How to get URL link on X (Twitter) App

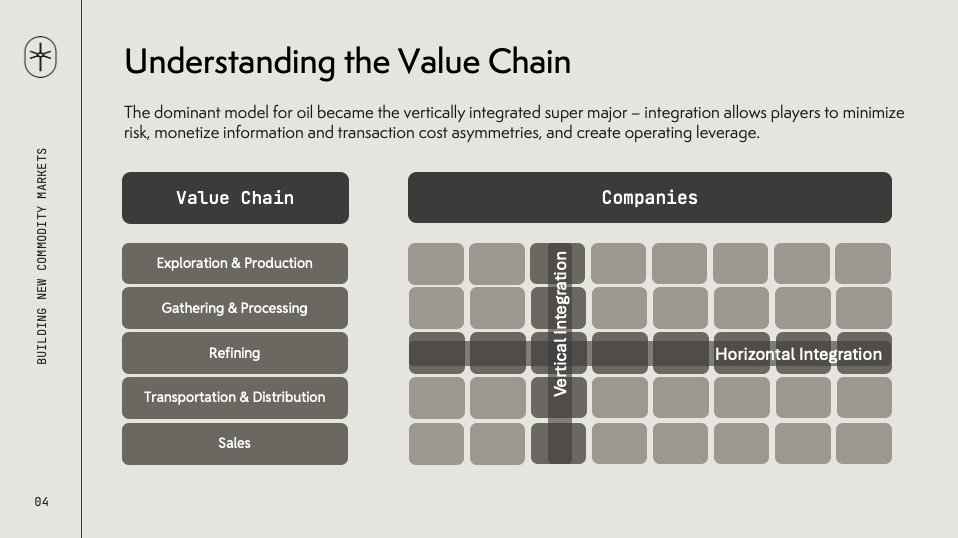

1/ the oil industry is an excellent primer on what i believe will happen to the energy to compute value chain over the next decade

1/ the oil industry is an excellent primer on what i believe will happen to the energy to compute value chain over the next decade

2/ the number of deals through our pipeline has stayed pretty consistent quarter over quarter - we generally will do 1-2 meetings and then decide quickly if we want to dig in or not

2/ the number of deals through our pipeline has stayed pretty consistent quarter over quarter - we generally will do 1-2 meetings and then decide quickly if we want to dig in or not

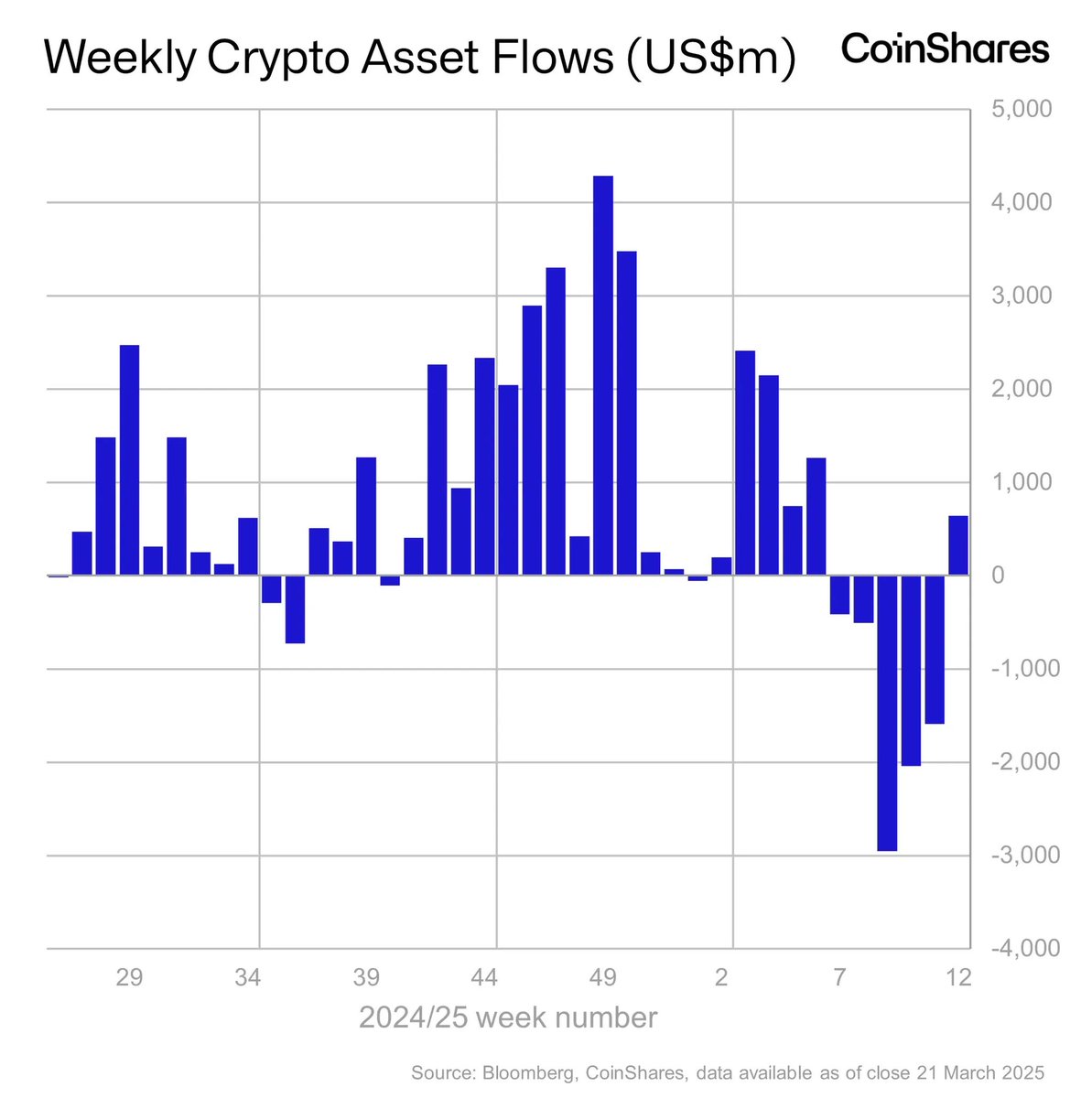

2/ first off - flows

2/ first off - flows

2/ if we take out bitcoin and ethereum, this is the last five years of crypto markets

2/ if we take out bitcoin and ethereum, this is the last five years of crypto markets

2/ we use @attio to manage our pipeline

2/ we use @attio to manage our pipeline

2/ the last few months show distrust of main stream media (MSM) and formal, credentialed sources of information is at an all time high.

2/ the last few months show distrust of main stream media (MSM) and formal, credentialed sources of information is at an all time high.

2/ history of oil and what it can teach us about DePIN

2/ history of oil and what it can teach us about DePIN

2/ bitcoin pricing is driven by FLOWS

2/ bitcoin pricing is driven by FLOWS

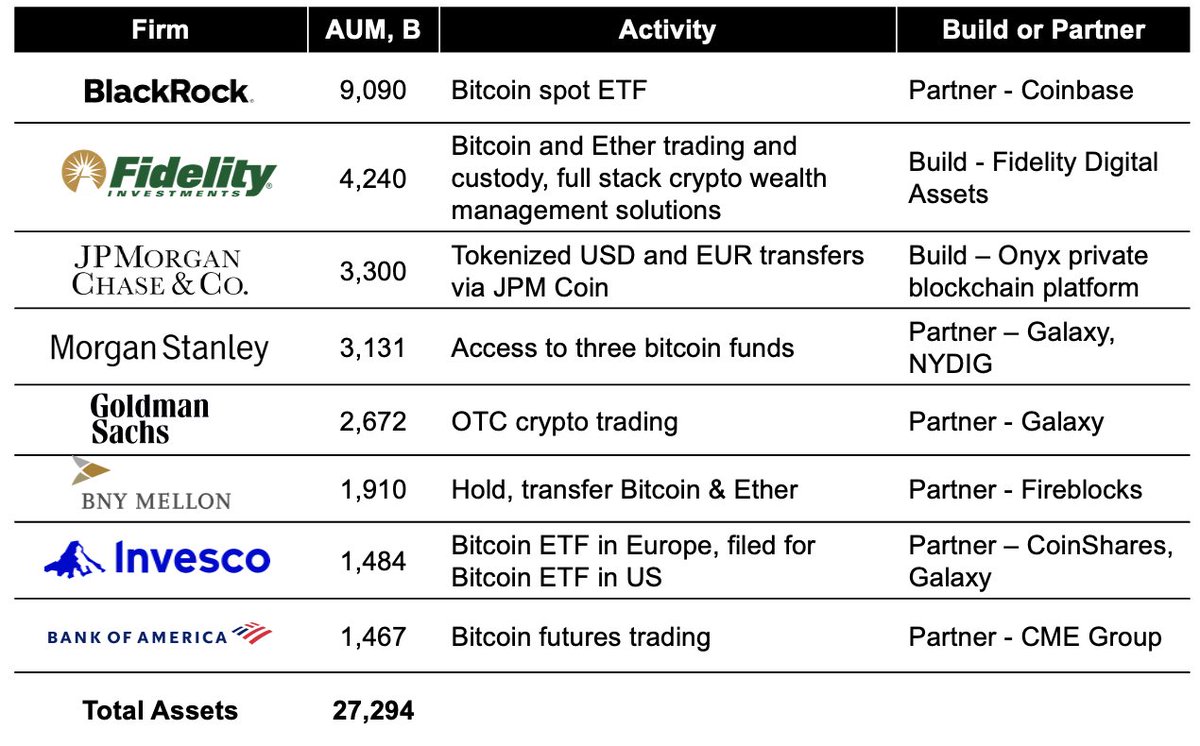

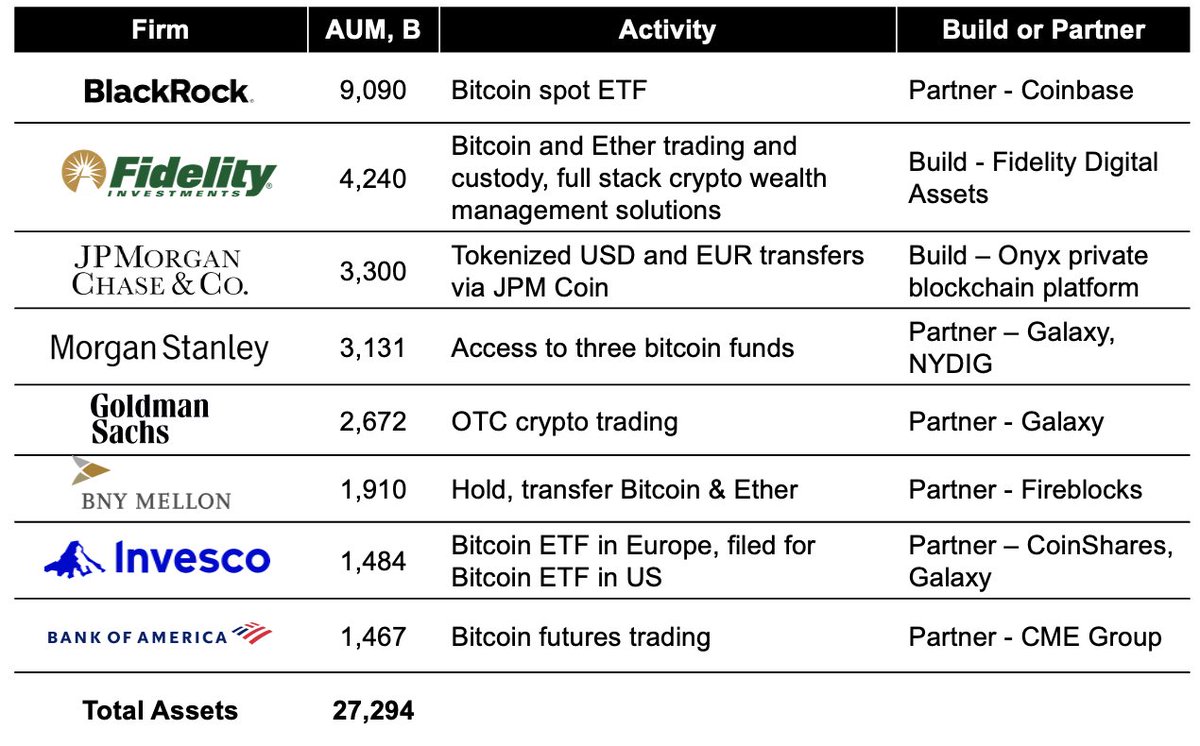

2/ as our lives become increasingly digitized, value creation is happening on a new frontier, and a handful of industries and companies are well positioned to capitalize on this shift

2/ as our lives become increasingly digitized, value creation is happening on a new frontier, and a handful of industries and companies are well positioned to capitalize on this shift

2/ today, there are a few ways to put bitcoin in a tax-advantaged retirement account

2/ today, there are a few ways to put bitcoin in a tax-advantaged retirement account

2/ this is by no means a complete overview of all the offerings available, but its always helpful to zoom out and look at the bigger picture

2/ this is by no means a complete overview of all the offerings available, but its always helpful to zoom out and look at the bigger picture

https://twitter.com/farokh/status/15570114673202954242/ blog post on NFT market microstructure and how it may evolve over time - don't worry, u will be able to explain market microstructure if u just skim it lightly

2/ first i focus on market data by segment - i split it into retail, institutions & funds, and traders & market makers

2/ first i focus on market data by segment - i split it into retail, institutions & funds, and traders & market makers

2/ more interesting in looking at velocity, or trading volumes as a % of market cap, to understand where the turnover is in current markets

2/ more interesting in looking at velocity, or trading volumes as a % of market cap, to understand where the turnover is in current markets

2/ unlike tradfi, in crypto, most debt doesn't have a fixed term and requires over-collateralization (you have to post more collateral than the value of your borrowing)

2/ unlike tradfi, in crypto, most debt doesn't have a fixed term and requires over-collateralization (you have to post more collateral than the value of your borrowing)

2/ from our weekly fund flows report - last week, investors added to #bitcoin positions, with $126M in net inflows into publicly traded bitcoin products

2/ from our weekly fund flows report - last week, investors added to #bitcoin positions, with $126M in net inflows into publicly traded bitcoin products