I want to introduce one of the coolest features we've been working on at @fraxfinance called veFXS gauges. Arguably the biggest innovation @CurveFinance introduced after their stableswap invariant was their gauge tokenomics. $FRAX is gauges on steroids 🚀

🧵

🧵

For those unfamiliar, users can lock Curve's $CRV token up to 4 years to vote on "gauge weights" that are tallied up every 7 days. Why is this a big deal? Each Curve pool has a gauge weight that signifies the amount of CRV token rewards it gets for 7 days until the next reweight.

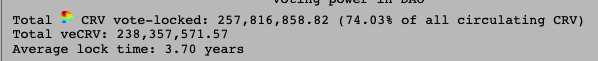

People lock so much $CRV to control future emission with whales @ConvexFinance @iearnfinance @StakeDAOHQ vying for kingmaker roles. If you deposit stablecoins with them, they'll vote for the Curve pool that maximizes their APY. 74% of all CRV is locked on average of 3.7 years!

Imagine a new stablecoin. One of the most important things is for foundational protocols to integrate you. In order for that you need liquidity -> need Curve -> need gauge weight -> need yearn vault -> users etc..

See where this is going? This mechanism has become DeFi's rulebook

See where this is going? This mechanism has become DeFi's rulebook

IMO this is the best farming token design in crypto. Notice $CRV itself captures the value of being able to control its own emission. If Curve picked where $CRV goes through loose governance, the immense buy pressure for $CRV to control its future emission would not exist.

This isn't the only benefit of veCRV. Staking veCRV gets Curve's fee revenue dividended out. So you get paid to go long term $CRV & control gauges. veFXS gets you juicy cash flow too but with FRAX's AMO profits. Even in this market that's 75% APR. 30% of FXS is locked!

@AndreCronjeTech has already gotten many projects to consider the veToken model. @Picklefinance DILL, @SushiSwap oSushi, @CreamdotFinance iceCREAM. veYFI soon? 🧐 This proves how important this model is. But one thing is missing, veToken for the money layer. That's veFXS!

FRAX's gauges work similarly but for the money/top layer. While Curve is mainly interested in getting TVL for their pools, $FRAX only cares about the money layer. We've built something similar but allow gauges to be ANY pool on ANY chain on ANY protocol that integrates $FRAX.

This is extremely powerful because we can have a veFXS gauge for our Curve pool, our new UNI V3 pools, & any new partners.

In order to control the future 40%+ of FXS emission, you'll need veFXS. Want an extremely deep dollar denominated pool for your token? Get a FRAX gauge :)

In order to control the future 40%+ of FXS emission, you'll need veFXS. Want an extremely deep dollar denominated pool for your token? Get a FRAX gauge :)

If you want a gauge for your protocol, the earlier the better since becoming the Yearn+Convex+StakeDAO of the money layer is still up for grabs until veFXS is fully accumulated. Maybe AMOs will be decided by gauges someday ;) veFXS = money printer

Specs:

docs.frax.finance/vefxs/gauge

Specs:

docs.frax.finance/vefxs/gauge

• • •

Missing some Tweet in this thread? You can try to

force a refresh