0) Tons of articles have discussed the Axie Infinity fever, but few have dug deeper enough in a scientific manner. Thus I wrote the first report about Axie covering its in-game economic system from a data-driven perspective. Any feedback is appreciated.

drive.google.com/file/d/1pqQBqc…

drive.google.com/file/d/1pqQBqc…

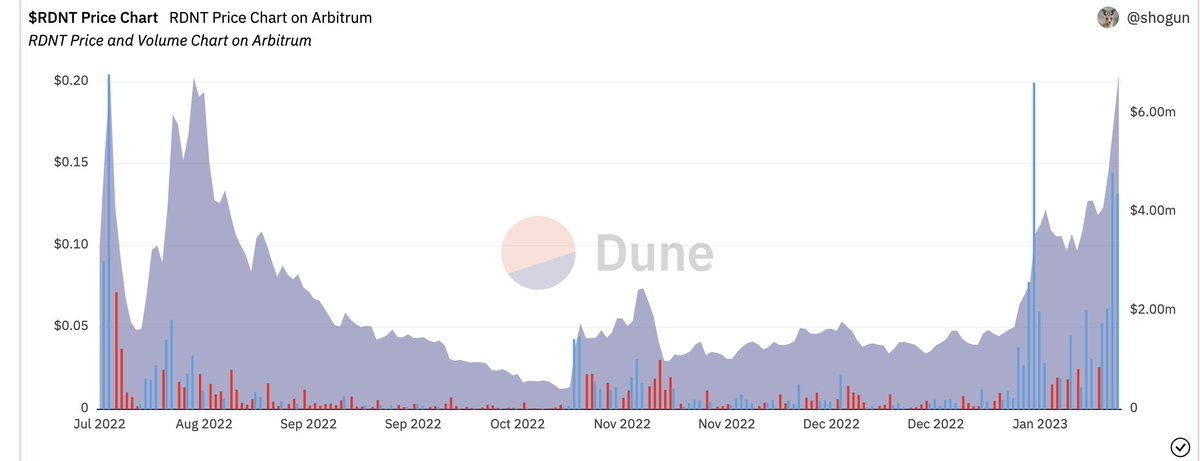

1) The Axie's economic flywheel is currently driven by two core gameplays: Battle and Breeding. The value chain formed a closed-loop from inflow to outflow.

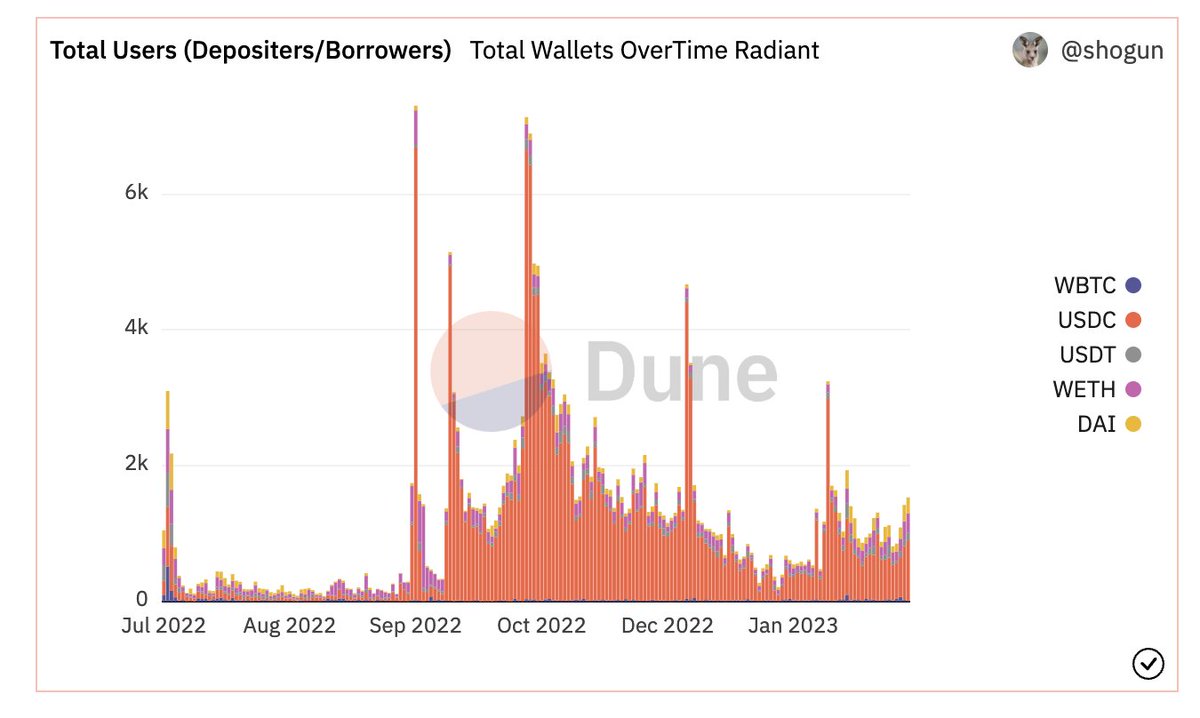

2)Taking the battle system into consideration solely, average players can earn more than $2000 USD at the present SLP price level.

Here is how can they achieve it:

Here is how can they achieve it:

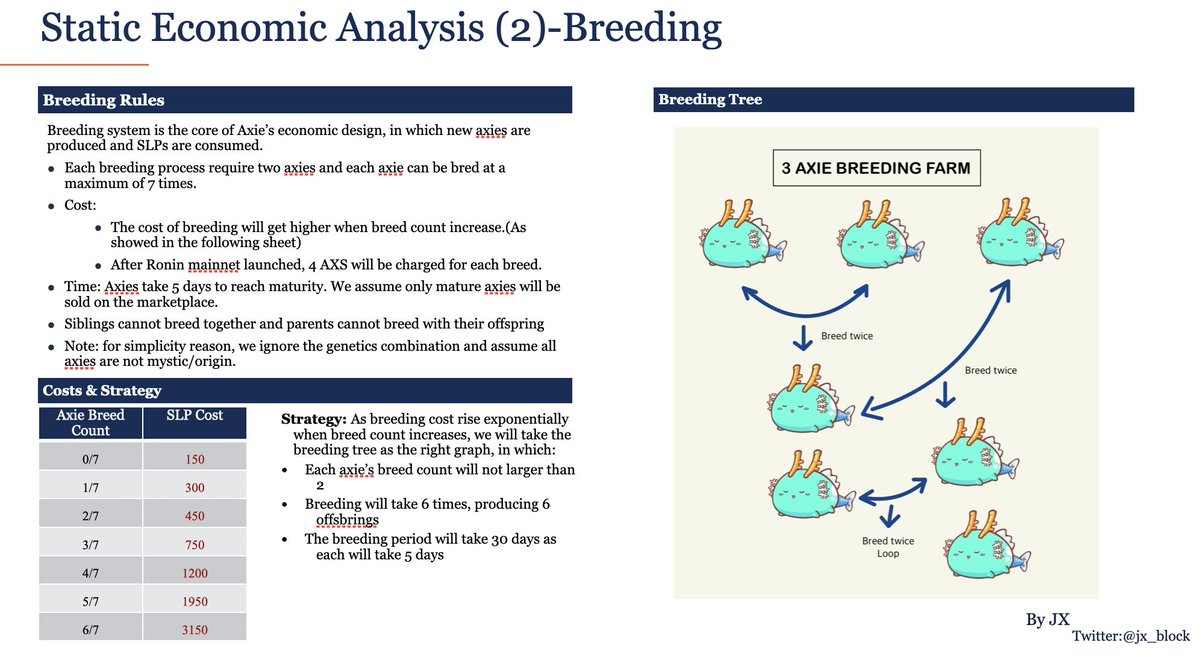

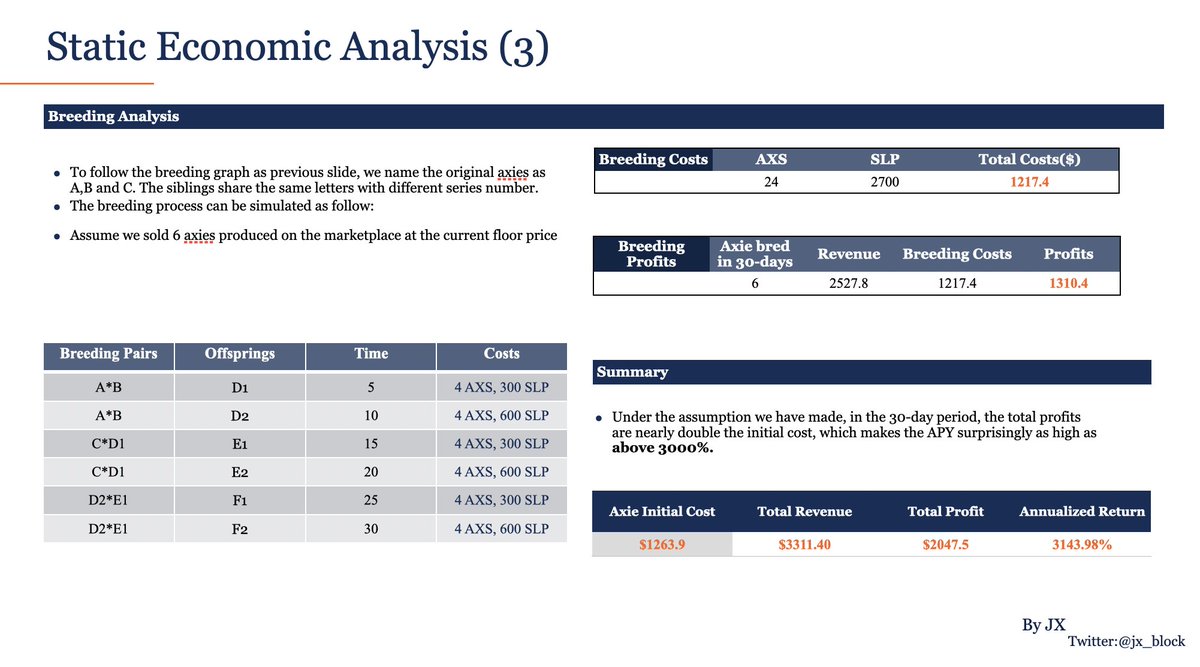

3) The breeding system is the core of Axie’s economic design, in which new axies are produced and SLPs are consumed. We choose a popular breeding strategy and the annualized return reach above 3000%, quite astonishing.

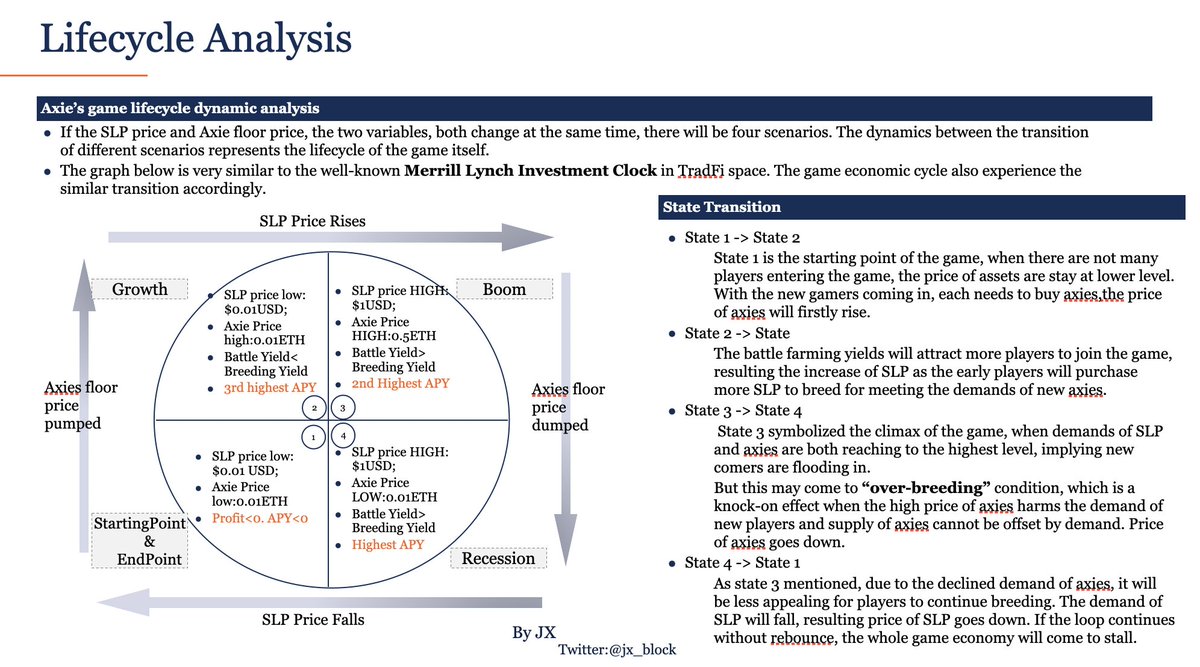

4)The report provides original research on the lifecycle analysis consists of theoretical modeling and historical data verification. The model is very similar to the well-known Merrill Lynch Investment Clock in TradFi space

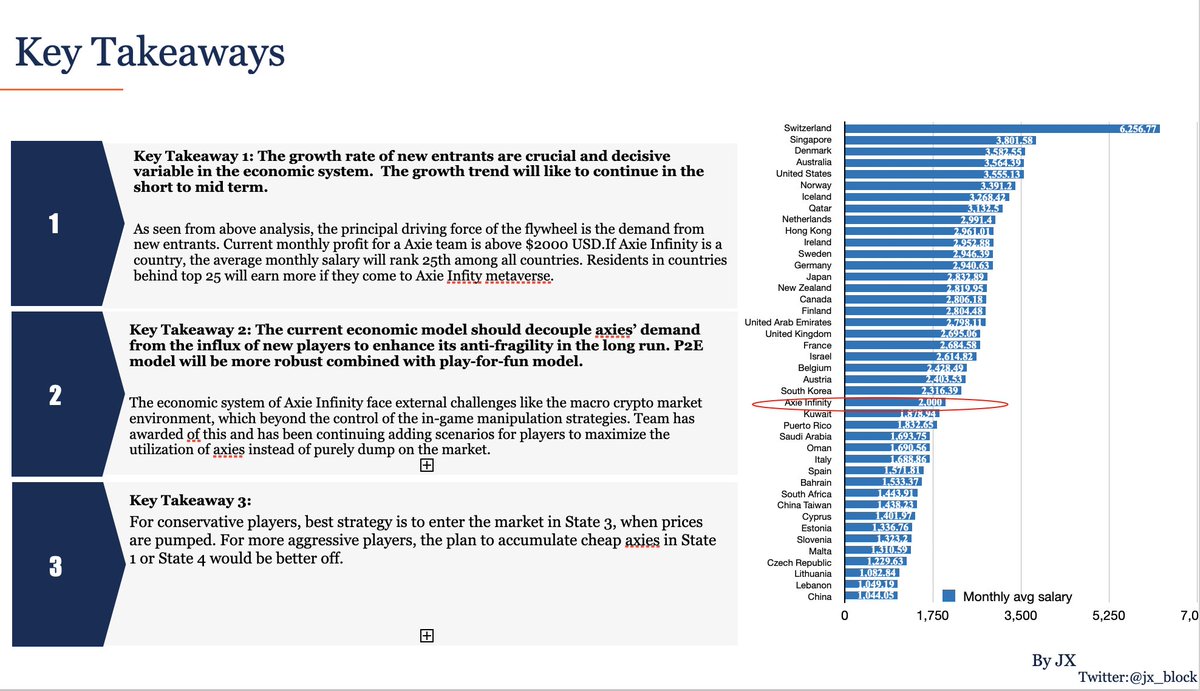

5)If Axie Infinity is a country, its average monthly salary will rank 25th among all countries. However, it would be essential to decouple the demand of new entrants with the economic system in the long run.

6)If this report gets more than 100 likes, I'll write about the valuation model on the price of AXS in my next report.

Disclaimer: The report is only for research purposes, please do not take it as financial advice. DYOR.

#AxieInfinity

Disclaimer: The report is only for research purposes, please do not take it as financial advice. DYOR.

#AxieInfinity

Latest PDF version for download:drive.google.com/file/d/1ip3H6l…

Typos are fixed.

Typos are fixed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh