At 40, Jim Simons left a famed math career to launch the most successful hedge fund ever: Renaissance Tech.

Even though it only won 51% of trades, the fund made 66%/yr for 30yrs (Simons worth = $25B). It's a story of genius, but also of how hard it is to beat markets.

THREAD🧵

Even though it only won 51% of trades, the fund made 66%/yr for 30yrs (Simons worth = $25B). It's a story of genius, but also of how hard it is to beat markets.

THREAD🧵

1/ The crown jewel of RenTech is The Medallion Fund (launched in 1988).

◻️ From 1988-2018, it posted a return of 66%/yr (39% after fees)

◻️$1 invested in 1988 is now worth $14m+

◻️ Cumulative profit = $100B+ even with an avg. fund size of only $4.5B

◻️ From 1988-2018, it posted a return of 66%/yr (39% after fees)

◻️$1 invested in 1988 is now worth $14m+

◻️ Cumulative profit = $100B+ even with an avg. fund size of only $4.5B

2/ Before creating what Bloomberg calls the “greatest money-making machine ever”, Simons was a legendary mathematician.

3/ While at Stony Brook, Simons started trading commodities (with money staked by former MIT classmates).

The side investing was good enough that Simons -- also going through a divorce -- decided to leave academia and launch his own money management firm in 1978: Monemetrics.

The side investing was good enough that Simons -- also going through a divorce -- decided to leave academia and launch his own money management firm in 1978: Monemetrics.

4/ At the time, there were 2 main investment approaches:

◻️ Fundamental (understanding and forecasting an asset based on key drivers)

◻️ Technical analysis (studying price charts)

Simons’ strategy was to place a “fundamental lens” on currencies (eg. supply and demand).

◻️ Fundamental (understanding and forecasting an asset based on key drivers)

◻️ Technical analysis (studying price charts)

Simons’ strategy was to place a “fundamental lens” on currencies (eg. supply and demand).

5/ While Monemetrics found moderate success, Simons called the emotional swings of day-trading “gut-wrenching”.

He wanted something more systematic and set out to create a 3rd approach: using complex math models to find signals that predicted price movements.

He wanted something more systematic and set out to create a 3rd approach: using complex math models to find signals that predicted price movements.

6/ Simons, a former codebreaker, said: "There are patterns in the market, I know we can find them."

The job wasn’t for MBAs. It was for PHDs and scientists.

His first hires were former colleagues from Stony Brook and NSA. In 1982, he renamed the firm Renaissance Technologies.

The job wasn’t for MBAs. It was for PHDs and scientists.

His first hires were former colleagues from Stony Brook and NSA. In 1982, he renamed the firm Renaissance Technologies.

7/ It took years, but they created a 3-step process to find "statistically significant moneymaking strategies" (AKA signals):

1⃣ Find an anomalous pattern in historic pricing data

2⃣Be statistically significance, non-random and consistent over time

3⃣Be somewhat explainable

1⃣ Find an anomalous pattern in historic pricing data

2⃣Be statistically significance, non-random and consistent over time

3⃣Be somewhat explainable

8/ These signals were called "tradeable effects". While many are now common in quant funds, RenTech did them first and better:

9/ In 1988, the single trading model -- it would remain *one* model -- officially became The Medallion Fund (named after one of Simon's math awards).

The 1st fund was $20m. Early returns were OK...

1988: +16%

1989: +1%

...but then:

1990: +78%

1991: +54%

1992: +47%

The 1st fund was $20m. Early returns were OK...

1988: +16%

1989: +1%

...but then:

1990: +78%

1991: +54%

1992: +47%

10/ By 1993, Simons stopped accepting outside money to The Medallion Fund.

He also jacked up the fees for investors, including employees.

Basically everyone agreed to the new terms:

He also jacked up the fees for investors, including employees.

Basically everyone agreed to the new terms:

11/ At the same time, Simons made personnel moves that would define RenTech for decades.

He hired a number of scientists and PHDs from IBM’s Thomas Watson Research Centre.

Its speech recognition unit yielded RenTech's future Co-CEOs: linguists Rob Mercer and Peter Brown.

He hired a number of scientists and PHDs from IBM’s Thomas Watson Research Centre.

Its speech recognition unit yielded RenTech's future Co-CEOs: linguists Rob Mercer and Peter Brown.

12/ As an IBM colleague observed “speech recognition and translation are the intersection of math and computer science.”

Mercer and Brown actually pitched IBM to apply computational stats to manage its $28B pension.

IBM said "no" and they (along with others) joined Simons.

Mercer and Brown actually pitched IBM to apply computational stats to manage its $28B pension.

IBM said "no" and they (along with others) joined Simons.

13/ The IBM move opened up the world of tradable assets. To that point, Medallion had notched near all gains on currency/commodity futures.

After bringing in algorithm and coding skills from IBM, it added 1000s of equities to its model, allowing the fund to scale up in size.

After bringing in algorithm and coding skills from IBM, it added 1000s of equities to its model, allowing the fund to scale up in size.

14/ The fund never got too big, though.

The short-term nature of its strategies limits how much money can be deployed.

Today, the fund is capped at ~$10B with annual profit distributions to partners (now restricted to its 300+ employees...1/3rd are PHDs).

The short-term nature of its strategies limits how much money can be deployed.

Today, the fund is capped at ~$10B with annual profit distributions to partners (now restricted to its 300+ employees...1/3rd are PHDs).

15/ The capped fund size and the fact that the money barely compounds makes the total cash generated — $100B+ profits — all the more remarkable.

Net of its massive 5/44 fees, the 1988-2018 annualized return for Medallion is a crazy 39% (vs. crazier gross return of 66%).

Net of its massive 5/44 fees, the 1988-2018 annualized return for Medallion is a crazy 39% (vs. crazier gross return of 66%).

16/ Interestingly, the Fund only won 50.75% of its trades.

An army of top PHDs are basically a coin flip. Markets are hard AF (most should buy and hold).

Per Mercer: “We’re right 50.75% of the time . . . but we’re 100% right 50.75% of the time. You can make billions that way.”

An army of top PHDs are basically a coin flip. Markets are hard AF (most should buy and hold).

Per Mercer: “We’re right 50.75% of the time . . . but we’re 100% right 50.75% of the time. You can make billions that way.”

17/ How was The Medallion Fund able to pull it off?

Let's break down 9 reasons:

◻️ Simons the manager

◻️ Culture for top talent

◻️ Never override the computer

◻️ Data edge

◻️ Great execution

◻️ “Don’t ask why”

◻️ Stealth trading

◻️ Extreme diversification

◻️ Leverage

Let's break down 9 reasons:

◻️ Simons the manager

◻️ Culture for top talent

◻️ Never override the computer

◻️ Data edge

◻️ Great execution

◻️ “Don’t ask why”

◻️ Stealth trading

◻️ Extreme diversification

◻️ Leverage

18/ SIMONS THE MANAGER

From his Stony Brook U. days, Simons has long experience managing intellectual egos.

His academic credentials and trading chops earn universal respect.

Per Bloomberg: Simons is the “benevolent father figure” that inspired “super nerds to stick together.”

From his Stony Brook U. days, Simons has long experience managing intellectual egos.

His academic credentials and trading chops earn universal respect.

Per Bloomberg: Simons is the “benevolent father figure” that inspired “super nerds to stick together.”

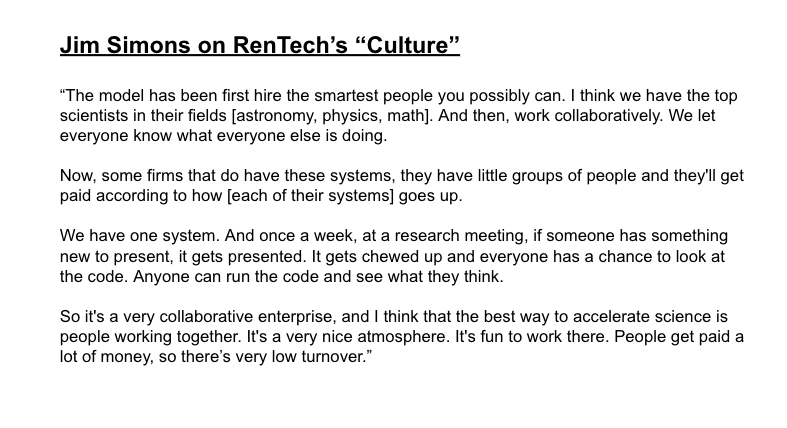

19/ CULTURE FOR TOP TALENT

A big part of Simons' job was creating a place for top scientists to want to work:

A big part of Simons' job was creating a place for top scientists to want to work:

20/ NEVER OVERRIDE THE COMPUTER

The driving logic behind RenTech was to create a systematic trading approach that wouldn't be compromised by human emotion.

Medallion performs best during volatile times...because it lets the model run while everyone else is losing their minds.

The driving logic behind RenTech was to create a systematic trading approach that wouldn't be compromised by human emotion.

Medallion performs best during volatile times...because it lets the model run while everyone else is losing their minds.

21/ DATA EDGE

RenTech’s unofficial motto is “There’s no data like more data.”

Earlier than most, the fund gathered data of all sorts (weather, prices, newspaper blurbs) for its model.

Today, its system ingests 1 terabyte of data a year to improve the trading model.

RenTech’s unofficial motto is “There’s no data like more data.”

Earlier than most, the fund gathered data of all sorts (weather, prices, newspaper blurbs) for its model.

Today, its system ingests 1 terabyte of data a year to improve the trading model.

22/ GREAT EXECUTION

RenTech does 150k-300k small trades a day and holding periods are very short (~2 days).

A key part of the trading model is estimating the exact bet size so as to not adversely impact the trade (RenTech's term for transaction costs is “slippage”).

RenTech does 150k-300k small trades a day and holding periods are very short (~2 days).

A key part of the trading model is estimating the exact bet size so as to not adversely impact the trade (RenTech's term for transaction costs is “slippage”).

23/ "DON'T ASK WHY"

RenTech believes that market participants vastly underestimate how many variables drive an asset.

The team rarely offers up hypotheses. Instead, they let the data speak and if a signal works -- even if they don't fully understand why -- they will trade it.

RenTech believes that market participants vastly underestimate how many variables drive an asset.

The team rarely offers up hypotheses. Instead, they let the data speak and if a signal works -- even if they don't fully understand why -- they will trade it.

24/ STEALTH TRADING

When RenTech finds a market inefficiency, it goes to great lengths as to not give away the trade:

When RenTech finds a market inefficiency, it goes to great lengths as to not give away the trade:

25/ EXTREME DIVERSIFICATION

The move into equities allowed RenTech to trade many more assets (and deploy up to $10B/yr).

At any one time, The Medallion Fund can have 4k long and 4k short trades.

Such a diversified portfolio reduces overall risk, giving RenTech access to...

The move into equities allowed RenTech to trade many more assets (and deploy up to $10B/yr).

At any one time, The Medallion Fund can have 4k long and 4k short trades.

Such a diversified portfolio reduces overall risk, giving RenTech access to...

26/ LEVERAGE

Having built a trading machine on great data and execution combined with diversification, banks (Deutsche, Barclays) are happy to lend RenTech money.

Medallion typically levers 12.5x (and can get up to 20x). Without leverage, its returns are comparable to S&P 500.

Having built a trading machine on great data and execution combined with diversification, banks (Deutsche, Barclays) are happy to lend RenTech money.

Medallion typically levers 12.5x (and can get up to 20x). Without leverage, its returns are comparable to S&P 500.

27/ Add it all up and the Medallion Fund's returns (1988-2018) are absurd:

◻️ Since 1990, its *worst* year is +32%

◻️ In 24 of the 31 years, it's up at least 50%

◻️ It has three 100%+ return years, all in the worst market conditions: 2000 (+128%), 2007 (+137%) and 2008 (+152%)

◻️ Since 1990, its *worst* year is +32%

◻️ In 24 of the 31 years, it's up at least 50%

◻️ It has three 100%+ return years, all in the worst market conditions: 2000 (+128%), 2007 (+137%) and 2008 (+152%)

28/ In 2005, RenTech booted outsiders from Medallion and launched 3 public funds (RIEF, RIDE, RIDGE) with different strategies.

It once managed $55B+ of public money but after 2020 (worst returns across all 3), $10B+ has been pulled.

Medallion was fine, though (+76% in 2020).

It once managed $55B+ of public money but after 2020 (worst returns across all 3), $10B+ has been pulled.

Medallion was fine, though (+76% in 2020).

29/ Simons officially retired from RenTech in 2009.

A lifelong Democrat, he had to deal with controversy around Robert Mercer: one of Donald Trump's top donors in 2016.

Mercer stepped down from Renaissance Technologies in 2017 over his politics (Peter Brown remains CEO).

A lifelong Democrat, he had to deal with controversy around Robert Mercer: one of Donald Trump's top donors in 2016.

Mercer stepped down from Renaissance Technologies in 2017 over his politics (Peter Brown remains CEO).

30/ Today, Simons (and his wife Marilyn) are focussed primarily on philanthropy.

Through their Flatiron Institute, he's donating billions to scientific research...in the search for signals, specifically for astrophysics, biology and quantum physics.

Through their Flatiron Institute, he's donating billions to scientific research...in the search for signals, specifically for astrophysics, biology and quantum physics.

31/ For all his success, Simons says "luck plays quite a role in life". He's dealt with very bad personal luck: losing two sons.

Taken all together, Simons laid out his life principles during a 2014 lecture at SF University:

Taken all together, Simons laid out his life principles during a 2014 lecture at SF University:

32/ For other threads like that, def smash the FOLLOW on @TrungTPhan.

Here's one I did after interviewing Stanley Druckenmiller:

Here's one I did after interviewing Stanley Druckenmiller:

https://twitter.com/TrungTPhan/status/1397927107682914308?s=20

33/ To dig deeper into the Simons story, here's a Google doc of sources:

The absolute number one resource is Gregory Zuckerman's 2019 book "The Man Who Solved The Market": bit.ly/3CkPOtg

amazon.com/Man-Who-Solved…

The absolute number one resource is Gregory Zuckerman's 2019 book "The Man Who Solved The Market": bit.ly/3CkPOtg

amazon.com/Man-Who-Solved…

34/ Watch like 10 hours of Simons lecture videos…will discuss more on next episode of the Not Investment Advice (NIA) podcast.

Check here: linktr.ee/notinvestmenta…

Check here: linktr.ee/notinvestmenta…

35/ Of all the Jim Simons videos, fave part was when MIT professor Andrew Lo asked him if his ringing cell phone was a “margin call”.

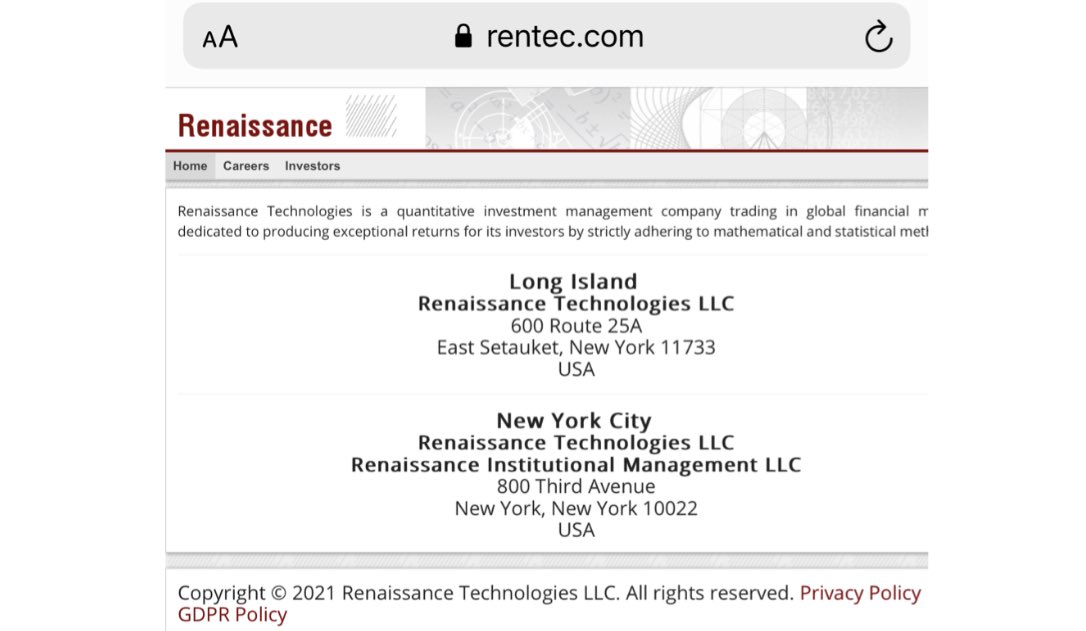

36/ Renaissance Technologies has generated $100B+ in profits since 1988.

It has spent $0 on its website, with

the worst-looking landing page ever for a company with the word “Technologies” in its name:

It has spent $0 on its website, with

the worst-looking landing page ever for a company with the word “Technologies” in its name:

37/ Three more nuggets from Simons story:

◻️ Fired from NSA/IDA for telling Newsweek his opposition to the Vietnam War

◻️ Found the Chern–Simons form, a theory widely used in quantum computing

◻️ A chainsmoker who can pay "whatever the fine is" for smoking in his own buildings

◻️ Fired from NSA/IDA for telling Newsweek his opposition to the Vietnam War

◻️ Found the Chern–Simons form, a theory widely used in quantum computing

◻️ A chainsmoker who can pay "whatever the fine is" for smoking in his own buildings

38/ UPDATE: Jim Simons and other RenTech execs agree to pay $7B in back taxes related to accounting of options trades:

🔗 wsj.com/articles/james…

🔗 wsj.com/articles/james…

• • •

Missing some Tweet in this thread? You can try to

force a refresh