1/14

✊ Core Units completed the final decentralization of @MakerDAO and its protocol

Now the workforce of a DeFi protocol that generates hundreds of millions in revenue is fully decentralized

How do Core Units work and why are they the future of work? Time for a new thread 👇

✊ Core Units completed the final decentralization of @MakerDAO and its protocol

Now the workforce of a DeFi protocol that generates hundreds of millions in revenue is fully decentralized

How do Core Units work and why are they the future of work? Time for a new thread 👇

2/14

🌄 From the beginning, Maker was conceived as an entirely decentralized organization. But for this to become a reality, it was necessary to build a solid base.

For this reason it started as a Foundation with employees in a traditional scheme.

🌄 From the beginning, Maker was conceived as an entirely decentralized organization. But for this to become a reality, it was necessary to build a solid base.

For this reason it started as a Foundation with employees in a traditional scheme.

3/14

🎯 This year the objectives of the Foundation were achieved, and therefore it was dissolved.

👨🏭🧑🏭So, without a Foundation, where is the workforce of the people who will continue to keep working and growing Maker? Core Units have arrived!

blog.makerdao.com/makerdao-has-c…

🎯 This year the objectives of the Foundation were achieved, and therefore it was dissolved.

👨🏭🧑🏭So, without a Foundation, where is the workforce of the people who will continue to keep working and growing Maker? Core Units have arrived!

blog.makerdao.com/makerdao-has-c…

4/14

☄️ A Core Unit is a structure that has a budget attached to it, managed by one or more Facilitators, that coordinate and pay contributors working to achieve the goals within MakerDAO

In other words, a Core Unit is an independent group that works for the DAO and its goals.

☄️ A Core Unit is a structure that has a budget attached to it, managed by one or more Facilitators, that coordinate and pay contributors working to achieve the goals within MakerDAO

In other words, a Core Unit is an independent group that works for the DAO and its goals.

5/14

👥🗣️ One of the most important decentralized features of a Core Unit is that they must be proposed by community members and voted on by Maker Governance.

👥🗣️ One of the most important decentralized features of a Core Unit is that they must be proposed by community members and voted on by Maker Governance.

6/14

📈 As the Maker Growth Core Unit, we are a company born out of the MakerDAO community, dedicated to the continued growth of the Dai stablecoin and the Maker protocol through strategic partnerships and business development.

📈 As the Maker Growth Core Unit, we are a company born out of the MakerDAO community, dedicated to the continued growth of the Dai stablecoin and the Maker protocol through strategic partnerships and business development.

7/14

🐣 How do we create ourselves? Just like all Core Units, everything starts from a proposal. @nad8802, as the Facilitator, made a proposal in the Maker forum so that the whole Maker community could see and comment it: forum.makerdao.com/t/mip39c2-sp4-…

🐣 How do we create ourselves? Just like all Core Units, everything starts from a proposal. @nad8802, as the Facilitator, made a proposal in the Maker forum so that the whole Maker community could see and comment it: forum.makerdao.com/t/mip39c2-sp4-…

8/14

🎨 There our motivation, our mandate and our strategy were described.

💸 In the same vein, our budget was proposed in another public blogpost for the community.

🗳️ And from that moment, our Core Unit proposal entered into the governance cycle.

🎨 There our motivation, our mandate and our strategy were described.

💸 In the same vein, our budget was proposed in another public blogpost for the community.

🗳️ And from that moment, our Core Unit proposal entered into the governance cycle.

9/14

👛 It was time for an entire community of token holders to decide if all the features of this Core Unit were necessary for Maker.

👛 It was time for an entire community of token holders to decide if all the features of this Core Unit were necessary for Maker.

10/14

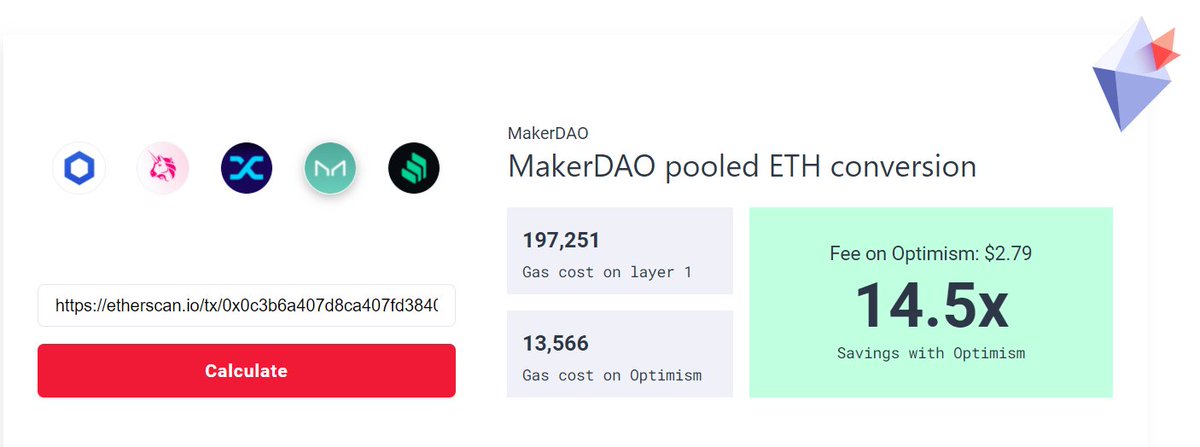

💰 Where does the money come from? Once the proposal and its budget are approved by the governance, that amount of Dai is transferred from the Surplus Buffer to a multisig wallet controlled by the Facilitator(s) of the Core Unit.

💰 Where does the money come from? Once the proposal and its budget are approved by the governance, that amount of Dai is transferred from the Surplus Buffer to a multisig wallet controlled by the Facilitator(s) of the Core Unit.

11/14

💱 Remember that the Surplus buffer is a place where all DAI from stability fees (fees from DAI minted as debt) are accrued. So, essentially it's where the protocol revenue is pooled.

💱 Remember that the Surplus buffer is a place where all DAI from stability fees (fees from DAI minted as debt) are accrued. So, essentially it's where the protocol revenue is pooled.

12/14

🤝 Our commitment to governance and the community does not end with the approval of the Core Unit. To contribute to the transparency of our work and the resources allocated, Core Units publish a weekly or bi-weekly performance report.

🤝 Our commitment to governance and the community does not end with the approval of the Core Unit. To contribute to the transparency of our work and the resources allocated, Core Units publish a weekly or bi-weekly performance report.

13/14

🏭 In short, MakerDAO's core unit system has shown that centralization of work is not essential. Chief officers, bosses, departments, hierarchy, and the commonplace we know as "work" have been redefined by the power of decentralized governance.

🏭 In short, MakerDAO's core unit system has shown that centralization of work is not essential. Chief officers, bosses, departments, hierarchy, and the commonplace we know as "work" have been redefined by the power of decentralized governance.

🧠🌌 Decentralization is here. Future is here. @MakerDAO, a business that generates hundreds of millions in revenue while redefining digital finance is driven by independent groups of workers that could be any community member with a great idea.

• • •

Missing some Tweet in this thread? You can try to

force a refresh