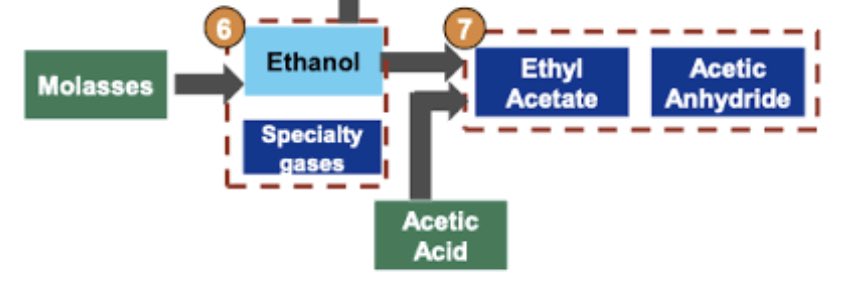

Ethyl acetate-One of the key products of Jubilant’s Life science business

Manufacturing from -bio-ethanol and acetic acid.

Jubilant is also the 7th largest Ethyl Acetate manufacturer in the world and has the largest market share in the domestic market.( See Below )

Manufacturing from -bio-ethanol and acetic acid.

Jubilant is also the 7th largest Ethyl Acetate manufacturer in the world and has the largest market share in the domestic market.( See Below )

ethyl acetate produced through bio- ethanol gives a much lower carbon footprint of 2.29 (cO2 per ton of chemical) as against 5.66 (cO2 per ton of chemical) through petro route. it is an important downstream product of bio-ethanol and acetic acid.

Acetic Anhydride

acetic anhydride is made from acetic acid. Jubilant holds more than half of the domestic market share in the production of acetic anhydride. it is also the 7th largest global manufacturer of acetic anhydride and the 4th largest in terms of merchant sales globally

acetic anhydride is made from acetic acid. Jubilant holds more than half of the domestic market share in the production of acetic anhydride. it is also the 7th largest global manufacturer of acetic anhydride and the 4th largest in terms of merchant sales globally

company has two state of the art production unit for ethanol manufacturing in Gajraula (Uttar Pradesh) and nira (maharashtra). ethanol produced is supplied to oil marketing companies for ethanol Blending Programme (eBP) in india making them the 4th largest supplier on Pan india

Monochloroacetic Acid (McAA)/ sodium Monochloro Acetate (sMcA)

Jubilant is the only integrated producer,manufacturing monochloroacetic acid/Sodium monochloro acetate by utilising acetic acid and acetic anhydride.The company is a prominent exporter of mcaa and Smca.

Jubilant is the only integrated producer,manufacturing monochloroacetic acid/Sodium monochloro acetate by utilising acetic acid and acetic anhydride.The company is a prominent exporter of mcaa and Smca.

Acetaldehyde

Acetaldehyde market in India is anticipated to grow at CAGR of 4% owing to its extensive utilization in the production of agrochemicals, pharmaceuticals, paints and coatings industries. Acetaldehyde, also known as ethanal, is an organic compound and is used as a

Acetaldehyde market in India is anticipated to grow at CAGR of 4% owing to its extensive utilization in the production of agrochemicals, pharmaceuticals, paints and coatings industries. Acetaldehyde, also known as ethanal, is an organic compound and is used as a

as a chemical intermediate for the manufacturing of various petrochemical products. Indian Acetaldehyde market is highly fragmented owing to the easy availability of raw material and production process, which encouraged the domestic manufacturers to enter this market.

Acetaldehyde finds its major application in the production of Pyridine & Pyridine bases, Pentaerythritol, Acetic Acid and Acetate Esters. Demand for Acetaldehyde in India is driven by the growing demand for Pyridine and Pyridine base in production of agrochemicals and

More than 50% of Pyridine produced is used in the manufacturing of pesticides and herbicides. Moreover, rising demand for Pentaerythritol in plasticizers, paints and coatings is boosting the demand for Acetaldehyde in India. Increasing construction activities coupled with rising

concern towards protection of surface coatings is likely to increase the consumption of Pentaerythritol in paints and coatings, which is further accelerating the growth of India Acetaldehyde market. Furthermore, Acetaldehyde is also used as precursor to produce other chemicals.

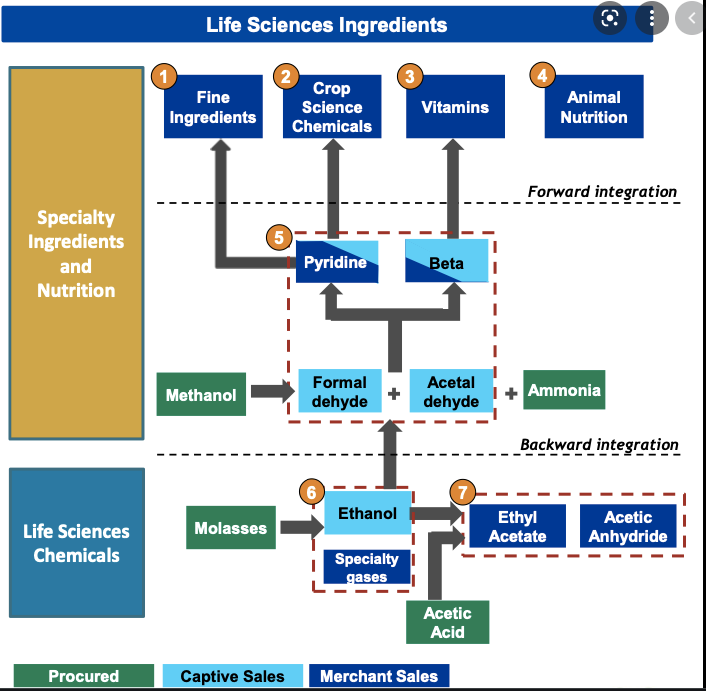

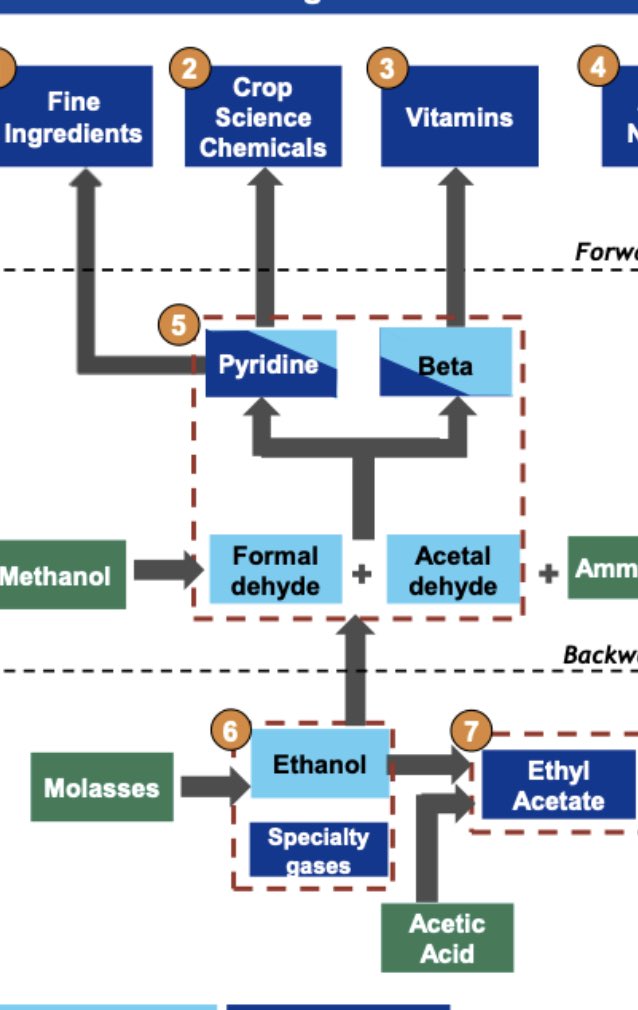

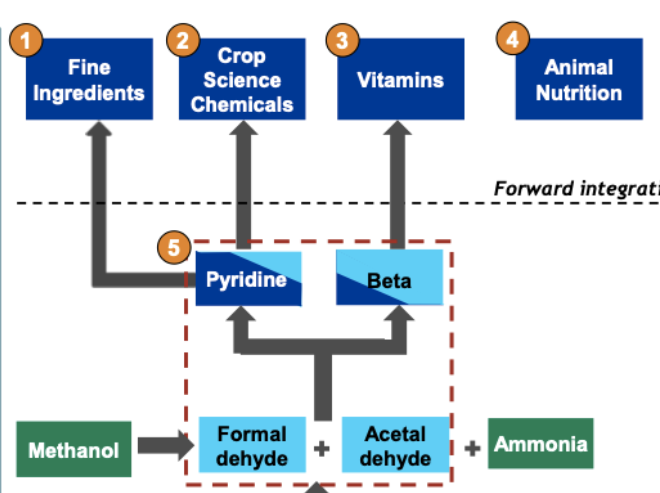

Again See the value chain of manufacturing of Ethanol - Acetaldehyde - pyridine - fine in gradients and crop science chemicals

@threader_app compile

Diketene market in india-

Until 2020, the Indian diketene market was valued at US$ 31.5 Mn, and is further expected to increase to US$ 48.4 Mn by 2030, expanding at a value CAGR of over 4%.

Until 2020, the Indian diketene market was valued at US$ 31.5 Mn, and is further expected to increase to US$ 48.4 Mn by 2030, expanding at a value CAGR of over 4%.

Pharmaceuticals & nutraceuticals is the key growth engine, likely to yield over two-fifths of the total revenue.

The India Brand Equity Foundation establishes that the country is the largest provider of generic drugs globally.

The India Brand Equity Foundation establishes that the country is the largest provider of generic drugs globally.

The Indian pharmaceutical sector generated over 50% of the global demand for various vaccines, 40% of generic demand in the U.S and a quarter of all medicines in the U.K. By 2025, the pharmaceutical industry will reach US$ 25 billion.

Recently, the Union Cabinet has amended existing FDI policies in the pharmaceutical segment to permit 100% investment with regard to medical devices manufacturing subject to certain conditions. pharmaceutical sector cumulatively attracted an FDI inflow worth over US$ 16 billion

between April and June 2020.

Based on these aforementioned broad trends, investments in diketene derivatives and associated products is likely to burgeon, creating massive revenue pools in the future.

Based on these aforementioned broad trends, investments in diketene derivatives and associated products is likely to burgeon, creating massive revenue pools in the future.

Rice fortification will increase growth of vitamin B3 market indianexpress.com/article/india/…

Paraquat is a herbicide and it require pyridine as a raw material for manufactring and Due to Paraquat ban in Brazil and Thailand Pyridine, prices were lower in last q but Beta picoline is a co product during pyridine manufacting so because of low pyridine demand even

beta picoline production was low because of This has resulted into improvement in Beta Picoline prices.( Just for knowledge sharing)See Diagram Below

Jubilant Ingrevia AR-

CDMO-

-We currently have seven molecules in our

pharma CDMO pipeline out of which four are in Phase

III for anti‑viral and cosmetic applications and three

are in Phase II for anti‑neoplastic, anti‑retroviral and

anti-thrombotic applications.

CDMO-

-We currently have seven molecules in our

pharma CDMO pipeline out of which four are in Phase

III for anti‑viral and cosmetic applications and three

are in Phase II for anti‑neoplastic, anti‑retroviral and

anti-thrombotic applications.

-Our agrochemical CDMO pipeline includes four

molecules, one in Stage III for insecticides and three

in Stage II for insecticide and fungicide application.

We are also planning to file DMFs for our intermediates regulated markets from our GMP facility at Bharuch

molecules, one in Stage III for insecticides and three

in Stage II for insecticide and fungicide application.

We are also planning to file DMFs for our intermediates regulated markets from our GMP facility at Bharuch

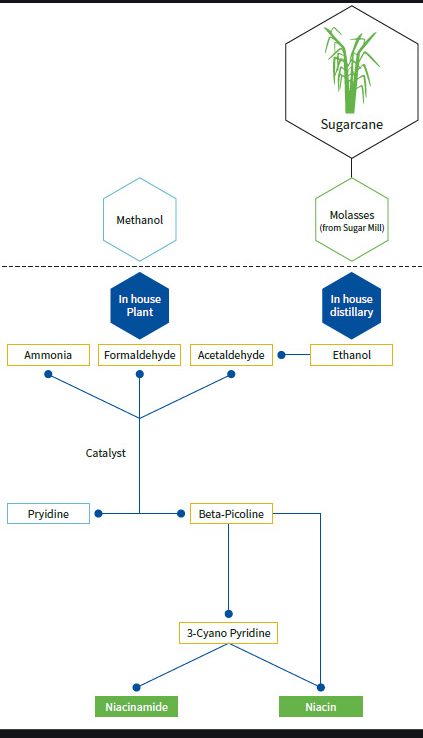

-Our Vitamin B3 is manufactured

through an eco-friendly route, starting from a renewable

source, instead of conventional fuels, thereby reducing

our carbon footprint.

-We offer Vitamin B4 (Choline Chloride) which helps maintain liver health in animals.

through an eco-friendly route, starting from a renewable

source, instead of conventional fuels, thereby reducing

our carbon footprint.

-We offer Vitamin B4 (Choline Chloride) which helps maintain liver health in animals.

We hold the domestic market leadership position in Choline Chloride.

We have also diversified into herbal replacer of

Choline, Methionine, Non-antibiotic growth promoter (under brand ‘Phytoshield’) which is a plant-based natural offering for animal health

We have also diversified into herbal replacer of

Choline, Methionine, Non-antibiotic growth promoter (under brand ‘Phytoshield’) which is a plant-based natural offering for animal health

In FY 2021, our in‑house RDT team developed ‘Propionic Anhydride’ in record time to capture the growing demand in Agrochemicals (mainly herbicides), Pharmaceuticals (APIs) and Dyes segments.

Our team has successfully

commissioned the global scale plant at Gajraula for

supply across India and the global market. The demand

for Propionic Anhydride is expected to grow on account

of strong growth from Agrochemical Segment (Growth in

Clethodim).

commissioned the global scale plant at Gajraula for

supply across India and the global market. The demand

for Propionic Anhydride is expected to grow on account

of strong growth from Agrochemical Segment (Growth in

Clethodim).

Clethodim- is a post-emergence herbicide used to control annual and perennial grasses in a wide variety of broad leaf crops including soybeans, cotton, flax, peanuts, sunflowers, sugarbeets, potatoes, alfalfa and most vegetables ( In FY 20 UPL also started its production)

Jubilant ingrevia -Acetaldehyde is used to manufacture Pentaerythitol and read about Market of Pentaerythrutol - Growth, Trends and Forecast (2020-2025) businesswire.com/news/home/2020…

• • •

Missing some Tweet in this thread? You can try to

force a refresh