1/ investing in bitcoin has historically been limited to passive exposure (long BTC)

yesterday, @viridifunds launched $RIGZ, the first publicly listed crypto mining ETF

as the bitcoin industry grows, so do opportunities to invest along the bitcoin value chain 👇

let's dive in!

yesterday, @viridifunds launched $RIGZ, the first publicly listed crypto mining ETF

as the bitcoin industry grows, so do opportunities to invest along the bitcoin value chain 👇

let's dive in!

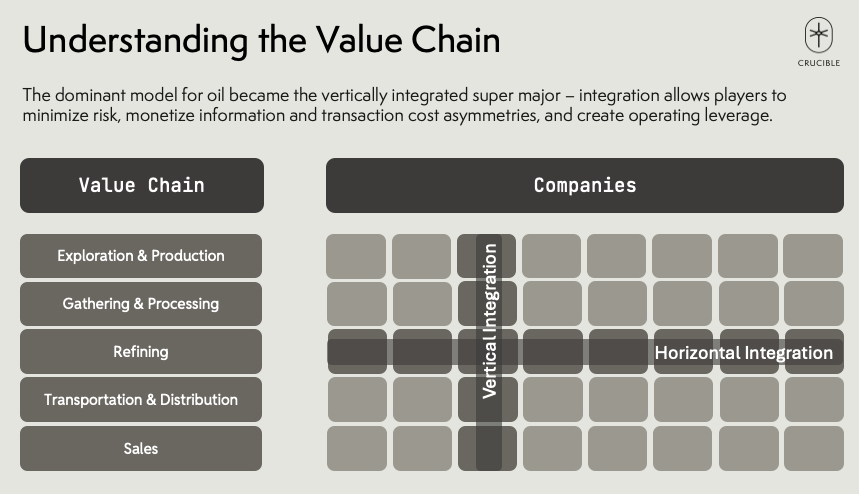

2/ before bitcoin, i worked in the oil & gas industry.

investors who want exposure to oil & gas in their portfolio don't just buy contracts for WTI crude or nat gas.

they buy a diversified portfolio of companies and commodities across the oil and gas value chain

investors who want exposure to oil & gas in their portfolio don't just buy contracts for WTI crude or nat gas.

they buy a diversified portfolio of companies and commodities across the oil and gas value chain

3/ an E&P company can produce oil at a lower cost than they sell it, and investors can realize significantly more upside than holding just the underlying commodity, oil

a refining company that converts crude into product and retails it can extract higher margins

a refining company that converts crude into product and retails it can extract higher margins

4/ similarly, companies are starting to emerge along different parts of the bitcoin value chain

for example, my company @CoinSharesCo ($CS.ST) creates bitcoin-based financial products and services. so does @coinbase ($COIN).

miners are like E&P companies - they "produce" $BTC

for example, my company @CoinSharesCo ($CS.ST) creates bitcoin-based financial products and services. so does @coinbase ($COIN).

miners are like E&P companies - they "produce" $BTC

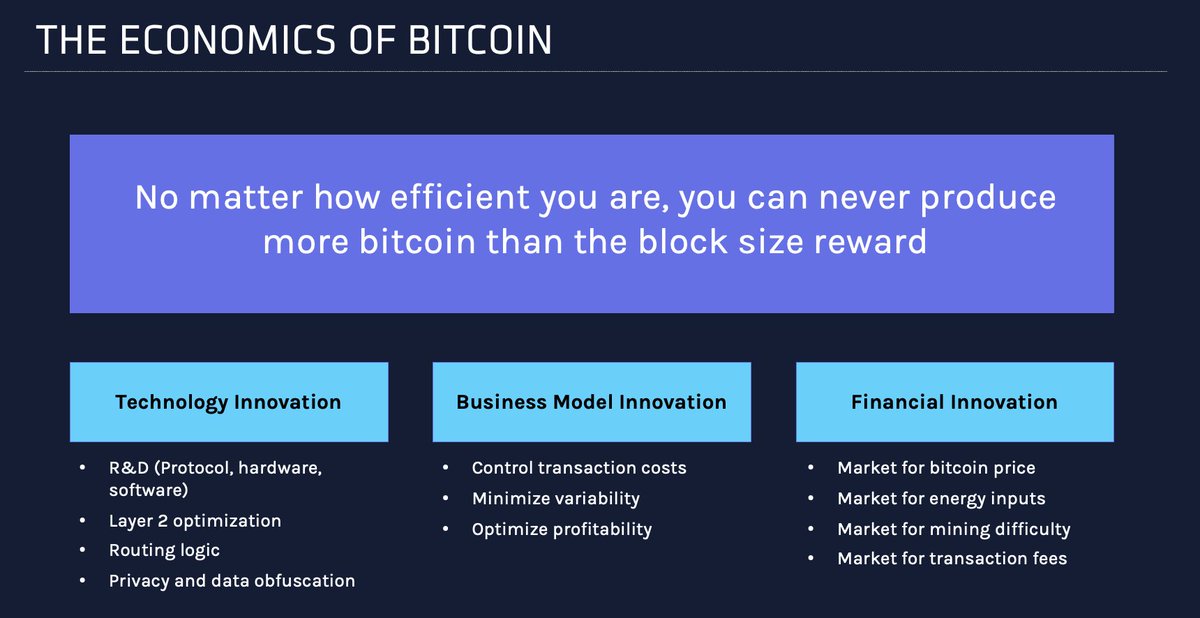

5/ now, to "produce" bitcoin, you need

🖥️ a specialized semiconductor (ASIC)

⚡️ electricity

per the the economics of bitcoin 👇the real competitive edge is lowering the cost of "producing" bitcoin by (a) reducing the capex drag of hardware and (b) securing the lowest cost power

🖥️ a specialized semiconductor (ASIC)

⚡️ electricity

per the the economics of bitcoin 👇the real competitive edge is lowering the cost of "producing" bitcoin by (a) reducing the capex drag of hardware and (b) securing the lowest cost power

6/ $RIGZ is an actively managed ETF, with a mandate is to invest in semiconductor and ASIC companies and crypto mining operators who are getting the majority of their power from "clean energy" or renewable power sources

you may be confused 😕 isn't bitcoin boiling the ocean?

you may be confused 😕 isn't bitcoin boiling the ocean?

7/ interestingly, over 50% of north american bitcoin mining is done with renewable energy 🌿

note the current US energy grid only utilizes 19% renewables 😢

that makes bitcoin mining one of the greenest industries in north america, and a great sector for this type of product!

note the current US energy grid only utilizes 19% renewables 😢

that makes bitcoin mining one of the greenest industries in north america, and a great sector for this type of product!

8/ as one of the world's largest digital asset managers, @CoinSharesCo is proud to be Viridi's lead investor, and to continue to expand the universe of crypto investment products with innovative partners like @ViridiFunds, @3iq_corp, and @InvescoEMEA

9/ for more detail on $RIGZ, see the link below!

disclosure: this is not financial advice, DYOR. CoinShares is an investor in Viridi, and an advisor to the management company. i personally own $RIGZ.

prnewswire.com/news-releases/…

disclosure: this is not financial advice, DYOR. CoinShares is an investor in Viridi, and an advisor to the management company. i personally own $RIGZ.

prnewswire.com/news-releases/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh