Rules on MREL (minimum requirement for eligible liabilities – eligible = the bond will be screwed if something bad happens) are so complicated, it’s comical.

I won’t go in the details of this nice equation and just mention the farcical situation of UK leverage requirements.

I won’t go in the details of this nice equation and just mention the farcical situation of UK leverage requirements.

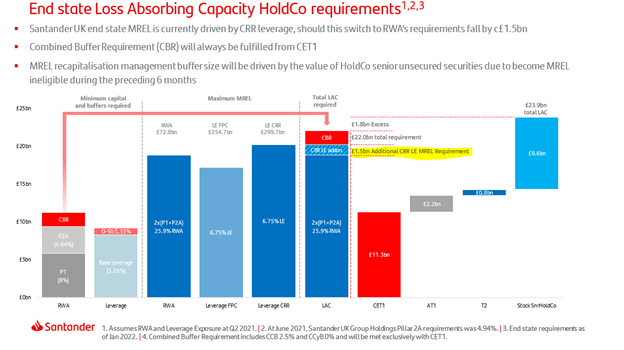

In the UK you have a leverage requirement – like everywhere else. But unlike in the EU (CRR) UK doesn’t count central bank cash in denominator (i.e. exposures). However, the UK MREL also includes a leverage requirement. This is basically 2x the 3.25% leverage requirement + CBR.

But because the UK also implemented the TLAC term sheet, UK banks also have to meet a *second* MREL leverage requirement which is 6.75%+CBR... BUT using CRR (i.e. EU) definitions of leverage, i.e. WITH central bank balances included!

Confused?

This is where it gets really funny.

Because of Covid, central bank balances were temporarily excluded from the leverage ratio in the EU / CRR – but that’s not applied In the UK !

So now the UK has to apply a EU rule… that has been temporarily suspended in the EU!

This is where it gets really funny.

Because of Covid, central bank balances were temporarily excluded from the leverage ratio in the EU / CRR – but that’s not applied In the UK !

So now the UK has to apply a EU rule… that has been temporarily suspended in the EU!

Santander UK had a nice chart explaining it but I’m fairly confident no one read it 😊 The bit in yellow I underlined is the glorious EU add-on.

• • •

Missing some Tweet in this thread? You can try to

force a refresh