Central Bank Governor speaking today.

A thread:

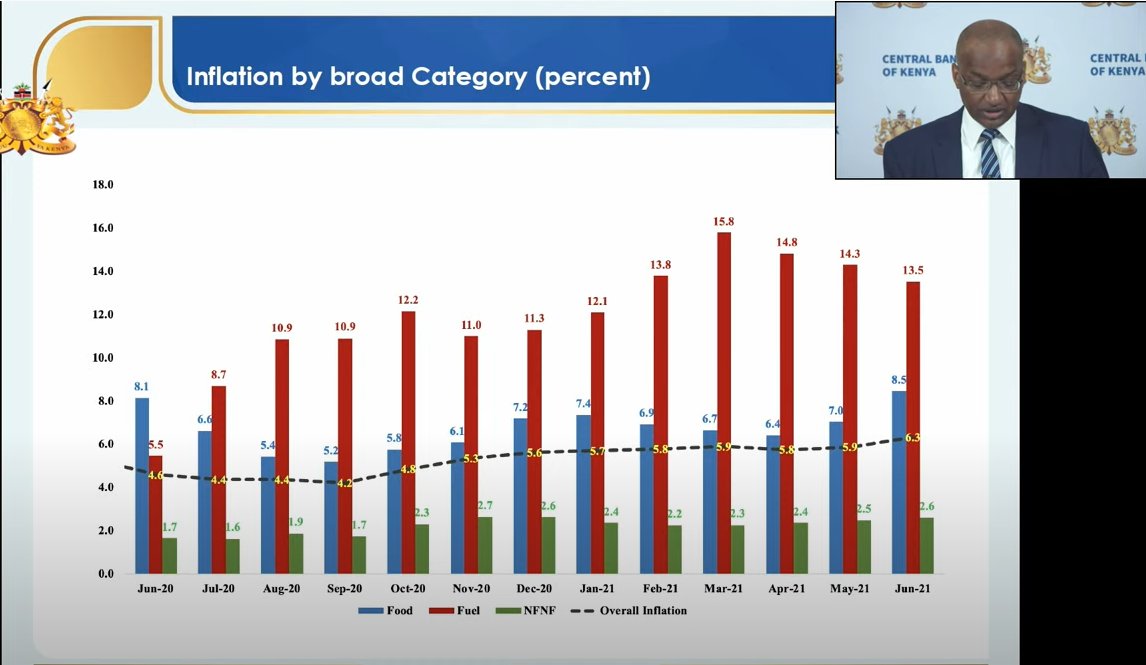

1. On Inflation:

A thread:

1. On Inflation:

https://twitter.com/CBKKenya/status/1420616629524865026

3. With the new taxes, the new tax measures would impact inflation by 1.78% all other factors held constant.

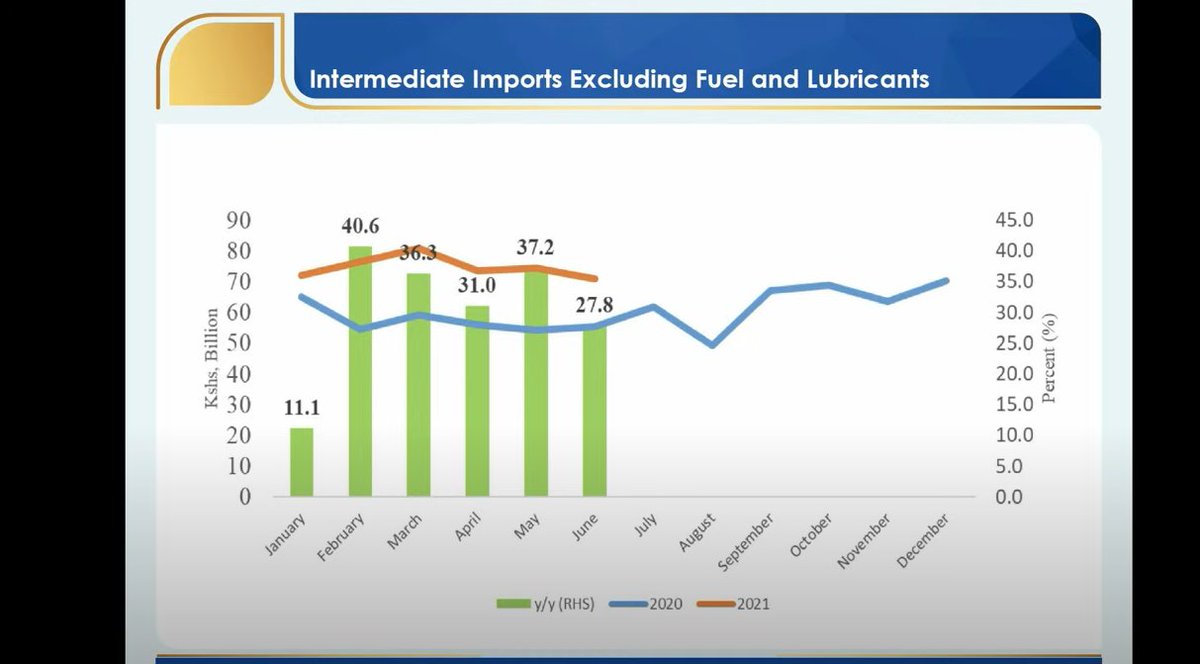

6. All indicators point to a strong recovery in H1 2021 - @njorogep

8. Hotels are re-opening, restructuring of businesses expected, Nairobi hit harder than the rest of the country

10. Seasonality in remittances still hold but time shifted due to factors such as changes in Kenyan academic calendar

12. "One word to say on reserves, they remain adequate" - Dr. @njorogep alluding to ~5.7 months of import cover

H/t @Ramah_Nyang @MihrThakar @LeoKemboiEcon

H/t @Ramah_Nyang @MihrThakar @LeoKemboiEcon

13. Bills to bond ratio

2 years ago:

34: 66%

Now:

21%: 79%

Very good to government.

H/t @MakoriGeorge_

2 years ago:

34: 66%

Now:

21%: 79%

Very good to government.

H/t @MakoriGeorge_

14. On liquidity management:

Jun/Jul 2021 saw influx and immediate outflow of liquidity on pending bills (counties, debt repayment e.t.c), expecting positive outcome on county level payments as contractors and firms get paid

Jun/Jul 2021 saw influx and immediate outflow of liquidity on pending bills (counties, debt repayment e.t.c), expecting positive outcome on county level payments as contractors and firms get paid

15. Modernisation of monetary policy framework and operations - paper published.

"We need to keep up with changing circumstances" - Dr. Njoroge

centralbank.go.ke/wp-content/upl…

"We need to keep up with changing circumstances" - Dr. Njoroge

centralbank.go.ke/wp-content/upl…

16. In response to a question by Faisal Ahmed (Citizen) on .ke election cycles & economic impact @njorogep says we need to be better planners and used a coconut lifecycle analogy, elections will always be there, we need to move and plan at the society level & not elections only

18. A lot of liquidity in the system, no need to lower rates at this point in time - @njorogep

With NIFC; Nariobi International Financial Centre being setup @CBKKenya still commits to AML; Anti Money Laundering standards

21. No approval for lending rate caps by @CBKKenya , interest is to strengthen lending market, not many players have been doing risk based pricing in the market, role of central bank is supervisory

22. NPLs at 14% down from 14.2%

23. Razia Khan (Stanbic) - Credit growth is fine but election cycles pose risks...

@njorogep - election slowdown expected, about time not be driven by political cycles, market based policies need to dictate direction, elections should drive argument for accommodative policy

@njorogep - election slowdown expected, about time not be driven by political cycles, market based policies need to dictate direction, elections should drive argument for accommodative policy

• • •

Missing some Tweet in this thread? You can try to

force a refresh