🌷A Weird History of Options 🫒

One hot summer day in 4 BC, Greek mathematician Thales had an epiphany.💡

"There's an oversupply of olives this year!"

More olives 🔜More demand for olive presses.

Yet the market price hadn't changed.

"How do I arb this🤔?" thought Thales.

👇

One hot summer day in 4 BC, Greek mathematician Thales had an epiphany.💡

"There's an oversupply of olives this year!"

More olives 🔜More demand for olive presses.

Yet the market price hadn't changed.

"How do I arb this🤔?" thought Thales.

👇

1/ He couldn't afford to buy every olive press in town & no bank would lend him that much.

So he devised his own leveraged strategy:

Buy the rights to future equipment use today; resell at harvest season if price goes up.

And like that the world's 1st call option was born! 🫒

So he devised his own leveraged strategy:

Buy the rights to future equipment use today; resell at harvest season if price goes up.

And like that the world's 1st call option was born! 🫒

Here,

"option premium" was analogous to Thales' upfront borrow fee;

"strike" to his locked-in usage rate;

"expiry" to the 1st day of autumn.

When autumn arrived demand for olive presses indeed surged just like Thales predicted.

He then exercised his call options for a profit!🧠

"option premium" was analogous to Thales' upfront borrow fee;

"strike" to his locked-in usage rate;

"expiry" to the 1st day of autumn.

When autumn arrived demand for olive presses indeed surged just like Thales predicted.

He then exercised his call options for a profit!🧠

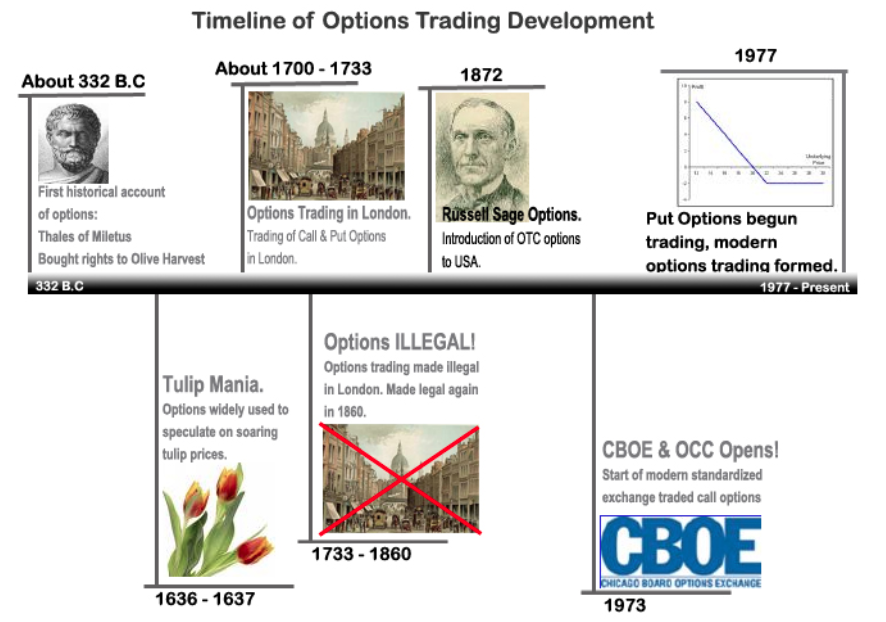

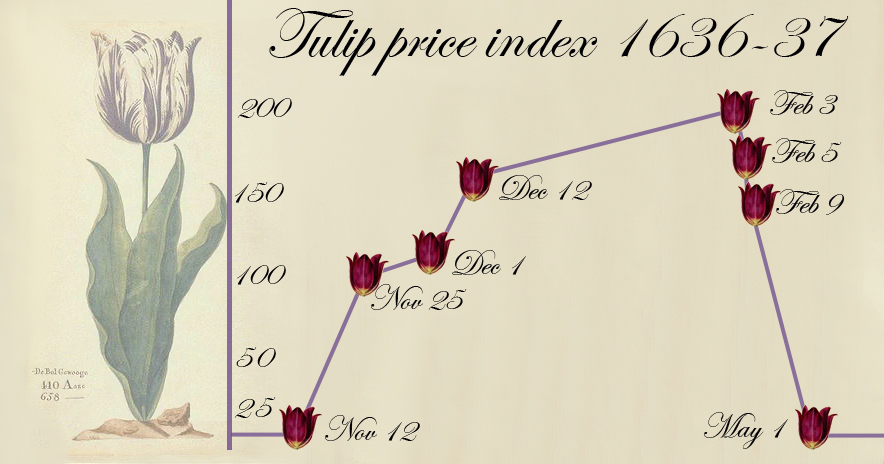

2/ Fast forward to 1636 AD Holland.

🌷🌷 Tulip memes have infiltrated the land!

Suddenly this exotic bulb starts going for 10x the avg man’s salary!

Johannes the plumber couldn’t afford a whole 🌷so he took out a loan... then a 2nd mortgage... then borrowed against his house!

🌷🌷 Tulip memes have infiltrated the land!

Suddenly this exotic bulb starts going for 10x the avg man’s salary!

Johannes the plumber couldn’t afford a whole 🌷so he took out a loan... then a 2nd mortgage... then borrowed against his house!

Investors began placing purchase orders months in advance, promising planters above-market prices.

But then came a supply glut.

Investors panicked. 🙀

First they tried to renege.

“JK! We don't want your🥀s anymore!”

It didn't work, so they said, “🤔Let's change the deal terms!”

But then came a supply glut.

Investors panicked. 🙀

First they tried to renege.

“JK! We don't want your🥀s anymore!”

It didn't work, so they said, “🤔Let's change the deal terms!”

“Instead of committing 100% to buying ur bulbs come springtime, I want the choice to buy only if spot price rises higher than my lock-in!"

They settled w/ a small upfront fee of 3% for this optionality.

Overnight, the tulip futures market transformed into a tulip options market

They settled w/ a small upfront fee of 3% for this optionality.

Overnight, the tulip futures market transformed into a tulip options market

3/ Moving on to 1720 AD London...

The House of Lords had just granted the South Sea Company monopoly access to South America's slave trade.

Shares surged 10x from £128 to £1000 in just 6 months.

“Blimey!” cried our British ape ancestors. “South Sea to the moon 🚀🍗💎!!"

The House of Lords had just granted the South Sea Company monopoly access to South America's slave trade.

Shares surged 10x from £128 to £1000 in just 6 months.

“Blimey!” cried our British ape ancestors. “South Sea to the moon 🚀🍗💎!!"

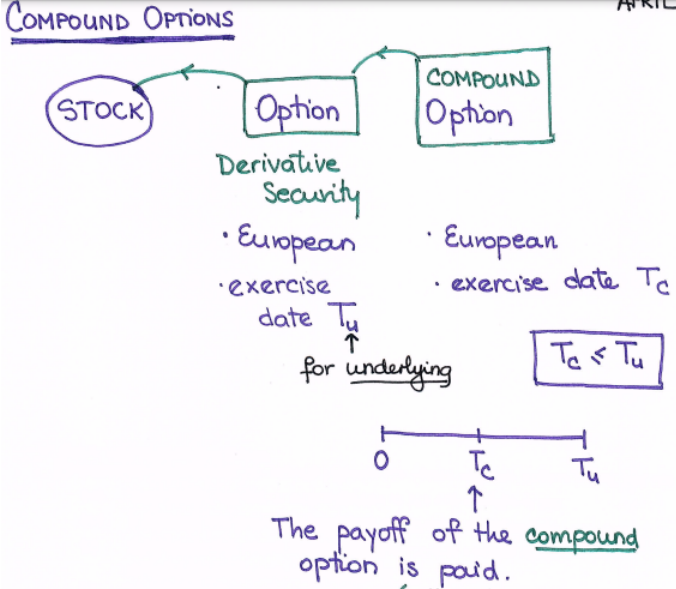

When the stock got too expensive, they turned to options.

When options got too expensive, they invented options on options.🤯

OK like.. 🧠WTF!?

How do u price such a damn thing?!

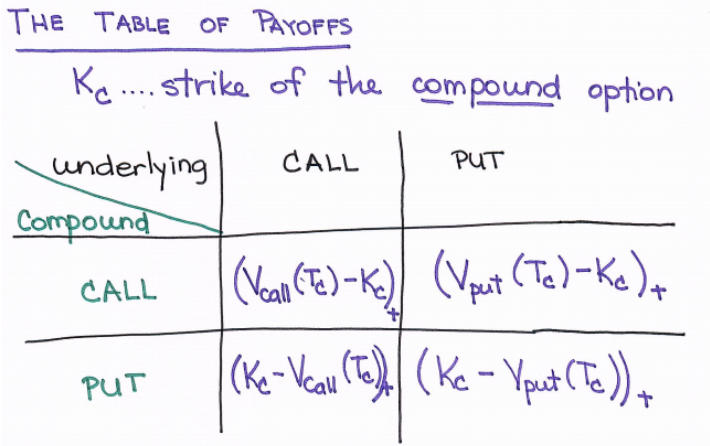

Today "compound options” come in 4 flavors

- call on call

- call on put

- put on call

- put on put

When options got too expensive, they invented options on options.🤯

OK like.. 🧠WTF!?

How do u price such a damn thing?!

Today "compound options” come in 4 flavors

- call on call

- call on put

- put on call

- put on put

The table below shows the payoff of each compound option type.

Now why would anyone buy such a #@%! beast?

Example:

$HOOD is @ $55.

$65-strike Dec 17 calls are @$13.

Say I want this call option but can't afford it. I might then buy $10-strike Sept 17 puts on such calls for <$5.

Now why would anyone buy such a #@%! beast?

Example:

$HOOD is @ $55.

$65-strike Dec 17 calls are @$13.

Say I want this call option but can't afford it. I might then buy $10-strike Sept 17 puts on such calls for <$5.

4/ Fast forward to 1791 New York 🇺🇸

Finally the birth of the US options market!

At first there was no centralized exchange. Everything was OTC; brokers would manually call up & match buyers w/ sellers.

3 major problems arose

- No standardization of pricing

- Illiquidity

- Fraud

Finally the birth of the US options market!

At first there was no centralized exchange. Everything was OTC; brokers would manually call up & match buyers w/ sellers.

3 major problems arose

- No standardization of pricing

- Illiquidity

- Fraud

Arbitrage was rampant.

The market needed standardization. Then,

“💡I've invented a solution!” said a big-brained man named Russell Sage. "Put-call parity!"

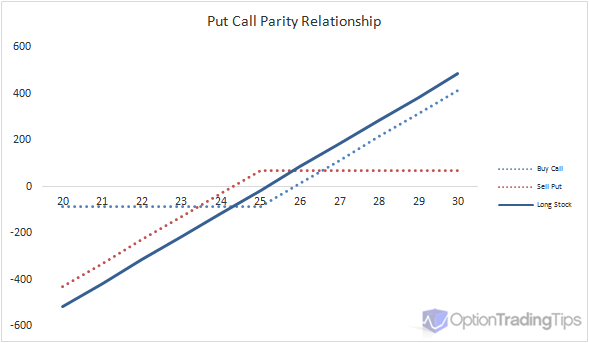

Put-call parity is the idea that buying 1 call & shorting 1 put creates the same risk payoff as owning 1 underlying share.

The market needed standardization. Then,

“💡I've invented a solution!” said a big-brained man named Russell Sage. "Put-call parity!"

Put-call parity is the idea that buying 1 call & shorting 1 put creates the same risk payoff as owning 1 underlying share.

So the prices of all 3 assets are bound to reconcile according to this inter-relationship.

Officially, the equation is:

C + PV(x) = P + S

where:

C = price of the European call option

PV(x) = present value of the strike price (x)

P = price of the European put

S = spot price

Officially, the equation is:

C + PV(x) = P + S

where:

C = price of the European call option

PV(x) = present value of the strike price (x)

P = price of the European put

S = spot price

Though Sage solved standardization (sorta), liquidity remained a huge headache.

Early options traders were mostly farmers and corporates looking to hedge agricultural exposure. Retail volume was still hard to access.

The market needed a centralized exchange with listed options.

Early options traders were mostly farmers and corporates looking to hedge agricultural exposure. Retail volume was still hard to access.

The market needed a centralized exchange with listed options.

5/ Some startups launch from a basement; others from a garage. CBOE launched from a smoker’s lounge!

On opening day in 1973, it could only trade a scant 16 stocks. Only calls, no puts.

Nevertheless, trading activity exploded.

By June '74, avg daily volume surged past 20,000.

On opening day in 1973, it could only trade a scant 16 stocks. Only calls, no puts.

Nevertheless, trading activity exploded.

By June '74, avg daily volume surged past 20,000.

6/ Then the SEC tried to intervene.

“What’s this madness?” said Gensler--JK he was still an awkward teen w/ braces back then.

Whoever his square counterpart was basically said, “we need to conduct a complete audit of all US option exchanges & write at least 42 more 69-pg docs!”

“What’s this madness?” said Gensler--JK he was still an awkward teen w/ braces back then.

Whoever his square counterpart was basically said, “we need to conduct a complete audit of all US option exchanges & write at least 42 more 69-pg docs!”

They tried to put a moratorium on all future options listings, but Wall St. resisted & the people revolted.

Finally they gave up & let CBOE add 25 more stock underliers plus puts!

[Spoiler alert: Chuck Rhoades loses every time guys.]

Finally they gave up & let CBOE add 25 more stock underliers plus puts!

[Spoiler alert: Chuck Rhoades loses every time guys.]

Some other major milestones followed!

1983:

Index options were born! First S&P 100 (OEX), then S&P 500 (SPX). Today more than 50 different index options are listed & billions of contracts have been traded!

1990:

LEAPs (long-dated options with expiries up to 3 years) were born!

1983:

Index options were born! First S&P 100 (OEX), then S&P 500 (SPX). Today more than 50 different index options are listed & billions of contracts have been traded!

1990:

LEAPs (long-dated options with expiries up to 3 years) were born!

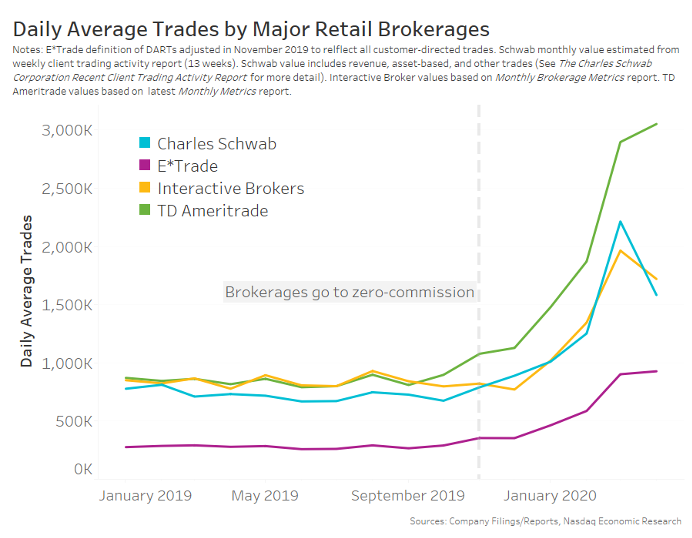

7/ Today it’s real GOOD in the $HOOD!

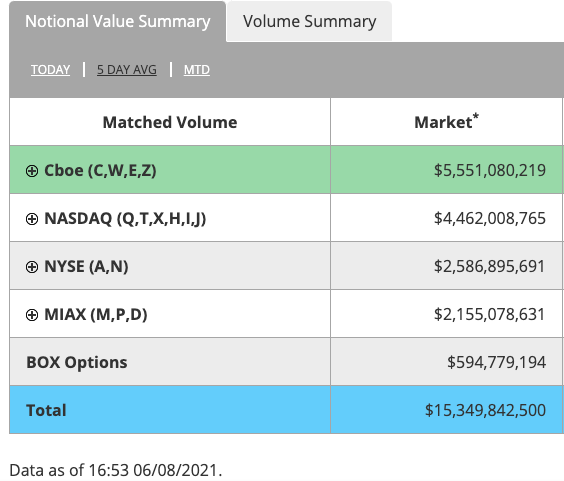

As of Aug 2021, $15.3 billion of options contracts trade daily on US exchanges!

😲This democratization of the market was spurred by:

- Zero-commission

- WSB

- COVID pushing people to take charge of their own financial destiny.

What's next?

As of Aug 2021, $15.3 billion of options contracts trade daily on US exchanges!

😲This democratization of the market was spurred by:

- Zero-commission

- WSB

- COVID pushing people to take charge of their own financial destiny.

What's next?

• • •

Missing some Tweet in this thread? You can try to

force a refresh