Term of The Week.

Rolling Return 😵💫

A Thread 🧵

There are several types of returns to get an idea about stocks or funds. The most widely used around the financial world is trailing returns.

1/10

Rolling Return 😵💫

A Thread 🧵

There are several types of returns to get an idea about stocks or funds. The most widely used around the financial world is trailing returns.

1/10

While it is good to glance at trailing returns, that is a point to point return, it does not actually give the idea about what an investor has experienced over time. 2/10

Rolling returns are the most underrated types of returns, it is useful for examining the behaviour of returns for holding periods, similar to those actually experienced by investors.

3/10

3/10

Rolling returns can provide a more accurate picture for an investor than a single snapshot of one period.

4/10

4/10

Rolling returns highlight the frequency and magnitude of an investment's stronger and poorer periods of performance.

It gives a better idea about the fund's more comprehensive return history, not overshadowed by the most recent data.

5/10

It gives a better idea about the fund's more comprehensive return history, not overshadowed by the most recent data.

5/10

A rolling return is the average of a series of returns over a long period of time. Here is the simple representation of data point.

6/10

6/10

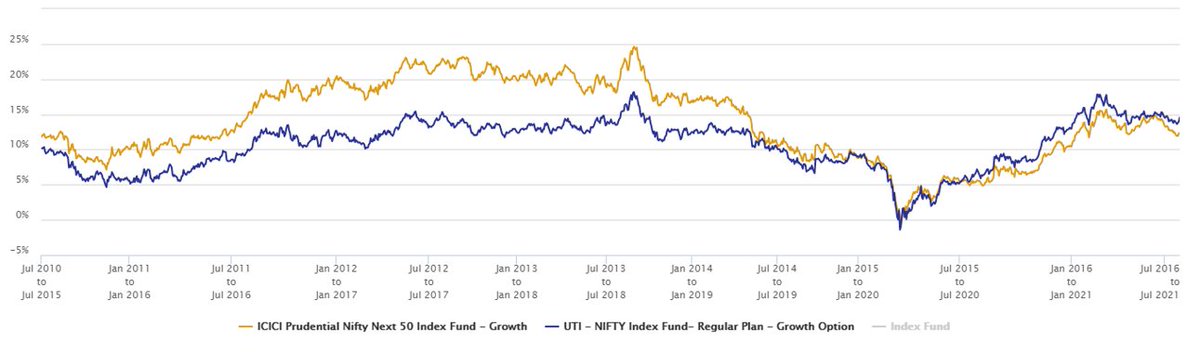

Data points of 5 year rolling returns of Nifty. (Reg. fund)

• 27 August 2013 -> 27 August 2018 ->24.62%

• 28 August 2013 -> 28 August 2018 -> 24.34%

• 29 August 2013 -> 29 August 2018 -> 24.19%

.

.

.

• 02 August 2016 -> 02 August 2021 -> 14.54%

7/10

• 27 August 2013 -> 27 August 2018 ->24.62%

• 28 August 2013 -> 28 August 2018 -> 24.34%

• 29 August 2013 -> 29 August 2018 -> 24.19%

.

.

.

• 02 August 2016 -> 02 August 2021 -> 14.54%

7/10

Analyzing rolling returns could demonstrate annual performance not simply starting Jan-1 and ending Dec-31 but also beginning Feb-1 and ending Jan-31 of the next year, then March-1 through Feb-28 of the next year, and so on.

9/10

9/10

A 10-year rolling return could highlight an investment’s best and worst decades in this form.

10/10

10/10

Few sites to compare rolling returns of mutual funds 👇

https://twitter.com/1PageFinance/status/1424789638560948226

If you found it useful, please re-tweet the first tweet below 👇

https://twitter.com/1PageFinance/status/1424784971286286337

• • •

Missing some Tweet in this thread? You can try to

force a refresh