on content (Marvel, LucasFilms/StarWars, Fox). BAM Tech at a fraction of spend ($2.6B) was the streaming unlock.

◻️ Can BAM Tech be in the same ballpark as FB/Instagram ($1B) and Google/YouTube ($1.6B) for value creation?

◻️ Between 2009-19, Disney spent $80B on content (Marvel, LucasFilms/StarWars, Fox). BAM Tech at a fraction of spend ($2.6B) was the streaming unlock.

◻️ Can BAM Tech be in the same ballpark as FB/Instagram ($1B) and Google/YouTube ($1.6B) for value creation?

20/ If you prefer Disney parks to streaming, check this LOL.

https://twitter.com/TrungTPhan/status/1408440552027168771?s=20

21/ Worth adding here the subscriber boost from Disney's acquisition of Fox (which includes Hotstar, an major Indian streaming asset).

Having said that: Disney+ was in the works 2 years before the Fox deal.

Having said that: Disney+ was in the works 2 years before the Fox deal.

https://twitter.com/harshendar/status/1414971565456777216?s=20

22/ Lastly, I deserve to get roasted for underselling Disney's existing IP that BAM Tech took to streaming:

https://twitter.com/josephflaherty/status/1414971582901067778?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh