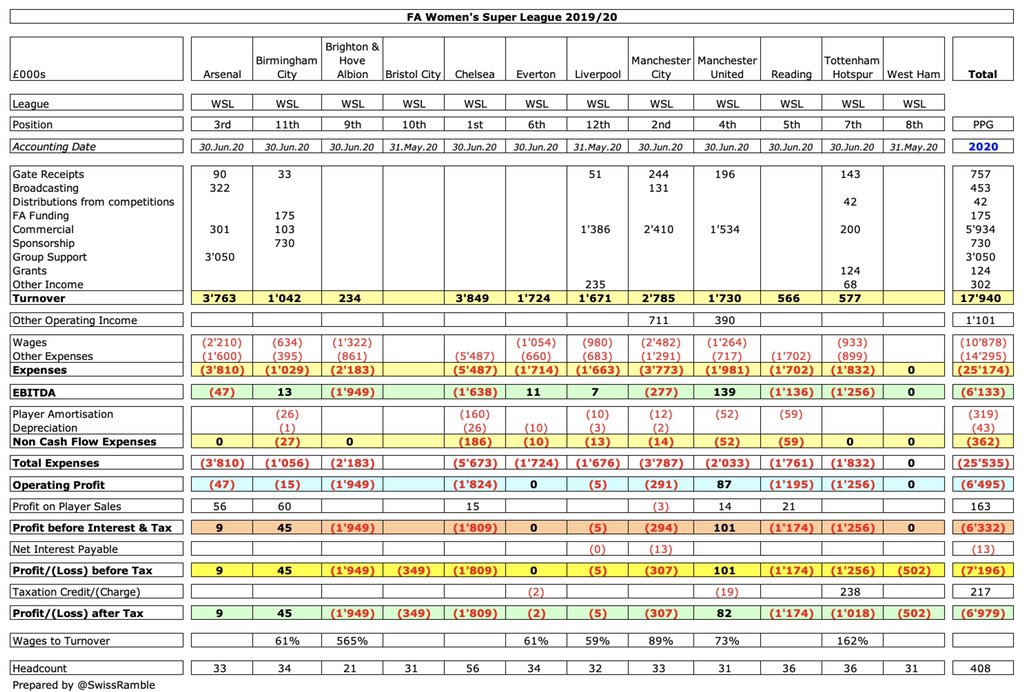

The FA Women’s Super League (WSL) 2019/20 season ended prematurely with places decided by Points Per Game due to COVID-19 with the pandemic obviously adversely affecting revenue. This thread will look at WSL underlying financials plus the impact of two major new TV deals.

Reviewing WSL financials is made more difficult by the fact that not all clubs publish detailed accounts, so some lack information on revenue, expenses, wages and headcount. Nevertheless, there is enough data available to identify some common themes.

This analysis will focus on the 12 clubs competing in the 2019/20 WSL, Overall the WSL reported a £7.2m pre-tax loss for the division, an improvement on the previous season’s £8.9m. Note: the WSL increased the number of clubs from 11 in 2019 to 12 in 2020.

WSL clubs invariably operate at a loss with their parent companies covering the shortfall. Only 4 clubs made (small profits), led by Manchester United £101k, but 8 of the 12 lost money – 4 above a million: Brighton £1.9m, Chelsea £1.8m, Tottenham £1.3m and Reading £1.2m.

Largest profit improvement was at Arsenal £2.8m, but mainly due to a change in funding, as group now contributes a support fee instead of parent bearing costs. Good year-on-year progress at Manchester City £0.6m and Liverpool £0.3m, but Tottenham £1.3m worse following promotion.

Chelsea £3.849m had the highest reported revenue, just ahead of Arsenal £3.763m followed by Manchester City £2.8m, Manchester United £1.7m, Everton £1.7m and Liverpool £1.7m. WSL revenue partly depends on how much income is shared from the parent company in the commercial area.

Arsenal’s £3.4m YoY revenue improvement was largely due to the revised accounting treatment (group support £3.1m). More than £0.5m growth at Manchester City £737k, Liverpool £595k, Everton £561k & Chelsea £514k. Manchester United £477k & Tottenham £301k improved after promotion.

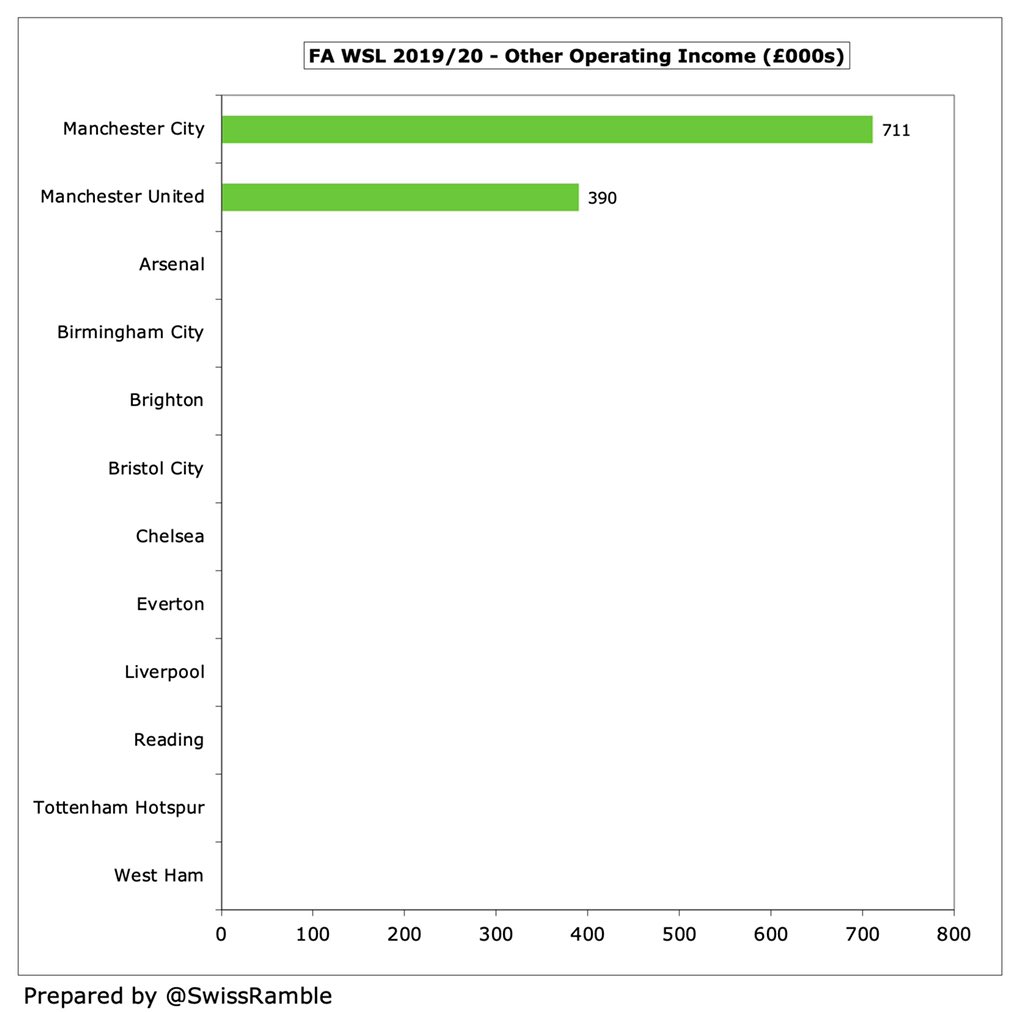

In addition to the reported revenue, the two WSL clubs from Manchester also benefited from substantial “other operating income”, though no details were divulged in the accounts: City £711k and United £390k.

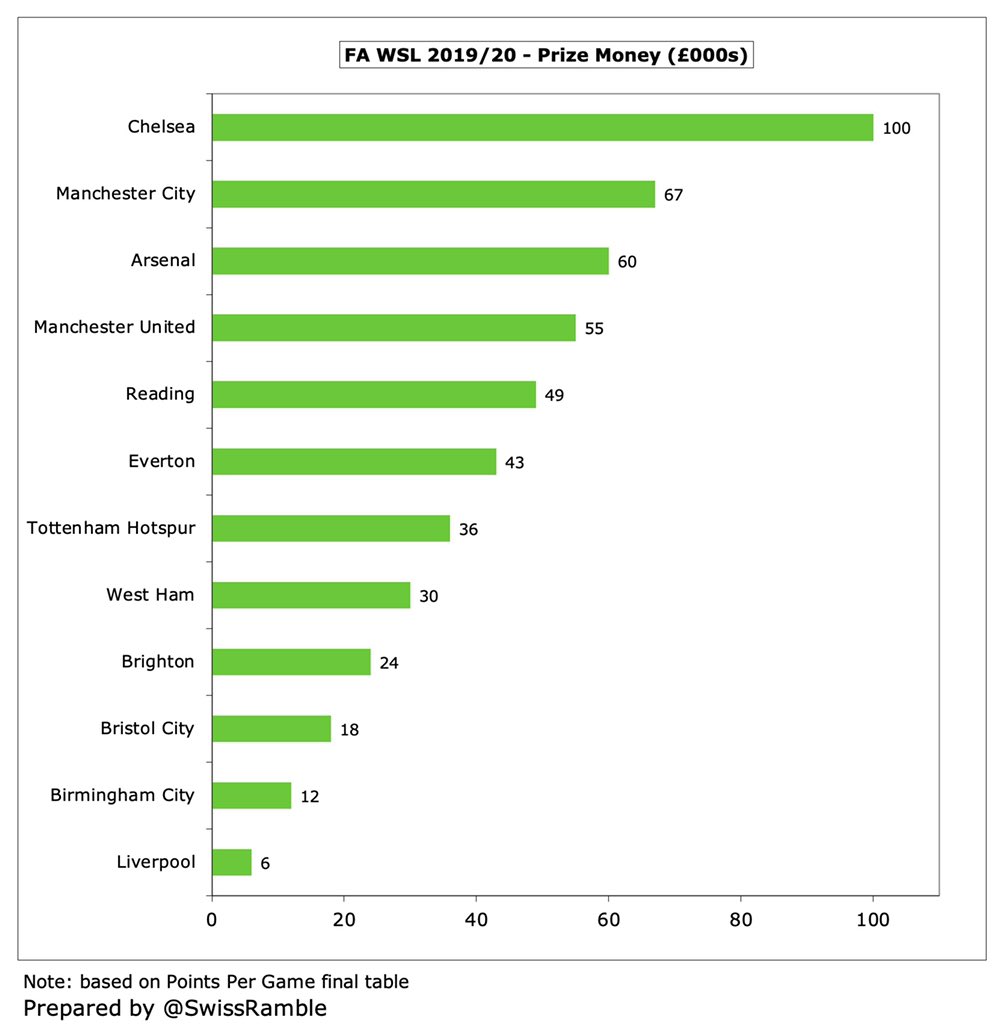

WSL broadcast rights were owned by BT Sport and the BBC, who cover their costs rather than pay for rights – in stark contrast to the men’s game. A £500k prize fund was added in 2019/20, thanks to Barclay’s sponsorship deal, with the champions receiving £100k and last place £6k.

As a reminder, Barclays became the WSL’s first ever title sponsor in 2019 in a three-year deal that the Football Association called "the biggest ever investment in UK women's sport by a brand". The agreement was understood to be worth in excess of £10m.

Even more encouragingly, there will be a new 3-year WSL TV deal from 2021/22 worth £8m a year with Sky showing up to 44 live games and BBC 22 (18 on BBC One or BBC Two). Revenue split between WSL 75% and Women’s Championship 25%. Part distributed evenly, part per league position.

Kathryn Swarbrick, the FA’s director of commercial and marketing, said, “This is a watershed moment. It’s a step change in the value of women’s football, bringing in more revenue than any other women’s domestic league in the world with an unprecedented level of exposure.”

Furthermore, there is a new 4-year UEFA Champions League TV deal from 2021/22 worth €24m a year, more than 4 times more than the current figure. Teams in group stage guaranteed €400k (almost 5 times current money for reaching last 16), while winner gets €1.4m maximum.

CL TV revenue part funded by €10m subsidy from UEFA men’s competitions. Solidarity payments to non-participating clubs will account for 23% (€5,6m). DAZN will screen 61 games live each season with all games also shown on free YouTube channel in first 2 years (then 19 games).

Despite the impressive growth over the previous deal, the winners of the UEFA Women’s Champions League will still only receive 1.6% of the amount the winners of the men’s competition will receive (€1.4m compared to €85.1m), albeit up from 0.5%.

Similar to revenue, Chelsea have the highest expenses in WSL with £5.7m, well ahead of Arsenal and Manchester City, both £3.8m, followed by Brighton £2.2m and Manchester United £2.0m. Relegated Liverpool lagged behind with a budget of only £1.7m.

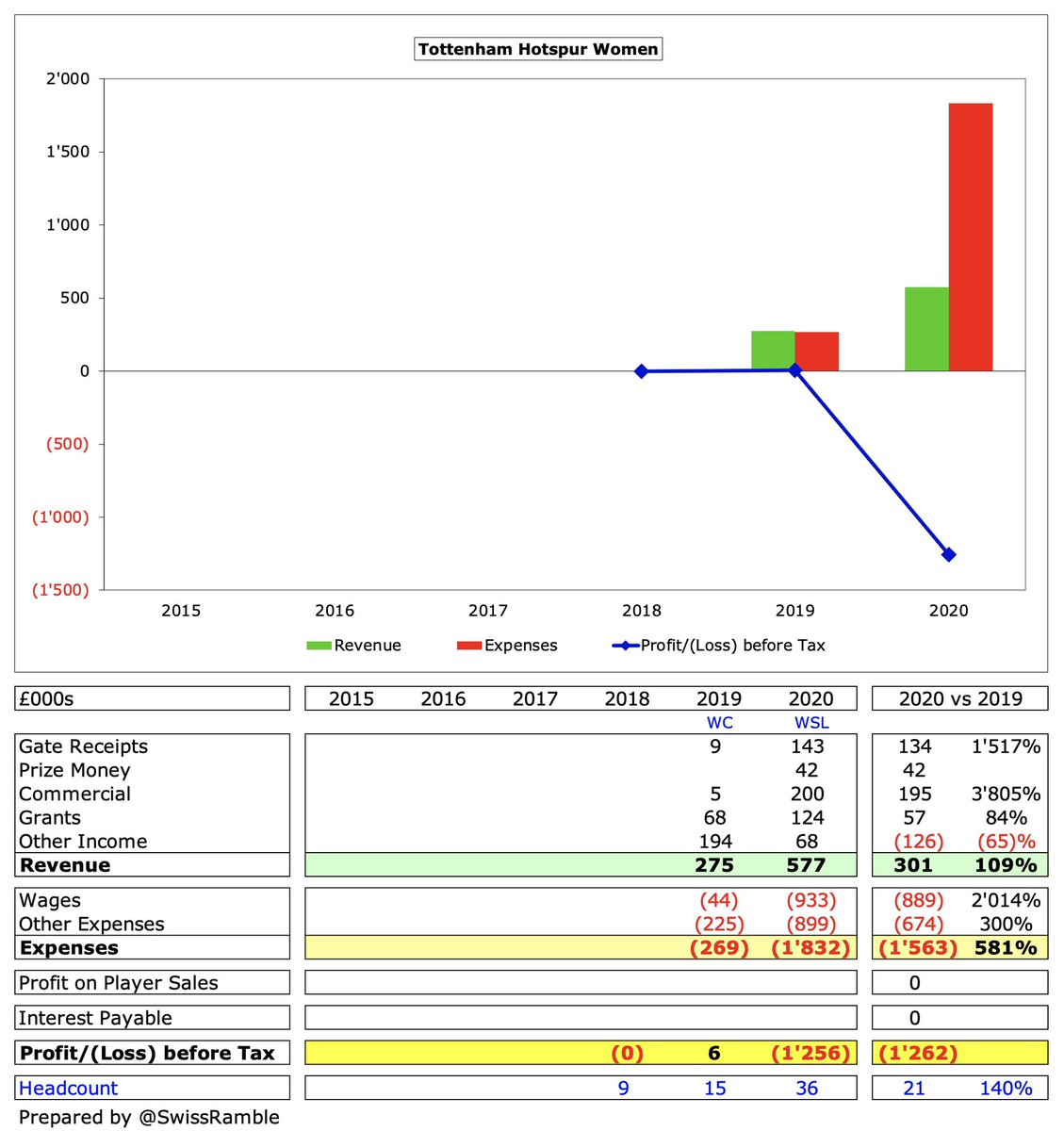

Almost all WSL clubs saw higher expenses in 2019/20, though the largest increase, Tottenham £1.6m, was partly due to investment after promotion from the Women’s Championship, followed by Chelsea £744k and Arsenal £642k. Only Birmingham City spent less than prior year.

Not all WSL clubs publish wages, but Manchester City is highest of those that do provide details with £2.5m, followed by Arsenal £2.2m and Brighton £1.3m. Given that Chelsea’s total expenses are much higher than City, their wages are almost certainly the highest in the league.

A salary cap is in place in the WSL at 40% of turnover, but this is fairly “soft”, given that turnover can include funding from the parent company. In other words, a greater share of commercial income would mean that a club could afford a higher wage bill.

WSL headcount numbers should also not necessarily be taken at face value, as clubs apply different criteria for inclusion. However, the 56 staff at Chelsea is significantly more than the next highest, Tottenham and Reading 36. Liverpool restated their figure and now show 32.

Unsurprisingly, the budget at WSL clubs is considerably lower than their male counterparts, especially at Liverpool and Manchester United, 0.3% and 0.4% respectively, e.g. Liverpool £1.7m vs. £564m. Highest ratio is at Reading 2.9%, which is more a reflection of low men’s budget.

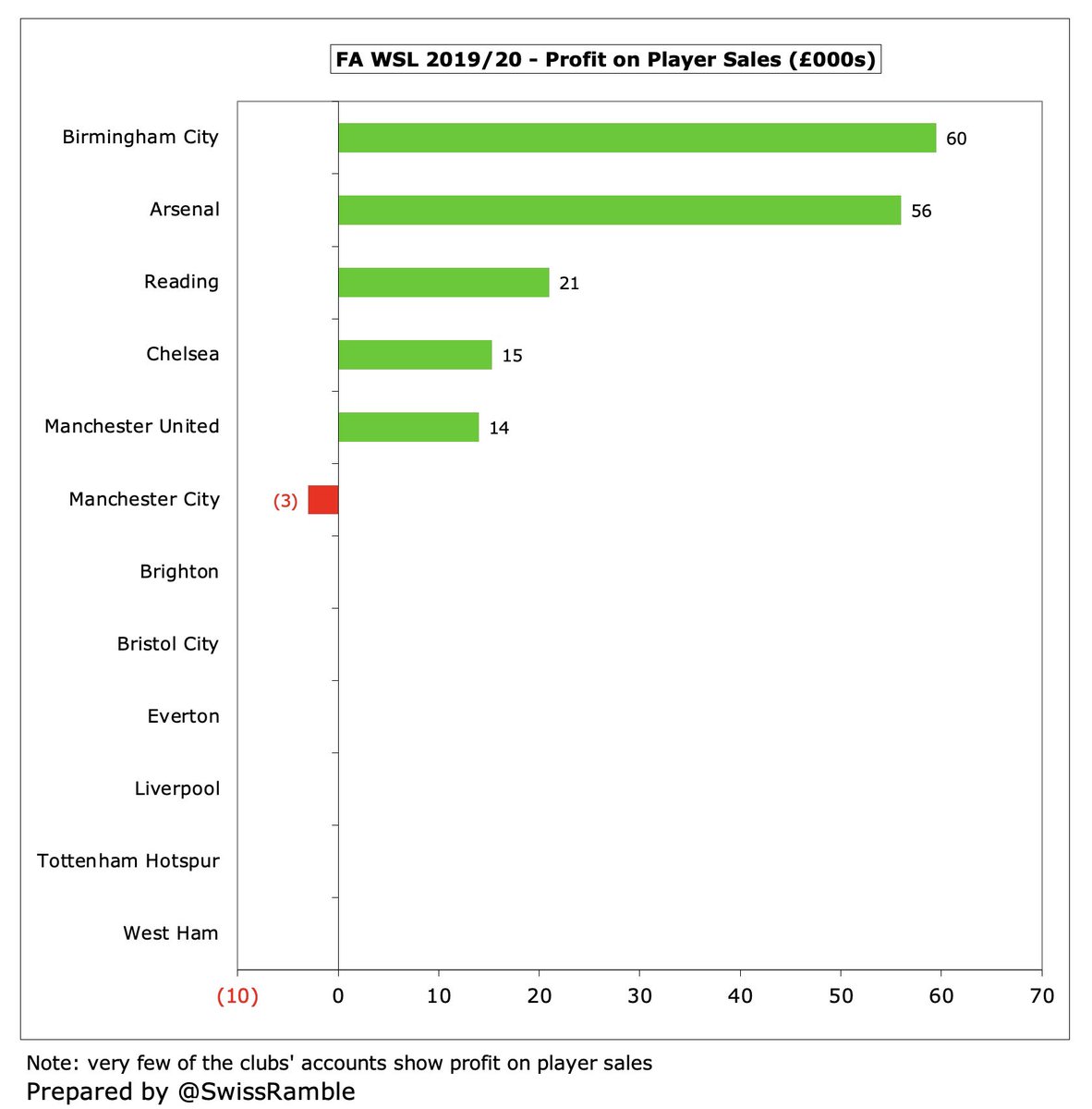

Again very few WSL clubs report profit on player sales with Birmingham City leading the way with just £60k. FIFA said only $1.2m was spent on transfer fees in women’s game in 2020 compared to $5.6 bln in men’s game. Only really high-profile players might command a six-figure fee.

Let’s now look at how the finances have developed at the 12 clubs in the 2019/20 WSL, staring with the champions Chelsea and finishing with the relegated club, Liverpool. Wherever possible, we will review the last six years’ financial results of each club from 2015 to 2020.

Chelsea, winners of the WSL 3 times in the last 4 years under the irrepressible Emma Hayes, saw their revenue rise £514k (15%) in 2020 to £3.8m, up more than £3m since 2015. Expenses also rose 15% (£744k) to £5.7m. leading to the club’s largest ever loss of £1.8m.

Manchester City loss narrowed from £910k to £307k in 2020, as £737k revenue growth to £2.8m (plus £382k more operating income) outpaced £426m expenses increase to £3.8m. Around 87% of City’s revenue comes from commercial, which has shot up from £192k in 2015 to £2.4m in 2020.

Arsenal swung from reported loss of £519k in 2019 to £9k profit in 2020, though improvement would have been even more if prior year included £2.3m expenses borne by parent company. Revised accounting treatment means revenue increased from £340k to £3.8m, while wages were £2.2m.

Arsenal benefited from a new commercial deal with Mastercard in 2019. Chief executive Vinai Venkatesham said, “Next year we’re going to invest much more than ever before to give us the best chance of being successful”, including recruitment of new medical and operations staff.

Manchester United only reintroduced women’s team in 2018, but they quickly secured promotion to WSL. Posted £101k profit on £1.7m revenue (almost 90% from commercial) plus £390k “other operating income”. Concerns about lack of investment led to manager Casey Stoney’s resignation.

Reading’s loss was virtually unchanged at £1.2m, despite revenue more than doubling from £277k to £566k, as expenses also increased £275k (18%) from £1.5m to £1.8m. Losses in 2019 and 2020 were much higher than the preceding four seasons.

Everton have basically broken-even each year. As an example, revenue and expenses both increased in 2020 by £0.5m from £1.2m to £1.7m. Wage bill up from £730k to £1.1m. No revenue details published, but it looks very much as if the parent company adjusts to cover costs.

Tottenham Hotspur secured promotion in 2018/19. Swung from £6k profit in the Women’s Championship to £1.3m loss in WSL. Revenue more than doubled from £275k to £577k, while expenses shot up from £269k to £1.8m (wages rose from just £44k to £933k).

Unfortunately West Ham only published abbreviated accounts in 2020 with a £502k loss. In 2019 they reported £1.3m revenue with the same amount of expenses (wages £705k). The club broke-even in the 2 years before 2020, when it looks like the Hammers’ parent company covered costs.

Brighton & Hove Albion loss increased by £166k from £1.8m to £1.9m, largely due to wages rising £264k (25%) from £1.1m to £1.3m, though other expenses fell £89k. Revenue only up £10k, which means that this has only grown by £108k in the last four years from £126k to £234k.

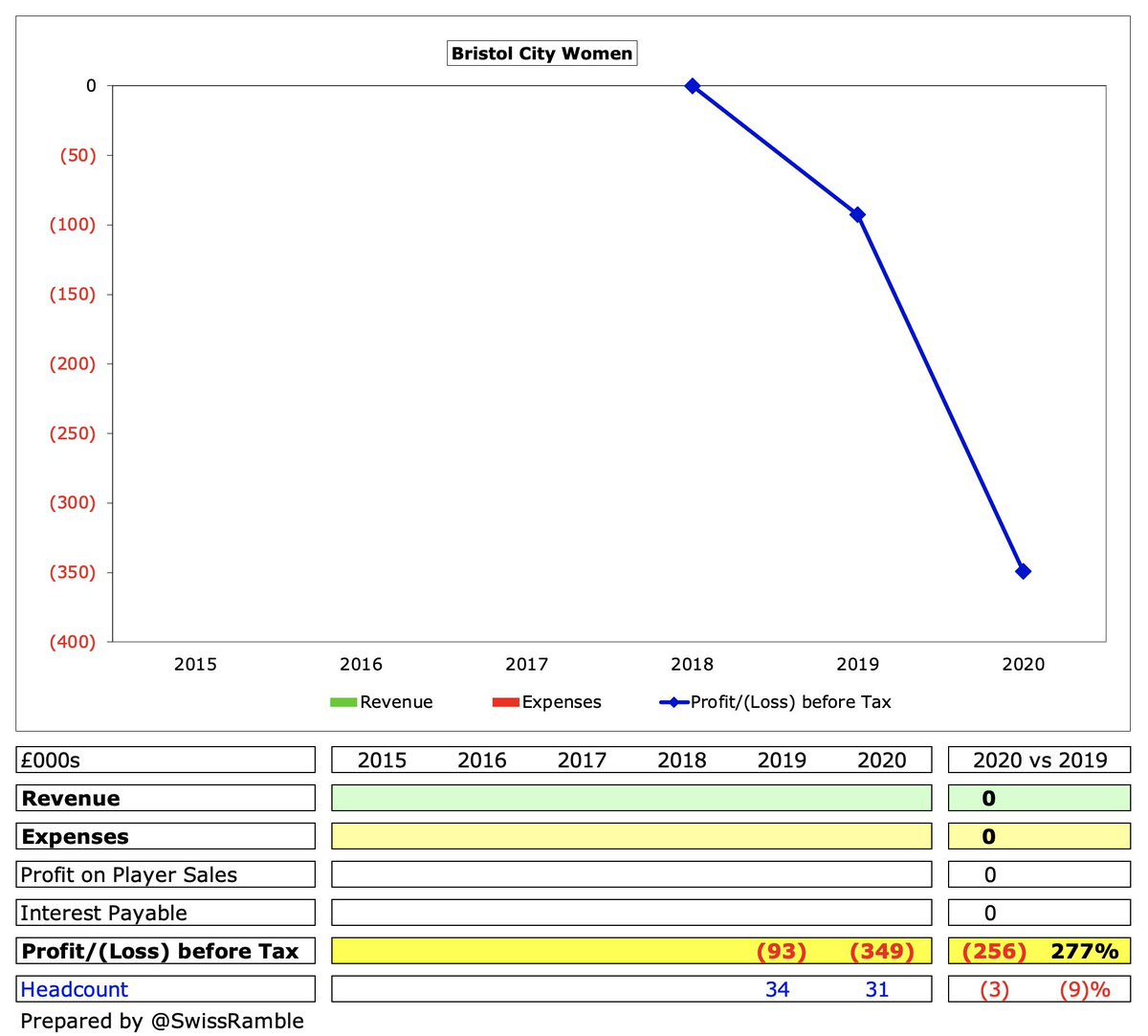

Bristol City only publish abbreviated accounts, which showed that their loss widened from £93k to £349k, while employing 31 staff. No revenue, expenses or wages details provided.

Birmingham City narrowed loss from £91k to £58k in 2020, mainly due to £60k profit from player sales. Revenue fell £88k (9%) to £938k, while expenses dropped £69k (6%) to £1.1m, including £634k wages. Nearly 78% of revenue comes from sponsorship £730k.

Liverpool loss narrowed from £313k to only £5k in 2020, as revenue surged £595k (55%) from £1.1m to £1.7m, while expenses were up £284k (20%) also to £1.7m. Commercial £1.4m accounts for 83% of revenue. Wage bill up 21% to nearly £1m. Headcount restated: now 32 full-time staff.

Deloitte noted that 18 of the top 20 clubs in their Money League now have a women’s football team (the only exceptions, Borussia Dortmund and Schalke 04, are forming teams this summer). Benefits include improved brand perception, appealing to a wider fan base and revenue growth.

Before the pandemic struck, women’s football had been building up some real momentum commercially. However, most clubs are still heavily reliant on their parent companies, so the two major TV deals this season are great news for the development of the women’s game.

Finally, if you are interested in reading more about women’s football and want to follow some real experts, I would heartily recommend @KatieWhyatt @FayeCarruthers @lynseyhooper @M0lly_Writes @FloydTweet @SuzyWrack @Stillberto

• • •

Missing some Tweet in this thread? You can try to

force a refresh