"Is more UST being locked up in @anchor_protocol good for Terra / LUNA?"

A 🧵 attempting to clear the air on this often-asked question.

It's heavy, but please read to the end.

A 🧵 attempting to clear the air on this often-asked question.

It's heavy, but please read to the end.

1/20

You'd think - yes, obviously? More UST entering Anchor is great (drives UST demand, and subsequently LUNA burn).

But take a step back.

People deposit into anchor for its renowned c.20% stable yield. TVL growth is good, but what if everyone came rushing at the same time?

You'd think - yes, obviously? More UST entering Anchor is great (drives UST demand, and subsequently LUNA burn).

But take a step back.

People deposit into anchor for its renowned c.20% stable yield. TVL growth is good, but what if everyone came rushing at the same time?

2/20

Would anchor be able to handle say, an influx of $500m of deposits suddenly? (cc: $ICE) How about millions increasingly being deposited on a daily basis?

It goes back to the question of where these yields come from.

Would anchor be able to handle say, an influx of $500m of deposits suddenly? (cc: $ICE) How about millions increasingly being deposited on a daily basis?

It goes back to the question of where these yields come from.

3/20 Anchor has been marketed as a solid savings account but don't forget it's also a lending protocol.

Borrowers can take loans by depositing collateral in the form of bLuna.

bLuna (or staked LUNA) is a cash-generating asset. All staking rewards are absorbed by anchor.

Borrowers can take loans by depositing collateral in the form of bLuna.

bLuna (or staked LUNA) is a cash-generating asset. All staking rewards are absorbed by anchor.

4/20 Right now, annualised staking yield is about 5%. These come from tax rewards, oracle rewards, gas, MIR / ANC airdrop rewards, etc.

In a bear market where blockchain traffic is much lower, we can expect staking yields to fall. Used to be 10-12% previously.

In a bear market where blockchain traffic is much lower, we can expect staking yields to fall. Used to be 10-12% previously.

5/20

Let's take a look at some numbers. Simple math ahead.

To date, anchor has $1.1bn TVL:

- $600m deposits

- $500m collateral

- $170m borrowed

Let's take a look at some numbers. Simple math ahead.

To date, anchor has $1.1bn TVL:

- $600m deposits

- $500m collateral

- $170m borrowed

6/20

$600m deposits demanding 20% APY = $120m need to be paid out to depositors.

$550m collateral yielding 5% APY = $28m collected by protocol from staking rewards.

$170m borrowers paying 13% APY = $22m collected by the protocol from borrowing fees.

$600m deposits demanding 20% APY = $120m need to be paid out to depositors.

$550m collateral yielding 5% APY = $28m collected by protocol from staking rewards.

$170m borrowers paying 13% APY = $22m collected by the protocol from borrowing fees.

7/20

That's a shortfall of $70m (120-28-22) that the protocol has to pay out to depositors.

Is Anchor sustainable on its own after 1Y? No.

Not at least based on current rates of deposits, collateral, borrowings.

That's a shortfall of $70m (120-28-22) that the protocol has to pay out to depositors.

Is Anchor sustainable on its own after 1Y? No.

Not at least based on current rates of deposits, collateral, borrowings.

8/20

Thankfully, the Terra community is backed by devoted founders and developers. They want to make this work.

Just over $70m was topped up in the yield reserve in early July.

Thankfully, the Terra community is backed by devoted founders and developers. They want to make this work.

Just over $70m was topped up in the yield reserve in early July.

https://twitter.com/anchor_protocol/status/1412614294185943043?s=20

9/20

If you see the calculation below, that gives anchor just enough to tide through 1Y.

Assuming all things stay unchanged over the course of the year, protocol may run dry.

(Please note this is a big assumption, just for illustration purposes.)

If you see the calculation below, that gives anchor just enough to tide through 1Y.

Assuming all things stay unchanged over the course of the year, protocol may run dry.

(Please note this is a big assumption, just for illustration purposes.)

10/20

So going back to the original question - is more UST being locked up in anchor a good thing?

Well, it depends!

If deposits keep increasing while everything else stays constant then no! That dries up organic yields and reserves, so not a good thing.

So going back to the original question - is more UST being locked up in anchor a good thing?

Well, it depends!

If deposits keep increasing while everything else stays constant then no! That dries up organic yields and reserves, so not a good thing.

11/20

But if deposits increase alongside 4 other variables...

1) Collateral;

2) Staking yield;

3) LTV; and

4) Borrowing interest rates;

...then yes!

We will be on track to a self-sustaining protocol in the long term. Potentially without having to deplete the yield reserves.

But if deposits increase alongside 4 other variables...

1) Collateral;

2) Staking yield;

3) LTV; and

4) Borrowing interest rates;

...then yes!

We will be on track to a self-sustaining protocol in the long term. Potentially without having to deplete the yield reserves.

12/20

See ideal scenario.

- Deposits and Collaterals both grow, and at the same rate. (Var 1)

- Staking yield increases over time, with more airdrops and traffic on the Terra blockchain (Var 2)

- LTV and Borrowing % increases (Var 3 and 4)

- Deposit rate also drops to 19.4%

See ideal scenario.

- Deposits and Collaterals both grow, and at the same rate. (Var 1)

- Staking yield increases over time, with more airdrops and traffic on the Terra blockchain (Var 2)

- LTV and Borrowing % increases (Var 3 and 4)

- Deposit rate also drops to 19.4%

13/20

The result is a protocol that runs self-sustainably, with positive net organic funds every year. $1m in annual recurring profits doesn't sound so bad.

Of course, this is but the bull case and we shouldn't get carried away. Still a long way but not impossible.

The result is a protocol that runs self-sustainably, with positive net organic funds every year. $1m in annual recurring profits doesn't sound so bad.

Of course, this is but the bull case and we shouldn't get carried away. Still a long way but not impossible.

14/20

If we expect deposits to grow, then we will need 1 or 4 of the variables to improve as well.

If you own $LUNA, don't be afraid to borrow. Deposit bLuna as collateral, try taking out a loan. This will help with Variable 1 (increasing total collateral in the system).

If we expect deposits to grow, then we will need 1 or 4 of the variables to improve as well.

If you own $LUNA, don't be afraid to borrow. Deposit bLuna as collateral, try taking out a loan. This will help with Variable 1 (increasing total collateral in the system).

15/20

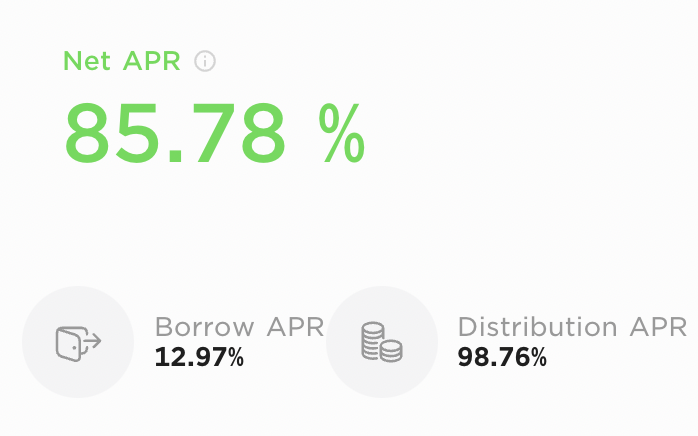

Don't know what to do with the borrowed $UST @ 13 interest? Throw it into Earn at 19% APY! Net gain of 6% in a few clicks.

Anchor's LM programme also pays you an additional 85% for taking out a loan now.

This has been one of my main plays in this crab / bear market.

Don't know what to do with the borrowed $UST @ 13 interest? Throw it into Earn at 19% APY! Net gain of 6% in a few clicks.

Anchor's LM programme also pays you an additional 85% for taking out a loan now.

This has been one of my main plays in this crab / bear market.

16/20

A proposal was just launched to increase max LTV to 60% (from previously 50%). This helps with Variable 3.

Even though current LTV is c.30%, increasing the threshold gives riskier borrowers more leeway.

A proposal was just launched to increase max LTV to 60% (from previously 50%). This helps with Variable 3.

Even though current LTV is c.30%, increasing the threshold gives riskier borrowers more leeway.

https://twitter.com/anchor_protocol/status/1414523144061153282?s=21

17/20

All in all, there's a lot we (I unabashedly speak for $LUNA holders) can do to make @anchor_protocol damn successful. If this is successful, so will the @terra_money ecosystem be.

All in all, there's a lot we (I unabashedly speak for $LUNA holders) can do to make @anchor_protocol damn successful. If this is successful, so will the @terra_money ecosystem be.

18/20

Before I digress, this post was meant to clarify the statement I've been hearing around.

"More TVL in Anchor! More UST locked up!"

This is a good thing, IF it is not solely driven by deposits. If deposits are the only thing increasing, the protocol won't be sustainable.

Before I digress, this post was meant to clarify the statement I've been hearing around.

"More TVL in Anchor! More UST locked up!"

This is a good thing, IF it is not solely driven by deposits. If deposits are the only thing increasing, the protocol won't be sustainable.

19/20

We should expect deposits to grow in mid-long term. Bear market = chase safer stablecoin yields.

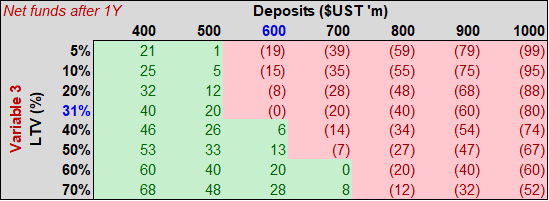

I've ran a few sensitivities to see how net funds may look like against the 4 Variables. This will be more accurate on a monthly CF but I don't have the time to build that.

We should expect deposits to grow in mid-long term. Bear market = chase safer stablecoin yields.

I've ran a few sensitivities to see how net funds may look like against the 4 Variables. This will be more accurate on a monthly CF but I don't have the time to build that.

20/20 To recap, this 🧵 is meant to:

(i) Clarify misconceptions of the title statement and;

(ii) Give suggestions of what can be done to make Anchor more sustainable.

Happy to have a chat if you think I've missed out anything or if any of the above pointers were inaccurate.

(i) Clarify misconceptions of the title statement and;

(ii) Give suggestions of what can be done to make Anchor more sustainable.

Happy to have a chat if you think I've missed out anything or if any of the above pointers were inaccurate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh