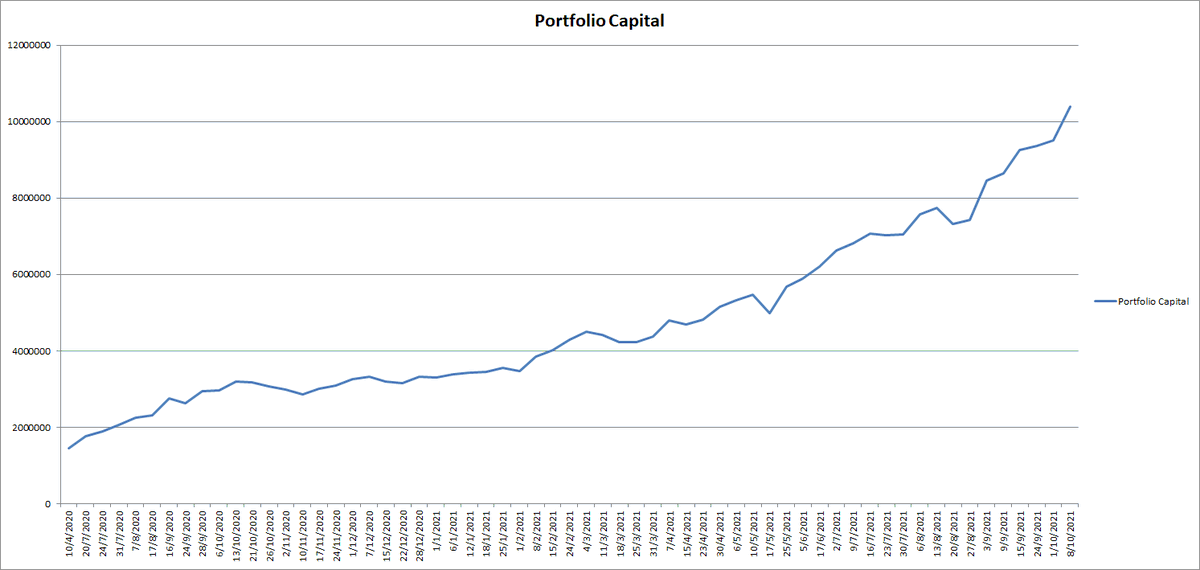

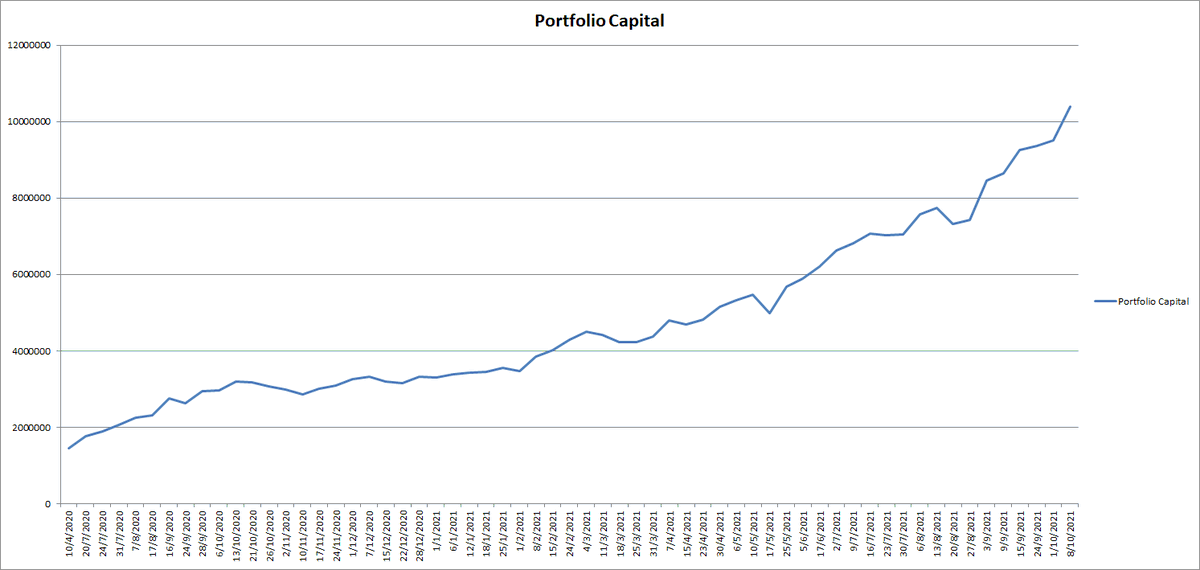

Full time Trader/Investor|FI @ 34|TechnoFunda|Trendfollowing| 6500%+ PF return in 4 yr(20-24)

👑छत्रपती शिवाजी महाराज की जय

👑छत्रपती संभाजी महाराज की जय🚩

How to get URL link on X (Twitter) App

In 2011, when I joined my 1st Job, A banker came to our hostel to open Bank Acc. of all new Joinee along with that he also opened our Demat acc. in HDFC sec by taking many signs

In 2011, when I joined my 1st Job, A banker came to our hostel to open Bank Acc. of all new Joinee along with that he also opened our Demat acc. in HDFC sec by taking many signs