1/ Expertise Value Added in the Real Estate Market (Gay, Zhang)

"Realtor activity is correlated with higher-quality listings (based on listing photos/remarks). Controlling for house characteristics, listing quality is correlated with higher sale prices."

papers.ssrn.com/sol3/papers.cf…

"Realtor activity is correlated with higher-quality listings (based on listing photos/remarks). Controlling for house characteristics, listing quality is correlated with higher sale prices."

papers.ssrn.com/sol3/papers.cf…

2/ "Waller and Jubran find that properties listed by experienced realtors sell for 2% more than those of inexperienced realtors and 32% faster.

"However, Munneke and Yavas find no difference in listing duration between realtors from full-commission firms and other realtors."

"However, Munneke and Yavas find no difference in listing duration between realtors from full-commission firms and other realtors."

3/ "We construct a novel dataset of real estate listings and sales from publicly available data from a major real estate website. This dataset covers a total of 40,049 real estate sales from across Arizona, California, and Illinois.

"We restrict our sample to MLS listings."

"We restrict our sample to MLS listings."

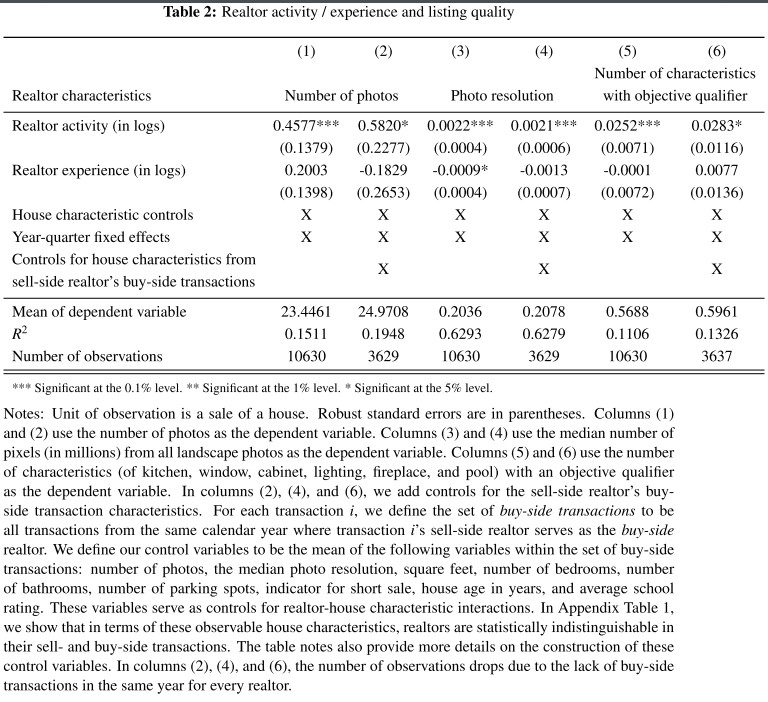

4/ Listing quality = (1) number, resolution of photos and (2) the presence of objective ("cherry cabinets") and subjective ("cozy fireplace") descriptions

Realtor activity = total # of sales within a calendar year

Realtor experience = # days licensed (not available in CA & IL).

Realtor activity = total # of sales within a calendar year

Realtor experience = # days licensed (not available in CA & IL).

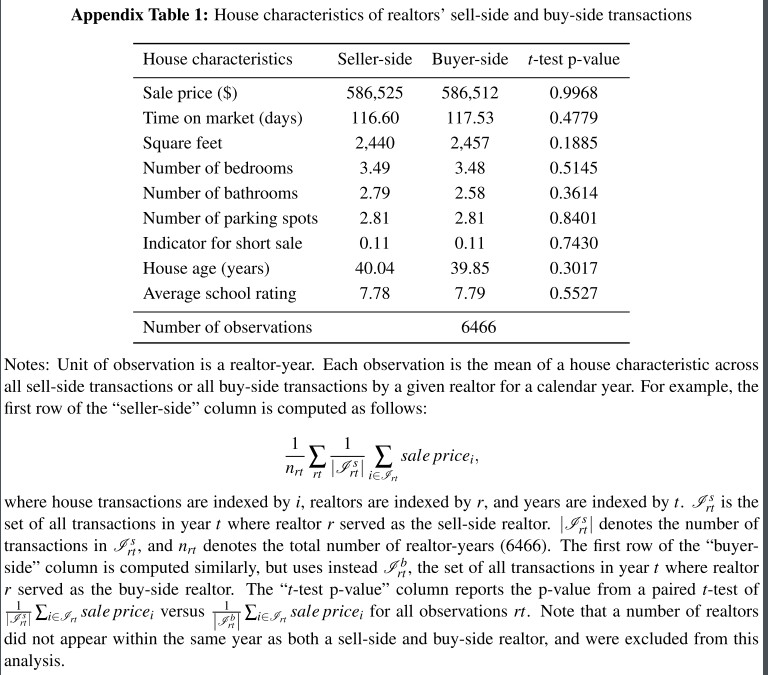

5/ "More experienced or active realtors may be more likely to represent (owners of) houses of higher quality.

"We partially address this confound using information about transactions where the seller’s realtor (whose expertise we are exploring) worked as a buy-side realtor."

"We partially address this confound using information about transactions where the seller’s realtor (whose expertise we are exploring) worked as a buy-side realtor."

6/ Listing quality is associated with realtor activity but not experience.

"Our measure for experience, time since first acquisition of license, is correlated with age. Older realtors may be less familiar w/ technology and unable to upload a large number of high-quality photos."

"Our measure for experience, time since first acquisition of license, is correlated with age. Older realtors may be less familiar w/ technology and unable to upload a large number of high-quality photos."

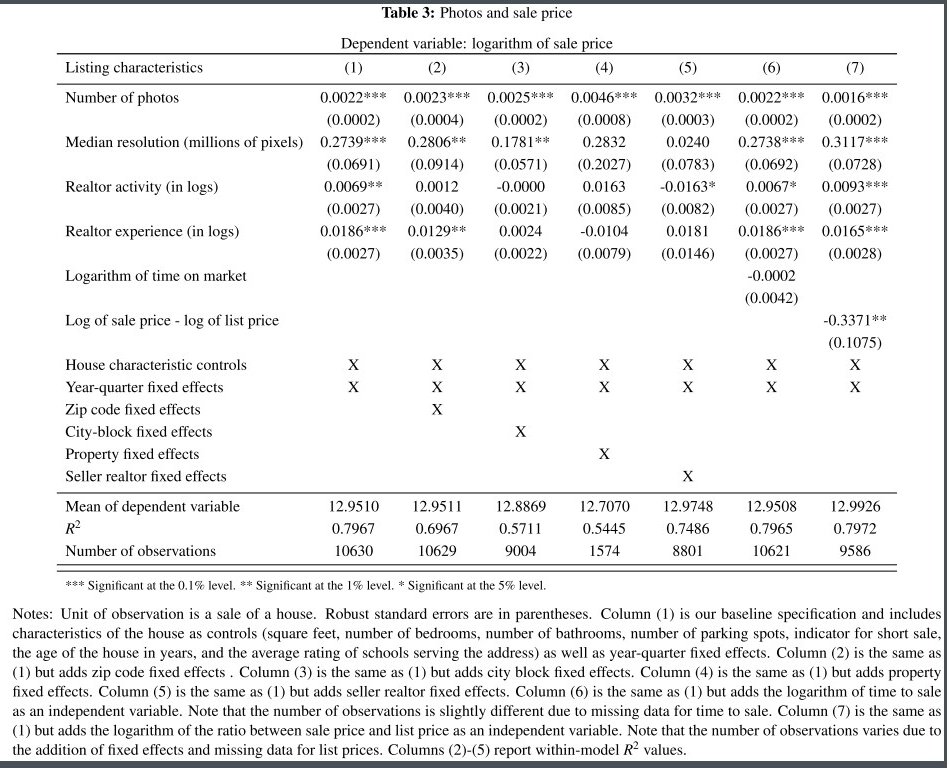

7/ "Activity & experience remain significant after controlling for photo quality, suggesting that expertise contributes to sale price in other ways. E.g. experienced realtors may be better negotiators, improve presentation of the house, or possess networks with buyers' realtors."

8/ Column 7: "The coefficient for activity changes; the price ratio coefficient is negative: conditional on observable characteristics, houses listed at lower prices sell for less.

"Realtors w/ large numbers of transactions may list at lower prices to facilitate quicker sales."

"Realtors w/ large numbers of transactions may list at lower prices to facilitate quicker sales."

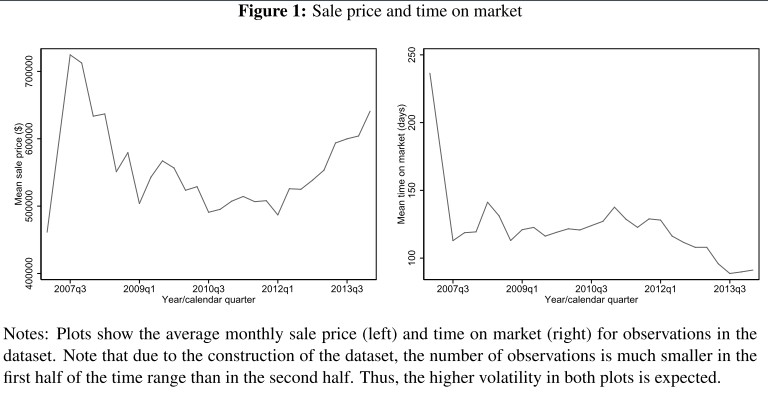

9/ "Having more photos is associated with longer time on market.

"Possible explanation: Sellers who post more photos choose to show more characteristics and are likely more confident in those characteristics. The seller might be more patient in waiting for an acceptable offer."

"Possible explanation: Sellers who post more photos choose to show more characteristics and are likely more confident in those characteristics. The seller might be more patient in waiting for an acceptable offer."

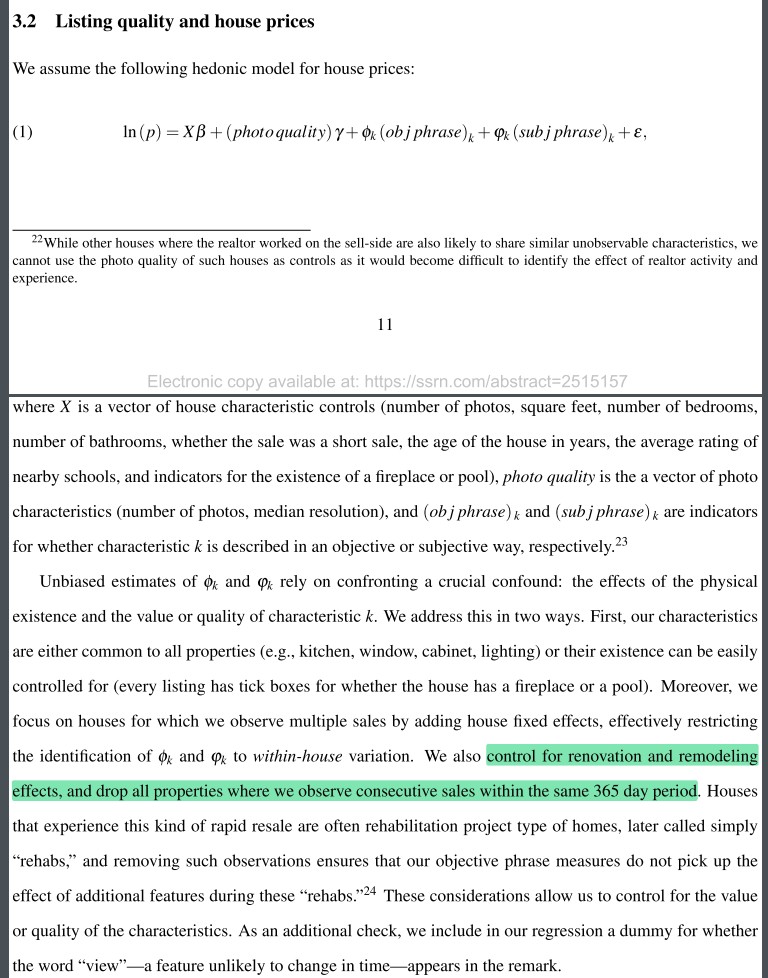

10/ "Using objective qualifiers to describe house characteristics is correlated with higher sale prices on average.

"Including property fixed effects in columns 2-4 controls for the effect of the characteristics’ physical existence & reduces the magnitudes of the coefficients."

"Including property fixed effects in columns 2-4 controls for the effect of the characteristics’ physical existence & reduces the magnitudes of the coefficients."

11/ "With our full set of controls, having one (two+) characteristic(s) with an objective qualifier is associated w/ a 2.03% (3.83%) increase in sale price.

"Caution regarding further extrapolation: few observations in our sample had 3+ characteristics w/ objective qualifiers."

"Caution regarding further extrapolation: few observations in our sample had 3+ characteristics w/ objective qualifiers."

12/ More:

Misguided Beliefs of Financial Advisors

Financial Advice and Bank Profits

Market for Financial Advice

The Wealthy Renter

Real estate thread

Misguided Beliefs of Financial Advisors

https://twitter.com/ReformedTrader/status/1225239381327302658

Financial Advice and Bank Profits

https://twitter.com/ReformedTrader/status/1231471053420912640

Market for Financial Advice

https://twitter.com/ReformedTrader/status/1412474821468848129

The Wealthy Renter

https://twitter.com/ReformedTrader/status/1411112122751148036

Real estate thread

https://twitter.com/ReformedTrader/status/1399891647287029760

13/ Incentives and Performance in Real Estate Brokerage

https://twitter.com/ReformedTrader/status/1417665207858462722

14/ Real Estate Agent Remarks: Help or Hype?

https://twitter.com/ReformedTrader/status/1417933899255074816

15/ Relative Performance of Real Estate Marketing Platforms: MLS Versus Fsbomadison.Com

https://twitter.com/ReformedTrader/status/1418015885726404608

• • •

Missing some Tweet in this thread? You can try to

force a refresh