PayTM IPO DRHP - Who moved my cheese? 👇 (1/n)

One97 Communications (One97) is primarily a one-man show. The board of One97 features 8 directors, of which 6 sit in the USA. Management team in India consists of Vijay Sharma (VS) and his lawyer (Pallavi Shroff). Yep, one man with 14.6% shareholding and a lawyer. (2/n)

Let's talk about Paytm Payments Bank Limited (PPBL), though, the engine underneath the layers of One97 and behind almost every meaningful vertical of One97. VS holds 51% of PBBL. And One97 has an option to buy this stake. (3/n)

Prima facie this is extremely odd, why is VS holding 51% in PPBL in his personal capacity? Are investors getting only 49% of PPBL? Why does VS get to keep 51% of PPBL and then be bought out with shareholder's money in the future? How much will it cost? (4/n)

For the answer, welcome to the Foreign Direct Investment policy. The policy restricts foreign investment in the banking sector (through the automatic route) to 49%. So, India requires any payments bank to be Indian owned and controlled. But isn't One97 an Indian company? (5/n)

One97 is classified a foreign investor (LOL) with 6 out of 8 directors of foreign investors and/or outside India, and minimal Indian ownership. One97 needs an Indian owned and controlled entity as JV partner to hold min 26-51% in insurance and bank subsidiaries. Enter VS. (6/n)

So essentially, first VS sold off so much of One97 to investors that it didn't even remain an Indian company, but then the regulatory arbitrage worked out even better to put him in control of the engine of the company, PPBL. This is very neat. (7/n)

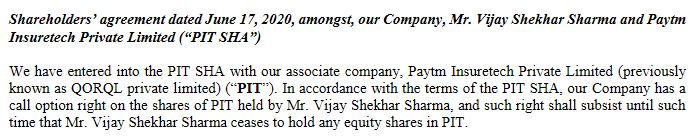

Interestingly, One97 also plans to lend 491 crore to VSS Holdings after the IPO, an entity held 100% by VS, who will then put money into Paytm Insuretech, who will then make an acquisition. One97 will get shares of VSS Holdings for this largesse. (8/n)

The notes to the financials state that One97 lost control of Paytm Insuretech during the course of the year , it now owns only 48.98%. So, when VSS Holding invests into Paytm Insuretech, One97 shareholders will lose ownership while VS gains ownership? (9/n)

One97 also has a shareholder agreement with VSS Holdings to exercise an option to purchase its shares in Paytm Insuretech. So, pay money to VSS to put into Paytm Insuretech, and then pay money to VSS to buy that stake in Paytm Insuretech? Neat again. (10/n)

So you could be funding One97 to buy out VS' stake in PPBL and Paytm Insuretech later. And don't forget the IPO won't make it an Indian owned and controlled entity, One97 will need VS to hold personal stakes for a few years at least. (11/n)

The financials are nothing much to speak about, as expected - a lot of burn to grab users and transactions. Contrary to common perception, One97 has talked about profitability, but in a pretty roundabout manner. Here's a new concept - contribution profit. (12/n)

Contribution profit is essentially revenue from operations minus some major heads of expenditure, as you can see from the second image. Quite a lot of expenses are omitted, which explains the 1700 crore gap with reported earnings. (13/n)

It's easy to trash a loss making operation, so let's see the silver lining too. Losses have declined substantially in the last 2 years with not much loss of revenue. Revenue has dipped from 3200 crore to 2800 crore, losses dipped from 4225 crore to 1700 crore. (14/n)

One97 uses a concept of 'take rate' to contextualize the Gross Merchandise Value numbers. We know GMV increased from 2.3 lakh crore (!) in 2019 to 4.03 lakh crore (!) in 2021. One97 says the take rate was 0.64%. On the FY21 base, that's ~2600 crore. (15/n)

FY21 reported revenue = 2800 crore, quite close. One97 lost traffic due to shutdown of travel, hospitality, tourism sectors and lockdown prohibitions (offset of course by more adoption). Could one think of a 10 lakh crore GMV and 1% take rate for 10,000 crore revenue? (16/n)

This analysis also highlights the criticality of Paytm Payments Bank to One97. One97 has highlighted the benefits of reduced transaction charges halving as a proportion of GMV from 2019 to 2021. The other part, is reduction in marketing expenses, which may be temporary. (17/n)

Anyway, there's reams to write on the financials and governance but none of it is new or interesting. The key man risk here is stupendously high and needs to be watched for. Investors are not even getting 51% of the engine - Paytm Payments Bank, which remains with VS. (18/n)

How much will One97 pay to acquire the rest of PPBL? This can work out in a few different ways. If enough foreign investors exit and their right to appoint directors is extinguished, One97 can become an Indian owned and controlled entity, and can then acquire all of PPBL. (19/n)

RBI and other regulations permitting, VS can sell stake to One97 at lowest permissible cost, and minority shareholders can benefit. Other such VS holdings in insurance can also be reversed to give One97 control. The exact cost is a huge question for anyone buying now. (20/n)

I wonder if this is a case of excessive dilution by the founders, which has come to bite hard as One97 goes deeper into regulated sectors. An IPO may now be necessary for One97 to eventually be reclassified as a domestic investor and get easier access to regulated markets. (21/n)

As always, this is educational and not intended as a recommendation to buy or otherwise. RT the top post if you liked it. (22/n)

Oh, and I almost forgot to mention, PPBL is the only profitable entity in One 97, with 17 crore PAT and almost 2000 crore sales. Only 1000 crore revenue gets consolidated with One97 due to 49% ownership. 1000 crore value left out of the pool currently. Profitable value.

As someone just pointed out, *none* of the revenue gets consolidated, only part of the profit. So that's 2000 crore more revenue that's outside the pool.

• • •

Missing some Tweet in this thread? You can try to

force a refresh