THREAD for sovereign debt geeks (and others who care about how governments' financing choices matter for all the other things governments do....):

New paper from @goodhouses, @UNCPoliSci's Cameron Ballard-Rosa & I, at @IntOrgJournal (now #FirstView and ungated all month).

[1]

New paper from @goodhouses, @UNCPoliSci's Cameron Ballard-Rosa & I, at @IntOrgJournal (now #FirstView and ungated all month).

[1]

"Coming to Terms: the Politics of Sovereign Bond Denomination"

We're interested in how non-OECD governments structure their bond borrowing.

Borrowing terms -- the currency, maturity structure, interest rate, as well as legal provisions -- matter.

Why? [2]

We're interested in how non-OECD governments structure their bond borrowing.

Borrowing terms -- the currency, maturity structure, interest rate, as well as legal provisions -- matter.

Why? [2]

Bond terms affect the extent to which governments experience market-related pressures in the future...do they need to generate foreign exchange to repay? How often must they roll over debt?

We focus on currency denomination: do gov'ts borrow in domestic or foreign currency?

[3]

We focus on currency denomination: do gov'ts borrow in domestic or foreign currency?

[3]

It was once the case that investors insisted on foreign-currency bonds for non-OECD borrowers.

But our data -- 240,000 bond issues, 131 countries, 1990-2016 -- suggest "original sin" is largely a thing of the past.

Many governments issue debt in their own currencies.

[4]

But our data -- 240,000 bond issues, 131 countries, 1990-2016 -- suggest "original sin" is largely a thing of the past.

Many governments issue debt in their own currencies.

[4]

Moreover, there's a partisan element to currency denomination: all else equal, left leaning governments are significantly more likely to issue debt in domestic (vs. foreign) currencies.

Doing so fits, we argue, with a desire to retain the ability to expand the money supply [5]

Doing so fits, we argue, with a desire to retain the ability to expand the money supply [5]

And it's not that left governments borrow more overall, nor that the prevalence of left governments has shifted dramatically over time [6].

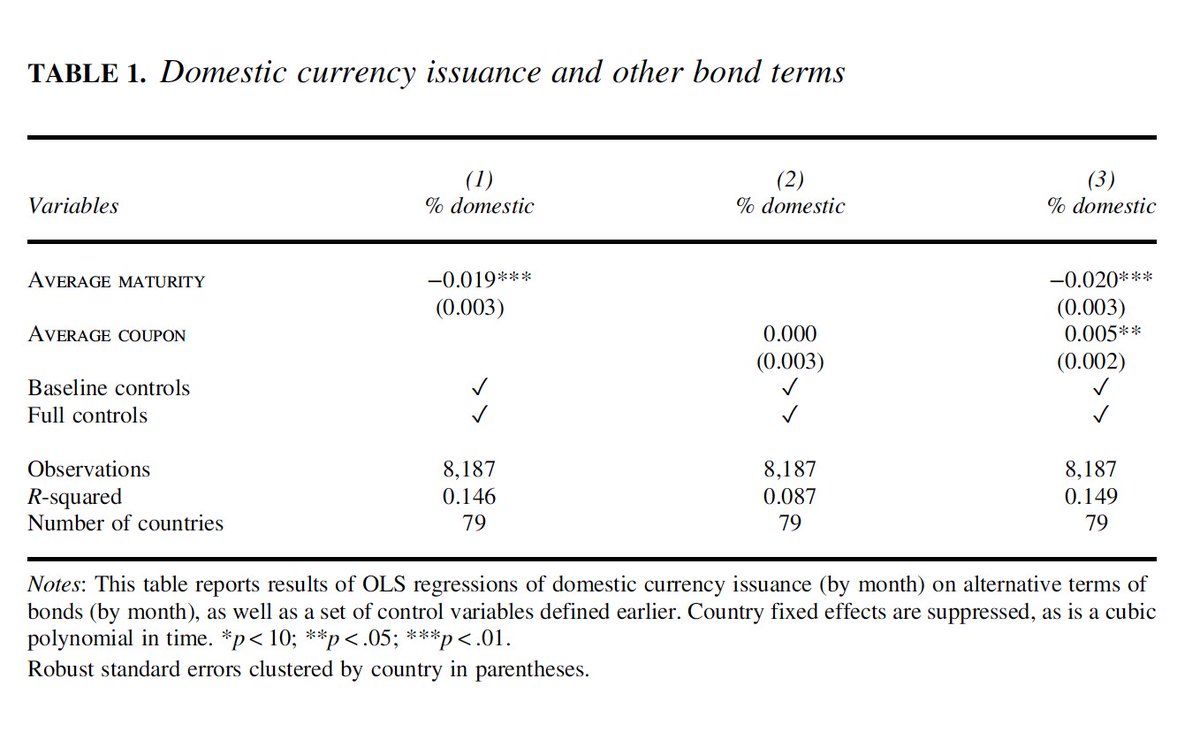

Domestic currency denomination comes at a cost; it is associated with shorter maturities and higher interest rates.

And it appears to be facilitated by central bank independence, which ties governments' hands in a different way [7]

And it appears to be facilitated by central bank independence, which ties governments' hands in a different way [7]

We hope to draw attention to the significant variation in, and importance of *how* governments borrow;

and to suggest that borrowing terms are not only about the supply side (investors' assessments of risk), but also about the demand side (govts' preferences over terms)

[8]

and to suggest that borrowing terms are not only about the supply side (investors' assessments of risk), but also about the demand side (govts' preferences over terms)

[8]

PS: If you're interested in whether governments issue bonds at all, also see "BMW1"

[Short answer: domestic institutions & int'l market conditions both matter]

[end]

cambridge.org/core/journals/…

[Short answer: domestic institutions & int'l market conditions both matter]

[end]

cambridge.org/core/journals/…

And with a discussion of some broader issues related to sovereign debt:

https://twitter.com/PrincetonSPIA/status/1422267772134993930?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh