1/ In my last post on #Gamma I said we would talk about Gamma bands. I expect this one to be slightly controversial, so at the end, let me know what you think.

In this post, I am going to teach you how to build these Gamma bands!

In this post, I am going to teach you how to build these Gamma bands!

2/ Here is that last post on Gamma for reference.

https://twitter.com/ResearchVariant/status/1421514329975783426

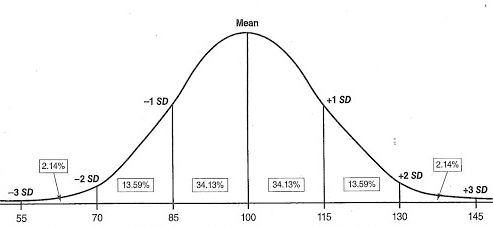

3/Let's begin, first we need to have a basic understanding of volatility. Volatility is expressed as an annualized number that is proportional to the square root of time. What does that mean? Simply put, it's the one standard deviation move $BTC is expected to make in a year.

4/ But if you are a short-timeframe trader that’s not really helpful, what would be helpful, however, is knowing the 1 stdev. move over the course of one day.

5/ How do we do this? Well, vol is proportional to time, $BTC trades 365 days so...

Sqrt 365=19.1

Vol = 81.98 (LXVX )

Daily volatility = Annual volatility/19.1

81.98/19= 4.31

Sqrt 365=19.1

Vol = 81.98 (LXVX )

Daily volatility = Annual volatility/19.1

81.98/19= 4.31

6/ There are a few places you can find $BTC’s volatility. These bands aren't set in stone, you can tweak them, test them, and find what works best for you.

(ATM vol in the graph below.)

@laevitas1

(ATM vol in the graph below.)

@laevitas1

7/ Now we need yesterday's close (at least I think that's what these pink bands use.) However, this will mean the bands are static (they won't move throughout the day.) A better way to do this would be using the VWAP. Which again, I will discuss later.

8/ Here they seem to be using 42,832-ish (I'm just going to use this number.) To get the useful one stdev move we need to take the closing price of $BTC and * it by the Daily Vol from above (4.3%.)

Close price $42,832*4.3% = 1,837

btw notice the bounces over the last few days

Close price $42,832*4.3% = 1,837

btw notice the bounces over the last few days

9/ The last thing we need to do is adjust for the 25d skew in the market. Skew is the 25d calls - 25d puts. If we don’t adjust for this the bands will be equidistance from our close price every time we run the numbers, and not as accurate. (more on skew later)

10/ Now let's build the bands. First, add and subtract our 1 stdev move (1,837) from our close price of 42k and adjust for skew, voilà we have our 1 gamma up move, and 1 gamma down move.

You can see in the simple spreadsheet below they are $1,758 up and $1,916 down.

You can see in the simple spreadsheet below they are $1,758 up and $1,916 down.

11/ Here is the formula. It's pretty simple, just get the daily move and adjust for skew then +/- it from the closing price.

$42,832+$1,758 = Upper band $44,590

$42,832 + $1,916 = Lower band $40,915

$42,832+$1,758 = Upper band $44,590

$42,832 + $1,916 = Lower band $40,915

12/ How did this line up with the next day's pink bands?

Our calculation had the top band around 44.5k and lower around 40.9k, right? I would say it's pretty close.

(Notice where resistance is right now. Remember this band was formed when $BTC was under 42k. 👇)

Our calculation had the top band around 44.5k and lower around 40.9k, right? I would say it's pretty close.

(Notice where resistance is right now. Remember this band was formed when $BTC was under 42k. 👇)

13/ So earlier I said this version was static, I think a better way to do this is to use VWAP as your input instead of the closing price. Using VWAP throughout the day will give you dynamic bands. I’m not going to go into this because @laevitas has built the bands for you.

14/ Again, these band don’t work perfectly (so don't @ me), if there is a massive flow incoming the bands will get blown out, but if you read our last thread on gamma, you should have a simple understanding of how large books hedge and move...

15/ ...they are dynamic, as they gain Deltas/Gamma they offload them, and as they lose Deltas/Gammas they buy them back.

16/ As an example maybe they have a massive call position, and the price of $BTC starts moving up, they might start offloading deltas by selling them, or locking them in via the perp, etc etc. These bands offer possible levels where this type of gamma hedging MIGHT occur.

17/ So what do you think would happen if a large book was long a strangle and the price of $BTC started ripping higher? How would you manage that position?

18/ That’s all I got for now, this isn’t financial advice, tweak it, test it, figure it out for yourself.

Shout out to @macrohedged for teaching me about skew and these bands last year.

Shout out to @macrohedged for teaching me about skew and these bands last year.

19/ As always, I would love your thoughts, even if you disagree. I don't hold anything with a closed fist and I'm always open to learning.

@Mtrl_Scientist @laevitas1 @tztokchad @TraderSkew @DeribitExchange @PowerTradeHQ @samchepal @GenesisVol @MrBenLilly

@Mtrl_Scientist @laevitas1 @tztokchad @TraderSkew @DeribitExchange @PowerTradeHQ @samchepal @GenesisVol @MrBenLilly

• • •

Missing some Tweet in this thread? You can try to

force a refresh