How to read an Income Statement 101

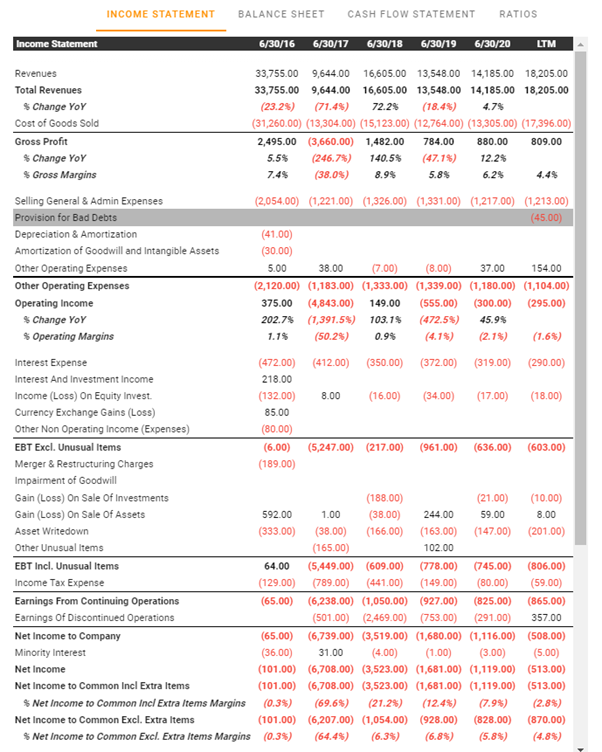

I use this website app.tikr.com

You can type in any company and it will display the financials.

Let's use Aveng of course

I use this website app.tikr.com

You can type in any company and it will display the financials.

Let's use Aveng of course

Red is bad. Black is good.

An Income Statement shows you if a company made profits or losses.

It contains all the income and all the expenses of the company

An Income Statement shows you if a company made profits or losses.

It contains all the income and all the expenses of the company

You start at the top with Revenue. This is the sales the company made. Think of it as the heart of any business. We all start a business to make sales.

You want this number to increase year on year, right???

Let's not worry about inflation now. This number must grow annually

You want this number to increase year on year, right???

Let's not worry about inflation now. This number must grow annually

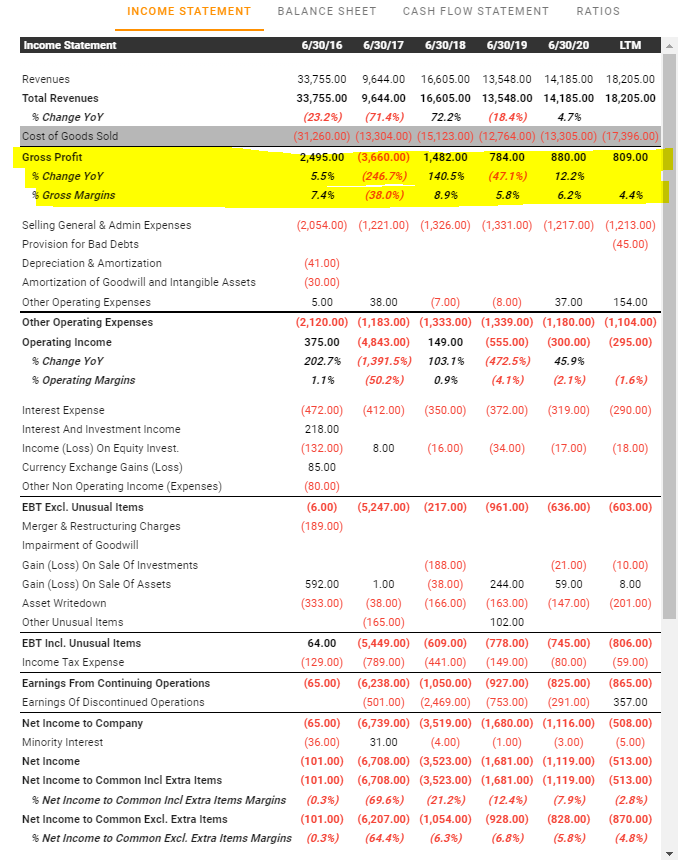

Next line is Gross Profit. This is the profit you make from selling your product.

If you are selling bread, you deduct the ingredients like flour, salt and yeast.

Here you don't deduct the rent and salaries and stuff yet, We are just checking if your product is profitable.

If you are selling bread, you deduct the ingredients like flour, salt and yeast.

Here you don't deduct the rent and salaries and stuff yet, We are just checking if your product is profitable.

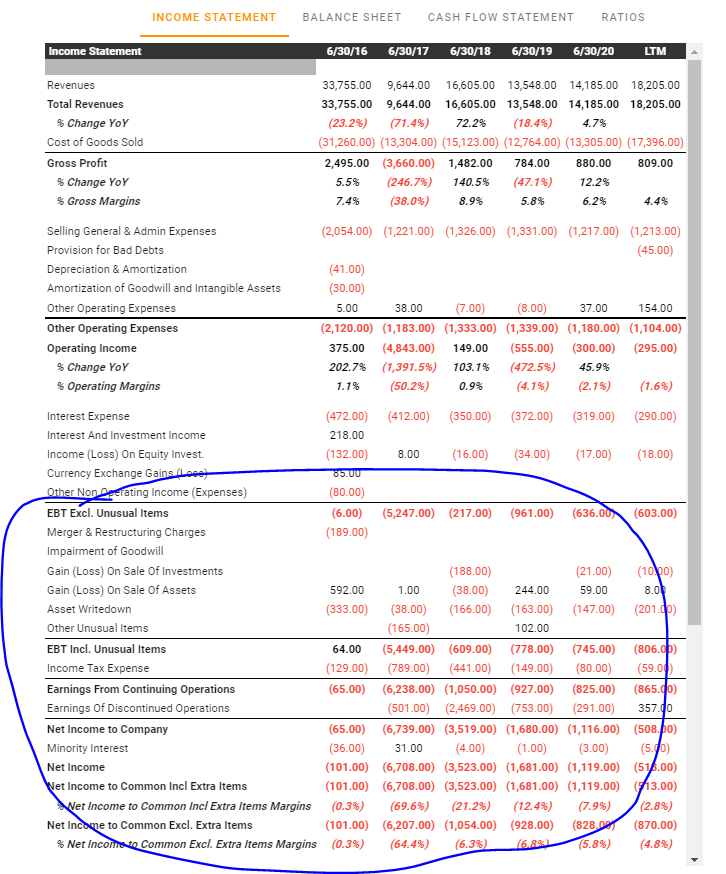

You see all those numbers at the bottom....Those are fancy stuff us accountants do because the accounting rules force us to. It means very little and it has no cash flow impact, so don't wreck your brain with it

When you look at Revenue, Gross profit and Net Profit, you must do these 3 things:

Compare it year on year

Compare it to the industry

Compare it to competitors

Sounds hard, but app.tikr.com does it for you

Compare it year on year

Compare it to the industry

Compare it to competitors

Sounds hard, but app.tikr.com does it for you

Thank you for attending this short lesson.

Tomorrow we tackle the Balance Sheet📚📚📚

Tomorrow we tackle the Balance Sheet📚📚📚

Sorry, sorry I forgot to tell you guys...

In accounting when you see LTM and NTM it means:

Last Twelve Months

Next Twelve Months

Companies have financial years which can be any 12 month period. Sometimes you wanna see last 12 months, instead of waiting for their year-end.

In accounting when you see LTM and NTM it means:

Last Twelve Months

Next Twelve Months

Companies have financial years which can be any 12 month period. Sometimes you wanna see last 12 months, instead of waiting for their year-end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh