An established business can still open a Recovery Startup Business to claim up to $100,000 of Employee Retention Credit in Q3/Q4 of 2021.

ERC can be claimed for a RSB opened in either a new entity OR AN EXISTING ENTITY.

How do we do this correctly? Thread time:

#TaxTwitter

ERC can be claimed for a RSB opened in either a new entity OR AN EXISTING ENTITY.

How do we do this correctly? Thread time:

#TaxTwitter

IRS Notice 2021-49 was released last Wednesday. It gave us guidance in many areas of ERC but didn’t break major ground on the topic of a Recovery Startup Business. The law was brief and caused confusion in this area. The confusion didn’t go away after reading this notice.

The IRS has said what they will about RSBs. It’s time to dig deeper. Let’s start with RSB code at §3134(c)(5).

RSBs must have begun carrying on any trade or business after February 15, 2020 and have average annual gross receipts under $1M. Seems simple enough! And for a brand-new, stand-alone business/owner, it is simple.

Also note §3134(c)(5)(C) – a business can’t be a RSB if it qualifies for ERC with a receipts drop or a suspension of operations. This makes senses. RSBs are subject to a $50k per quarter cap under §3134(b)(1)(B) while there is no cap for regular ERC eligibility.

So how can something so simple become so confusing? Well with $100k on the table, everyone wants to determine how to qualify – even with existing businesses. Can I spin this off? Can I open this division with a new EIN? Can each partner take five staff and go make new Corps?

The IRS guidance of Notice 2021-49 didn’t give us much new to go on. There were no RSB examples. There was no discussion of M&A or reorg situations. So we must look harder at the information that is given.

One clarification was welcome (though not unexpected): Controlled Group and Affiliated Service Group aggregation rules applied to ERC and will also specifically apply to RSBs.

If your client with an existing business has avg receipts over $1M already, none of this is possible with a RSB (even if they open a new LLC). This is limited. Really limited when it comes to existing businesses. $1M of receipts isn’t all that much for businesses with employees.

So how DO we make RSB ERC work for an existing business?

Okay, okay. Enough background. Time to get to the point.

Okay, okay. Enough background. Time to get to the point.

An “employer” is not the same thing as a “trade or business” (TOB). An employer for ERC purposes may be just the corporation. An employer may also be 10 corporations in a controlled group treated as a single employer for the purposes of ERC.

Additionally, an employer may have one TOB under §162 or many TOBs.

For example: There are 10 separate S-Corps owned by the same individual to separate each franchise restaurant location. This is clearly a controlled group – or a single employer for the purposes of ERC. But does each separate location represent a separate TOB?

The regulations at 1.446-1(d) go on to give us some basic rules. For TOBs to be considered separate, there MUST be separate sets of books and any intercompany transactions MUST be arms-length instead of shifting profits or losses between companies.

We also can learn about separate TOBs from case law. Marlin Grocery Co 15 BTA 1080 was the case of a wholesale grocer that also operated a cattle ranch. The court allowed the grocery inventory at cost basis and cattle inventory at market basis by finding each was a separate TOB.

Joseph Stern Et Al 14 BTA 838 was the case of a partnership operating retail stores and coal land purchasing/sales businesses. The TOBs were determined to be “distinct, separate, and of different character, and maintained separate accounts.”

Burgess Poultry Market Inc operated poultry raising and processing/sales divisions which were found to be separate TOBs. The facts here included separate employees, separate bookkeepers, and separate bank accounts. (14 AFTR 2d 5036)

In CCA 201430013, the IRS found separate TOBs with separate books, employees, and geographical locations though there were shared high-level executives. Here one TOB manufactured product while the other distributed, marketed, and sold the same purchased product.

Now back to RSBs for that $100k of ERC.

We must be any “employer” who begins carrying on a “trade or business” after February 15, 2020. Being a separate employer is the clearer approach. If the aggregation rules do not pull multiple entities together, that's great.

We must be any “employer” who begins carrying on a “trade or business” after February 15, 2020. Being a separate employer is the clearer approach. If the aggregation rules do not pull multiple entities together, that's great.

Having a separate TOB which began to be carried on after 2/15/20 within the same employer is less clear. We must at least have separate books and no profit shifting – but these are not determinative. Courts look at the facts and circumstances.

Anything to support that each TOB is separate and distinct will improve our position including separate employees, different geographical locations, separate bank accounts, and separate customers. Differences in the type of activity may help, but also are not determinative.

While the court in Marlin Grocery determined separate TOBs based on the differences between the grocery and ranch activities, the court in Riener C. Nielsen 61 TC 311 found separate TOBs where both were hospitals (same type of activity).

So this is possible, but it may be tough.

So this is possible, but it may be tough.

The existing employer can begin a new TOB after 2/15/20 to qualify for RSB ERC. This could be in a new corporation aggregated as the same employer by the controlled group rules or could be in the same entity.

In either case, there are some hurdles we have noted that would justify whether this is truly a separate TOB or not.

Most questions seem to have revolved around two premises: “But I’m too big for RSB” or “ But I just want to do more of the same thing.”

Most questions seem to have revolved around two premises: “But I’m too big for RSB” or “ But I just want to do more of the same thing.”

“I’m too big” – sorry bud. No matter how many LLCs you start, the affiliation rules will generally pull your businesses together into a single employer for ERC purposes. Average receipts been over $1M in total? Then it’s a no-go.

“I just want to do more of the same thing.” Okay you are small enough, but you don’t want to do much to get this RSB ERC. It’s a tough road. You need to have separate books and build a strong case that these are distinct TOBs.

A new location for the same type of operations might work as geographically different with different books, but if assets and employees are shared the court may not agree.

Questions have also swirled about mergers, spin-offs, and acquisitions in regards to RSBs. Notice 2021-49 doesn’t mention M&A. Here are my opinions: A merger, spin-off, and stock acquisition are continuations of an existing TOB. Unlikely to get RSB ERC.

There is a temptation to consider any company with a new name or new EIN as a new TOB – particularly if a complex restructuring occurs. But at the end of the day, this is just a restructuring of an ongoing TOB though facts and circumstances may vary.

I’m admittedly on the fence when it comes to an acquisition by means of asset purchase. I’ll have to look into that further if I run into that scenario in practice. Would be interested to hear other arguments on that topic, but initially it feels like a continuing TOB regardless.

So how about we wrap this all up with an example? A retailer has $400k average receipts and wants RSB ERC by starting up a new TOB.

The retailer opens another store but does nothing to separate the TOBs. This is an easy fail. We have to keep separate books at a bare minimum.

The retailer opens another store but does nothing to separate the TOBs. This is an easy fail. We have to keep separate books at a bare minimum.

What if the retailer keeps separate books and the stores are geographically separated but still shares employees between locations and makes deliveries of product to both store with the same truck? Things are grayer here, but the shared assets and staff are bad facts.

If the retailer can smooth this over, I think it can work.

•Average receipts of only $400k.

•New store after 2/15/20

•Separate books

•No shifting of profits (arms-length transactions between TOBs)

•Geographically separated

•No shared employees

•No shared assets

•Average receipts of only $400k.

•New store after 2/15/20

•Separate books

•No shifting of profits (arms-length transactions between TOBs)

•Geographically separated

•No shared employees

•No shared assets

This RSB example can work in the same entity or in separate entities (viewed as one employer for ERC as a controlled group).

Owning a business before 2/15/20 doesn’t wholly disqualify you from the Recovery Startup Business ERC. It just means you must build a strong new TOB case.

Owning a business before 2/15/20 doesn’t wholly disqualify you from the Recovery Startup Business ERC. It just means you must build a strong new TOB case.

A side conversation with @adammarkowitzEA helped me realize that I did not adequately explain the $1M threshold for RSBs.

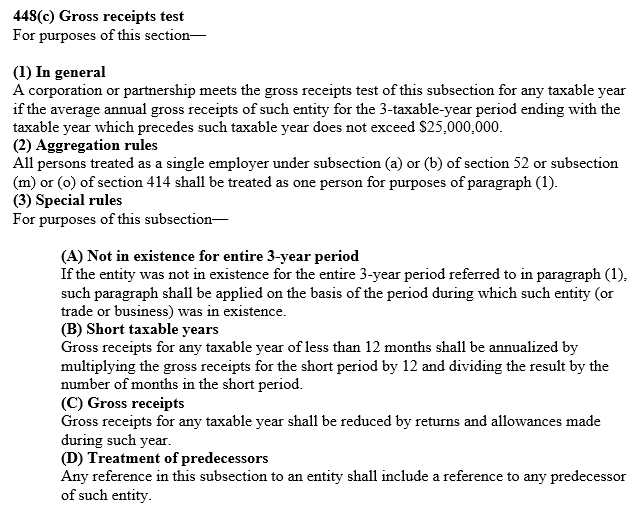

Here is the ERC code on this again and the 448(c) code:

Here is the ERC code on this again and the 448(c) code:

Average annual gross receipts for the employer cannot exceed $1M. For calendar year taxpayers claiming RSB status, the lookback will be calendar tax years 2018-2020.

This means an existing small employer under $1M can create a new TOB start up AS LARGE AS THEY WANT and still qualify for RSB ERC.

The new TOB gross receipts are not included in the determination of the $1M threshold.

The new TOB gross receipts are not included in the determination of the $1M threshold.

**I should say a new TOB can be any size ONLY IN 2021**

A new TOB in 2020 (after 2/15/20) can be an RSB but will be part of the average annual gross receipts baseline calc. Still, even here it will only be a portion of a 3 year avg for an existing employer.

A new TOB in 2020 (after 2/15/20) can be an RSB but will be part of the average annual gross receipts baseline calc. Still, even here it will only be a portion of a 3 year avg for an existing employer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh