Glenmark Life Sciences (GLS) IPO notes 🔬

Plans to take the capacity to 1762KL (currently 762KL) in the next 4 years.

Hit the 'retweet' & help us educate more investors

A thread 🧵👇

#IPOwithJST

Plans to take the capacity to 1762KL (currently 762KL) in the next 4 years.

Hit the 'retweet' & help us educate more investors

A thread 🧵👇

#IPOwithJST

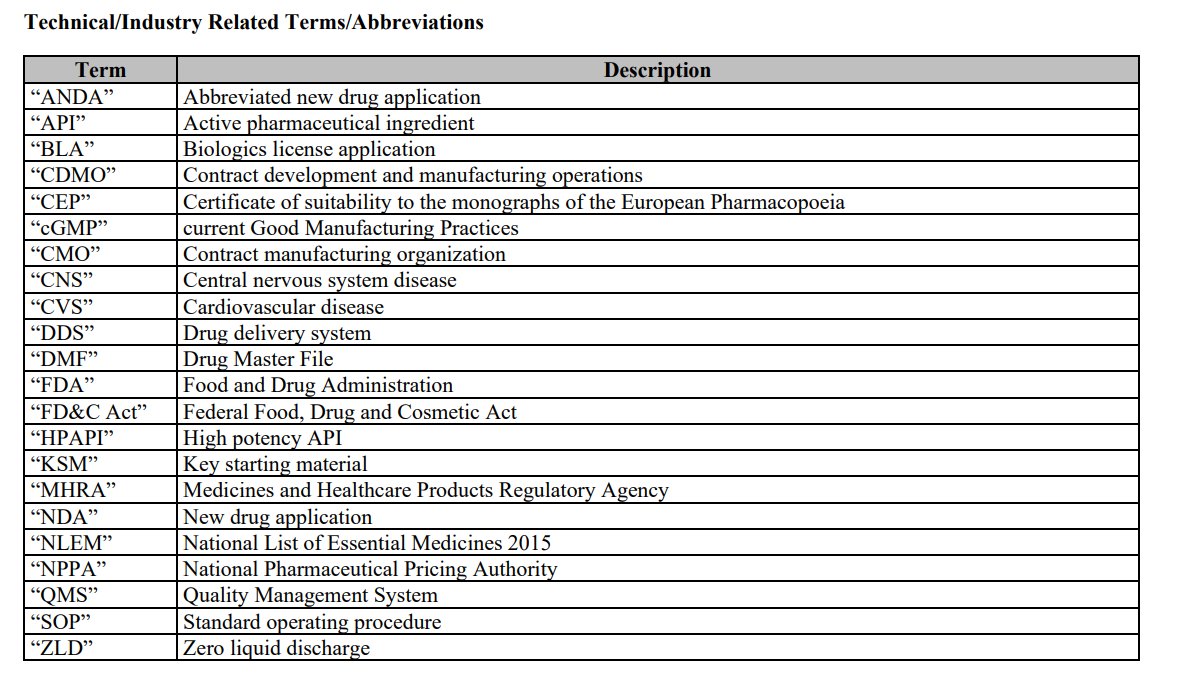

1/ About the company

Developer & manufacturer of high value, non- commoditized APIs (complex & low competition) in chronic therapeutic areas: CVS, CNS, pain management & diabetes, etc

Basic details about the IPO 👇

Note: After paying off liabilities, 150crs remain for capex.

Developer & manufacturer of high value, non- commoditized APIs (complex & low competition) in chronic therapeutic areas: CVS, CNS, pain management & diabetes, etc

Basic details about the IPO 👇

Note: After paying off liabilities, 150crs remain for capex.

2/ The Journey

Established the API business in FY02

Since 2015, Have not received any adverse reactions from regulators (USFDA, PMDA) in the total 38 audits & inspections & Have gone through 432 customer audits.

Filled 403 DMFs & CEP registration across markets globally.

Established the API business in FY02

Since 2015, Have not received any adverse reactions from regulators (USFDA, PMDA) in the total 38 audits & inspections & Have gone through 432 customer audits.

Filled 403 DMFs & CEP registration across markets globally.

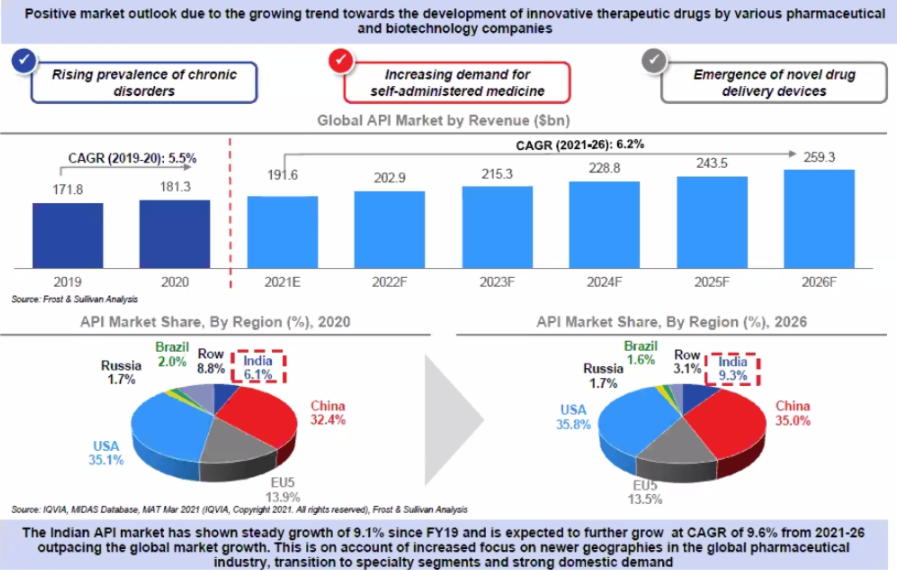

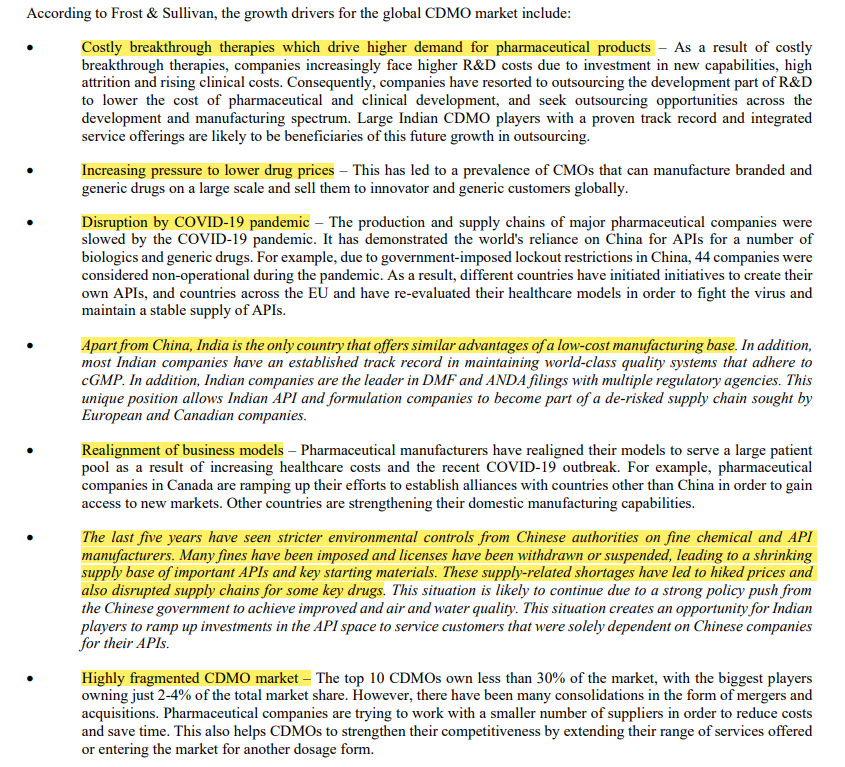

3/ Trends that the company is betting on & what works for them

China+1: India API market growth (10% cagr projected from FY21-26) will outpace the industry: Driven by specialty API+ Strong domestic market

Highest no. of USFDA approved API facilities & % of DMFs filled

China+1: India API market growth (10% cagr projected from FY21-26) will outpace the industry: Driven by specialty API+ Strong domestic market

Highest no. of USFDA approved API facilities & % of DMFs filled

4/ Interesting facts

- 120 molecules: $142B market size

- Targetting 8 to 10 new molecules every yr (Key differentiator over time)

- 66% of sales from regulated markets

- Works with 16 of the top 20 generic cos.

- Top 7 customers: 5 to 15yrs old

- 120 molecules: $142B market size

- Targetting 8 to 10 new molecules every yr (Key differentiator over time)

- 66% of sales from regulated markets

- Works with 16 of the top 20 generic cos.

- Top 7 customers: 5 to 15yrs old

5/ API Portfolio

Key products in generic API business 👇 (Shows cost leadership in few molecules as market share is 30%+)

Strategy to mix: High value & High Volume APIs

Complex API is a future growth market: Going into the development of Peptide APIs by FY22.

Key products in generic API business 👇 (Shows cost leadership in few molecules as market share is 30%+)

Strategy to mix: High value & High Volume APIs

Complex API is a future growth market: Going into the development of Peptide APIs by FY22.

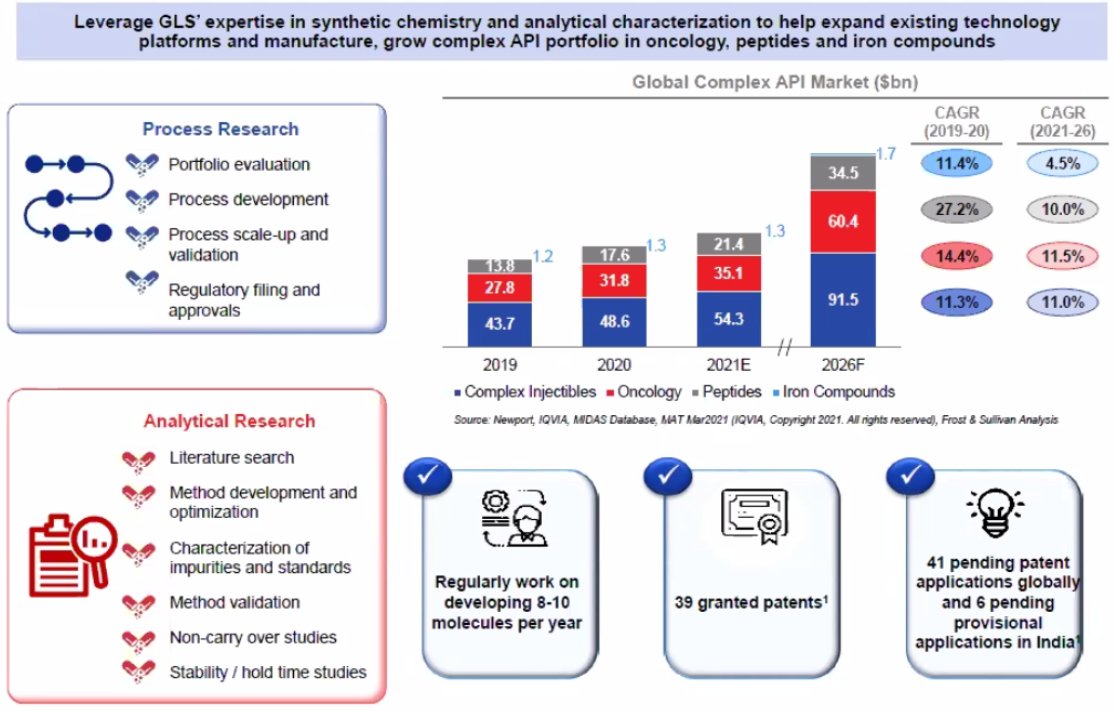

6/ R&D: the secret ingredient

Spends 2-2.5% of rev every year

39 patents under the belt

213 R&D personnel in 3 dedicated facilities

Focus on cost improvements in existing products & developing newer products: onco, peptides, iron compounds

Spends 2-2.5% of rev every year

39 patents under the belt

213 R&D personnel in 3 dedicated facilities

Focus on cost improvements in existing products & developing newer products: onco, peptides, iron compounds

7/ Manufacturing Capacity & Capex

4 plants 762KL capacity, running at 85% capacity: 3 USFDA approved, 1 for emerging markets

Increasing capacity by 200KL in Dahej & Ankleshwar by FY23

Investing in a new greenfield capacity: will take it to aggregate 800KL capacity in 3-4yr

4 plants 762KL capacity, running at 85% capacity: 3 USFDA approved, 1 for emerging markets

Increasing capacity by 200KL in Dahej & Ankleshwar by FY23

Investing in a new greenfield capacity: will take it to aggregate 800KL capacity in 3-4yr

9/ CDMO business: 8-10% of their rev (will ramp up)

End of lifecycle management- when the innovator loses its patent & looks for a cheaper source of their API; they can choose GLS

The 🌎 trends that benefit this business 👇

End of lifecycle management- when the innovator loses its patent & looks for a cheaper source of their API; they can choose GLS

The 🌎 trends that benefit this business 👇

10/ Financials

Rev scaled at 16% cagr from FY19-21

Margins consistently above 30% (high operational efficiency as GMs are 50-55%)

Stable cash flows: WC requirements are high, OCF & debt would be enough to increase capacity over the next 4-5yrs

Rev scaled at 16% cagr from FY19-21

Margins consistently above 30% (high operational efficiency as GMs are 50-55%)

Stable cash flows: WC requirements are high, OCF & debt would be enough to increase capacity over the next 4-5yrs

11/ Risks:

- High Customer churn: Only 41% of the customers stayed from FY19 to FY21.

- Imports 40% of RM from China: could face huge pricing pressure which they are not able to pass on.

- Regulatory & compliance risks

- Client concentration: 56% of rev from the top 5 customers

- High Customer churn: Only 41% of the customers stayed from FY19 to FY21.

- Imports 40% of RM from China: could face huge pricing pressure which they are not able to pass on.

- Regulatory & compliance risks

- Client concentration: 56% of rev from the top 5 customers

12/

- Dependence on key products: Top 10 account for 66% of sales

- Capex implementation risk

- Multiple outstanding litigations against the promoter & the company

- COVID risk: some disruptions in acute products & favipiravir sales benefit: net 2-3% +ve effect in FY21.

- Dependence on key products: Top 10 account for 66% of sales

- Capex implementation risk

- Multiple outstanding litigations against the promoter & the company

- COVID risk: some disruptions in acute products & favipiravir sales benefit: net 2-3% +ve effect in FY21.

13/

- Increased competition in their respective products: pricing pressure

- Working capital risk: have huge credit terms up to 180 days

- High employee attrition of 18-20%

- Failure to get the environmental clearances for new facilities.

- Increased competition in their respective products: pricing pressure

- Working capital risk: have huge credit terms up to 180 days

- High employee attrition of 18-20%

- Failure to get the environmental clearances for new facilities.

14/

We believe Glenmark Life sciences IPO which is currently valued at 4.6x EV/sales, 15x EV/EBITDA & 25x Price/Earnings & following the lucrative strategy to become bigger in complex APIs, is rather reasonably valued.

End of thread.

We believe Glenmark Life sciences IPO which is currently valued at 4.6x EV/sales, 15x EV/EBITDA & 25x Price/Earnings & following the lucrative strategy to become bigger in complex APIs, is rather reasonably valued.

End of thread.

Comparison with the peers

- Top quartile EBITDA margins

- Low capex requirements & high asset turnover business

- Cash conversion cycle is one of the worst: Needs to invest a lot of working capital to grow if it doesn't improve

- Valuation wise, A discount to industry averages

- Top quartile EBITDA margins

- Low capex requirements & high asset turnover business

- Cash conversion cycle is one of the worst: Needs to invest a lot of working capital to grow if it doesn't improve

- Valuation wise, A discount to industry averages

To understand more about the business dynamics of the API sector in depth

Watch this video by Sajal Sir @unseenvalue, hosted by @soicfinance (Better get the whole webinar from them)

Watch this video by Sajal Sir @unseenvalue, hosted by @soicfinance (Better get the whole webinar from them)

• • •

Missing some Tweet in this thread? You can try to

force a refresh