WARNING - Long thread @ptrmadurai @mkstalin

The union government seems to be in no mood to cut the excise duty. The FM @nsitharaman recently said that “State govts can give relief by reducing taxes or levies on petrol.”

How fair is that as SG is in NO Position to Cut ST / VAT.

The union government seems to be in no mood to cut the excise duty. The FM @nsitharaman recently said that “State govts can give relief by reducing taxes or levies on petrol.”

How fair is that as SG is in NO Position to Cut ST / VAT.

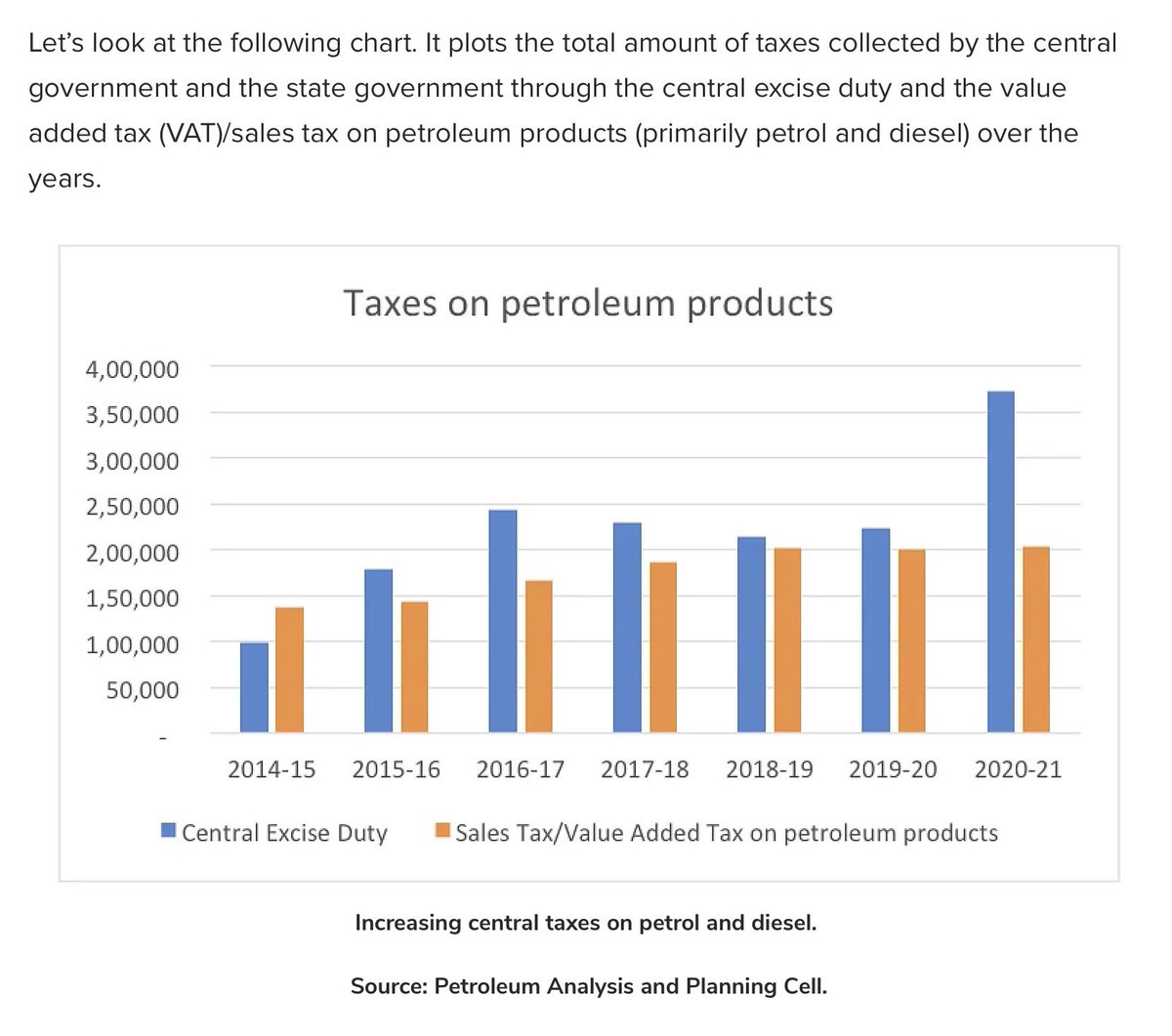

When it comes to petrol, the central government tax has gone up from Rs 10.39 per litre in 2014-15 to Rs 32.90 per litre now, a rise of 217%. This has led to a massive increase in tax collections from sale of petroleum products at the central government level.

The ST/VAT earned by SG from petroleum products has remained largely flat between 2014-15 & 2020-21. It was at 1.1% of the GDP in 2014-15 & at 1% of the GDP in 2020-21. But GG tax has gone from 0.8% of GDP to 1.9% of GDP during same period leading to higher pump prices for P& D

As we can see from the above chart, the taxes state governments earned through the sales tax or VAT, on petroleum products have more or less stayed constant and in line with the size of the economy.

Also, it needs to be mentioned here that since the Goods and Services Tax (GST) has come into the picture, the ability of the state governments to earn taxes has gone down. So, state governments are in no position to cut the sales tax or VAT on petrol and diesel.

The union government has ended up in this situation primarily because CORPORATE TAX COLLECTIONS have collapsed from 3.5% of the GDP in 2018-19 to 2.3% in 2020-21. This is because in September 2019, the base corporate tax rate was cut to 22% from the earlier 30%.

Basically, the central government now is totally dependent on excise duty on petrol and diesel, in order to compensate for the drop in corporate taxes.

Which is why in all its public communication to drive the right narrative, it has been blaming high oil prices for the rise in the pump prices of petrol and diesel. While high oil prices are to blame, the higher central excise duty is also responsible for the prevailing situation

Courtesy …thequint.com/voices/opinion… #PetrolPriceHike

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh