It's been a month. State that decided to cut off their residents' access to UI benefits early have done so.

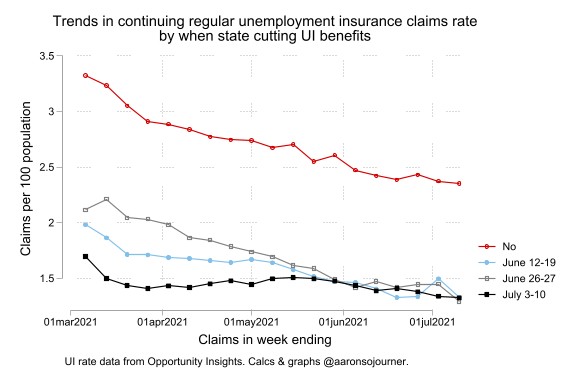

Without the $300/wk federal supplement to regular state programs, have they experienced faster declines in the shares of their population continuing to claim regular UI?

Without the $300/wk federal supplement to regular state programs, have they experienced faster declines in the shares of their population continuing to claim regular UI?

https://twitter.com/aaronsojourner/status/1407426719812890627

No. The number of continuing claims in regular state programs seems to be declining just as fast in not-cutting as in cutting states.

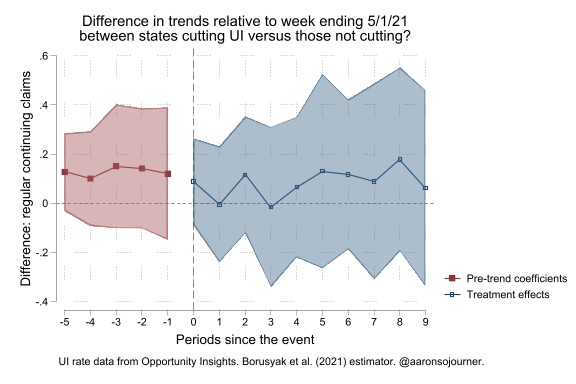

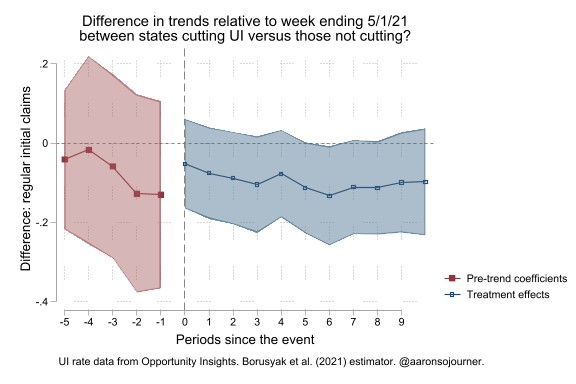

Here it is in difference-in-differences form relative to the week ending May 8, the last week before the first state announced its intention to cut off federal UI payments.

No difference in trends in not-cutting versus cutting states.

No difference in trends in not-cutting versus cutting states.

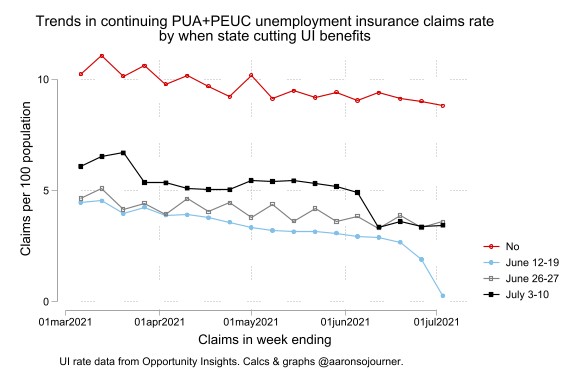

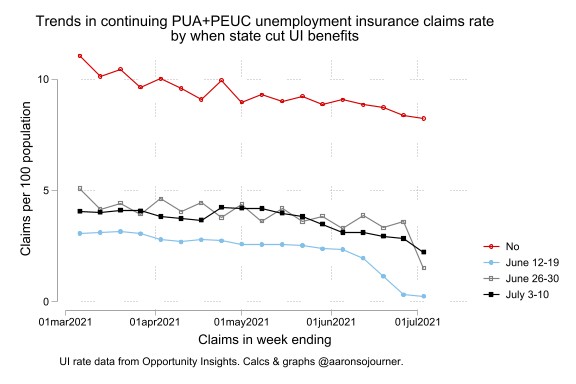

However, some but not all of the cutting states literally shut down residents' access to federal pandemic UI programs such as PUA & PEUC.

Mechanically, these states forced down PUA+PEUC continuing claims rates in those programs.

Mechanically, these states forced down PUA+PEUC continuing claims rates in those programs.

However, the cohort that saw that big decline (July 12-19 cutters) is a few, very small states. On average, there appears to be no discernable difference in trends between the cutting & not-cutting states.

Many of states that cut the $300/wk did not cut off PUA+PEUC.

Many of states that cut the $300/wk did not cut off PUA+PEUC.

Shout out & thanks @michaelstepner for his work processing & publishing this data @OppInsights. Best of luck in your new position @UofT!

For evidence on employment levels & financial distress, check out @arindube.

https://twitter.com/JStein_WaPo/status/1417553441996615680?s=19

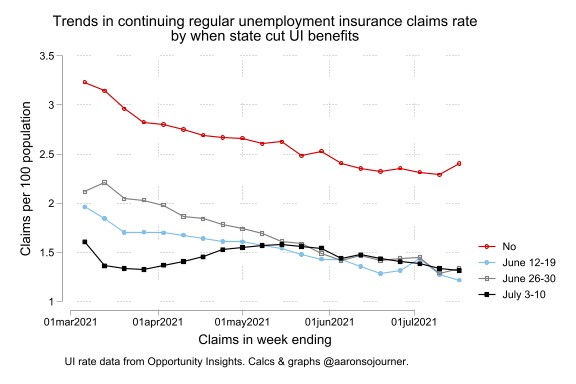

I updated:

1) added new weeks of data

2) OI corrected mistaken 1-wk offset in PUA+PEUC claims @arindube caught, &

3) I recoded MD & IN as no-cut states cuz courts blocked UI cuts there.

Results different? Not yet.

1) added new weeks of data

2) OI corrected mistaken 1-wk offset in PUA+PEUC claims @arindube caught, &

3) I recoded MD & IN as no-cut states cuz courts blocked UI cuts there.

Results different? Not yet.

The continuing claims rate in regular state programs has declined just as fast in not-cutting as in cutting states, though a small rise in no-cut states in WE 7/23 (left).

Formally, cutters don't have significantly different trend than no-cutters in analysis (right).

Formally, cutters don't have significantly different trend than no-cutters in analysis (right).

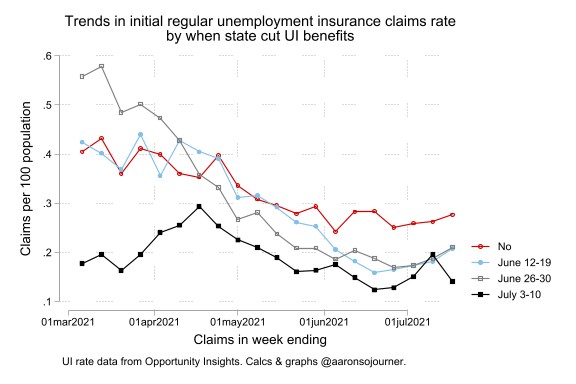

Initial claims rate in regular state programs also have declined just as fast in not-cutting as in cutting states, though most groups have flared up recently.

Also the magnitudes of difference are very small, 1 claim per 1000 population.

Also the magnitudes of difference are very small, 1 claim per 1000 population.

However, some but not all of the cutting states literally shut down residents' access to federal pandemic UI programs such as PUA & PEUC.

Mechanically, these states forced down PUA+PEUC continuing claims rates in those programs.

Differences are starting to open up here.

Mechanically, these states forced down PUA+PEUC continuing claims rates in those programs.

Differences are starting to open up here.

I want to do a better job focusing on the states cutting PUA+PEUC but haven't coded that yet.

@p_ganong has a good round up of evidence here:

@p_ganong has a good round up of evidence here:

https://twitter.com/p_ganong/status/1423483873745309697

• • •

Missing some Tweet in this thread? You can try to

force a refresh