Brit blogging from Switzerland, usually about the business of football.

85 subscribers

How to get URL link on X (Twitter) App

Barcelona made a pre-tax loss of €8m, significantly better than prior year's €204m deficit, largely driven by steep reduction in exceptional items from €225m to €10m, due to movement in economic levers. Club referenced a €2m "operating" profit excluding exceptionals.

Barcelona made a pre-tax loss of €8m, significantly better than prior year's €204m deficit, largely driven by steep reduction in exceptional items from €225m to €10m, due to movement in economic levers. Club referenced a €2m "operating" profit excluding exceptionals.

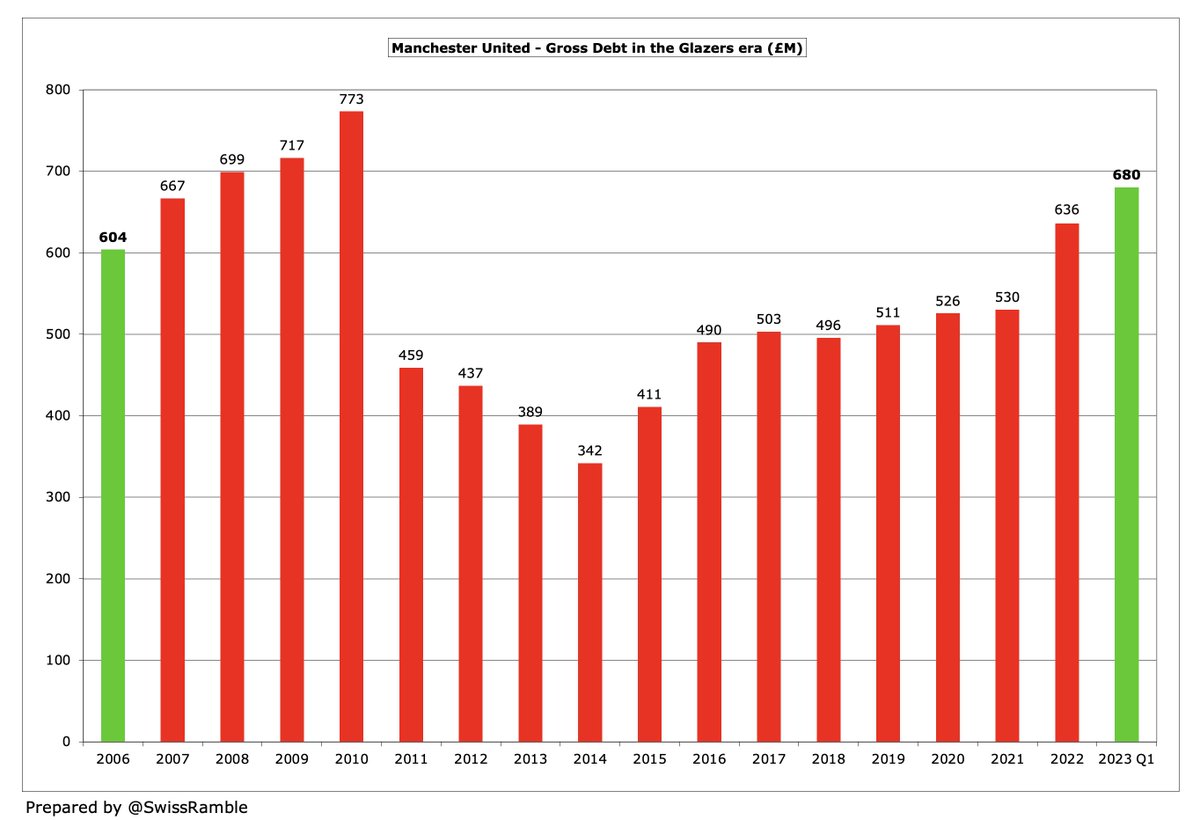

United lost money for the sixth year in a row, but significantly reduced their pre-tax loss from £131m to £40m, mainly due to steep reductions in wages and interest payable #MUFC

