(1) When they say inflation will "spike" or increase this year, and then "come back down next year", what they are saying is the price will skyrocket.... AND THEN the price will remain high.

EX. A lemon goes from $0.49 to $0.99 today. And next year remains $0.99 !

EX. A lemon goes from $0.49 to $0.99 today. And next year remains $0.99 !

https://twitter.com/yohiobaseball/status/1425507864647512074

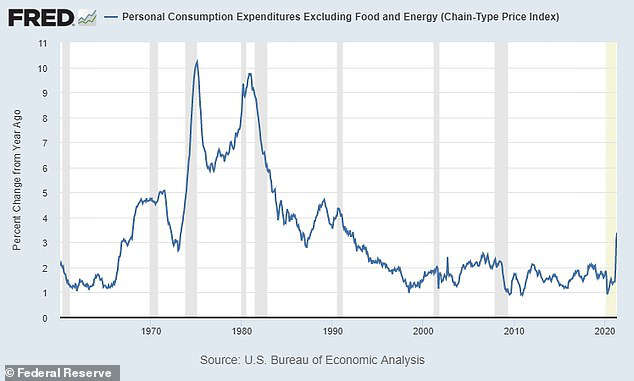

(2) Inflation is a measure of the change in a price.

Inflation is usually presented in terms of percentage of change. Currently inflation is running in excess of 10% this year, on an annual basis (annualized). Meaning prices (on aggregate) are 10% more than last year.

Inflation is usually presented in terms of percentage of change. Currently inflation is running in excess of 10% this year, on an annual basis (annualized). Meaning prices (on aggregate) are 10% more than last year.

(3) The rate of inflation for fuel, unleaded regular gasoline, is up 60% on an annualized basis.

When the WH and FED say inflation will "level off" next year, they are saying the price next year will remain at least 60% more than last year, and will increase *more slowly*.

When the WH and FED say inflation will "level off" next year, they are saying the price next year will remain at least 60% more than last year, and will increase *more slowly*.

(4) Saying "inflation is transitional", or "inflation will come back down", is a misnomer intended to lull you to sleep and accept what Barack Obama said years ago: "under my policies prices will necessarily skyrocket".

(5) Why such a massive one-year spike, and then a leveling off with prices remaining high?

The answer is not difficult; however, the financial media have a vested interest in you not understanding.

The answer is not difficult; however, the financial media have a vested interest in you not understanding.

(6) For the entirety of President Trump's term in office his economic policies were intentionally lowering prices.

For four years we were in a deflationary, or static place with consumer prices. [I'll explain in a minute]

For four years we were in a deflationary, or static place with consumer prices. [I'll explain in a minute]

(7) Four years of static pricing and dropping pricing that was specifically due to America-First economic policy.

Now... RIGHT NOW.... in one year, with the America-First agenda being destroyed, we are getting FOUR years of inflation compacted into one year.

Now... RIGHT NOW.... in one year, with the America-First agenda being destroyed, we are getting FOUR years of inflation compacted into one year.

(8) Right after the election the Fed knew what the reversal of Trump's trade and economic policies would do. That's why they said they would "accept inflation" in 2021.

reuters.com/business/energ…

reuters.com/business/energ…

(9) That’s Fed admission is because – while they will not say it openly, they know there’s no way to stop it.

Massive inflation is a direct result of the multinational agenda of the Biden administration; it’s a feature not a flaw, and it has nothing whatsoever to do with COVID.

Massive inflation is a direct result of the multinational agenda of the Biden administration; it’s a feature not a flaw, and it has nothing whatsoever to do with COVID.

(10) Keep in mind the first group to admit what is to come were the banks, specifically Bank of America, because the Fed monetary policy is part of the cause.

There is a doubling inflationary impact from the Fed pumping money.

msn.com/en-us/money/ma…

There is a doubling inflationary impact from the Fed pumping money.

msn.com/en-us/money/ma…

(11) Notice how Bank of America says "for up to four years" of large inflation. Why *four years*?

That's because BoA knows four years of Trump policy deflation preceded the current state of Obama/Biden "re-inflation". Four years = Presidential term.

That's because BoA knows four years of Trump policy deflation preceded the current state of Obama/Biden "re-inflation". Four years = Presidential term.

(12) If Biden policy to reverse Trump was executed at the same rollout scale of Trump's economic policy, it would take four years of rising prices. But Biden is reversing Trump policy in year one. Hence all the re-inflation comes in year one.

(13) You might remember, when Trump initiated tariffs against China (steel, alum, & more), Southeast Asia (product specific), Europe (steel, alum, & direct products), Canada (steel, alum, lumber, dairy), the financial pundits screamed that consumer prices were going to skyrocket.

(14) They didn’t. Consumer prices did not increase.

Trump knew they wouldn’t because essentially those trading partners responded in the exact same way the U.S. did decades ago when the import/export dynamic was reversed.

Trump knew they wouldn’t because essentially those trading partners responded in the exact same way the U.S. did decades ago when the import/export dynamic was reversed.

(15) Trump’s massive, and in some instances targeted, import tariffs against China, SE Asia, Canada and the EU not only did not increase prices, the prices of the goods in the U.S. actually dropped.

It sounds counter-intuitive, until you understand what happened. 👇

It sounds counter-intuitive, until you understand what happened. 👇

(16) To retain their position, China and the EU responded to U.S. tariffs by devaluing their currency as an offset to higher export prices. It started with China, because their economy is so dependent on exports to the U.S.

(17) China first started subsidizing the targeted sectors hit by Trump's tariffs. The CCP government of Beijing gave industries free electricity, gas, eliminated taxes due, etc etc. To help offset U.S. import tariffs.

They lowered the price of goods being exported.

They lowered the price of goods being exported.

(18) Then China went further. Beijing (total communist control over their banking system) devalued their currency to boost their avoidance of U.S. tariffs.

However, the currency devaluation had an unusual effect.

However, the currency devaluation had an unusual effect.

(19) The cost of all Chinese imports dropped, not just on the tariff goods. Imported stuff from China dropped in price at the same time the U.S. dollar was strong. This meant it took less dollars to import the same amount of Chinese goods; and those goods were at a lower price.

(2 0) Yes, the Beijing subsidies and currency devaluation worked in the way it dropped prices of Chinese goods and offset U.S. tariffs.

However, as a result, we were importing deflation…. the exact opposite of what the financial pundits claimed would happen.

However, as a result, we were importing deflation…. the exact opposite of what the financial pundits claimed would happen.

(21) Trump's overall "trade war" with China meant the Chinese were lowering prices in the battle, and as a consequence U.S. importers had lower prices.

These lower prices were passed on to U.S. consumers. Stuff from China was cheaper. ie. "deflation"

These lower prices were passed on to U.S. consumers. Stuff from China was cheaper. ie. "deflation"

(22) However, as the Chinese economy was under pressure, they stopped purchasing industrial products from the EU, that slowed the EU economy.

Germany, France and the EU were furious....

Germany, France and the EU were furious....

(24) In response to a lessening of overall economic activity, a *pissed off* EU then followed the same approach as China.

[Remember, the EU was already facing pressure from the exit of the U.K. from the EU system. BREXIT !!]

[Remember, the EU was already facing pressure from the exit of the U.K. from the EU system. BREXIT !!]

(25) The EU didn't like Trump putting steel & aluminum tariffs on them, then walking away from the Paris treaty, then dismissing the Transatlantic trade deal (TTIP), and now creating a massive North American economic engine with Mexico via the USMCA.

(26) So the EU decided to take the same approach as China and fight back. The EU central banks started pumping money into their economy and offsetting with subsidies. Yes, they essentially devalued the euro.

(27) The outcome for U.S. importers from the EU was same as the outcome for U.S-China importers. We began importing deflation from the EU side.

A strong dollar, lower Euro value; that means cheaper goods from the EU, and ultimately more deflation.

They really hated orange man.

A strong dollar, lower Euro value; that means cheaper goods from the EU, and ultimately more deflation.

They really hated orange man.

(28) In the middle of this there was a downside for U.S. exporters. With China and the EU devaluing their currency, and with a very strong domestic U.S. economy, the value of the dollar increased.

(29) This made purchases from the U.S. more expensive. U.S. multinational companies who relied on exports (lots of agricultural industries and raw materials) took a hit from higher export prices.

Trump would need to help farmers, specifically those dependent on exports....👇

Trump would need to help farmers, specifically those dependent on exports....👇

(30) However,... and this part is really interesting,... it only made those multinationals more dependent on domestic U.S. sales for income. With less being exported, there was more product available in the U.S for domestic purchase.

(31) With more product remaining in the U.S. what happened? Yup, you guessed it.... this dynamic led to another predictable outcome, even lower prices for U.S. consumers.

Lots of happy middle-class Americans. Orange man notsobad for them.

Lots of happy middle-class Americans. Orange man notsobad for them.

(32) From 2017 through early 2020 U.S. consumer prices were dropping. We were in a rare place where deflation was happening. Combine lower prices with higher wages, and you can easily see the strength within the U.S. economy.

(33) For the rest of the world this seemed unfair, and indeed they cried foul – especially Canada.

Canada was apoplectic. Tariffs on their lumber, dairy, Steel and aluminum, and then Trump shut down the NAFTA loophole they were using. Trudeau furious... sent Freeland to fight.

Canada was apoplectic. Tariffs on their lumber, dairy, Steel and aluminum, and then Trump shut down the NAFTA loophole they were using. Trudeau furious... sent Freeland to fight.

(34) However, this was "America First" in action.

Middle-class Americans were benefiting from Trump's reversal of 40 years of economic policies like those that created the rust belt. Democrats knew they had a big problem. Trump's economic agenda was working.

Middle-class Americans were benefiting from Trump's reversal of 40 years of economic policies like those that created the rust belt. Democrats knew they had a big problem. Trump's economic agenda was working.

(35) NOW.... REVERSE THIS… and you understand where we are with inflation.

JoeBama economic policies are exactly the reverse. The monetary policy that pumps money into into the U.S. economy via COVID bailouts and ever-increasing federal spending drops the value of the dollar.

JoeBama economic policies are exactly the reverse. The monetary policy that pumps money into into the U.S. economy via COVID bailouts and ever-increasing federal spending drops the value of the dollar.

(36) With the FED pumping money into the U.S. system, the dollar value plummets. At the same time, JoeBama dropped tariff enforcement to please the Wall Street multinational corporations and banks that funded his campaign.

(37) Now the value of the Chinese and EU currency increases. This means it costs more to import products, and that is the primary driver of current price increases in consumer goods.

(38) Simultaneously, a lower dollar means cheaper exports for the multinationals (Big AG and raw materials).

China, SE Asia and even the EU purchase U.S. raw materials at a lower price. That means less raw material in the U.S. which drives up prices for U.S. consumers.

China, SE Asia and even the EU purchase U.S. raw materials at a lower price. That means less raw material in the U.S. which drives up prices for U.S. consumers.

(39) It is a perfect storm. Higher costs for imported goods and higher costs for domestic goods (food). Combine this dynamic with massive increases in energy costs from ideological policy, and that’s fuel on a fire of inflation.

(40) Annualized inflation is now estimated to be around 10+ percent, and it will likely keep increasing. This is terrible for wage earners in the U.S. who are now seeing wage growth incapable of keeping up with higher prices.

(41) Real wages are decreasing by the fastest rate in decades. We are now in a downward spiral where your paycheck buys less. As a result, consumer middle-class spending contracts.

(42) Gasoline costs more (+60%), food costs more (+10% at a minimum) and as a result, real wages drop; disposable income is lost. Ultimately this is the cause of a stagnant economy & inflation.

(43) None of this is caused by COVID-19. All of this is caused by current economic policy and current monetary policy sold under the guise of COVID-19.

(44) If spending continues, the dollar drops. As a result the inflationary period continues. It is a spiral that can only be stopped if policies are reversed…. and the only way to stop these insane policies is to get rid of Wall Street democrats & republicans constructing them.

(45) Be patient, be respectful, be kind and caring. Don’t look for trouble. But when the time comes to fight, drop the niceties and fight for your family with insane ferocity. Fight like you're the third monkey on the ramp to Noah’s Ark…. and damned if it ain’t starting to rain.

• • •

Missing some Tweet in this thread? You can try to

force a refresh