It's the weekend!

Grab a cup of coffee, in this thread I will explain

1. How I achieved financial independence before my 28th Birthday?

2. How a janitor become a millionaire?

3. How even you can live a financially healthy life by following a few concepts?

Lets dive right in.

Grab a cup of coffee, in this thread I will explain

1. How I achieved financial independence before my 28th Birthday?

2. How a janitor become a millionaire?

3. How even you can live a financially healthy life by following a few concepts?

Lets dive right in.

This year before my 28th Birthday.

My Net Worth surpassed my Lifetime Earnings and I achieved my goal of becoming Financially Independent.

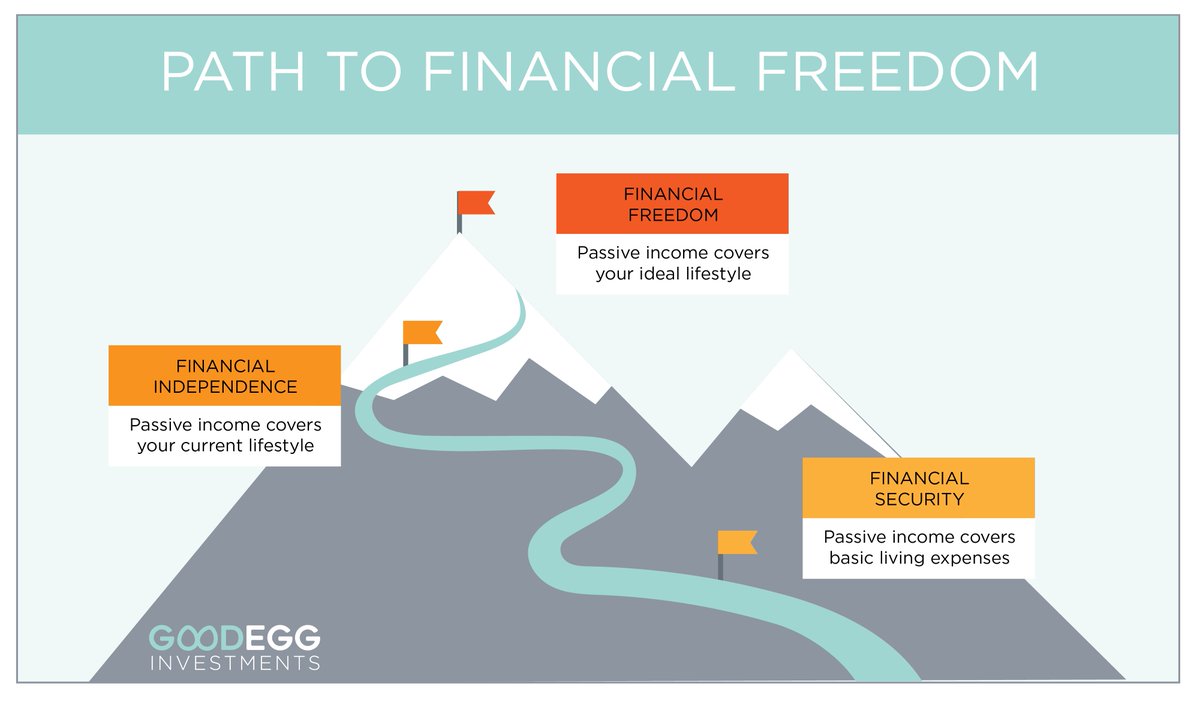

Financial Independence = When you do not have to work to earn for a living, you work cause you like to on whatever that makes you happy.

My Net Worth surpassed my Lifetime Earnings and I achieved my goal of becoming Financially Independent.

Financial Independence = When you do not have to work to earn for a living, you work cause you like to on whatever that makes you happy.

Talking about money is hard and uncomfortable and writing this thread, even I do feel a tad bit uncomfortable and exposed but its a conversation we need to have, cause its an Important one.

So many of us are treating and using money the wrong way cause we aren't taught about this very important life skill called Personal Finance either in school or college.

Somehow the world expects us to just figure it out as we transition to our adult lives.

Somehow the world expects us to just figure it out as we transition to our adult lives.

I do not come from a wealthy family.

I grew up in a small town in India and did see plenty of financial hardship growing up.

Today, when I look back at those times, I feel glad that I went through that, cause it taught me the importance of Money at a very young age.

I grew up in a small town in India and did see plenty of financial hardship growing up.

Today, when I look back at those times, I feel glad that I went through that, cause it taught me the importance of Money at a very young age.

