Good morning! Here is Asia latest Covid cases. Graph shows net change daily & so far I hate to say this but Southeast Asia is doing rather poorly.

The Philippines is in green & net change is down from peak but still pretty high & there is fear that new Covid surge = new restrictions when it barely recovered from previous lockdowns. More fiscal likely needed. Dominguez says he is willing. Fully vaccinated only 4.4% of pop.

Philippines google mobility is not crashing yet (retail is -19% from pre Covid) but not great. For the Philippines to exit out of the current wave/restriction trap, it needs to up its vaccination rate from 4.4%.

Silver lining playbook? Hopefully the delta variant'll speed it up

Silver lining playbook? Hopefully the delta variant'll speed it up

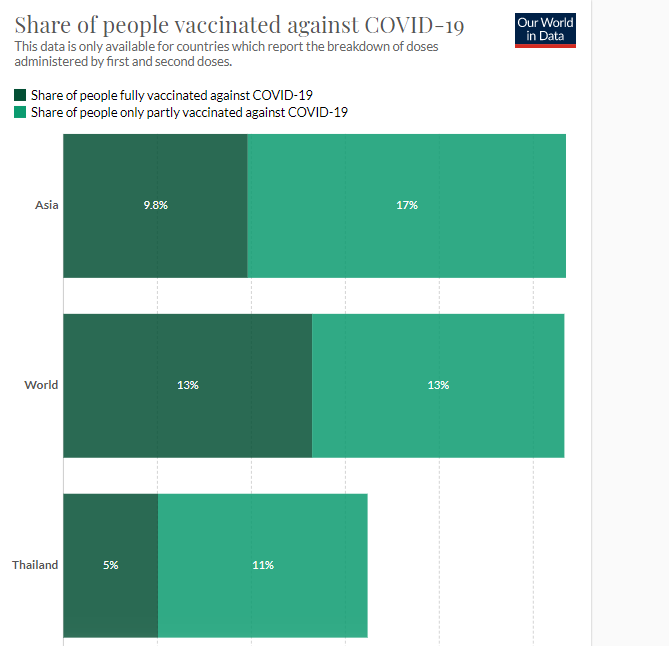

Indonesia is in blue (yes, my chart is ugly but u know what speed > beauty; I can make these in like 10 seconds) & cases are going down but from a pretty high level & apparently highest in world? Not good is it. Indo > Phils but only 6% fully vaccinated, behind Asia & world.

Indo retail mobility worse than the Philippines due to restrictions that is extended till 26 July. Jokowi ratings taking a hit. Will Bank Indonesia cut to help? No, IDR already weak. No space.

Thailand is yellow & trend is not its friend. Very bad for a country that needs tourism more than most in Asia. For being more developed than PH & ID, Thailand isn't much better w/ vaccination (yep 5%), something I flagged in Q1 & not much has changed since. So? Needs to change.

Malaysia is also pretty bad & trend is upward. Yikes. But it is better than Asia & world in vaccination rate. Yep! 15%, not bad but defo not enough to open up etc so here we are. Malaysia google mobility for retail sales is the WORST -54% (Thailand -23%)

Vietnam is orangy yellow & trend is bad too. It's doing everything it can to curb it from lockdown in Saigon + Hanoi & giving vaccines to industrial parks + making people build bubble (eg sleep at work) to avoid disruption to supply chain but the virus is raging.

And???

And???

Vietnam has a collapse of mobility (retail sales -53% so bad like Thailand) & thus growth in Q3 is not good. It needs to up its vaccination, which is WORST in Asia, as the ZERO covid strategy is not going to work w/ such an infectious strain.

So? Expect a pickup of vaccination!

So? Expect a pickup of vaccination!

Singapore is in aqua blue - kind of like my mood - optimistic! Cases "surging" & got restrictions but also has a path out!!! ENDEMIC VS PANDEMIC. Basically vaccinate 2/3 of the pop in 2 wks & then open up to live w/ the virus like dengue fever. Mobility for retail sales only -10%

Singapore vaccination so far - did I tell you that Singapore is my silver lining playbook for Covid in Asia? If Singapore is able to exit this restriction trap via speedy vaccination, then we're seeing the light at the end of the tunnel. 48% vaccindated!

https://twitter.com/Trinhnomics/status/1417457828810293251?s=20

South Korea got a surge of cases too & restrictions are on; but u know what, its google mobility is not bad at -5% for retail sales so I'm thinking the restrictions aren't that harsh? Anyway, its exports doing great but can't say the same for domestic consumption. Vaccination low

South Korea needs to boost its inoculation rate from 13% currently to exit out of the restriction trap as well. Hopefully it will considering it is very capable of doing so.

Wanna compare Asia vs US vs World? The US vaccination rate is on par w/ Singapore, which is pretty good at 48% as it has a much larger economy/population. Google mobility is pretty good as the economy opens up.

US new covid cases & new deaths (deaths = lagging indicator) - key here is that smudge of higher cases will result in more deaths. If not, then that means that vaccines are effective at allowing us to turn from pandemic into endemic, to borrow the Singaporean phrase.

Ok, so everyone is like wut about Israel? Isn't it a better silver lining playbook than say Singapore? Well, yes, but I wanted to use an Asian example. So Israel managed to vaccinated 61% of its population. And so? Cases still rose BUT DEATHS NOT!

I like that gap below. Me likey. Obvs deaths = lagging so let's wait and see but so far the rise of cases not MASSIVELY SURGING so don't be alarmed. Plus deaths/cases gap wide, which is good.

Hope this thread cheered u up even though trend is pretty bad for Asia, Southeast Asia

Hope this thread cheered u up even though trend is pretty bad for Asia, Southeast Asia

Let me end this thread of cases in Asia w/ vaccination rates in Asia by saying the following:

Southeast Asia, esp Vietnam, the Philippines, Indonesia & Thailand at the BOTTOM for vaccination rates & below world.

Needs to do better ASAP. Also where cases are rising. So?

Southeast Asia, esp Vietnam, the Philippines, Indonesia & Thailand at the BOTTOM for vaccination rates & below world.

Needs to do better ASAP. Also where cases are rising. So?

If Israel, US & UK data come out to show that vaccination = reduction of deaths + hospitalization, then we got a situation where those that vaccinated vs not will have divergent performance economically & socially. Because we need to move to ENDEMIC ASAP. End of 2021 please.

Southeast Asia has a lot of catching up to do & it needs to do it like NOW. You are also seeing more headlines of these economies more urgently acquiring jabs etc. And so it's not all negative. Perhaps the delta variant will change the trajectory of vaccination for the positive.

And to loop this back to the US/geopolitics, if it really wants to influence the region, perhaps helping these economies w/ acquiring jabs is a good start. They are rather desperate to get some, as they should be. We are seeing the beginning of the end or a huge divergence.

• • •

Missing some Tweet in this thread? You can try to

force a refresh