Now that all the clubs in the Scottish Premiership have finally published their accounts for the 2019/20 season, here is an overview of their financials, which were adversely impacted by the season’s early closure due to the COVID-19 pandemic #spfl

Most Scottish Premiership clubs aim for break-even with 5 making small profits, led by Hearts £0.5m and Motherwell £0.3m. #RangersFC £17.5m post-tax loss is the big outlier, especially compared to #CelticFC £0.4m deficit, largely due to their recent investment in the squad.

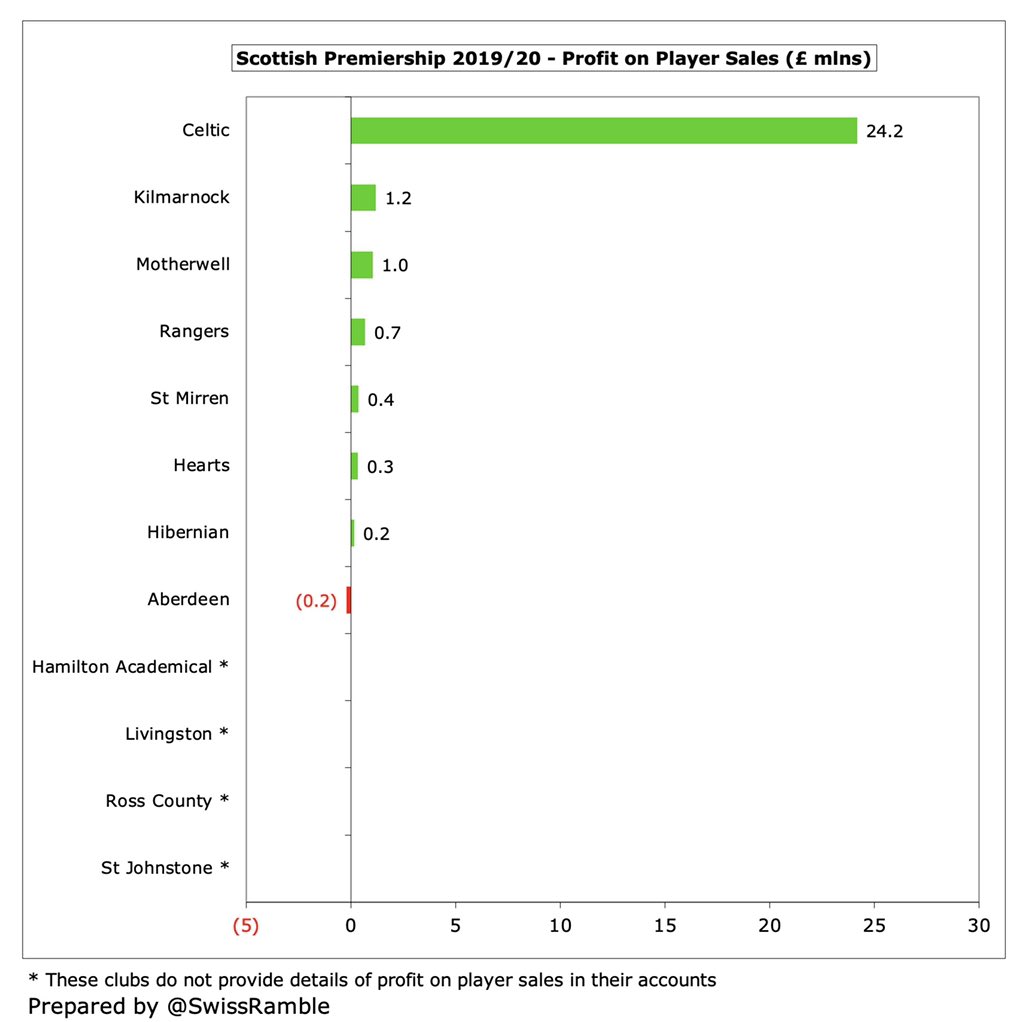

However, it is worth noting that #CelticFC were boosted by £24m profit from player sales, largely due to Kieran Tierney’s move to Arsenal, which was significantly higher than other Scottish clubs. The next highest were Kilmarnock £1.2m, Motherwell £1.0m and #RangersFC £0.7m.

The Old Firm had by far the largest operating losses (i.e. excluding player sales and interest) with #CelticFC being highest at £24.5m then #RangersFC £15.9m. Next highest was Hibernian with just £1.4m. Hearts was the only club with an operating profit, thanks to £3.7m donations.

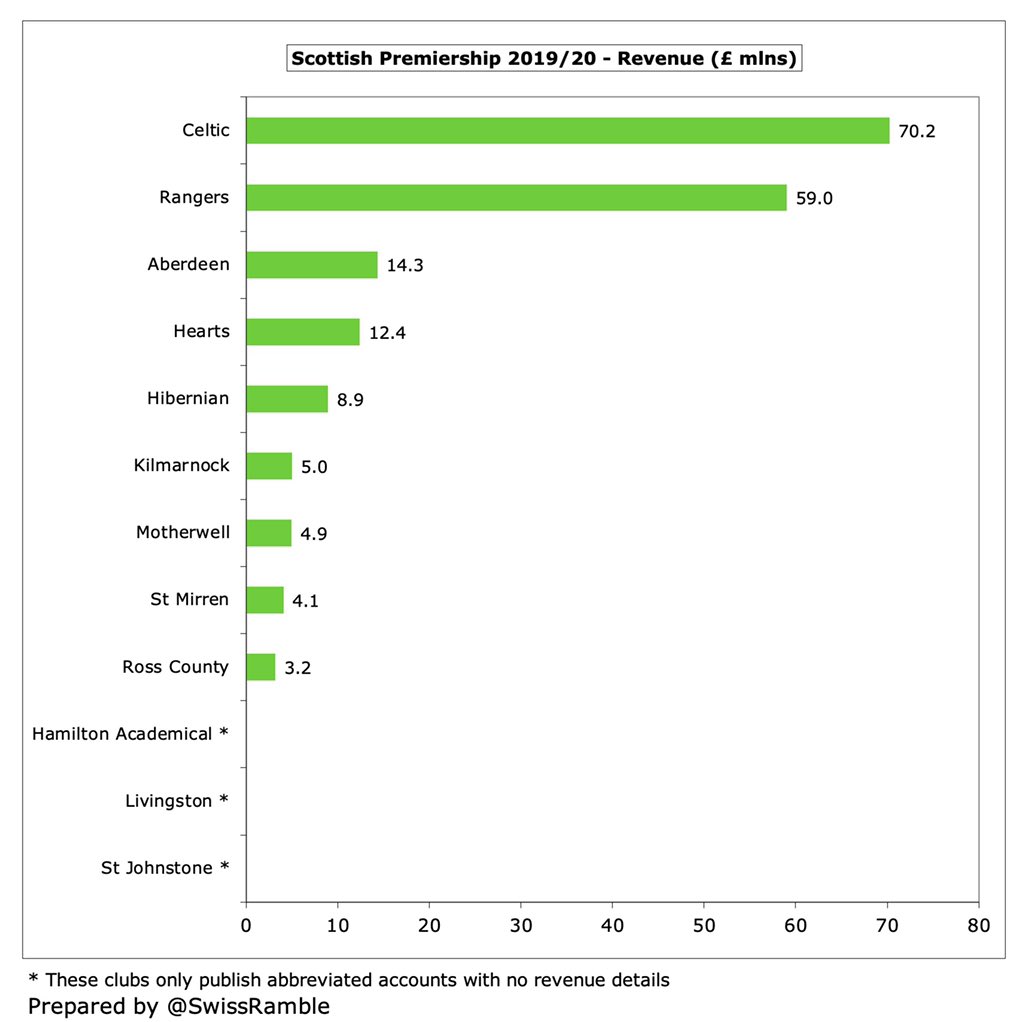

#CelticFC had the highest revenue with £70m, though the gap to #RangersFC £59m has narrowed. Both Glasgow clubs earn at least four times as much as other Scottish clubs with closest challengers being Aberdeen £14m, Hearts £12m, Hibernian £9m and Kilmarnock £5m.

Revenue for most Scottish clubs fell in 2019/20, partly due to the impact of COVID-19, but #RangersFC increased by £6m (11%), due to reaching Europa League last 16. In contrast, #CelticFC revenue dropped £13m (16%) with match day and commercial heavily affected by the pandemic.

#CelticFC £35.8m match day revenue was just ahead of #RangersFC £35.7m, then a big drop to Hearts £5.1m, Aberdeen £3.7m and Motherwell £1.5m. All clubs adversely impacted by season’s early closure, though Rangers boosted by Europa League run and 5% ticket price increase.

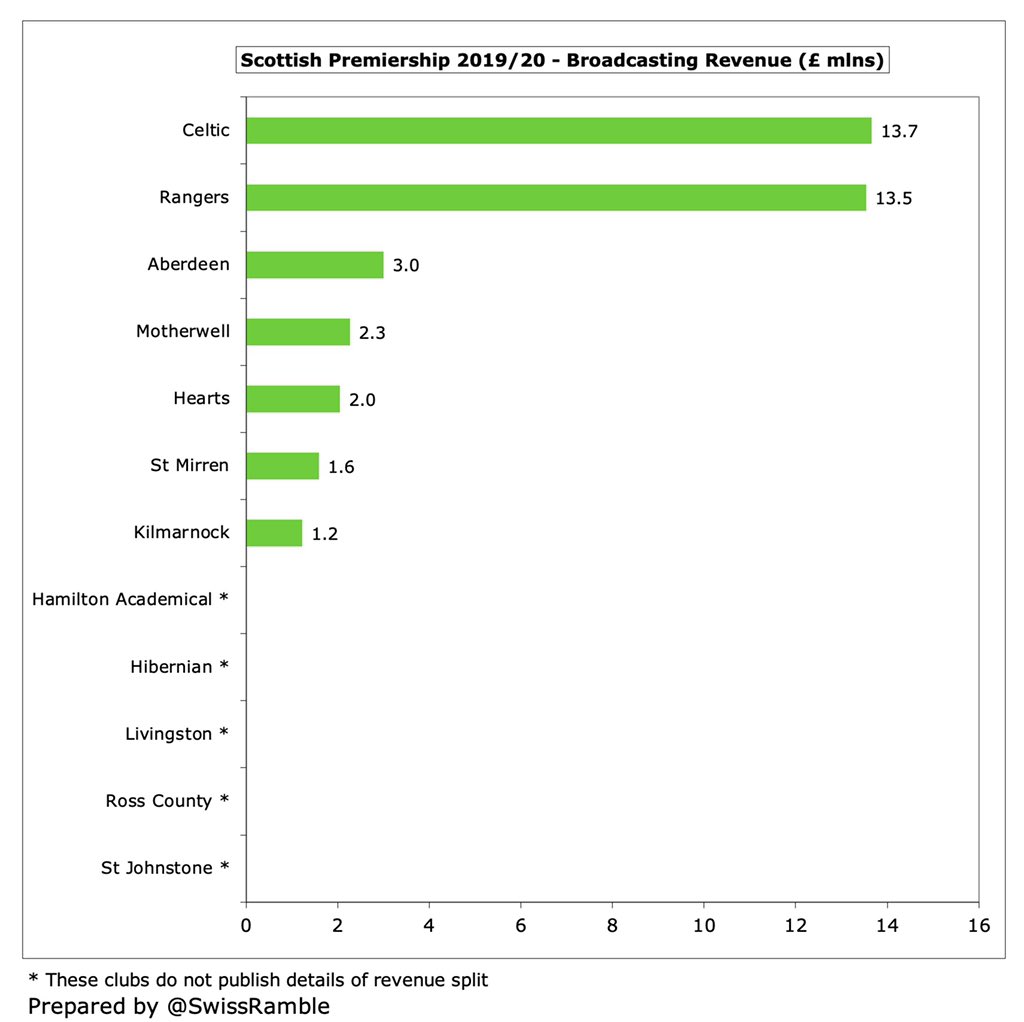

Similarly, #CelticFC £13.7m broadcasting income was just above #RangersFC £13.5m, with both of them a long way ahead of the other Scottish clubs: Aberdeen £3.0m, Motherwell £2.3m and Hearts £2.0m.

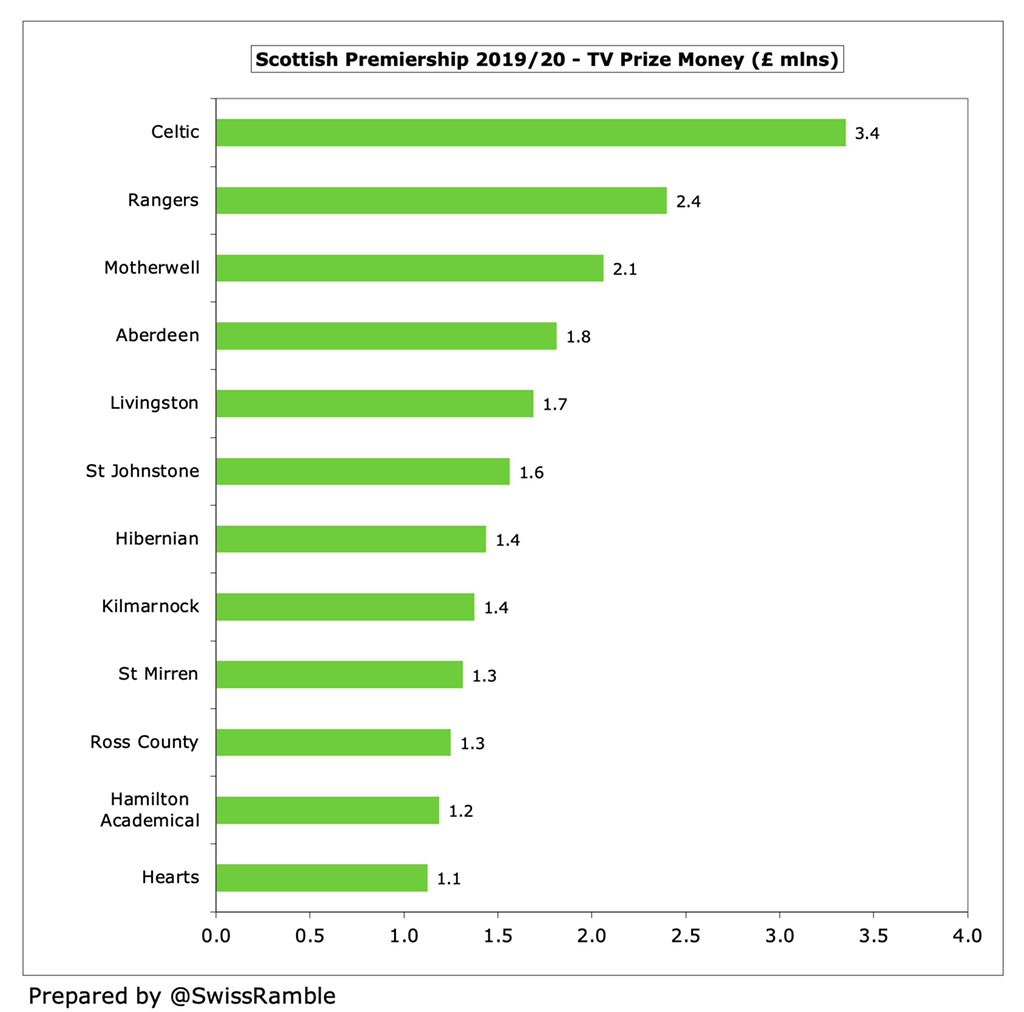

The Scottish Premiership TV deal is very low, so #CelticFC only received £3.4m for winning the title in 2020. To put this into perspective, Premier League winners got £152m, while last place was worth £97m. Even a Championship club (no parachute payments) got twice as much £7m.

There is a new 5-year Scottish TV deal with Sky Sports worth £30m (€34m) a year from 2020/21 (up from £25m), but this is not going to move the needle by much. It’s still much lower than Poland Ekstraklasa €58m and Belgium Jupiler League €83m, let alone Premier League €3.6 bln

The Glasgow clubs’ broadcasting revenue was boosted by the Europa League: #CelticFC £9.9m earned more than #RangersFC £9.2m, despite only reaching last 32 compared to last 16, due to higher UEFA coefficient (based on last 10 year’s results) and better results in the group.

Reaching the Champions League group stage can make a big difference to Scottish clubs, e.g. the last time #CelticFC managed this in 2018 they received £30m TV money. On top of that, a club would have higher gate receipts and an uplift from performance bonuses in commercial deals.

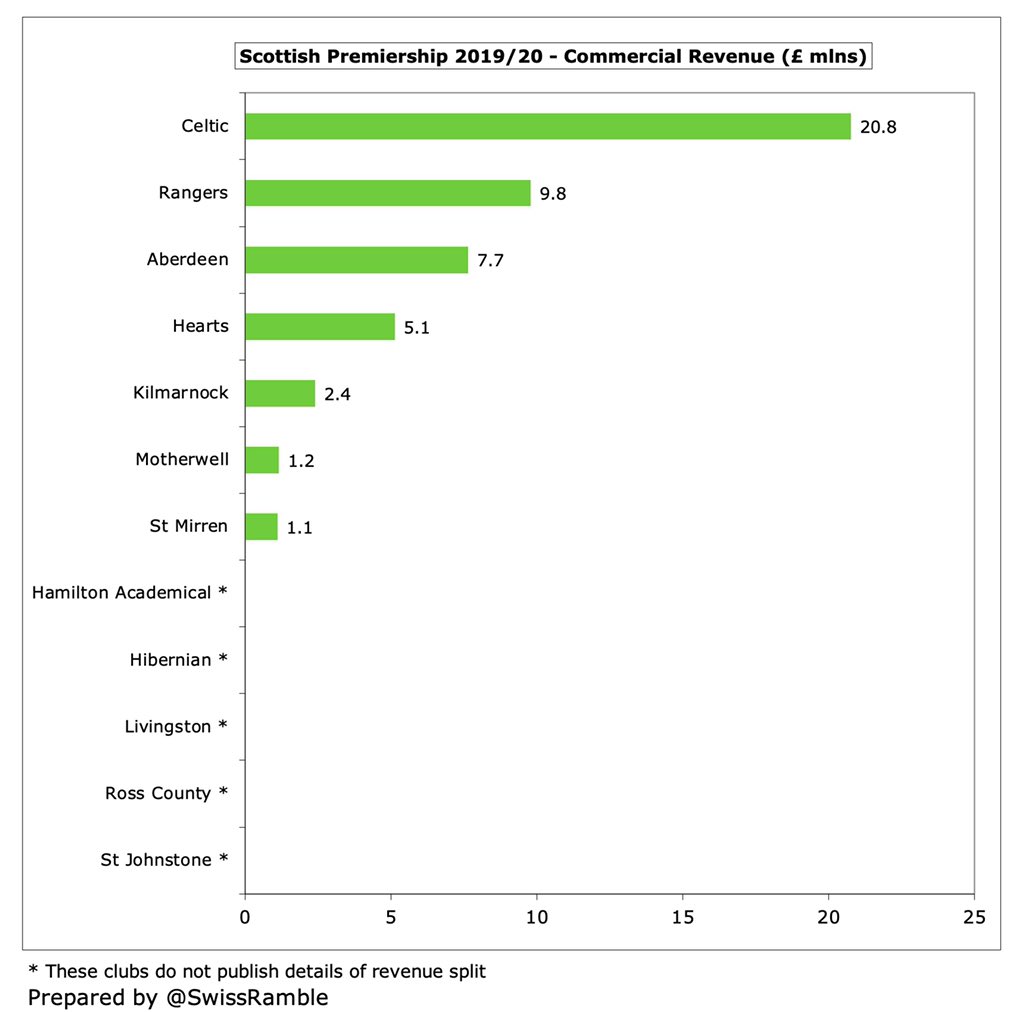

#CelticFC £20.8m commercial income (sponsorship £8.1m, retail and e-commerce £11.2m and other income £1.4m) was more than double #RangersFC £9.8m (sponsorship & advertising £3.1m, commercial £3.9m and other income £2.8m), followed by Aberdeen £7.7m and Hearts £5.1m.

#CelticFC had the highest wage bill with £54m, ahead of #RangersFC £43m, though the gap has narrowed to £11m from £35m in 2018. There remains an abyss between the Old Firm and the other Scottish clubs, i.e. the next highest are Aberdeen £10m, Hearts £9m and Hibernian £7m.

Most Scottish clubs have reasonable wages to turnover ratios, just above UEFA’s recommended upper limit of 70%, but that’s not too bad in a COVID-impacted season. The highest (worst) was Ross County 103%, followed by Motherwell 85%, #CelticFC 77%, Hibernian 74% & #RangersFC 73%.

#CelticFC £12.2m player amortisation, the annual charge to write-off transfer fees over a player’s contract, was the highest in Scotland, well ahead of #RangersFC £7.6m. Both clubs are a lot higher than the rest: Hibernian £0.5m, Aberdeen £0.4m and Hearts £0.4m.

Scottish clubs do not often pay big money to sign players. In fact, #CelticFC gross transfer spend of £20.7m in 2019/20 was easily more than the rest of the Scottish Premiership combined with the next highest being #RangersFC £11.0m, followed by Aberdeen £1.3m and Hearts £0.4m.

#RangersFC £19.3m gross debt is more than all the other Scottish Premiership clubs combined (£15.7m) with the next highest being Hearts £5.7m, Celtic £5.4m and Aberdeen £1.3m. These numbers are significantly lower than most English clubs.

#CelticFC cash balance dropped from £34.1m to £22.4m in 2020, though this was still by far the highest in Scotland, more than double #RangersFC £11.1m, followed by Hibernian £5.4m, St. Johnstone £2.8m, Aberdeen £2.5m and Hearts £2.4m.

Obviously these figures for the 2019/20 season are a year behind, as we will have to wait a few months before clubs start publishing accounts for 2020/21, which will reflect a full season of COVID.

I’ve just realized that there was a formula error for Aberdeen’s profit figures in my database. Updated graphs attached. My apologies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh