It wont surprise many that the House of Lords inquiry into QE did not produce a Radcliffe Report - but is more hawkish than I expected.

ft.com/content/60d239…

ft.com/content/60d239…

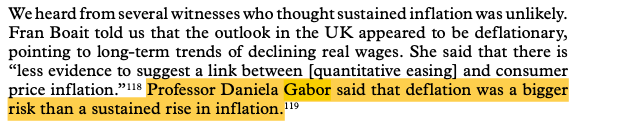

first, it's somehow concluded that QE may be inflationary, while simultaneously calling @bankofengland to clarify how QE generates inflation

@bankofengland 'slaves to which defunct (monetary) economists?' via quick word count in 68 pages report:

* 'inflation' x ≈ 200 times

* 'money supply' x 1

* 'fiscal' x 60

* 'coordination' fiscal&monetary x 2

* 'market liquidity' x 4

Milton alive in spirit, if not theoretical essence

* 'inflation' x ≈ 200 times

* 'money supply' x 1

* 'fiscal' x 60

* 'coordination' fiscal&monetary x 2

* 'market liquidity' x 4

Milton alive in spirit, if not theoretical essence

@bankofengland My testimony has sadly failed to convince Committee that you cannot worry about 'deficit financing ' without understanding why it's necessary structurally in sovereign-bond based macrofinancial regime

Coordination fiscal-monetary matters not just because financial system is so different from age of Friedmanite obsessions with inflation, but also because climate crisis

Report reduces complex questions of fiscal-monetary interactions to 'how do we manage peculiarities of institutional arrangement Treasury - BoE?'

hiding theoretical and structural issues in an operational Trojan Horse

hiding theoretical and structural issues in an operational Trojan Horse

one picture that exquisitely captures lack of any macrofinancial lens in this report.

through macrofinancial lens, state issues both reserves and gilts (sovereign bonds) to private finance

gilts do for market-based finance what reserves do for banks

through macrofinancial lens, state issues both reserves and gilts (sovereign bonds) to private finance

gilts do for market-based finance what reserves do for banks

if there is a substantive failure from Bank of England, it's the failure to communicate clearly the macrofinancial role that government bonds play *

* great Andrew Hauser speeches notwithstanding

* great Andrew Hauser speeches notwithstanding

https://twitter.com/DanielaGabor/status/1355163318797930497?s=20

this is the monetary world we live in:

we worry about inflation, we insinuate fiscal dominance, we condemn central banks' self-harming insistence on buying sovvies, we remain oblivious to the obvious explanation: they HAVE to

we worry about inflation, we insinuate fiscal dominance, we condemn central banks' self-harming insistence on buying sovvies, we remain oblivious to the obvious explanation: they HAVE to

https://twitter.com/DanielaGabor/status/1355161368064905219?s=20

to make sense of Report's focus on inflation, read this brilliant @MkBlyth piece

theguardian.com/commentisfree/…

theguardian.com/commentisfree/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh