AR20-21 Notes

AAVAS Financiers

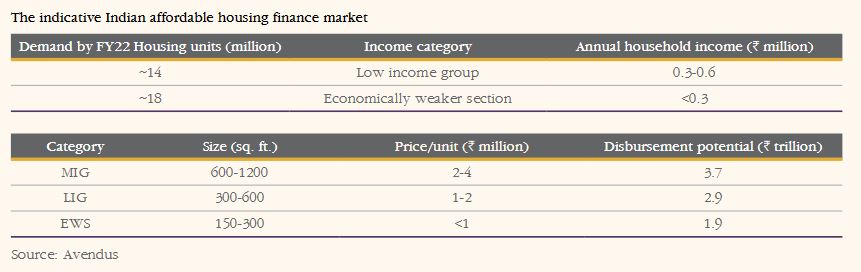

A Leading Housing Finance Company concentrating on Affordable Housing

Put on your helmets & Enjoy the ride 🙂

Retweet for wider reach 🙏

AAVAS Financiers

A Leading Housing Finance Company concentrating on Affordable Housing

Put on your helmets & Enjoy the ride 🙂

Retweet for wider reach 🙏

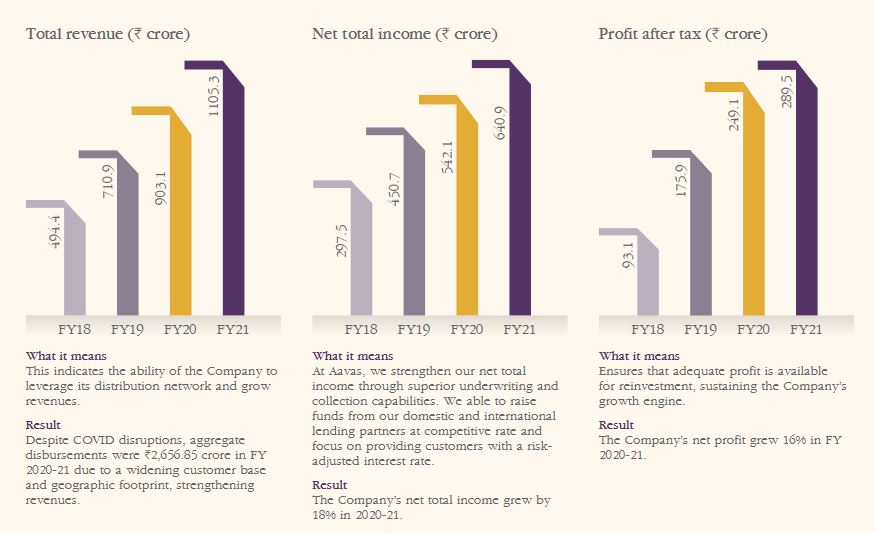

1/ Performance Overview

~Annual Revenues exceeded Rs 1000 Cr for the first time

~AUM reached Rs 9454 Cr

~Spread at 5.76% in FY21

~Active Customer base at >1.25 Lacs

~Annual Revenues exceeded Rs 1000 Cr for the first time

~AUM reached Rs 9454 Cr

~Spread at 5.76% in FY21

~Active Customer base at >1.25 Lacs

2/ 10 Year Report Card

~Developed Niche & maintained disciplined and conservative underwriting

~Scaled the business sustainably

~Promoted financial inclusion & led to the development of the sector

~Developed Niche & maintained disciplined and conservative underwriting

~Scaled the business sustainably

~Promoted financial inclusion & led to the development of the sector

3/ Performing Through COVID-19

Despite the difficult environment, Aavas managed to

~maintain its book strength

~diversify borrowing sources

~leverage tech to enable the smooth running of the business

Despite the difficult environment, Aavas managed to

~maintain its book strength

~diversify borrowing sources

~leverage tech to enable the smooth running of the business

4/ Enhanced Return for Stakeholders and Improvements in

~Financial Capital

~Company Infrastructure

~Employee Strength

~Business Process & Operations

~Financial Capital

~Company Infrastructure

~Employee Strength

~Business Process & Operations

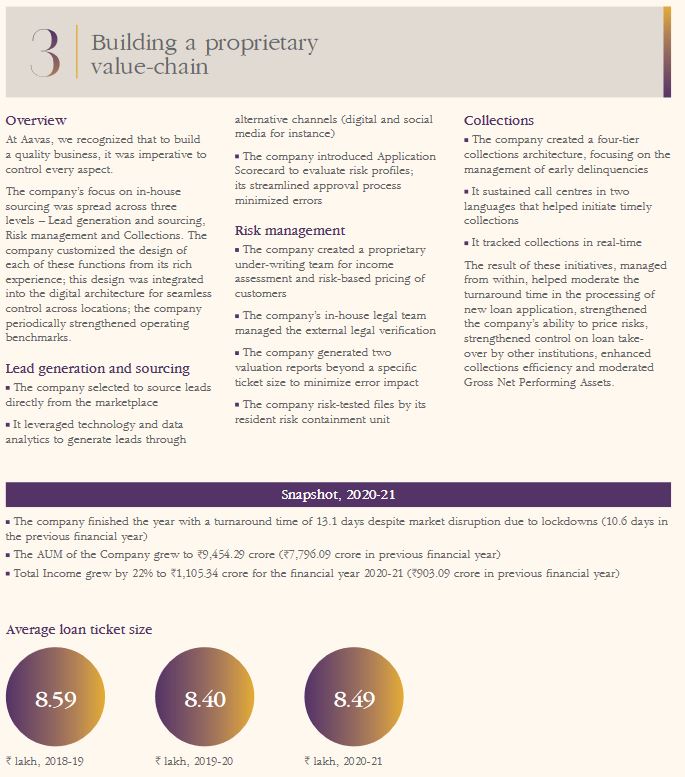

5/ Strategic Priorities

~Increasing Presence in Market Niche

~Strengthening Customer Engagement

~Building Proprietary Value Chain

~Expanding in Indian housing markets

~Increasing Presence in Market Niche

~Strengthening Customer Engagement

~Building Proprietary Value Chain

~Expanding in Indian housing markets

6/ Strategic Priorities Contd

~Maintaining discipline in managing yields

~Enhancing long term liquidity

~Maximizing Capital Returns

~Maintaining discipline in managing yields

~Enhancing long term liquidity

~Maximizing Capital Returns

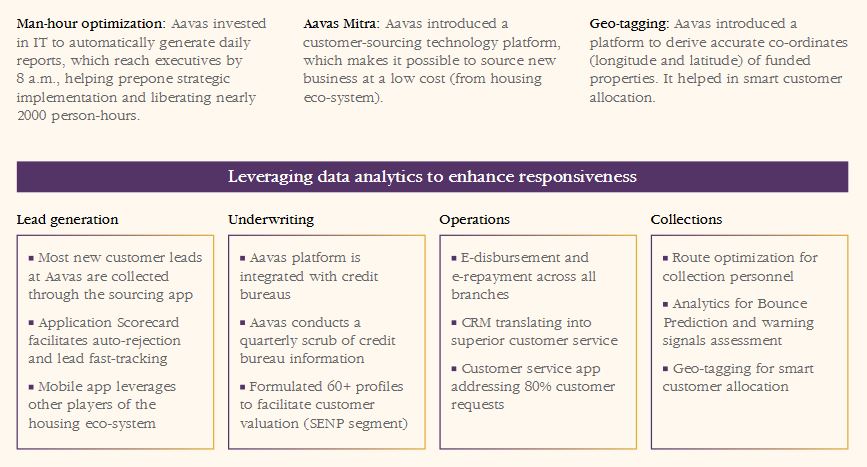

7/ Technological Priorities

~Strengthen tech team and invest in new tech

~Leverage tech and enhance competitiveness

~Strengthen tech team and invest in new tech

~Leverage tech and enhance competitiveness

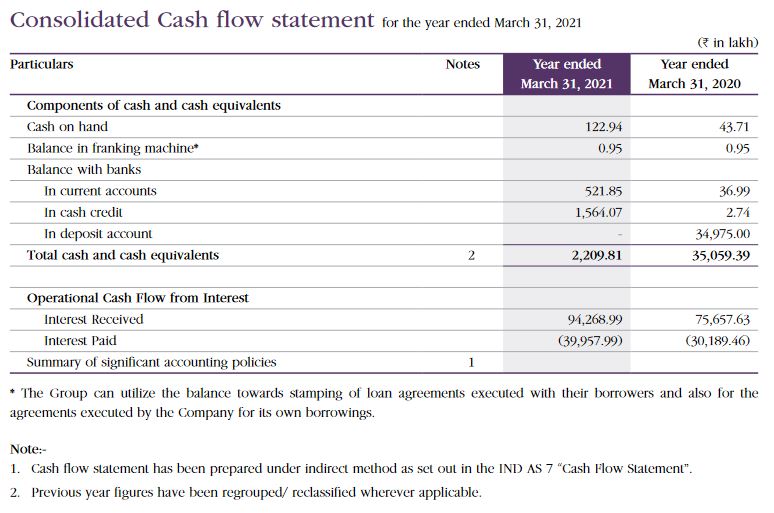

12/ Financials

~Consolidated Balance Sheet

~Consolidated P&L Statement

~Consolidated Cash Flow Statement

~Consolidated Balance Sheet

~Consolidated P&L Statement

~Consolidated Cash Flow Statement

13/

~Latest investor concall notes: bit.ly/3bf4put

End 🙂🙏

Plz L&R the 1st tweet here if you liked this

~Latest investor concall notes: bit.ly/3bf4put

End 🙂🙏

Plz L&R the 1st tweet here if you liked this

• • •

Missing some Tweet in this thread? You can try to

force a refresh