So Avalara is a Quiet Giant in SaaS -- that you don't know enough about

At $600m ARR, growing 38%+, it does something both boring AND hard

It sells tax compliance software to SMEs

5 Interesting Learnings: ⬇️⬇️⬇️⬇️⬇️

At $600m ARR, growing 38%+, it does something both boring AND hard

It sells tax compliance software to SMEs

5 Interesting Learnings: ⬇️⬇️⬇️⬇️⬇️

#1. 15,580 customers, up 20% year-over-year — or $40,000 per customer per year on average.

NRR is 107%, fairly consistently over the past 4 quarters. Good but not great for a $40k deal.

What they do is mission critical, so ACVs from SMEs are pretty high

NRR is 107%, fairly consistently over the past 4 quarters. Good but not great for a $40k deal.

What they do is mission critical, so ACVs from SMEs are pretty high

#2. 1000 partners are key to their GTM strategy. And “in 950 of the partners, Avalara has no competition”.

Like HubSpot, Shopify and other leaders that sell sophisticated, $10k+ solutions to SMEs, partners are key to implementation.

They invest >heavily< here

Like HubSpot, Shopify and other leaders that sell sophisticated, $10k+ solutions to SMEs, partners are key to implementation.

They invest >heavily< here

#3. $180,000 revenue per employee. With 3,351 employees, Avalara is not that leveraged.

We’ve seen this with sales-driven SMB and SME leaders like Xero as well. If you are selling to SMBs, you have to be efficient. Especially if they need a lot of human interaction.

We’ve seen this with sales-driven SMB and SME leaders like Xero as well. If you are selling to SMBs, you have to be efficient. Especially if they need a lot of human interaction.

#4. 7% of revenues from prof services — which have 48% margins

Avalara leans on partners to do most of the heavy lifting here (see #2), but they still provide them for larger customers. They mark the services up about 2x. They don’t lose money on services.

Avalara leans on partners to do most of the heavy lifting here (see #2), but they still provide them for larger customers. They mark the services up about 2x. They don’t lose money on services.

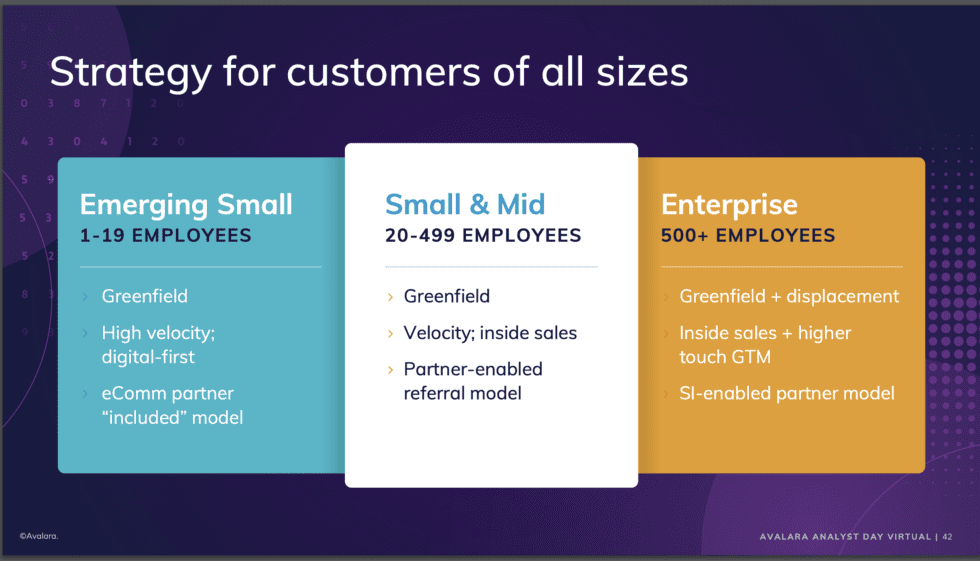

#5. Driving upmarket to cross $1B in ARR, but $100k is still a big customer for them

Avalara is fueling growth to $1B ARR by pushing into $100k+ deals, but it didn't rush there.

Their core is still SME and it got to hundreds of millions of ARR while remaining SME focused:

Avalara is fueling growth to $1B ARR by pushing into $100k+ deals, but it didn't rush there.

Their core is still SME and it got to hundreds of millions of ARR while remaining SME focused:

And a few bonus notes

#6. It wasn't a rocketship to start.

Avalara was founded in 2004, took 16 years to hit the first $500m in ARR, in 2020.

But the compounding now is epic.

#6. It wasn't a rocketship to start.

Avalara was founded in 2004, took 16 years to hit the first $500m in ARR, in 2020.

But the compounding now is epic.

#7. Gross annual churn of 4%, NRR of 107%.

It’s great to see an SME leader disclose the combo of gross churn and NRR.

It’s great to see an SME leader disclose the combo of gross churn and NRR.

#8. Long-tail drive revenue.

Most of us underinvest in our partner ecosystem, see #2 above

A great visual here about how their 1000+ partners bring in revenue and deals for them:

Most of us underinvest in our partner ecosystem, see #2 above

A great visual here about how their 1000+ partners bring in revenue and deals for them:

#9. Finally, deal sizes are up across all segments — Small, Medium, & Large

Enterprise is $71k ACV, Mid-market is $36k, SMB is $23k, and small customers are $14k ACV

Deal sizes are all up over the past 24 mos outside of smallest customers

This is how most of us scale

Enterprise is $71k ACV, Mid-market is $36k, SMB is $23k, and small customers are $14k ACV

Deal sizes are all up over the past 24 mos outside of smallest customers

This is how most of us scale

• • •

Missing some Tweet in this thread? You can try to

force a refresh