What is liquidity and why does it matter for $OHM holders?

A thread for Ohmies wondering how liquidity fits into the overall equation and how to interpret results on dashboard.

A thread for Ohmies wondering how liquidity fits into the overall equation and how to interpret results on dashboard.

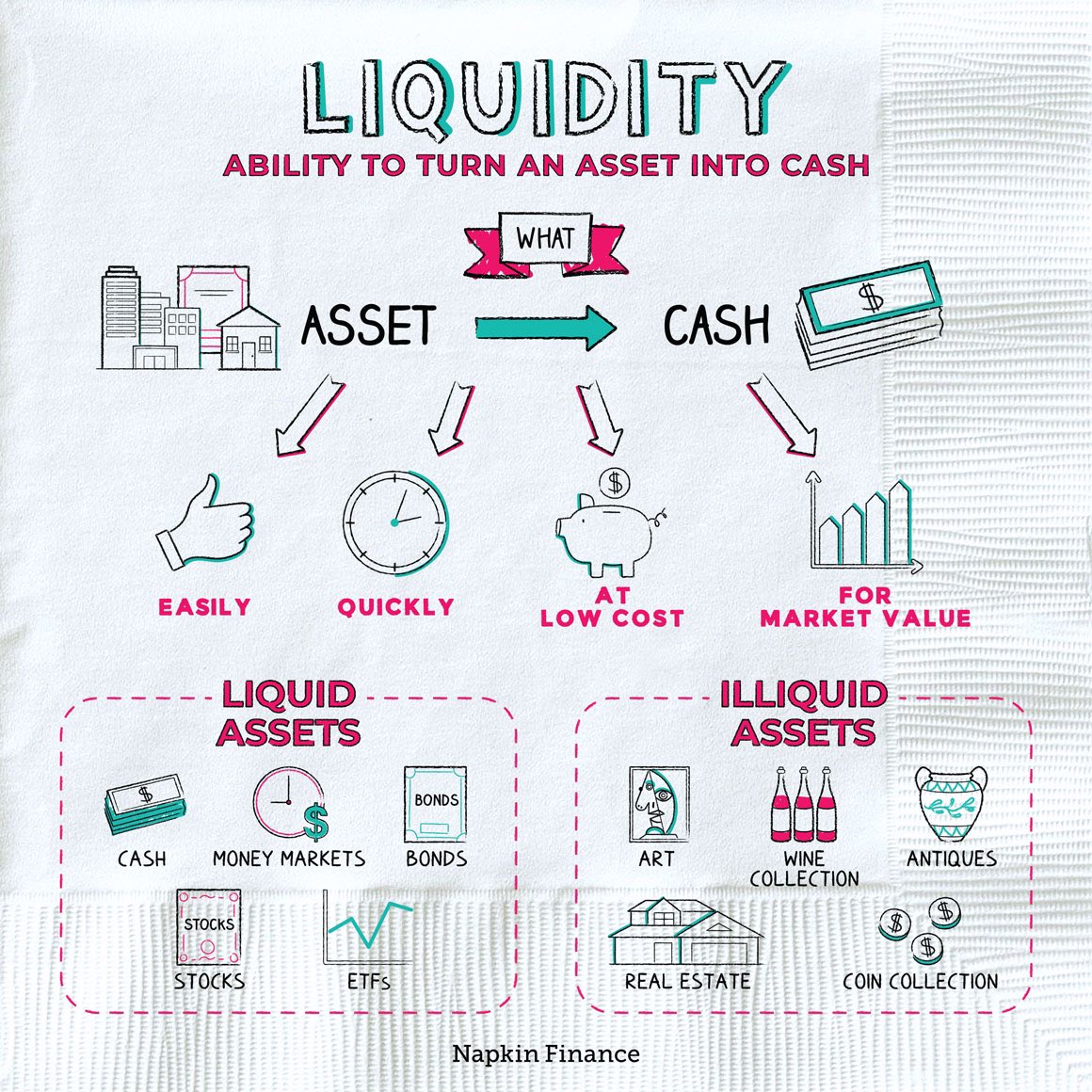

1. Liquidity is ability to turn an asset into cash.

If you try to sell your house at 30% below market value you will find plenty of buyers.

Try selling at a 30% premium and you won’t find as many.

Point being: liquidity depends on selling price and asset quality.

If you try to sell your house at 30% below market value you will find plenty of buyers.

Try selling at a 30% premium and you won’t find as many.

Point being: liquidity depends on selling price and asset quality.

2. Asset quality depends on an asset’s ability to generate cash flow.

Or command a premium in case of art.

$OHM has strong cash flows. A $23 mm cash balance growing at $500k/day.

If $OHM was a typical Series A start up, there would be NO liquidity for its tokens btw.

Or command a premium in case of art.

$OHM has strong cash flows. A $23 mm cash balance growing at $500k/day.

If $OHM was a typical Series A start up, there would be NO liquidity for its tokens btw.

3. So how’s $OHM liquidity?

We hit $50 mm market value of liquidity 6 days ago.

We’ve seen a lot of sell pressure. But liquidity didn’t go down.

Why?

Because of Liquidity Pool (LP) bonds or LP bonds that add about $1.2 mm / day to $OHM liquidity.

We hit $50 mm market value of liquidity 6 days ago.

We’ve seen a lot of sell pressure. But liquidity didn’t go down.

Why?

Because of Liquidity Pool (LP) bonds or LP bonds that add about $1.2 mm / day to $OHM liquidity.

4. Wtf are LP bonds?

$OHM has two types of bonds 1) reserve bonds and 2) LP bonds.

Reserve bonds mostly grow our treasury and LP bonds mostly grow our liquidity.

The policy team uses the Bond Control Variable to direct find flow.

On 7/15 we decided to prioritize liquidity.

$OHM has two types of bonds 1) reserve bonds and 2) LP bonds.

Reserve bonds mostly grow our treasury and LP bonds mostly grow our liquidity.

The policy team uses the Bond Control Variable to direct find flow.

On 7/15 we decided to prioritize liquidity.

5. Is there enough exit liquidity for all?

Obviously not. If all shareholders sell any given stock, the stock will tank. But many stockholders don’t sell and are in it for the long term?

Why?

Because of predictable cash flows that show a promising growth rate.

Obviously not. If all shareholders sell any given stock, the stock will tank. But many stockholders don’t sell and are in it for the long term?

Why?

Because of predictable cash flows that show a promising growth rate.

5. Simply put investors chases predictable cash flows.

In $OHM’s case, we see this represented by %age of $OHM staked.

Now obviously some Ohmies will sell and take a profit.

If they do that and staking % goes down, you know what happens then to remaining stakers right?

In $OHM’s case, we see this represented by %age of $OHM staked.

Now obviously some Ohmies will sell and take a profit.

If they do that and staking % goes down, you know what happens then to remaining stakers right?

6. Their APY shoots up. This APY that was about 15,000% last week is now 17,000%.

Why?

Well staking rewards are only paid to stakers.

This self healing nature is the power of $OHM and why it commands a premium over its Risk Free Value.

Why?

Well staking rewards are only paid to stakers.

This self healing nature is the power of $OHM and why it commands a premium over its Risk Free Value.

7. $OHM makes money when you buy OHM, sell $OHM, and it doesn’t matter whether it trades above or below $1.

This is the whole point of making protocols that try to own the whole stack of where value accrues to token holders.

This is the whole point of making protocols that try to own the whole stack of where value accrues to token holders.

8. If you are new to $OHM, my humble submission is this:

Don’t look at a few data points in isolation. Study the whole system. Join our discord. Ask questions. Put the equations in a spreadsheet. Ask for help if you don’t get it. Get involved.

Don’t just ape in.

Don’t look at a few data points in isolation. Study the whole system. Join our discord. Ask questions. Put the equations in a spreadsheet. Ask for help if you don’t get it. Get involved.

Don’t just ape in.

9. Some people say our liquidity / market cap is low. We agree. That’s why we changed the BCVs.

But at the same time can you point me one more company or project that owns 100% of its liquidity?

Can you even calculate liquidity / market cap for another project?

But at the same time can you point me one more company or project that owns 100% of its liquidity?

Can you even calculate liquidity / market cap for another project?

10. The answer is no because liquidity depends on selling price of an asset.

Selling price depends on asset quality.

Asset quality depends on cash flows.

Cash flows depend on incentive structure.

$OHM incentive structure is next level awesome.

#OHMISBACKED.

Selling price depends on asset quality.

Asset quality depends on cash flows.

Cash flows depend on incentive structure.

$OHM incentive structure is next level awesome.

#OHMISBACKED.

@sayinshallah thanks for the nudge to put this out there.

• • •

Missing some Tweet in this thread? You can try to

force a refresh