Though #Bullmarket is continue since Apr 20.

But not every stock remain in Bull run.

Few rises up gradually and continuously but few get exhausted and gone into side ways consolidation or shifted into downtrend there bull run has come to halt.

So, the point is we need to(1/n)

But not every stock remain in Bull run.

Few rises up gradually and continuously but few get exhausted and gone into side ways consolidation or shifted into downtrend there bull run has come to halt.

So, the point is we need to(1/n)

Either trim our position or exit that stock which not only saves our hard earned money getting stuck for longer period of time with no return.

So, exit from a Stock which gave multibagger return is also imp.

Sharing few examples where Bull run is halted long back , 2/n

So, exit from a Stock which gave multibagger return is also imp.

Sharing few examples where Bull run is halted long back , 2/n

Which if u have exited could have save ur capital getting stuck and u could have compounded that in other better stocks.

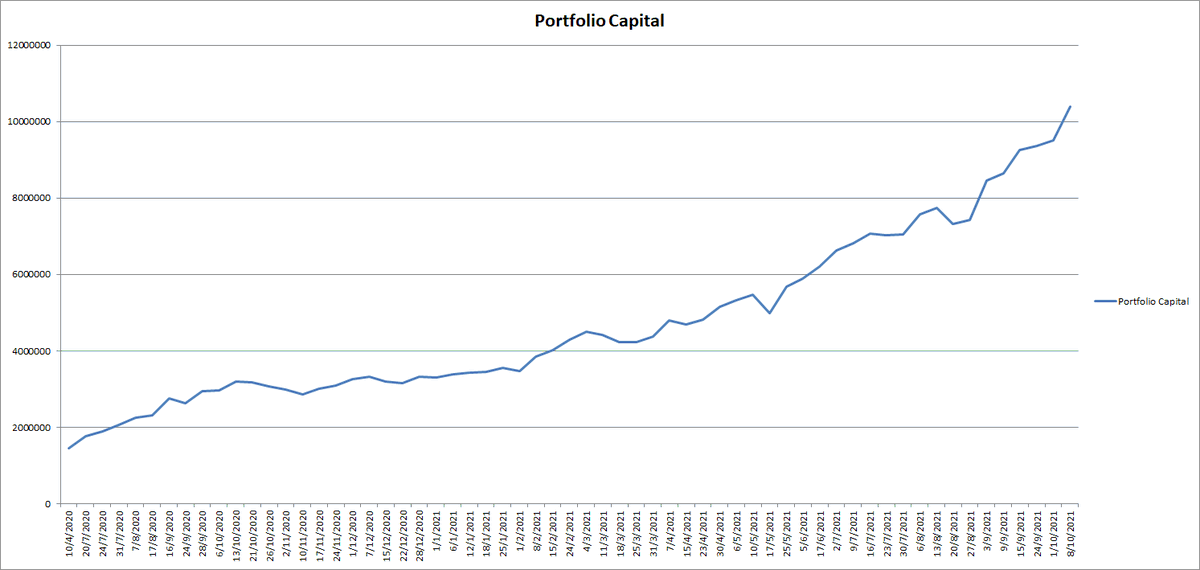

I did that with many stocks in last 1 yr. Which helped me compound my money faster.

Sharing few for ur study.3/n

I did that with many stocks in last 1 yr. Which helped me compound my money faster.

Sharing few for ur study.3/n

#Indiamart

Stock gave 4X return in 6 months after BO

But after climax top going down in last 6 months

7/n

Stock gave 4X return in 6 months after BO

But after climax top going down in last 6 months

7/n

#Neulandlabs

Stock gave 10X return from koee and 6X after BO in just 9 months

I bought at 470 and exited at 2500

But after bad result it gave climax top

And going down after that fall almost 50%

8/n

Stock gave 10X return from koee and 6X after BO in just 9 months

I bought at 470 and exited at 2500

But after bad result it gave climax top

And going down after that fall almost 50%

8/n

#Granules

Stock gave 2.5X return in 6 months after BO

I bought at 170 and exited at 370

But stock is stuck in sideways for almost 10 months now

10/n

Stock gave 2.5X return in 6 months after BO

I bought at 170 and exited at 370

But stock is stuck in sideways for almost 10 months now

10/n

So, finding multibagger is imp but it is also imp to exit from a stock after a decent run up when it starts to give sell signal. That's helps ur capital to compound and not get stuck.

@RajarshitaS @nishkumar1977 @caniravkaria @MashraniVivek @chartmojo @equialpha @MarketScientist

@RajarshitaS @nishkumar1977 @caniravkaria @MashraniVivek @chartmojo @equialpha @MarketScientist

#Hikal

Gave 4X return in just 4 months

But now shifted in downtrend.

Indication:

Made double top

Breaks 50DMA

similar to Aarti drugs example

Whatever be the fundamentals (I know it's good) but stock lost its momentum

Hikal ki nikal gayi hawa

Gave 4X return in just 4 months

But now shifted in downtrend.

Indication:

Made double top

Breaks 50DMA

similar to Aarti drugs example

Whatever be the fundamentals (I know it's good) but stock lost its momentum

Hikal ki nikal gayi hawa

#Persistent

Stock gave 6.5X return in 20 months after giving Break out around 780 level.

Stock respected 100 DMA very well through out before topping out.

Gave double top alert.

Get rerated from from high single digit PE to 40+ PE multiple.

Breaks last laxman resha 200DMA

Stock gave 6.5X return in 20 months after giving Break out around 780 level.

Stock respected 100 DMA very well through out before topping out.

Gave double top alert.

Get rerated from from high single digit PE to 40+ PE multiple.

Breaks last laxman resha 200DMA

• • •

Missing some Tweet in this thread? You can try to

force a refresh