United lost money for the sixth year in a row, but significantly reduced their pre-tax loss from £131m to £40m, mainly due to steep reductions in wages and interest payable #MUFC

Arsenal Women's revenue has significantly grown, more than tripling in the last three years, so it has risen by £11.0m from £4.3m to £15.3m #AFC

Arsenal Women's revenue has significantly grown, more than tripling in the last three years, so it has risen by £11.0m from £4.3m to £15.3m #AFC

Bayern's finances remain solid, as they have now been profitable for a barely credible 32 years in a row, generating an amazing €429m pre-tax profit in the last decade alone, even including the COVID impacted seasons.

Bayern's finances remain solid, as they have now been profitable for a barely credible 32 years in a row, generating an amazing €429m pre-tax profit in the last decade alone, even including the COVID impacted seasons.

Wolves’ pre-tax loss significantly reduced from £67m to £14m, as profit from player sales increased from £44m to £65m, while revenue rose £9m (5%) from £169m to £178m and operating expenses were cut by £18m (7%) from £269m to £241m #WWFC

Wolves’ pre-tax loss significantly reduced from £67m to £14m, as profit from player sales increased from £44m to £65m, while revenue rose £9m (5%) from £169m to £178m and operating expenses were cut by £18m (7%) from £269m to £241m #WWFC

In fact, Napoli have four of the top ten player sales profits ever in Italy, also including Higuain, Cavani and Jorginho. Furthermore, they have made the highest profit from player sales in Italy in the last five years with nearly €300m #sscnapoli

In fact, Napoli have four of the top ten player sales profits ever in Italy, also including Higuain, Cavani and Jorginho. Furthermore, they have made the highest profit from player sales in Italy in the last five years with nearly €300m #sscnapoli

City's revenue slightly increased to £715m, which means that this has risen by more than a third (£180m) in just five years from the 2019 pre-pandemic level of £535m. Growth has been led by commercial, which now accounts for 48% of total income #MCFC

City's revenue slightly increased to £715m, which means that this has risen by more than a third (£180m) in just five years from the 2019 pre-pandemic level of £535m. Growth has been led by commercial, which now accounts for 48% of total income #MCFC

After two years of small losses, when they very nearly broke-even, Rangers lost £17m before tax, mainly because profit from player sales dropped from £24m to £6m #RangersFC

After two years of small losses, when they very nearly broke-even, Rangers lost £17m before tax, mainly because profit from player sales dropped from £24m to £6m #RangersFC

On the plus side, revenue rose £14m (2%) from £648m to a new club record of £662m, while profit from player sales increased from £20m to £37m, United's best result for 15 years #MUFC

On the plus side, revenue rose £14m (2%) from £648m to a new club record of £662m, while profit from player sales increased from £20m to £37m, United's best result for 15 years #MUFC

Chelsea had the highest gross transfer spend in the Premier League for the third year in a row, i.e. ever since the Clearlake Capital crew arrived, with a hefty £265m.

Chelsea had the highest gross transfer spend in the Premier League for the third year in a row, i.e. ever since the Clearlake Capital crew arrived, with a hefty £265m.

The last available accounts from the 2022/23 season are now a full year out of date, but they still offer some indications of how well the strategy is working #SAFC

The last available accounts from the 2022/23 season are now a full year out of date, but they still offer some indications of how well the strategy is working #SAFC

Losses have been growing under the new owners, as they invested in the squad and infrastructure in an attempt to return Ipswich to former glories - which has clearly worked #ITFC

Losses have been growing under the new owners, as they invested in the squad and infrastructure in an attempt to return Ipswich to former glories - which has clearly worked #ITFC

The number of clubs in the Champions League will increase from 32 to 36 with the group stage of 8 groups of 4 teams being replaced by a single league of 36 teams, then a new knockout round, before reverting to the traditional last 16.

The number of clubs in the Champions League will increase from 32 to 36 with the group stage of 8 groups of 4 teams being replaced by a single league of 36 teams, then a new knockout round, before reverting to the traditional last 16.

Champions League TV money is split into 4 elements:

Champions League TV money is split into 4 elements:

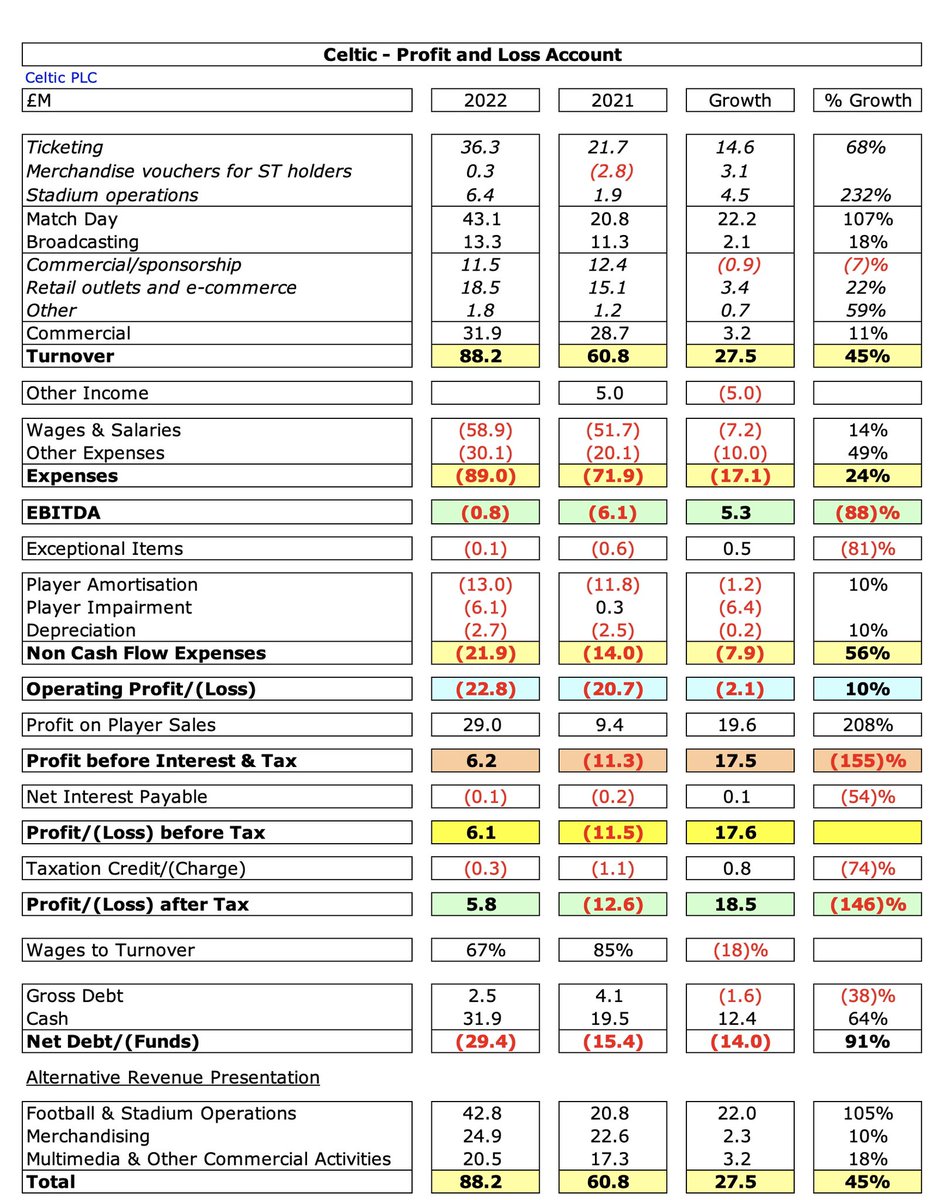

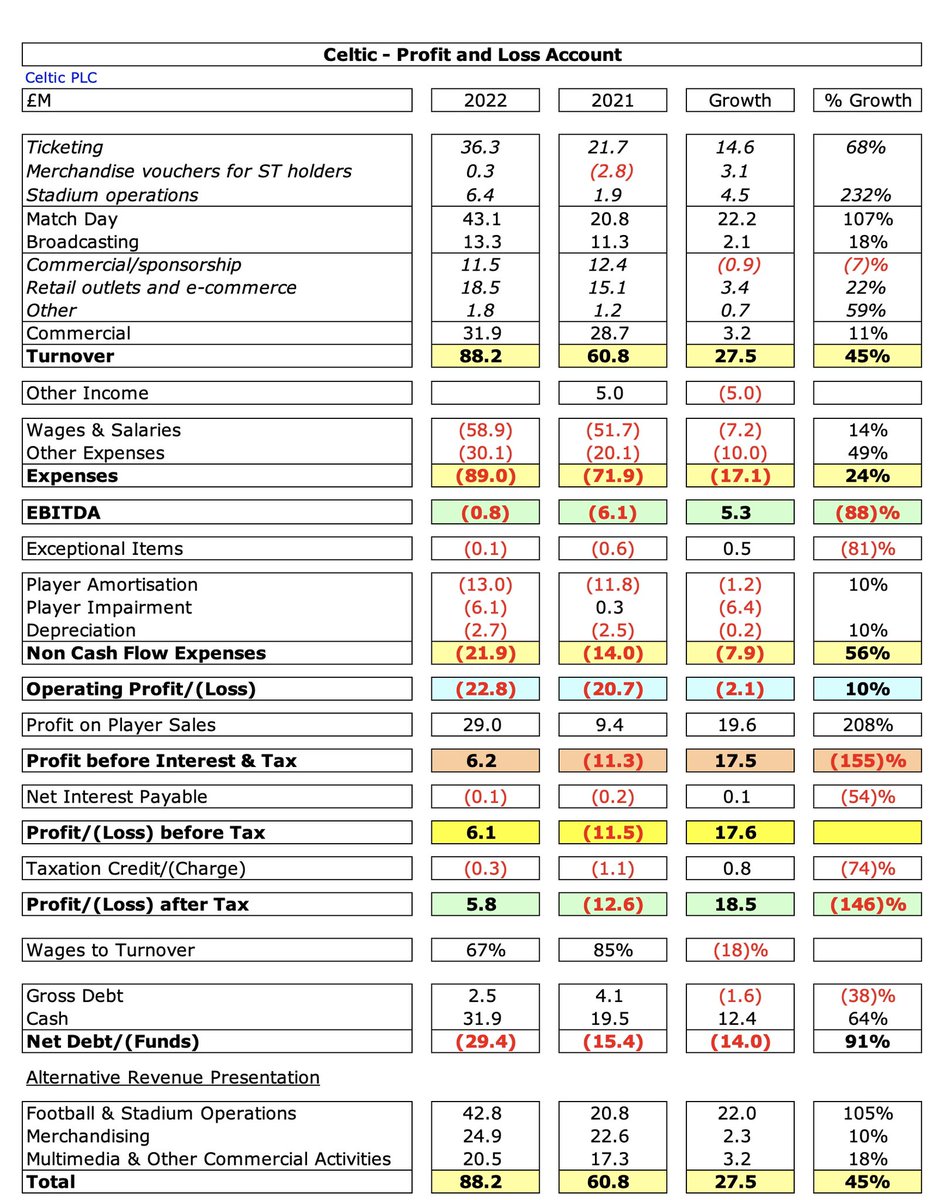

In terms of profitability, #RangersFC and #CelticFC were at the opposite end of the spectrum with Rangers posting a small £3m pre-tax loss, while Celtic generated a record £41m profit.

In terms of profitability, #RangersFC and #CelticFC were at the opposite end of the spectrum with Rangers posting a small £3m pre-tax loss, while Celtic generated a record £41m profit.