Colgate-Palmolive India Ltd

Annual Report FY21 Summary

Going by many investment gurus, Colgate falls under the 'Keep it Simple' category. No buzzwords nor anything enticing.

Stock has given 14.25% CAGR returns since it got listed in 1994..27 years!

A Thread

Annual Report FY21 Summary

Going by many investment gurus, Colgate falls under the 'Keep it Simple' category. No buzzwords nor anything enticing.

Stock has given 14.25% CAGR returns since it got listed in 1994..27 years!

A Thread

1/n

Ram Raghavan's(Managing Director) message to shareholders where he gives glimpse on innovations in Oralcare and new product launches.

Ram Raghavan's(Managing Director) message to shareholders where he gives glimpse on innovations in Oralcare and new product launches.

2/n

Innovations & launches

(1) Colgate Vedshakti: Mouth protect spray & oil pulling

(2) Diabetics Toothpaste

(3) Visible White Instant Toothpaste

(4) Zig-Zag Anti Bacterial & Turmeric Toothbrush

(5) Super Flexi salt toothbrush

(6) Gentle range of toothbrushes

Innovations & launches

(1) Colgate Vedshakti: Mouth protect spray & oil pulling

(2) Diabetics Toothpaste

(3) Visible White Instant Toothpaste

(4) Zig-Zag Anti Bacterial & Turmeric Toothbrush

(5) Super Flexi salt toothbrush

(6) Gentle range of toothbrushes

3/n

(7) Colgate-Palmolive Charcoal & Mint bodywash

(8) Colgate DentistsforMe App for people to reach out to Dentists via their platform

(7) Colgate-Palmolive Charcoal & Mint bodywash

(8) Colgate DentistsforMe App for people to reach out to Dentists via their platform

4/n

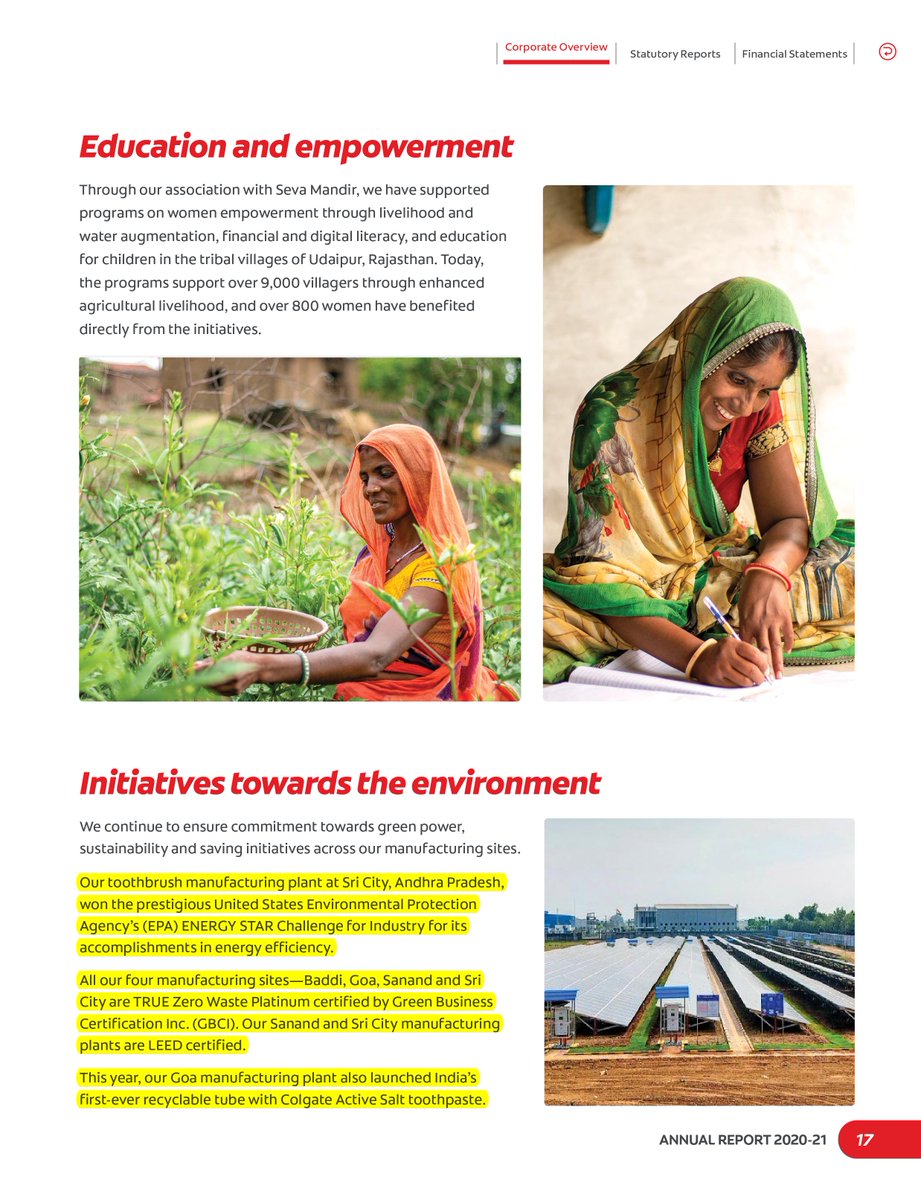

Initiatives towards Environment

All four manufacturing sites—Baddi, Goa, Sanand and Sri City are TRUE Zero Waste Platinum certified by Green Business Certification Inc. (GBCI). Our Sanand and Sri City manufacturing plants are LEED certified.

Initiatives towards Environment

All four manufacturing sites—Baddi, Goa, Sanand and Sri City are TRUE Zero Waste Platinum certified by Green Business Certification Inc. (GBCI). Our Sanand and Sri City manufacturing plants are LEED certified.

6/n

Board of Directors. I believe People who have been nurtured by company and grown to become leaders give lot of value to the company.

Mukul Deoras-Chairman-Joined since 2004

Ram Raghavan-MD- Joined as a Trainee

M Chandrasekar-Ex VP- Joined 1989

M.S. Jacob-CFO- Joined 1995

Board of Directors. I believe People who have been nurtured by company and grown to become leaders give lot of value to the company.

Mukul Deoras-Chairman-Joined since 2004

Ram Raghavan-MD- Joined as a Trainee

M Chandrasekar-Ex VP- Joined 1989

M.S. Jacob-CFO- Joined 1995

7/n

Management Discussion & Analysis Report

90% of revenues come from Oral Care.

Four key drivers company has worked towards- assortment, availability, value and innovation.

Management Discussion & Analysis Report

90% of revenues come from Oral Care.

Four key drivers company has worked towards- assortment, availability, value and innovation.

10/n

Once company is able to increase it's sales on backing of new product launches, then Colgate should do extremely well.

A good compounder and I believe it falls under Charlie Munger's line - " Take a simple idea and take it seriously."

#colgate

#investing

#Fibonalysis

Once company is able to increase it's sales on backing of new product launches, then Colgate should do extremely well.

A good compounder and I believe it falls under Charlie Munger's line - " Take a simple idea and take it seriously."

#colgate

#investing

#Fibonalysis

• • •

Missing some Tweet in this thread? You can try to

force a refresh