GET funded ➡ $200m https://t.co/AVvPIrIdFP🦄🦄🦄🦄🦄🦄🦄 FREE PLAYBOOK ➡ https://t.co/TIsMr22AhO CHAT Digital Jason ▶ https://t.co/bwkZCtvqlr Founder/ceo #AdobeSign

13 subscribers

How to get URL link on X (Twitter) App

The one-time wealth tax revenue is just the headline number. The real damage may be ongoing — and much larger:

The one-time wealth tax revenue is just the headline number. The real damage may be ongoing — and much larger:

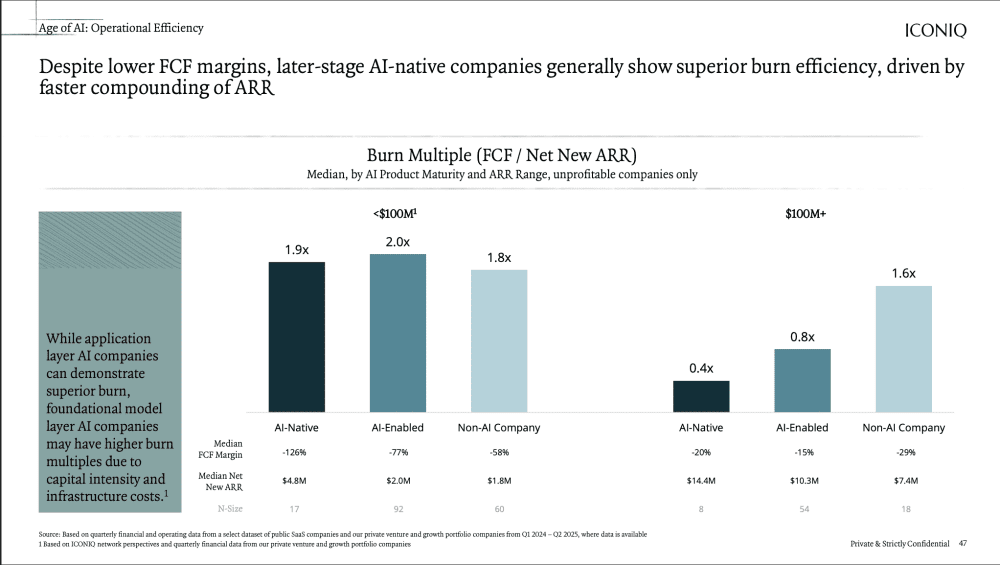

#1. AI Companies Burn More Cash — But Also Have Better Capital Efficiency. It’s Not a Paradox But … It’s Complicated.

#1. AI Companies Burn More Cash — But Also Have Better Capital Efficiency. It’s Not a Paradox But … It’s Complicated.

https://x.com/jasonlk/status/1942992088288891104First, the reality check: We have unfair advantages

#1: 2025 is the “Year of Offense” – Growth Trumps Everything -- Again

#1: 2025 is the “Year of Offense” – Growth Trumps Everything -- Again

1. AI User Adoption Is Literally Unprecedented

1. AI User Adoption Is Literally Unprecedented

Klaviyo and Instacart in the end didn’t leave any money on the table

Klaviyo and Instacart in the end didn’t leave any money on the table