okay, so I went through @DonBeyerVA 's proposed 'Digital Asset Market Structure and Investor Protection Act' more carefully, and here is the obligatory thread

beyer.house.gov/news/documents…

beyer.house.gov/news/documents…

the good:

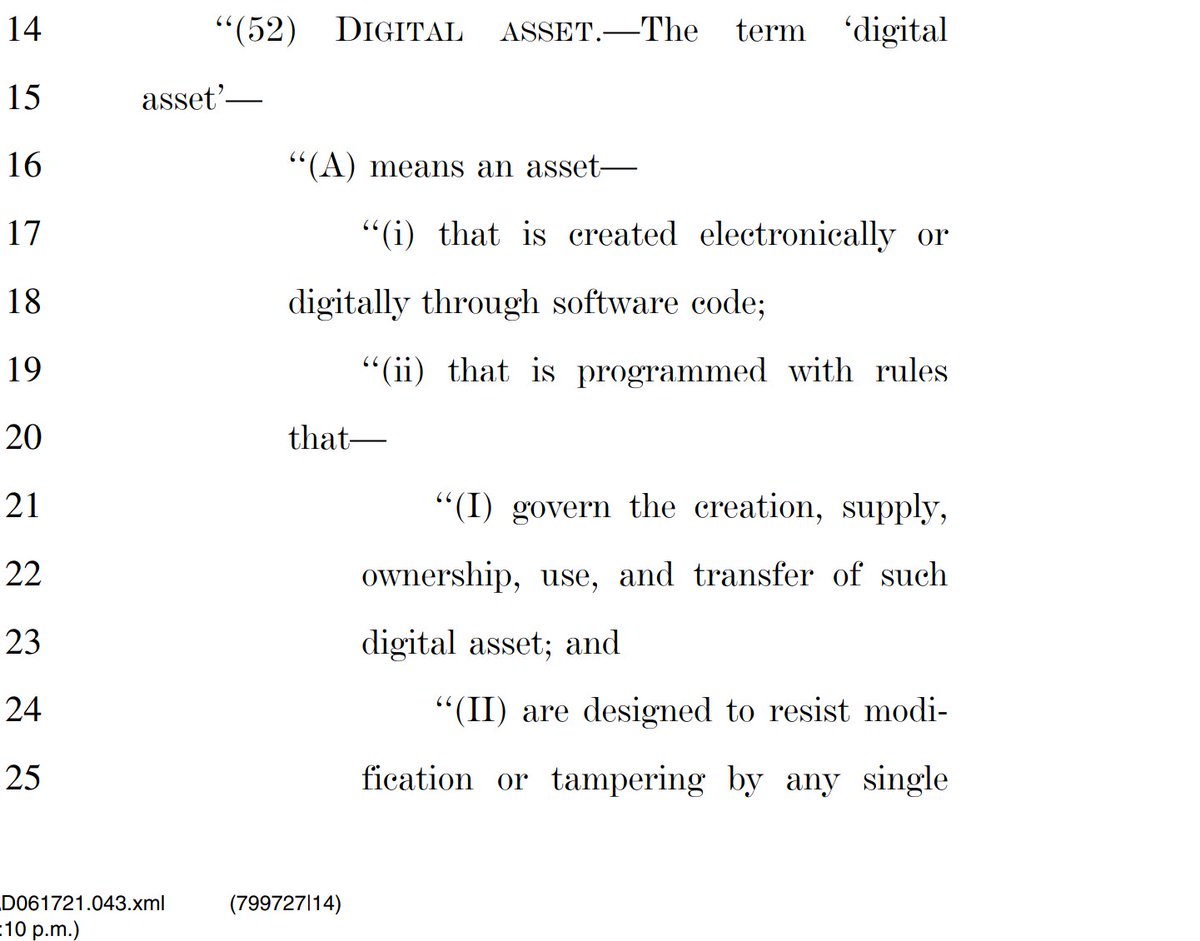

*this should be a low bar, but the definitions/drafting are non-circular and reasonably technologically accurate--more than I can say for other blockchain legislation

*this should be a low bar, but the definitions/drafting are non-circular and reasonably technologically accurate--more than I can say for other blockchain legislation

the good (cont'd):

*reasonable approach to securities laws:

-->token is security if it carries equity-ish rights in the issuer or was sold for risk capital (sorry @NYcryptolawyer)

-->can 'de-securitize' Howey tokens

-->3-year grace period prior to desecuritization

*reasonable approach to securities laws:

-->token is security if it carries equity-ish rights in the issuer or was sold for risk capital (sorry @NYcryptolawyer)

-->can 'de-securitize' Howey tokens

-->3-year grace period prior to desecuritization

the good (cont'd):

-->bill codifies what 'actual delivery' means under the Commodities Ex. Act (as exception to retail commodities tx regs) & includes delivery through private keys

-->bill codifies what 'actual delivery' means under the Commodities Ex. Act (as exception to retail commodities tx regs) & includes delivery through private keys

the good (cont'd):

-->the bill tries to encourage market transparency by requiring 'digital asset repositories' that aggregate off-chain transactions to be registered w/ CFTC and publicly file off-chain transaction data

-->the bill tries to encourage market transparency by requiring 'digital asset repositories' that aggregate off-chain transactions to be registered w/ CFTC and publicly file off-chain transaction data

the good (cont'd):

-->the bill authorizes the creation of 'digital versions of Federal reserve notes' on a distributed ledger and gives them legal tender status without any weird surveillance requirements

-->the bill authorizes the creation of 'digital versions of Federal reserve notes' on a distributed ledger and gives them legal tender status without any weird surveillance requirements

the good (cont'd)

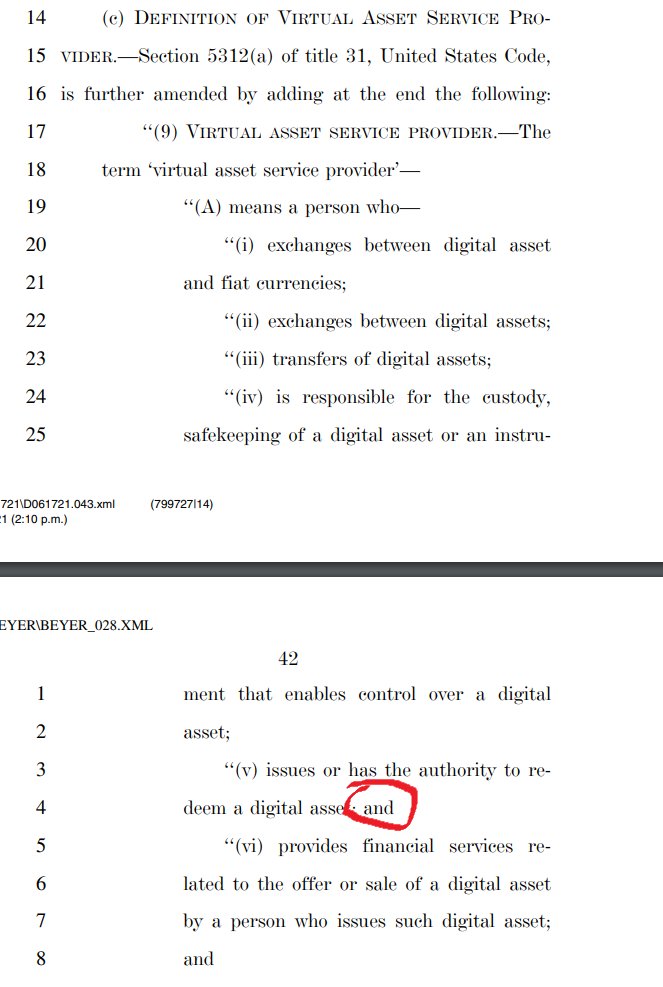

-->assuming the 'and' here is intentional, the bill creates a fairly narrow definition of 'virtual asset service provider' for BSA purposes & also has nice broad carve-outs for software and network service providers

-->assuming the 'and' here is intentional, the bill creates a fairly narrow definition of 'virtual asset service provider' for BSA purposes & also has nice broad carve-outs for software and network service providers

the good (cont'd):

-->the bill mostly lays off of DeFi, instead asking all the major agencies to submit a joint report of recommendations and analysis on DeFI

-->the bill mostly lays off of DeFi, instead asking all the major agencies to submit a joint report of recommendations and analysis on DeFI

Now the bad:

-->the bill empowers the SEC and CFTC to classify the *top 25 currently trading* tokens as either securities or commodities, essentially in their sole discretion with no prescribed due process in case they get the legal analysis wrong

-->the bill empowers the SEC and CFTC to classify the *top 25 currently trading* tokens as either securities or commodities, essentially in their sole discretion with no prescribed due process in case they get the legal analysis wrong

the bad (cont'd):

-->although providing a 3-year grace period for Howey tokens (like @HesterPeirce 's safe harbor proposal does), it does not solve the 'chicken/egg' problem re: sufficient decentralization because it only suspends registration reqs, not trading reqs*

-->although providing a 3-year grace period for Howey tokens (like @HesterPeirce 's safe harbor proposal does), it does not solve the 'chicken/egg' problem re: sufficient decentralization because it only suspends registration reqs, not trading reqs*

the bad (cont'd):

*(however, this would still probably be achievable for most projects, because under this bill descuritization is possible as long as the platform is "fully operational")

*(however, this would still probably be achievable for most projects, because under this bill descuritization is possible as long as the platform is "fully operational")

the bad (cont'd):

an additional problem with the descuritization process is that descuritization only happens once the SEC determines not to deny the descuritization certificate, and there is no time limit within which the SEC is required to make that determination

an additional problem with the descuritization process is that descuritization only happens once the SEC determines not to deny the descuritization certificate, and there is no time limit within which the SEC is required to make that determination

the bad (cont'd):

the bill shortens the 'actual delivery' requirement for tokens not to be retail commodities transactions from 28 days (current rule & CFTC guidance) to *24 hours*--good for 'not your keys, not your coins' mentality but bad for exchanges & maybe DeFi

the bill shortens the 'actual delivery' requirement for tokens not to be retail commodities transactions from 28 days (current rule & CFTC guidance) to *24 hours*--good for 'not your keys, not your coins' mentality but bad for exchanges & maybe DeFi

the ugly #1:

has blanket, probably totally unenforceable and possibly unconstitutional rule that "no PERSON may issue, USE or PERMIT TO BE USED a digital asset fiat-based stablecoin that is not approved by the Secretary of the Treasury"

has blanket, probably totally unenforceable and possibly unconstitutional rule that "no PERSON may issue, USE or PERMIT TO BE USED a digital asset fiat-based stablecoin that is not approved by the Secretary of the Treasury"

the ugly #1 (cont'd):

this one is a real head-scratcher given the breadth of the 'fiat-based stablecoin' definition...I get making *issuance* of an unregistered stablecoin illegal in commerce, but *use*? this is treating stablecoins like Schedule I drugs or fissile material

this one is a real head-scratcher given the breadth of the 'fiat-based stablecoin' definition...I get making *issuance* of an unregistered stablecoin illegal in commerce, but *use*? this is treating stablecoins like Schedule I drugs or fissile material

the ugly #1 (cont'd):

EVERY token that is "tied, pegged to, or collateralized substantially with" *ANY* 'fiat currency(ies)' would be illegal unless approved by Dept of Treasury

basically, only (arguably) RAI would be legal, and probably, eventually, USDC

EVERY token that is "tied, pegged to, or collateralized substantially with" *ANY* 'fiat currency(ies)' would be illegal unless approved by Dept of Treasury

basically, only (arguably) RAI would be legal, and probably, eventually, USDC

the ugly #1 (cont'd):

while I do think it is surprising stablecoins have gotten this far (they are basically digital dollar counterfeiting, if you think about it) & am not surprised state wants to keep its monopoly on this--wow, the breadth of this is huge & problematic

while I do think it is surprising stablecoins have gotten this far (they are basically digital dollar counterfeiting, if you think about it) & am not surprised state wants to keep its monopoly on this--wow, the breadth of this is huge & problematic

the ugly #1 (cont'd):

there are many potential objections, but for starters--why does the U.S. care if we make tokens pegged to *other* nations' currencies?

there are many potential objections, but for starters--why does the U.S. care if we make tokens pegged to *other* nations' currencies?

the ugly #2:

the bill basically requires FinCEN to try to ban anonymizing services & anonymity-enhanced tokens; possibly, this part just applies to transactions by/with institutions, in which case I get it, but in parts it seems like the institutions may be required...

the bill basically requires FinCEN to try to ban anonymizing services & anonymity-enhanced tokens; possibly, this part just applies to transactions by/with institutions, in which case I get it, but in parts it seems like the institutions may be required...

the ugly #2 (cont'd)

...to police extrinsic anonymizing transactions somehow; that seems basically impossible, & so at minimum this section needs some clarification--is it just a rule about how institutions interact with anonymizing tech, or is it a broad use prohibition?

...to police extrinsic anonymizing transactions somehow; that seems basically impossible, & so at minimum this section needs some clarification--is it just a rule about how institutions interact with anonymizing tech, or is it a broad use prohibition?

All in all, although this bill would take a big bite out of the value and confidence in our industry, in spirit it is unsurprising and fairly measured. But, in a few key places, its overbreadth or ambiguities raise civil rights and other issues that need to be addressed.

Private txs cannot be per se illegal (maybe that is not the intent), the SEC and CFTC cannot have carte blanche to classify the top 25 tokens today however they want, and there needs to be some room for true p2p decentralized algorithmic stables not collateralized by securities.

PS #1: the more I think about it, the more I realize the U.S. probably does not need stablecoin-specific regs

PS #1 (cont'd): many stablecoins are probably securities or swaps--I doubt all the "commercial paper" backing USDT is true 4(2) "commercial paper"; DAI is partly collateralized by securities

PS #1 (cont'd): the stablecoins backed by securities are the really 'dangerous' ones--they pose counterparty risk & are potentially highly highly scalable

PS #1 (cont'd): by contrast, algorithmic stablecoins are of uncertain scalability, and in any event while they might be risky and unstable, their risks are quite transparent and of the algorithmic, not counterparty, variety

PS #1 (cont'd): moreover, algorithmic stablecoins are essentially peer-to-peer make-believe transactions--can you make it illegal for me and my neighbor to decide that acorn caps are worth $1 each? this raises constitutional issues, I suspect

PS #1 (cont'd): so, my humble proposal would be to ditch the stablecoin part of the bill and focus on regulating stablecoins that are backed by securities (which is likely nearly all of them, anyway)

PS #1 (cont'd): a securities law focus to stablecoin regulation would be more consistent with legacy law and would avoid empowering Treasury to draw arbitrary lines in an essentially unappealable discretionary process, while giving breathing room to algorithmic stability

• • •

Missing some Tweet in this thread? You can try to

force a refresh