Lets talk results #lauruslabs

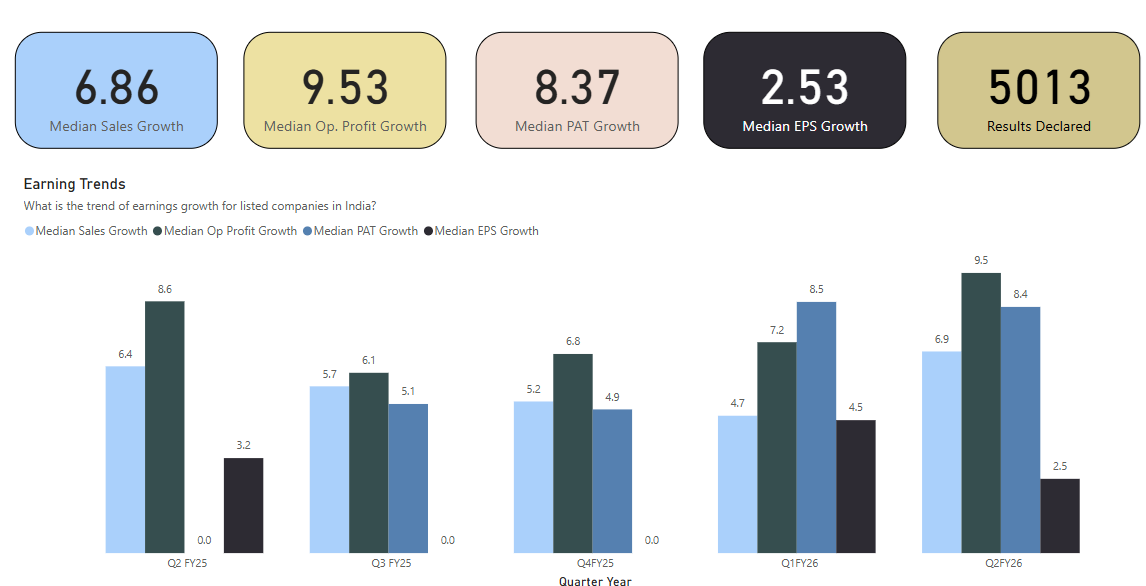

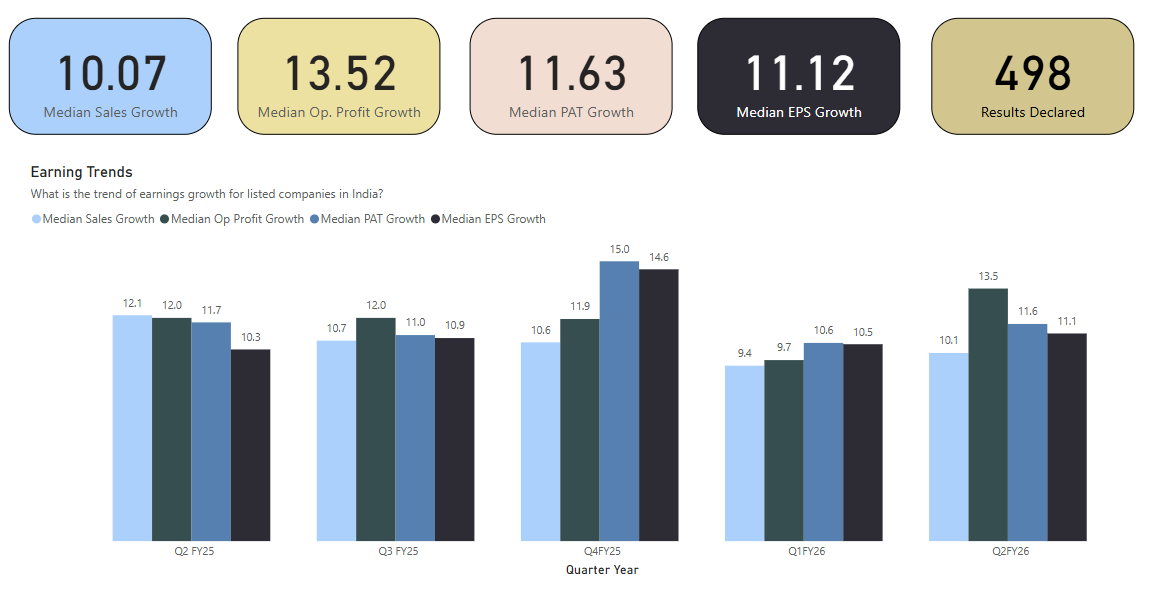

Always zoom out and view the results, never take a QoQ approach.

Here is how Sales, Op.Profit and PAT looks like when you zoom out.

The upwards trends continues.

No business will move linearly up or linearly down.

Always zoom out and view the results, never take a QoQ approach.

Here is how Sales, Op.Profit and PAT looks like when you zoom out.

The upwards trends continues.

No business will move linearly up or linearly down.

You can get all the numbers from their filings, so I won't talk about them.

Company Statement: bseindia.com/xml-data/corpf…

Investor Presentation: bseindia.com/xml-data/corpf…

Result Filing: bseindia.com/xml-data/corpf…

Company Statement: bseindia.com/xml-data/corpf…

Investor Presentation: bseindia.com/xml-data/corpf…

Result Filing: bseindia.com/xml-data/corpf…

Lets talk qualitative results, what stood out for me.

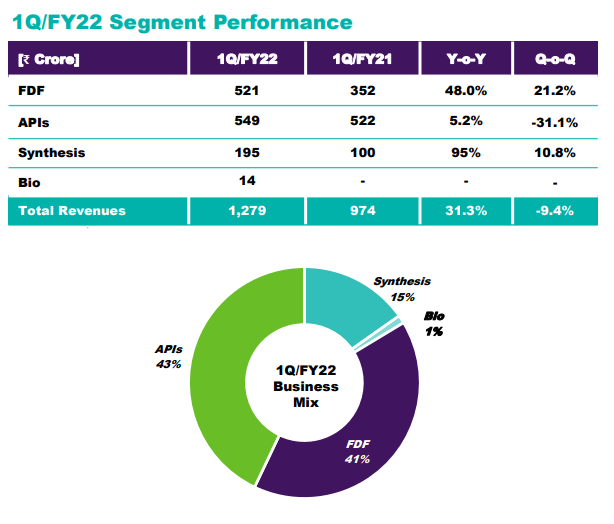

Growth in FDF, this is where the major earnings will come from in the near term (1-2 years)

Healthy 21% QoQ growth even though they are building a lot more capacities.

Growth in FDF, this is where the major earnings will come from in the near term (1-2 years)

Healthy 21% QoQ growth even though they are building a lot more capacities.

Synthesis

Growth area for medium term.

95% YoY growth but the base is lower.

The only have 4 commercial products.

While the active projects stand at 50.

When those 46 get commercialized, this will be the main growth engine of the company.

Growth area for medium term.

95% YoY growth but the base is lower.

The only have 4 commercial products.

While the active projects stand at 50.

When those 46 get commercialized, this will be the main growth engine of the company.

Laurus Bio

1% of the Revenue Pie

This segment only started yielding results from late May 2021, so the revenue you see before you of ~14cr is only for a month. Next Quarter this should contribute more.

1% of the Revenue Pie

This segment only started yielding results from late May 2021, so the revenue you see before you of ~14cr is only for a month. Next Quarter this should contribute more.

Q4 of this year or Q1 of next year is when you should see a good increase in earnings.

Why?

Their new additions towards FDF capacity will get commercialized and in effect will double the FDF earnings of Q4FY21.

Why?

Their new additions towards FDF capacity will get commercialized and in effect will double the FDF earnings of Q4FY21.

Generic APIs

They are moving away from ARV to other areas like oncology, CVS and Diabetes.

Moving from one product API company to a diversified basket of APIs.

Oncology showed a robust growth.

CVS and Diabetes witnessed shipment disruptions

(my #1 risk to monitor this Q)

They are moving away from ARV to other areas like oncology, CVS and Diabetes.

Moving from one product API company to a diversified basket of APIs.

Oncology showed a robust growth.

CVS and Diabetes witnessed shipment disruptions

(my #1 risk to monitor this Q)

Synthesis, CDMO business

(the most exciting slide from their investor presentation)

550KL+ capacity is no small feat.

(the most exciting slide from their investor presentation)

550KL+ capacity is no small feat.

All in all, great results. I am happy, remain invested.

Fin.

Fin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh