HDFCBANK trade opened with view on results :

View : Bullish

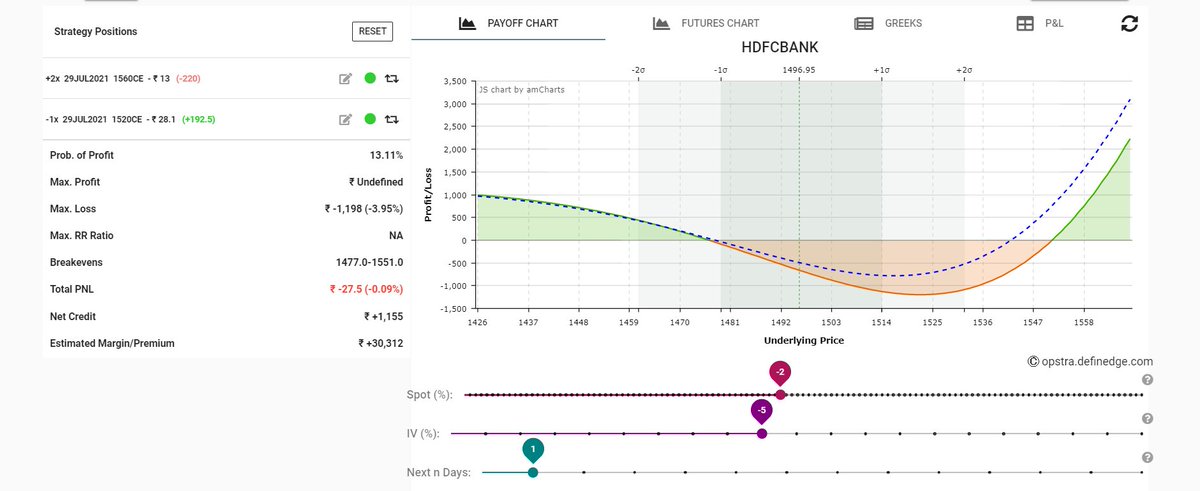

Strategy: CE Backspread

Sold 1*1520CE at 28 & bought 2*1560CE at 13

Net credit =Rs.2

Payoff diagram for Monday

View : Bullish

Strategy: CE Backspread

Sold 1*1520CE at 28 & bought 2*1560CE at 13

Net credit =Rs.2

Payoff diagram for Monday

I will trade all the major results, expect to win max 40% of the trades. Will lose small if wrong, will win large if big. So I am looking at net payoff over at least 10 trades. A single win/loss does not matter. Trade will be sqedoff the day post results, so holding is 1 day

The first trade of this series was INFY, won a small amount . This is the next one.

Keeping max amount risk at 10k per trade

Keeping max amount risk at 10k per trade

• • •

Missing some Tweet in this thread? You can try to

force a refresh