As soon as I entered college, I started learning about Personal Finance on my own.

It started as a curiosity - what made rich people rich?

Did they have some common personality traits among them?

I wanted to learn so that I could copy and follow their path.

It started as a curiosity - what made rich people rich?

Did they have some common personality traits among them?

I wanted to learn so that I could copy and follow their path.

I soon learnt that there was a big difference between

Becoming Rich

Staying Rich

and

Being Wealthy.

Becoming Rich

Staying Rich

and

Being Wealthy.

There are 1000s of cases where multi millionaire lottery winners have lost it all in a few years and filed for bankruptcy.

At the same time there are cases where janitors have become multimillionaires through practicing a few principles of Personal Finance.

At the same time there are cases where janitors have become multimillionaires through practicing a few principles of Personal Finance.

But why?

(I wondered curiously)

(I wondered curiously)

How could someone who is already rich go broke and bankrupt while someone who doesn't come from much become wealthy?

It almost seem illogical and incomplete.

So I investigated further and came across the story of Ronald James Read - that changed my life.

It almost seem illogical and incomplete.

So I investigated further and came across the story of Ronald James Read - that changed my life.

News headlines around the United States were reporting a bizarre news.

A janitor that month had died in Vermont.

Nothing about his death was extra ordinary that would grab headlines.

He was 92 and very few people in the world knew he existed until he died.

What happened upon his death though was the extra ordinary part.

Nothing about his death was extra ordinary that would grab headlines.

He was 92 and very few people in the world knew he existed until he died.

What happened upon his death though was the extra ordinary part.

Ronald James Read was a gas station attendant for 25 years of his life followed by working as a part time janitor for another 17 years.

Upon his death, Ronald left millions in donation to the local hospital and library and it was this news that grabbed headlines .

Here a great video detailing his life, if you want to learn more.

I read that story in 2014 and wondered - how was a janitor ever able to amass a wealth most can only dream of?

News headlines reported that it was cause he invested in blue chip stocks.

But that was only half the story.

News headlines reported that it was cause he invested in blue chip stocks.

But that was only half the story.

The other half that they were not reporting was that Ronald was following principles of personal finance to its core, right from the time he started earning.

In a fair world, people would know and celebrate Ronald James Read as much as they celebrate Warren Buffett, if not more.

Years later, I would read about Ronald Read again in this amazing book called - Psychology of Money

(highly recommended)

(highly recommended)

Here is another story for you.

Most people know Mike Tyson.

He is probably the greatest boxers of his generation and maybe the best that has ever arrived after Mohamed Ali.

He is probably the greatest boxers of his generation and maybe the best that has ever arrived after Mohamed Ali.

Both Ronald Read and Mike Tyson are two ends of a spectrum.

But, they have only one thing separating them.

Mr. Read knew about Personal Finance, while Mr. Tyson didn't.

But, they have only one thing separating them.

Mr. Read knew about Personal Finance, while Mr. Tyson didn't.

Personal Finance is the most important life skill you can learn.

And it is this simple skill that can change the course of your life - from ever living in financial anxiety to living a financially healthy one.

And it is this simple skill that can change the course of your life - from ever living in financial anxiety to living a financially healthy one.

Most people find managing money hard as they are not taught how to!

Imagine if you had to play a sport for a living every day without knowing the rules of the game - You will never be able to win the game until you figure out the rules.

Imagine if you had to play a sport for a living every day without knowing the rules of the game - You will never be able to win the game until you figure out the rules.

I cannot possibly teach these rules in a simple Twitter Thread -

that's why I have spent the last two months building a FREE course that will teach you all about it.

that's why I have spent the last two months building a FREE course that will teach you all about it.

The course is hosted on Skill Share and you can get access to it for FREE by using this link.

skl.sh/2Wjk7A7

skl.sh/2Wjk7A7

What is Skill Share?

Skill Share is a YouTube like platform where people around the world can build courses on various skills and teach those skills to anyone around the world.

It has 30,000+ courses and the above link will grant you free access to all of them for 30 days.

Skill Share is a YouTube like platform where people around the world can build courses on various skills and teach those skills to anyone around the world.

It has 30,000+ courses and the above link will grant you free access to all of them for 30 days.

Here is a quick overview of how my course is structured.

Everything I have learnt over the last decade is covered in the course in the form of bite sized classes.

Everything I have learnt over the last decade is covered in the course in the form of bite sized classes.

Here are the principles I have followed to gain financial independence. All of these are covered in detail in the course mentioned above.

1⃣ Always Track Your Income and Expenses

Without knowing where you spend and how you spend you cannot begin to improve what you do not know.

The class teaches you ways in which you can automate this tracking to remove all the friction from the process.

Without knowing where you spend and how you spend you cannot begin to improve what you do not know.

The class teaches you ways in which you can automate this tracking to remove all the friction from the process.

2⃣ Make a Budget

Budgeting keeps you under control and inculcates discipline in the entire process.

The class teaches you how to make your own budget - the right way (without stress).

Budgeting keeps you under control and inculcates discipline in the entire process.

The class teaches you how to make your own budget - the right way (without stress).

3⃣ Save! Save! Save!

Everything to do with Savings and how to achieve a high savings rate is covered in this chapter.

Everything to do with Savings and how to achieve a high savings rate is covered in this chapter.

4⃣ Net Worth

Knowing your Net Worth is important - It helps for you to understand where and how you're progressing in life.

Chapter Four of the class will teach you all about it.

Knowing your Net Worth is important - It helps for you to understand where and how you're progressing in life.

Chapter Four of the class will teach you all about it.

5⃣ Emergency Funds

It will take me days to list down the names of friends who do not know what an Emergency Fund is.

Chapter Five of the class teaches you about it and how to build one for yourself.

It will take me days to list down the names of friends who do not know what an Emergency Fund is.

Chapter Five of the class teaches you about it and how to build one for yourself.

6⃣ Insurance

The most misunderstood of all financial products.

Most view insurance as an investment product and are unaware of the criteria to use to select a health and life insurance policy for themselves.

Chapter Six of the class will bust these myths and help you learn .

The most misunderstood of all financial products.

Most view insurance as an investment product and are unaware of the criteria to use to select a health and life insurance policy for themselves.

Chapter Six of the class will bust these myths and help you learn .

7⃣ Credit Scores

Let me ask you - Do you know your credit score?

Most will reply no!

Credit Scores are one of the most important parts of finance and yet most people only get introduced to them in their 30s when they apply for a home loan.

Chapter Seven will take care of that.

Let me ask you - Do you know your credit score?

Most will reply no!

Credit Scores are one of the most important parts of finance and yet most people only get introduced to them in their 30s when they apply for a home loan.

Chapter Seven will take care of that.

8⃣ Financial Pitfalls to Avoid

Very easy to fall into financial pitfalls and destroy your financial well being. There will be no warnings when it happens.

Chapter Eight teaches you on how to not fall into those and how to get out if you ever find yourself in one.

Very easy to fall into financial pitfalls and destroy your financial well being. There will be no warnings when it happens.

Chapter Eight teaches you on how to not fall into those and how to get out if you ever find yourself in one.

9⃣ The Magic of Compounding

Long term compounding is truly magical and this chapter introduces to you to it with examples to showcase how powerful compounding can be.

It will also teach you some metrics of compounding like the Rule of 72.

Long term compounding is truly magical and this chapter introduces to you to it with examples to showcase how powerful compounding can be.

It will also teach you some metrics of compounding like the Rule of 72.

🔟Investing 101

Chapter Ten will teach you all about Risk vs Return, Goal Based Investing and How to invest the right way.

Chapter Ten will teach you all about Risk vs Return, Goal Based Investing and How to invest the right way.

I know I normally do threads related to investing and companies and trend etc.

This is not one of them.

But, I would argue that is the most important thread of them all.

This is not one of them.

But, I would argue that is the most important thread of them all.

Until you learn how to manage and save your money, you will never be able to amass wealth just by investing alone.

I hope you will give the course a try and will help me in my mission towards creating awareness on personal finance to all.

I hope you will give the course a try and will help me in my mission towards creating awareness on personal finance to all.

Regular threads related to investing resume next weekend onwards.

Please retweet the first tweet in this thread so that it reaches more people.

Please retweet the first tweet in this thread so that it reaches more people.

Have you been following some concepts in Personal Finance in your life?

Tell me in comments what are they and how they have worked for you?

Here is my hack - I use a credit card for everything and pay it off all in full every month.

It helps me track all my expenses in detail.

Tell me in comments what are they and how they have worked for you?

Here is my hack - I use a credit card for everything and pay it off all in full every month.

It helps me track all my expenses in detail.

Thank you for reading.

See you next weekend.

See you next weekend.

• • •

Missing some Tweet in this thread? You can try to

force a refresh