The latest in @propublica's #SecretIRSFiles reporting is a crossover episode, combining leaked tax-returns of America's ultrawealthy with campaign contribution data to reveal the incredible return on investment the rich reaped from Trump's #TaxScam.

propublica.org/article/secret…

1/

propublica.org/article/secret…

1/

If you'd like an unrolled version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2021/08/11/the…

2/

pluralistic.net/2021/08/11/the…

2/

You may remember how Trump's "Tax Cuts and Jobs Act" (AKA the "big, beautiful tax-cut") was a shambles of amendments and annotations, whose final draft was literally covered in hand-scribbled changes that handed millions to donors.

usatoday.com/story/news/201…

3/

usatoday.com/story/news/201…

3/

The new Propublica report quantifies the effect of those last-minute changes, and also reveals their causes - the handful of one-percenters who bankrolled senators like @SenRonJohnson with $20m in campaign funds and reaped $215m back in just the first year of the tax cuts.

4/

4/

Johnson stunned fellow Republican senators by announcing that he would NOT support the tax bill, then pressed them to add the provision that allowed three people - owners of @uline and roofing magnate Diane Hendricks - to pocket $215m in one year, with more every year since.

5/

5/

Uline's Dick and Liz Uihlein and Hendricks stand to make more than $500m from Johnson's amendment, which created deductions for "pass-through entities." Johnson claims he did this to "simplify and rationalize the tax code" and help a wide range of business owners.

6/

6/

But Johnson's pass-through rule overwhelming benefits a tiny number of people, most of them major donors to his campaign. These are donors who met with Johnson extensively in the runup to the introduction of his bill.

7/

7/

All told, the major beneficiaries of Trump's #taxscam were just 82 households, who pocketed $1 billion in benefits. Many of the beneficiaries are the children or grandchildren of successful businesspeople, who owe their wealth to an accident of birth.

8/

8/

The US system doesn't just allocate billions to people on the basis of which orifice they emerge from - it provides a vast range of bespoke services to allow orifice-tycoons to maintain their fortunes, including accounting magic and lobbying might.

pluralistic.net/2021/06/19/dyn…

9/

pluralistic.net/2021/06/19/dyn…

9/

Take the mysterious, anonymous addition of eight words to the final draft of the tax bill: "applied without regard to the words 'engineering, architecture.'"

10/

10/

No one knows who inserted this text, but it produced $111m in additional wealth for orifice tycoons Brendan, Darren and Katherine Bechtel, the great-grandchildren of the founder of @Bechtel. Their father, cousins and other relations also benefited.

11/

11/

While no one knows for sure who added these 8 words, a Bechtel lobbyist called Marc Gerson claimed credit for it. The Bechtel lobbying effort cost $1m. The return on that investment, again, was more than $111m. Why make THINGS when you can make LAWS?

12/

12/

Bechtel is a curious enterprise: for generations, it firehosed cash on anti-tax extremist politicians and thinktanks - yet the entire Bechtel fortune comes from government contracts.

Today, CEO Brendan Bechtel leads the corporate charge against Biden's infrastructure plan.

13/

Today, CEO Brendan Bechtel leads the corporate charge against Biden's infrastructure plan.

13/

The Propublica investigation matched other major donors to specific tax-breaks. Donald Bren, who owns the massive Southern California Irvine Corporation, pocketed $22m after hiring Ernst & Young lobbyist Wes Coulam to go to bat for him.

14/

14/

Real Estate Investment Trust (REIT) tycoon Steven Roth spent $5m lobbying for a 20% deduction on REIT dividends. The change lets him deduct $5m/year on the dividends from his company, Vornado Realty Trust.

15/

15/

The heirs of Enterprise Product Partners, a Houston-based pipeline company, pocketed $150m from a pipeline-specific amendment introduced at the last moment by @JohnCornyn.

16/

16/

They're the 11th richest family in America - and their family pumped a fortune into Cornyn's campaigns through industry association cutouts.

17/

17/

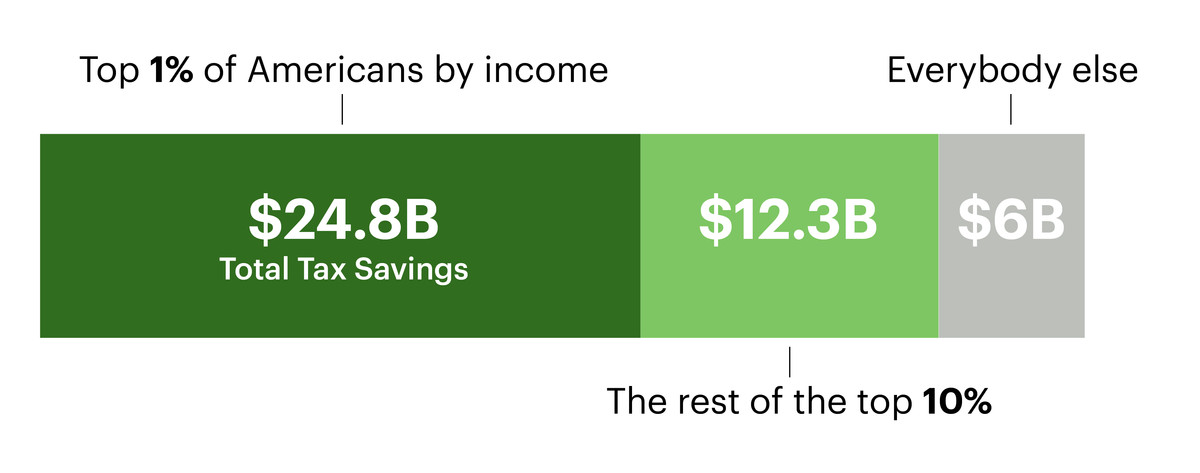

Everyone who voted for the tax bill knew that it was a conspiracy to benefit a tiny number of people at the expense of the vast majority. Treasury economists say that 60% of the tax bill's benefit went to the 1%, and the majority of that went to the 0.1%.

18/

18/

I am not a believer in the Great Man Theory of History. Our world changes because of broad-based political will and grassroots organizing.

But stories like this are enough to make me believe in the Shitty Man Theory of History.

19/

But stories like this are enough to make me believe in the Shitty Man Theory of History.

19/

That's the theory that while improving the world is a cooperative, mass effort, destroying it is easy for a handful of immoral sociopaths - ultrawealthy looters, orifice tycoons, and enablers in the House and Senate.

20/

20/

In America's state religion, "business acumen" and "political effectiveness" are code for the dead-eyed, pathological absence of empathy and conscience, and the cynicism to turn those deficits into billions.

eof/

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh