I write about Credit Card, Personal Finance, Travel, and sometimes Startups! 💳💰✈️

The thought is to spread awareness among such subjects without any hidden agenda, with community-driven & collective insights.

Thread of Thread (s) 🧵| RT for Karma 🙏

The thought is to spread awareness among such subjects without any hidden agenda, with community-driven & collective insights.

Thread of Thread (s) 🧵| RT for Karma 🙏

Here's an overview of the tracker and what we will read,

It takes time to write good content, I'm more than passionate to make at least 10Mn people financially aware, Thanks to Social Media/Twitter.

Also do let me know if any posts have helped you, I appreciate feedback,

It takes time to write good content, I'm more than passionate to make at least 10Mn people financially aware, Thanks to Social Media/Twitter.

Also do let me know if any posts have helped you, I appreciate feedback,

• LIC Thread | Personal Finance (1)

https://twitter.com/Ravisutanjani/status/1413770932426919937?s=20

• BYJU's Mis-selling | Awareness (2)

https://twitter.com/Ravisutanjani/status/1357702437088468992?s=20

• Fintech App Experience | Personal Finance (5)

https://twitter.com/Ravisutanjani/status/1421112681608613889?s=20

• Mutual Fund Apps | Personal Finance (7)

https://twitter.com/Ravisutanjani/status/1411025378009698305?s=20

• My 10 Favourite Fintech Apps | Personal Finance (8)

https://twitter.com/Ravisutanjani/status/1417531459930230784?s=20

• How to choose a Debit Card | Personal Finance (9)

https://twitter.com/Ravisutanjani/status/1412115956080386049?s=20

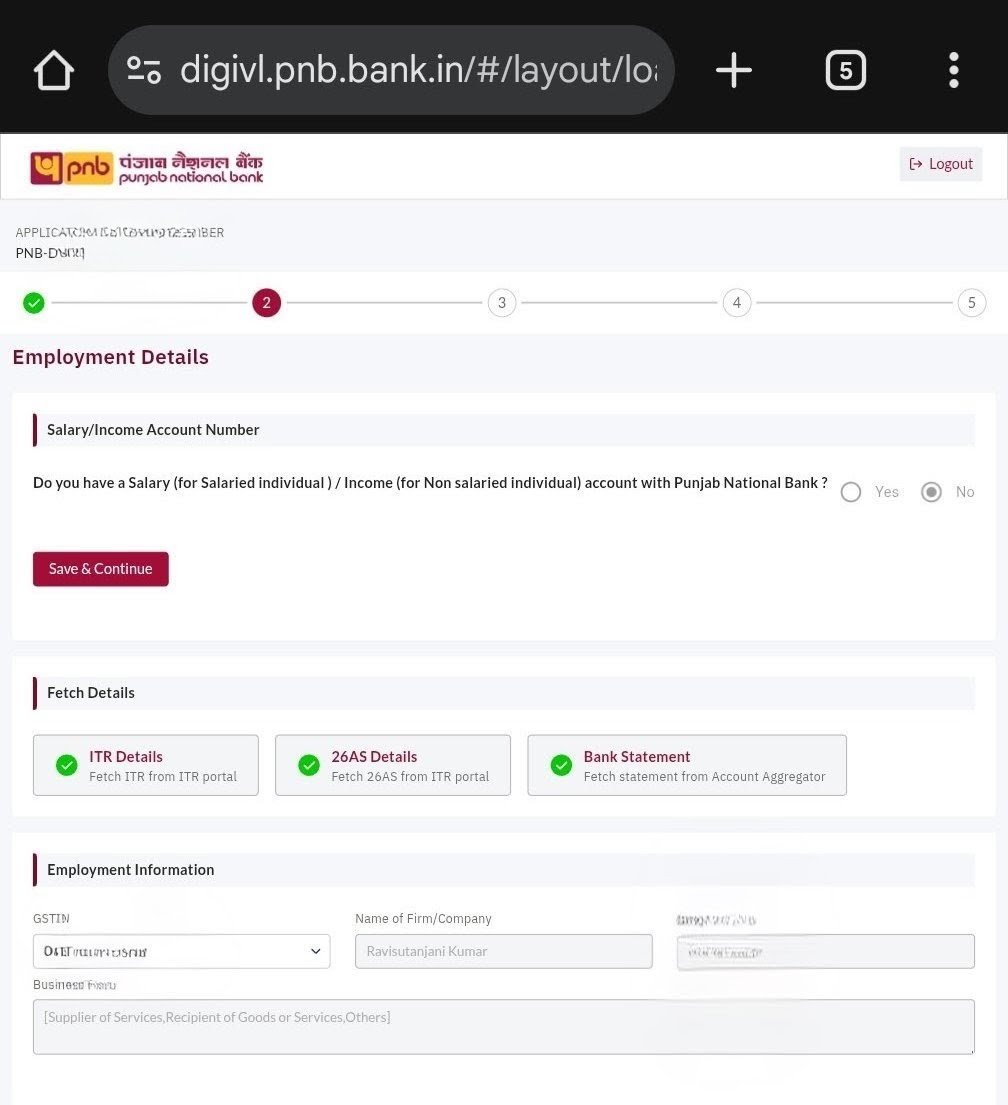

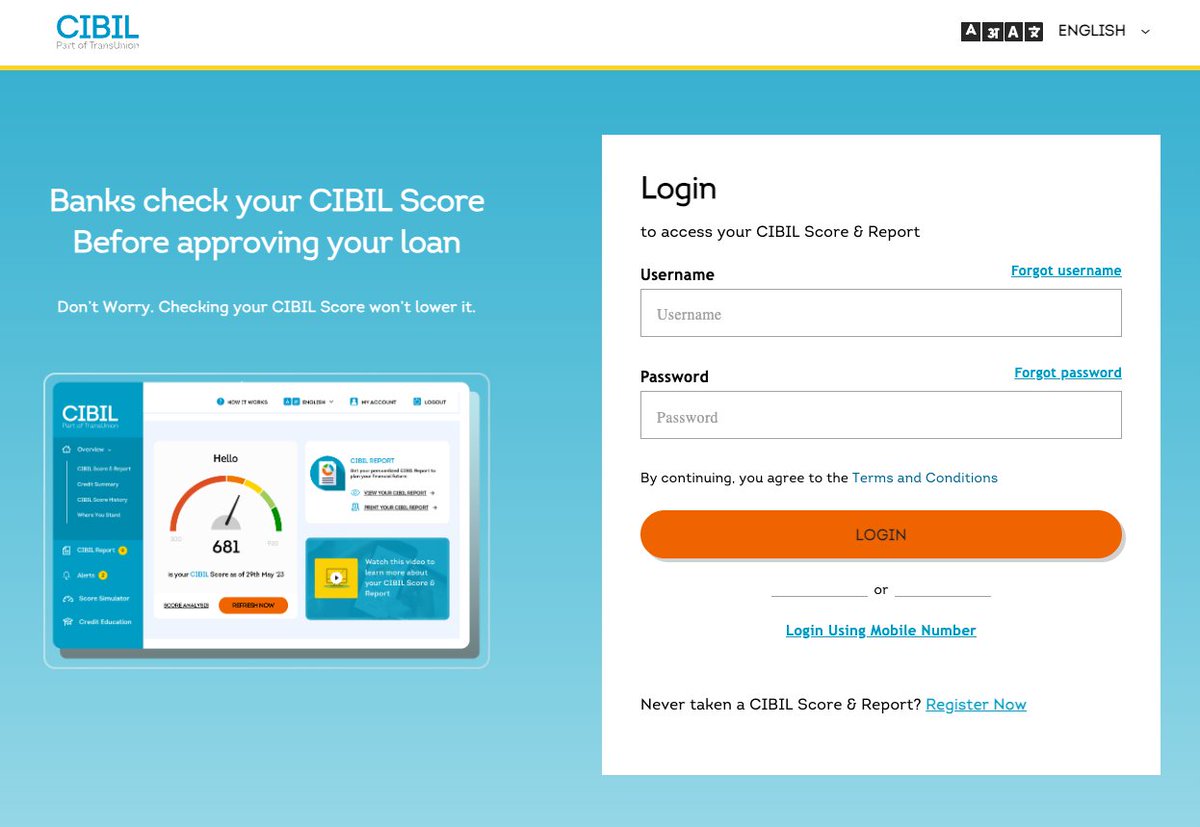

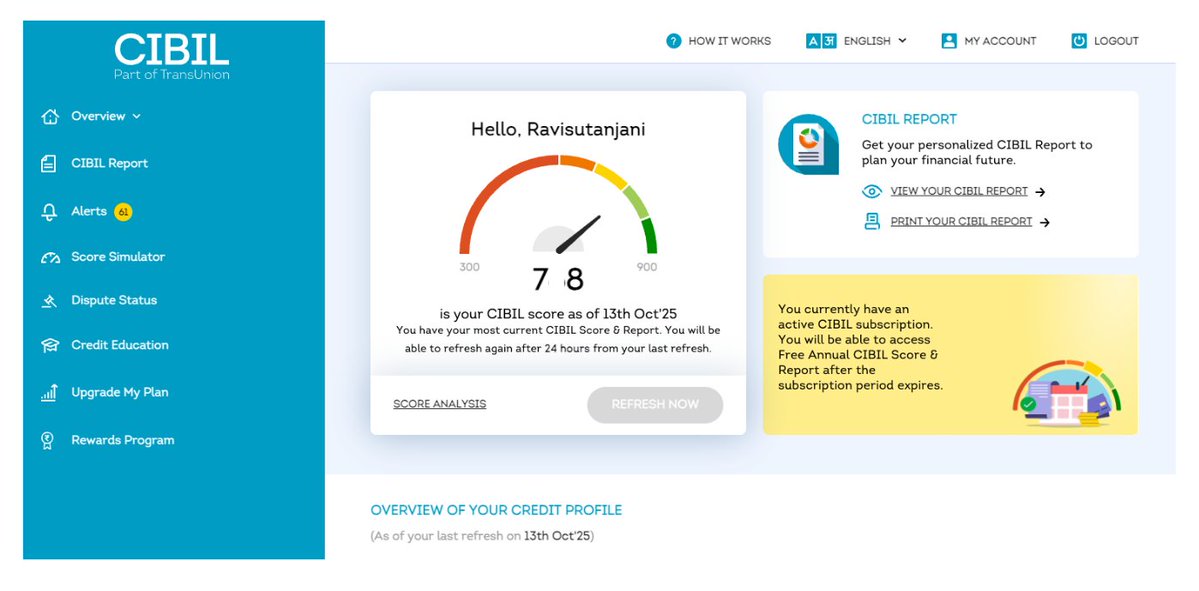

• Credit Score & Credit Report | Credit Cards (10)

https://twitter.com/Ravisutanjani/status/1420074265508945920?s=20

• Trading Journey | Personal Finance (11)

https://twitter.com/Ravisutanjani/status/1394641341146042375?s=20

• Basics of Personal Finance | Personal Finance (12)

https://twitter.com/Ravisutanjani/status/1354840382023073794?s=20

• Sovereign Gold Bonds | Personal Finance (14)

https://twitter.com/Ravisutanjani/status/1394201253433909254?s=20

• CC Hacks, Tips | Credit Cards (15)

https://twitter.com/Ravisutanjani/status/1395273408338821124?s=20

• Mother’s Day Thread| Personal Finance (16)

https://twitter.com/Ravisutanjani/status/1368601512574816259?s=20

• SIP in Stocks | Personal Finance (17)

https://twitter.com/Ravisutanjani/status/1396056602906562562?s=20

• Aadhar OTP - Security | Awareness (18)

https://twitter.com/Ravisutanjani/status/1357959942968201217?s=20

• Personal Finance 101 ft Memes | Personal Finance (25)

https://twitter.com/Ravisutanjani/status/1425867901613920267?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh