1/ Relative Performance of Real Estate Marketing Platforms: Mls Versus Fsbomadison.Com (Hendel, Nevo, Ortalo-Magné)

"We do not find that listing on the MLS helps sellers obtain a higher sale price, but it does shorten the time it takes to sell."

papers.ssrn.com/sol3/papers.cf…

"We do not find that listing on the MLS helps sellers obtain a higher sale price, but it does shorten the time it takes to sell."

papers.ssrn.com/sol3/papers.cf…

2/ "FSBOMadison.com actively extinguishes any listing from its website that ends up on the MLS.

"Real estate agents are occasionally involved in FSBO sales when they represent the buyer and one of the parties agrees to pay a buying agent commission, typically 3%."

"Real estate agents are occasionally involved in FSBO sales when they represent the buyer and one of the parties agrees to pay a buying agent commission, typically 3%."

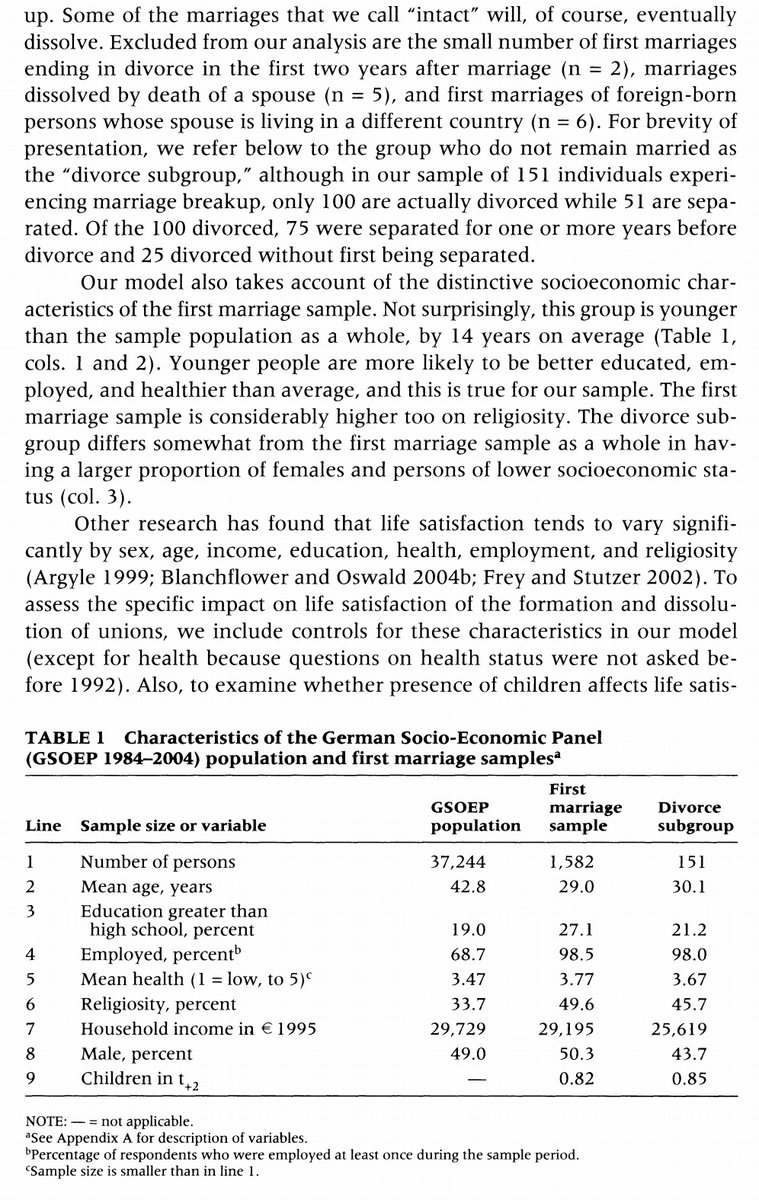

3/ Table 1: "A row represents where a property was initially listed. The columns represent the eventual outcome (where/how it sold).

"Out of properties that sell, 95% sell through the initial listing platform. The remaining 5% are almost completely switches from FSBO to MLS."

"Out of properties that sell, 95% sell through the initial listing platform. The remaining 5% are almost completely switches from FSBO to MLS."

4/ "Top FSBO share neighborhoods tend to be close to campus.

"The success rate of FSBO listings varies by neighborhood. For a neighborhood with at least ten FSBO listings, the success rate ranges from 31% to 100% (w/ one outlier at 9%). The mean success rate (σ) is 66% (13.2%).

