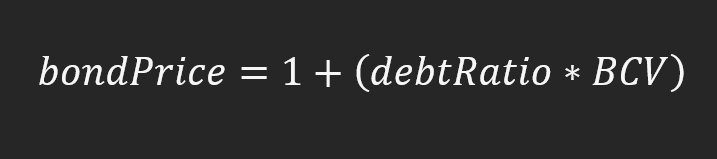

Bond prices at @OlympusDAO are mainly determined by 2 factors: the Bond Control Variable (BCV), and the debt ratio of the protocol. This is cool and all, but what does it really mean?

🧵on the inner workings of bonds 👇:

🧵on the inner workings of bonds 👇:

First, a refresher on bonds:

Bonds are the main source of revenue for the protocol. When you bond, you’re buying OHM from the protocol instead of the open market, for a better price. Since the protocol values every OHM at 1 USD, it makes money off the arbitrage on the trade.

Bonds are the main source of revenue for the protocol. When you bond, you’re buying OHM from the protocol instead of the open market, for a better price. Since the protocol values every OHM at 1 USD, it makes money off the arbitrage on the trade.

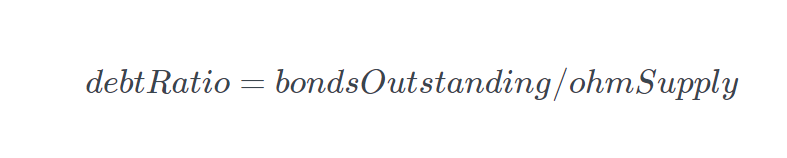

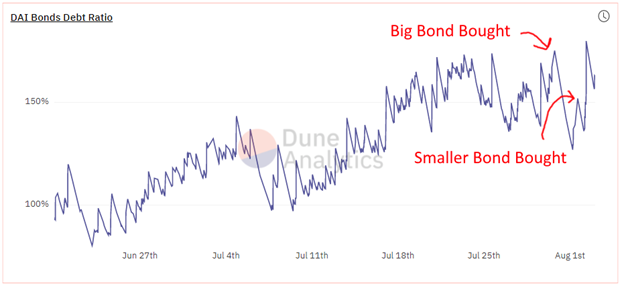

We’ll start with the debt ratio of the protocol: this is determined by the unrealized revenue from bonds divided by the total supply of OHM.

At the time of this post, we have $1,879,684 of DAI bonds waiting to be paid out, and 1.07 million ohm, which calculates to a debt ratio of 175% (you can find all this information on the bond contract).

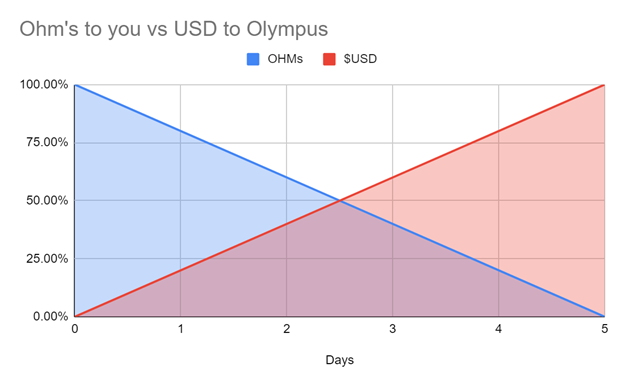

As your OHM vests over time from a bond, so does the revenue from the bond.

If you had a $420 bond today (worth 1 OHM),you’ll get an OHM over a 5-day period, and the protocol gets the $420 over the 5 days.

If you had a $420 bond today (worth 1 OHM),you’ll get an OHM over a 5-day period, and the protocol gets the $420 over the 5 days.

If you’re sharp, you’ll see that the bond price will naturally go down over time, as the protocol realizes the revenue from bonds. We can approximate this decay as linear, but because people bond at different prices, the decay rate will vary slightly block by block.

This also explains why you’ll often see negative bond discounts; The bigger the bond, the bigger impact it has on the debt ratio, causing a higher bond price (equating to a negative bond ROI)!

The other part of the bond price is the BCV, the bond control variable. I like to think of this as the “scaling factor” for the debt ratio. The larger the BCV, the faster the bond prices decay from the debt ratio.

This is currently controlled and maintained by the DAO, and changes depending on the needs of the protocol.

More liquidity? Lower the BCV for the LP bonds.

More runway? Lower the BCV for the naked bonds.

More liquidity? Lower the BCV for the LP bonds.

More runway? Lower the BCV for the naked bonds.

As we get more data (shoutout to the D&M team!), we'll be able to more effectively control the BCV, and perhaps one day transfer to an algo-controlled BCV.

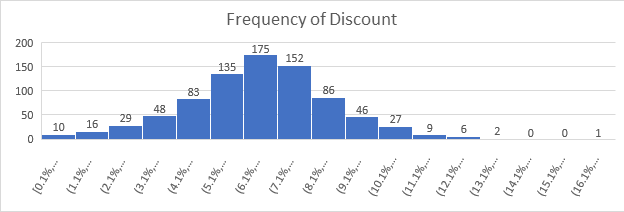

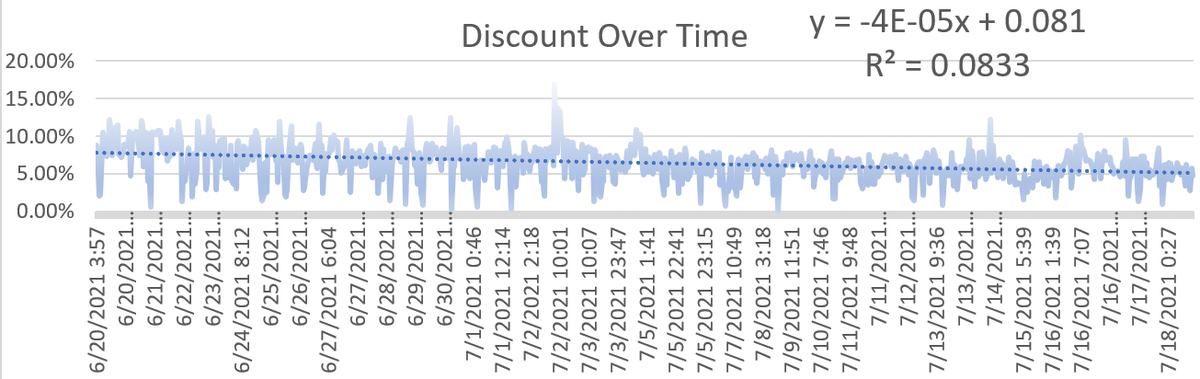

Some more cool statistics I found about bonds: the discounts are going down over time! Signs of an efficient market in place.

This thread just covers the basics of the BCV and how it functions within @OlympusDAO. In the next thread I’ll cover the concept of bond capacity and lowering the BCV increases capacity. Shoutout to @ishaheen10 for making bomb threads and inspiring me to make my own!

• • •

Missing some Tweet in this thread? You can try to

force a refresh