#TheBWord conference, Demystifying Bitcoin Session 4 notes:

Debunking "Bitcoin Ownership is Concentrated" w/ @natemaddrey

Debunking "Bitcoin Ownership is Concentrated" w/ @natemaddrey

@natemaddrey Misleading headlines:

- "over 99% of bitcoin is held by 10% of addresses"

- "bitcoin whales ownership concentration is rising"

- "over 99% of bitcoin is held by 10% of addresses"

- "bitcoin whales ownership concentration is rising"

@natemaddrey alright first of all, bitcoin supply data is completely transparent and verifiable

every transaction is recorded on the bitcoin blockchain

everyone can run a full node to look at the entire history of bitcoin transactions

@coinmetrics runs their own node to do analysis

every transaction is recorded on the bitcoin blockchain

everyone can run a full node to look at the entire history of bitcoin transactions

@coinmetrics runs their own node to do analysis

@natemaddrey @coinmetrics The $BTC supply controlled by the Top 1% of addresses HAS gone up over time, BUT..

- an address can represent many individuals, and

- an individual can own many addresses

that's the complex part of doing forensics on the blockchain

- an address can represent many individuals, and

- an individual can own many addresses

that's the complex part of doing forensics on the blockchain

@natemaddrey @coinmetrics One thing that's easy and helps, is to look at how much BTC is flowing through exchange addresses, i.e. @coinbase, @Poloniex, @binance, etc.

@natemaddrey @coinmetrics @coinbase @Poloniex @binance Another helpful item is to look at "dormant OGs", i.e. Satoshi Nakamoto, who is thought to own over 1M BTC split across several addresses.

This BTC hasn't been moved since the inception of the project, and it's thought of as "locked" or.. "lost".

This BTC hasn't been moved since the inception of the project, and it's thought of as "locked" or.. "lost".

@natemaddrey @coinmetrics @coinbase @Poloniex @binance And a third group to look at is Investment Products.

An increasing amount of BTC (3.48% of total supply) is being held in i.e. @Grayscale's Bitcoin Trust

An increasing amount of BTC (3.48% of total supply) is being held in i.e. @Grayscale's Bitcoin Trust

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale And on the other end of the spectrum, there are ~5.8 million addresses that hold less than $1 of BTC.

It's such a small amount that they're basically abandoned because it would cost more to transfer the BTC out of those addresses than the actual amount they hold.

It's such a small amount that they're basically abandoned because it would cost more to transfer the BTC out of those addresses than the actual amount they hold.

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale It's tempting to compare BTC distribution to world or US wealth distribution, but as we've seen, the data can be pretty skewed because addresses <-> individuals are not a 1:1 mapping.

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale the key thing to look at is that Bitcoin has a "fair distribution by design"

- in the beginning, miners received 50 BTC per mined block

- block reward halved every 4 years until max supply of 21 million BTC

- miners sell some of their BTC to cover costs, which helps distribute

- in the beginning, miners received 50 BTC per mined block

- block reward halved every 4 years until max supply of 21 million BTC

- miners sell some of their BTC to cover costs, which helps distribute

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale you can see that over time BTC distribution has increased rather than decreased over time

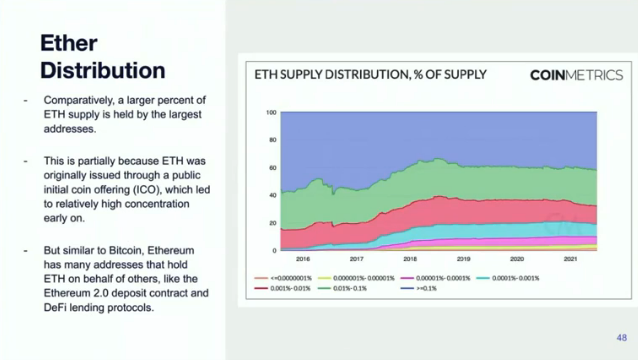

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale we can compare to other blockchain currencies like $ETH or $DOGE

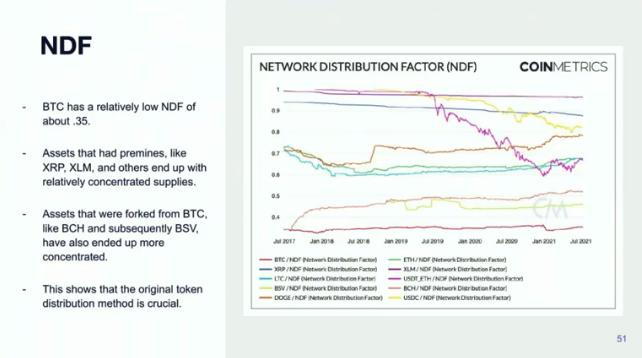

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale Network Distribution Factor (NDF) is a good way to compare how evenly spread a cryptocurrency is, and the lower the better:

- Bitcoin: 0.35

- Ethereum: 0.65

- Doge: 0.77

- XRP, XLM: > 0.9

- Bitcoin: 0.35

- Ethereum: 0.65

- Doge: 0.77

- XRP, XLM: > 0.9

@natemaddrey @coinmetrics @coinbase @Poloniex @binance @Grayscale Conclusion:

"Bitcoin has a unique, fair issuance mechanism, which has led to supply getting more distributed over time." - @natemaddrey

to see more: charts.coinmetrics.io

"Bitcoin has a unique, fair issuance mechanism, which has led to supply getting more distributed over time." - @natemaddrey

to see more: charts.coinmetrics.io

• • •

Missing some Tweet in this thread? You can try to

force a refresh