"The success rate of FSBO listings varies by neighborhood. For a neighborhood with at least ten FSBO listings, the success rate ranges from 31% to 100% (w/ one outlier at 9%). The mean success rate (σ) is 66% (13.2%).

5/ "There is a positive relation between the propensity to list on FSBO and the success rate, which can be seen through a linear regression. Using the estimated slope, one σ increase in success rate translates into 2 percentage points' increase in the propensity to list on FSBO."

6/ "Differences in the means for most characteristics are small. However, b/c of the reasonably large sample size, they are sometimes significant.

"FSBO properties are somewhat older & tend to be on smaller lots and have smaller basements but somewhat newer roofs and furnaces."

"FSBO properties are somewhat older & tend to be on smaller lots and have smaller basements but somewhat newer roofs and furnaces."

7/ "Sellers on FSBO are able to sell their houses at a premium relative to MLS. In addition, sellers that initially list their houses on FSBO but then move to MLS also command a premium relative to initial MLS listings.

"Random assignment is a strong assumption in this context."

"Random assignment is a strong assumption in this context."

8/ "The lack of a statistical difference in the time on the market does not imply that FSBO is as effective as the MLS. Quite the contrary, this suggests the MLS to be more effective.

"The FSBO average is conditional on the house belonging to the 75% that sold on FSBO."

"The FSBO average is conditional on the house belonging to the 75% that sold on FSBO."

9/ "Properties listed on FSBO tend to take longer to sell; their initial success is lower than for MLS listings. This is mainly driven by the properties that start on FSBO and switch to MLS.

"This is consistent with MLS exposing sellers to a bigger stock of buyers."

"This is consistent with MLS exposing sellers to a bigger stock of buyers."

10/ "Results suggest that there is no bias in the estimates due to an unobserved house effect that is fixed over time. This should not be surprising. The differences in the observed characteristics were not large, and controlling for them before did not make a large difference."

11/ Footnote 13: "For the sample of movers (from FSBO to MLS) we regressed price, time on the market on the MLS, and probability of selling within the first 60 days after moving on the time the house spent on FSBO before changing platforms.

12/ "Time spent on FSBO has no explanatory power on any of those performance variables on the MLS. The lack of correlation between stay in FSBO and MLS performance seems to suggest as the decision to stay more or less on FSBO does not seem to reflect any systematic selection."

13/ "Our second approach to quantify the role of unobservable seller characteristics is to compare FSBO sales to realtors' transactions of their own properties.

"Owners do obtain a price premium. However, we find no statistical difference between agent/owner & sales on FSBO."

"Owners do obtain a price premium. However, we find no statistical difference between agent/owner & sales on FSBO."

14/ "FSBO sellers (those who listed a property on FSBO at any time during the sample, not necessarily at that particular observation) are indeed likely to get a higher price even when selling through the MLS."

15/ "In summary, we explored various ways to control for seller selection in the decision to use FSBO. Results suggest that selection is present.

"After controlling for selection, the FSBO premium disappears. However, we find no evidence that MLS provides any premium over FSBO."

"After controlling for selection, the FSBO premium disappears. However, we find no evidence that MLS provides any premium over FSBO."

16/ "Although FSBO does not entail a price penalty, it is a less effective platform. The larger MLS network does better in terms of both expected time to sell and probability of a transaction within a time period. Scale economies appear not to yet be fully achieved by FSBO."

17/ "We do not know if our results hold more broadly. The penetration rates of FSBOMadison.com vary widely across neighborhoods. It is our impression, based on casual observation, that the penetration rates of FSBO also vary across markets.

18/ "The data we analyzed so far end at 2004. It would be interesting to study a market during a more difficult time, during a cooler housing market. We could see if the cost or, returns to, using a realtor vary with the cyclicality of the market."

19/ More:

Thread on real estate investing

Real Estate Agent Remarks: Help or Hype?

Incentives & Performance in Real Estate Brokerage

Expertise Value Added in the Real Estate Market

Thread on real estate investing

https://twitter.com/ReformedTrader/status/1399891647287029760

Real Estate Agent Remarks: Help or Hype?

https://twitter.com/ReformedTrader/status/1417933899255074816

Incentives & Performance in Real Estate Brokerage

https://twitter.com/ReformedTrader/status/1417665207858462722

Expertise Value Added in the Real Estate Market

https://twitter.com/ReformedTrader/status/1417516527134199818

20/ Do Real Estate Brokers Add Value When Listing Services are Unbundled?

https://twitter.com/ReformedTrader/status/1418237527819837440

21/ Market Distortions When Agents are Better Informed: The Value of Information in Real Estate Transactions

https://twitter.com/ReformedTrader/status/1418362609389031427

• • •

Missing some Tweet in this thread? You can try to

force a refresh