Friday Night Thoughts - Thread on inflation and other stuff:

The cure for higher prices is higher prices, but it's also a three card trick...

Prices of goods disrupted by supply issues have exploded...(I used CPI Index, not CPI YoY as its distorted).

The cure for higher prices is higher prices, but it's also a three card trick...

Prices of goods disrupted by supply issues have exploded...(I used CPI Index, not CPI YoY as its distorted).

What is going to happen in housing is clear - the homebuilders need to stop building or they will have an inventory problem...

And therefore we will see the age old chart of truth (the 10 yr bond regression channel) work its magic. An excessively indebted economy can not have large rises in prices without collapsing demand...(and rates CANNOT rise).

In fact with global debts of all forms between $400 trillion net and $1.2 quadrillion gross (yes, Quad-fucking-trillion) - the collateral (assets) can NOT be allowed to fall or the system is wiped out.

and so the merry game of systematic bailout MUST continue....

and so the merry game of systematic bailout MUST continue....

(All of you who comment that the Fed MUST reverse course, normalize etc actually will lead to a total wipe out of equity, credit, currency, banks, savings, pensions, innovation funding - all of it. That is not going to be allowed to happen (in this way)). Those days are long gone

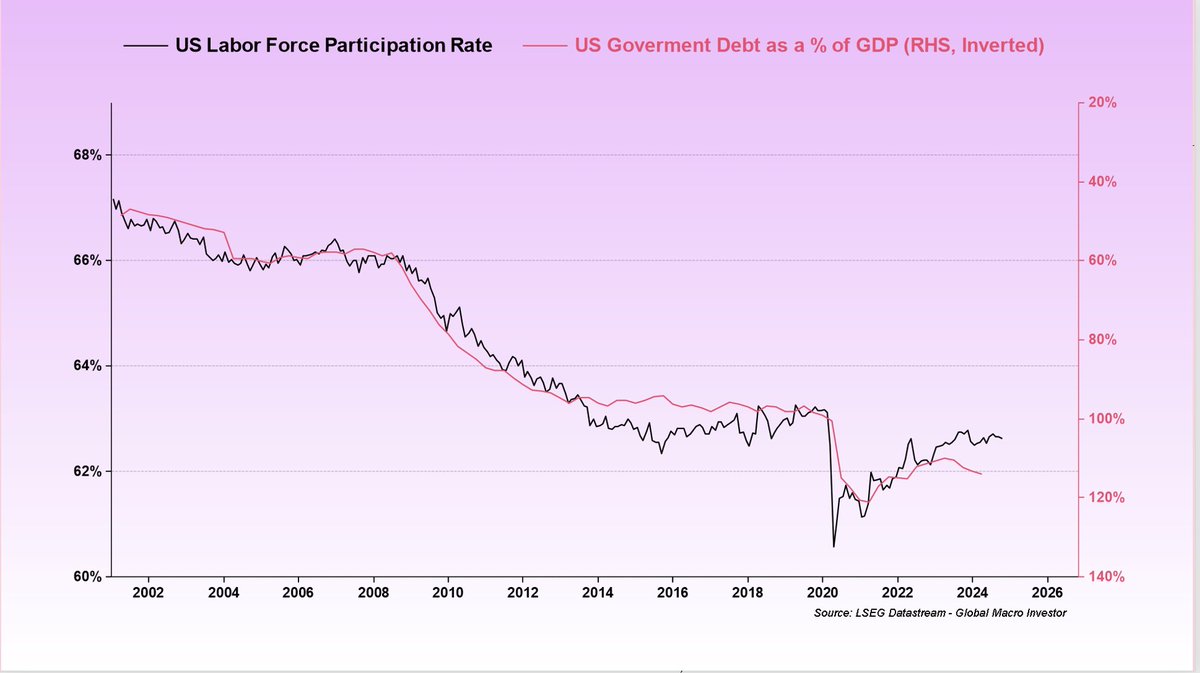

But technology, globalization, demographics and debt actually weigh heavily on traditional inflation measures...Demographics being key. (i.e wages are not going up in real terms... they cant...variable earnings not either...its near impossible).

So prices don't rise in YoY terms much (which is why I worry less about runaway inflation over time) BUT prices never stop going up... FACT.

This is why disinflationists and inflationists are BOTH right.

But runaway inflation kills demand, which kills inflation growth. That is undeniable currently.

Can that change? Maybe.

I am open to it but I am much more in the disinflation camp.

But runaway inflation kills demand, which kills inflation growth. That is undeniable currently.

Can that change? Maybe.

I am open to it but I am much more in the disinflation camp.

But we all know we are getting fucked, right? Yes. Inflationists expect its coming via CPI, deflationists think that the collateral will go bust. But the answer is most likely neither. It is that old denominator issue. The value is fiat is falling and its not easy to measure.

I measure it in asset terms. Prices are not rising or their earnings and wages would rise in line but aren't. They are being marked up in price by falling purchases power versus assets. (An asset is something with limited supply.)

Here is the inflation adjusted SPX,seems OK.

Here is the inflation adjusted SPX,seems OK.

Here it is versus the Fed balance sheet (my approximation of purchasing power of asset devaluation.)

And I know so many of you, using theoretical frameworks call bullshit on this, but this is hard to explain...the G4 Central Bank Balance Sheets vs SPX. It is the EXACT same thing.

Don't give me cheap "correlation doesn't equal causation" gibes. It gets old and the burden of proof is on you.

As is the burden of proof of" QE doesn't not equal money printing!". I DON'T CARE. Evidence suggests that fiat is being devalued, regardless of the mechanism.

As is the burden of proof of" QE doesn't not equal money printing!". I DON'T CARE. Evidence suggests that fiat is being devalued, regardless of the mechanism.

I have never been a money printing guy.

I am a disinflatist.

I realized a while ago I was looking at the wrong measure in my understanding.

There is endless evidence that the denominator effect holds true globally...

I am a disinflatist.

I realized a while ago I was looking at the wrong measure in my understanding.

There is endless evidence that the denominator effect holds true globally...

Smart arses love to ridicule all of this (Wiesenthal etc al) but the evidence is so deep and so broad (I can show 20 or more charts) that it is tough to argue that the BIG issue is most likely the purchasing power of fiat vs assets. (there are no certainties but odds are v high).

In the end, assets are future deferred consumption and debt is future deferred savings.

Everyone is royally fucked.

This is financial repression 101.

But I have sympathy because there is no choice as all other outcomes are worse.

Everyone is royally fucked.

This is financial repression 101.

But I have sympathy because there is no choice as all other outcomes are worse.

Invest wisely. Bonds might be a one year trade but over 5 years you WILL lose. Most equities just allow you to stand still. Tech does better. Crypto much better. Real Estate is a stand still too (except super limited supply).

The rarer the asset, the more it rises.

The rarer the asset, the more it rises.

But with low cost of capital and high returns on tech entrepreneurship, there is no better time in history to do your own thing.

If you make yourself the rare asset, you are worth a fortune.

If not, make sure you get equity in your firm, and make sure you invest wisely on top.

If you make yourself the rare asset, you are worth a fortune.

If not, make sure you get equity in your firm, and make sure you invest wisely on top.

Rum O'Clock. Over and Out.

Toodle Pip!

Toodle Pip!

• • •

Missing some Tweet in this thread? You can try to

force a refresh