1/ A quick explainer on what happened with the infrastructure bill last night:

We were on track to pass the Wyden-Lummis-Toomey amendment to fix the worst issues with the bill, & then Senators @RobPortman & @MarkWarner came from nowhere to blow it up.

Now the vote's tomorrow 👇

We were on track to pass the Wyden-Lummis-Toomey amendment to fix the worst issues with the bill, & then Senators @RobPortman & @MarkWarner came from nowhere to blow it up.

Now the vote's tomorrow 👇

2/ As a refresher, the current infra bill draft has a provision expanding the Tax Code definition of "broker" to include:

"any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person."

"any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person."

3/ This definition is wildly overbroad. It captures nearly everyone in crypto, forcing them all to surveil users in order to comply with tax reporting obligations.

We spent all week asking Congress to remove it, change it, or add exceptions for miners, developers, & many others.

We spent all week asking Congress to remove it, change it, or add exceptions for miners, developers, & many others.

4/ Thankfully, some smart Senators understood that the language in the original draft was unworkable.

It treats everyone in crypto like a traditional financial institution no matter how different they are, & forces them to report data to the IRS that they don't have & can't get.

It treats everyone in crypto like a traditional financial institution no matter how different they are, & forces them to report data to the IRS that they don't have & can't get.

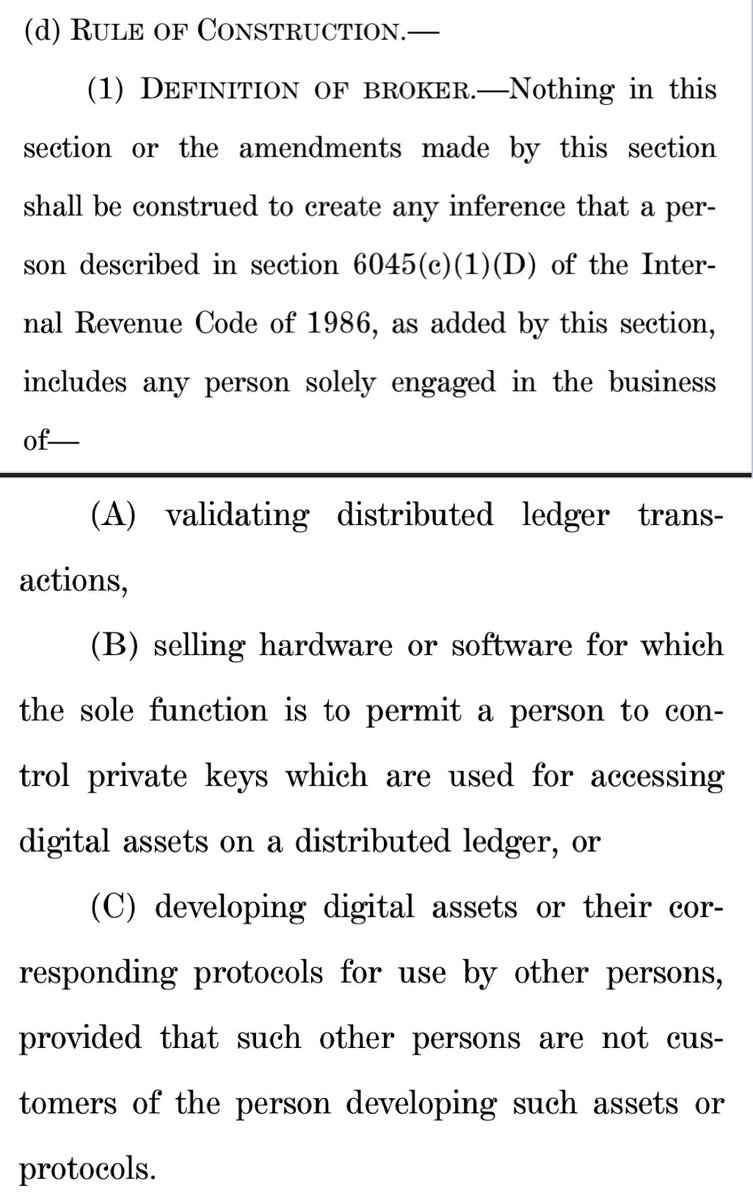

8/ The three of them, a bipartisan group of one Democrat & two Republicans, put together an amendment fixing the worst issues with the bill.

The Wyden-Toomey-Lummis amendment clarifies that certain non-custodial actors like miners & developers aren't covered by the broker rule:

The Wyden-Toomey-Lummis amendment clarifies that certain non-custodial actors like miners & developers aren't covered by the broker rule:

9/ The amendment was set for a vote yesterday & appeared likely to pass.

It had strong support (thanks largely to all your calls) & even Senator Portman, who led negotiations on the original crypto provision for the Republicans, suggested he was for it:

It had strong support (thanks largely to all your calls) & even Senator Portman, who led negotiations on the original crypto provision for the Republicans, suggested he was for it:

https://twitter.com/senrobportman/status/1423309129981042696?s=20

10/ Then, in a DC flip-flop so fast it'll make your head spin, Senator Portman proposed his own competing amendment, co-sponsored by Senator Warner, a Democrat.

The Portman-Warner amendment is worse than useless. It doesn't come close to passing the laugh test. It only excepts:

The Portman-Warner amendment is worse than useless. It doesn't come close to passing the laugh test. It only excepts:

11/ Portman-Warner protects PoW miners & some (but not all) wallet projects.

That's it. 🤡

Not software developers, or Lightning node operators, or PoS validators, or DEX liquidity providers, or DeFi aggregators, or many other non-custodial actors who can't comply with the law.

That's it. 🤡

Not software developers, or Lightning node operators, or PoS validators, or DEX liquidity providers, or DeFi aggregators, or many other non-custodial actors who can't comply with the law.

12/ What really gets me is how Portman-Warner cuts out subsection (C) from Wyden-Lummis-Toomey, which simply protects developers who write code & don't sell anything.

This is *basic* First Amendment freedom of speech. It's jaw-dropping for two sitting Senators not to get that.

This is *basic* First Amendment freedom of speech. It's jaw-dropping for two sitting Senators not to get that.

13/ Now we have two competing bills, one good & one terrible, both coming up for a vote tomorrow.

The *correct* outcome is for Wyden-Lummis-Toomey to pass & Portman-Warner to fail, assuming the Senators care about good policy & promoting US interests through innovation.

But....

The *correct* outcome is for Wyden-Lummis-Toomey to pass & Portman-Warner to fail, assuming the Senators care about good policy & promoting US interests through innovation.

But....

14/ Good policy apparently isn't the priority here.

Instead, this looks like a continuation of the US Treasury Department's embrace of warrantless surveillance & crusade against financial privacy in crypto.

The strategy is new, but the motivation is not:

Instead, this looks like a continuation of the US Treasury Department's embrace of warrantless surveillance & crusade against financial privacy in crypto.

The strategy is new, but the motivation is not:

https://twitter.com/jchervinsky/status/1315758137903902721?s=20

15/ Word in DC is that this whole thing was Treasury's idea. They don't like what we're building & their solution is to obtain jurisdiction over non-custodial actors.

They tried this via FinCEN's proposed rule last year & failed. Now they're trying again.

washingtonpost.com/politics/2021/…

They tried this via FinCEN's proposed rule last year & failed. Now they're trying again.

washingtonpost.com/politics/2021/…

16/ Problem is, they might succeed this time.

Portman-Warner is DC gamesmanship at its worst, but I have to give it to them: it's a nifty political trick.

Although the amendment is garbage, Senator Warner's involvement makes it "bipartisan," which means Dems can vote for it. 😑

Portman-Warner is DC gamesmanship at its worst, but I have to give it to them: it's a nifty political trick.

Although the amendment is garbage, Senator Warner's involvement makes it "bipartisan," which means Dems can vote for it. 😑

17/ Dems can say "we fixed the crypto provision" without actually fixing the crypto provision, which requires voting for Wyden-Lummis-Toomey instead.

Even the White House jumped in (with a push from Treasury, perhaps) to give Dems cover for this strategy.

Even the White House jumped in (with a push from Treasury, perhaps) to give Dems cover for this strategy.

https://twitter.com/JStein_WaPo/status/1423461677589270535?s=20

18/ But we *can* stop them.

To do that, we need to make more calls to Senators. A lot more. We need to tell them to vote YES on Wyden-Lummis-Toomey & NO on Portman-Warner.

If you're willing & able, please use the number & script here to call today:

fightforthefuture.org/actions/stop-t…

To do that, we need to make more calls to Senators. A lot more. We need to tell them to vote YES on Wyden-Lummis-Toomey & NO on Portman-Warner.

If you're willing & able, please use the number & script here to call today:

fightforthefuture.org/actions/stop-t…

19/ Both amendments are up for a vote tomorrow.

I'm lucky to be working with all the smartest people in DC, but even they aren't sure how the process for competing amendments works. We'll just have to see how it plays out.

Yes, this is how a bill becomes a law. It isn't pretty.

I'm lucky to be working with all the smartest people in DC, but even they aren't sure how the process for competing amendments works. We'll just have to see how it plays out.

Yes, this is how a bill becomes a law. It isn't pretty.

20/ No matter what happens tomorrow, the fight will go on.

The infrastructure bill as a whole will very likely pass, & then it'll go to the House. Depending what happens to the crypto provision, we can push for an amendment there too.

We have a lot more friends in the House.

The infrastructure bill as a whole will very likely pass, & then it'll go to the House. Depending what happens to the crypto provision, we can push for an amendment there too.

We have a lot more friends in the House.

21/ After that, the crypto provision won't take effect until 2023 at earliest, so we can keep fighting to reverse it in Congress or overturn it in the courts.

Let's cross that bridge if & when we get there.

For now, only one thing really matters:

CALL YOUR SENATORS! 🇺🇸

[end]

Let's cross that bridge if & when we get there.

For now, only one thing really matters:

CALL YOUR SENATORS! 🇺🇸

[end]

• • •

Missing some Tweet in this thread? You can try to

force a refresh