🔴App Annie's latest mobile gaming report

🕹 Gaming is larger than the music and move industry combined.

📱 Mobile gaming is 3.1x console spend and continues to grow at a rapid pace! 🤯

🕹 Gaming is larger than the music and move industry combined.

📱 Mobile gaming is 3.1x console spend and continues to grow at a rapid pace! 🤯

One year into the Covid-19 pandemic, demand for mobile gaming remained strong with no sign of slowing down.

🚀🚀🚀

🚀🚀🚀

As mobile technology improves, we see a lot of value migrating towards mobile gaming.

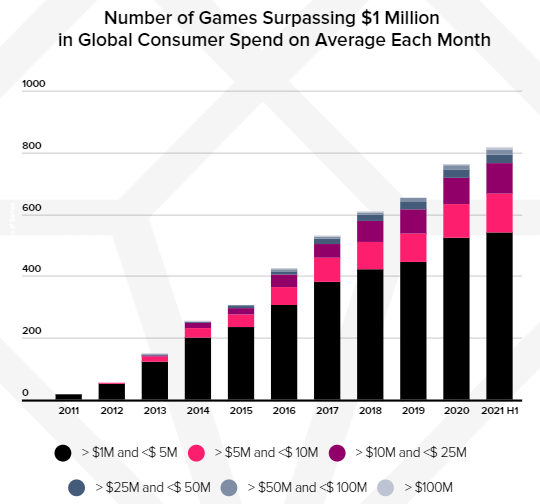

There are over 810 games surpassing $1M in consumer spends EACH MONTH.

There are over 810 games surpassing $1M in consumer spends EACH MONTH.

India is the World's biggest mobile game market by downloads.

Brazil, Indonesia and Russia present a ripe opportunity for publishers.

Find out why Garena Free Fire ($SE) is actively expanding into this region in this mega-thread here 👇

Brazil, Indonesia and Russia present a ripe opportunity for publishers.

Find out why Garena Free Fire ($SE) is actively expanding into this region in this mega-thread here 👇

https://twitter.com/SteadyCompound/status/1414394128243195907

US remains the biggest spender of mobile games.

However, APAC remained the world's biggest region for consumer spend in mobile games - accounting for over 45% of market share!

Mobile offers a unique opportunity to have a portable gaming console in the pocket of every smartphone

However, APAC remained the world's biggest region for consumer spend in mobile games - accounting for over 45% of market share!

Mobile offers a unique opportunity to have a portable gaming console in the pocket of every smartphone

This was a lil surprising, there are actually more female mobile gamers in the Western Markets!

Pokemon Go is the most popular game in most western countries.

Pokemon Go is the most popular game in most western countries.

RPG games are among the most successful genre for app monetization!

Genshin Impact launched on Sep 28, 2020 and generated over 23 million downloads on day one!

As of Jul 2021, Genshin Impact has surpassed Pokemon Go to be #1 game by lifetime consumer spend.

Genshin Impact launched on Sep 28, 2020 and generated over 23 million downloads on day one!

As of Jul 2021, Genshin Impact has surpassed Pokemon Go to be #1 game by lifetime consumer spend.

A core reason for RPG insane monetization is that it offers a much wider mix of engagement and monetization features.

Games under Shooting, Action, RPG and Strategy genres made up around half of total time spent!

Social and online features help cultivate deeper play and foster longer retention.

Social and online features help cultivate deeper play and foster longer retention.

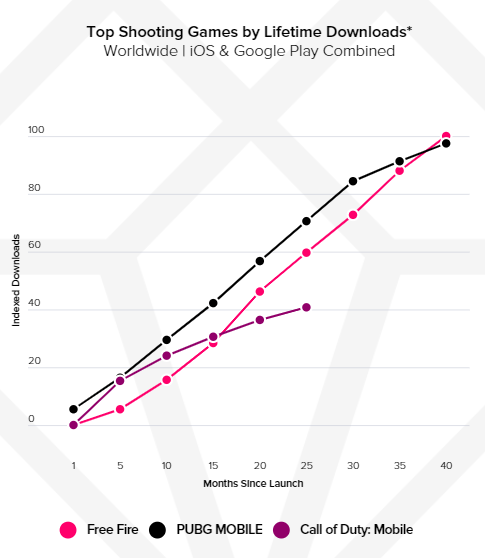

Free Fire ($SE) remains the top game under Battle Royale genre!

Insane execution by Garena in key markets such as Latin America, Indonesia and India.

Insane execution by Garena in key markets such as Latin America, Indonesia and India.

• • •

Missing some Tweet in this thread? You can try to

force a refresh