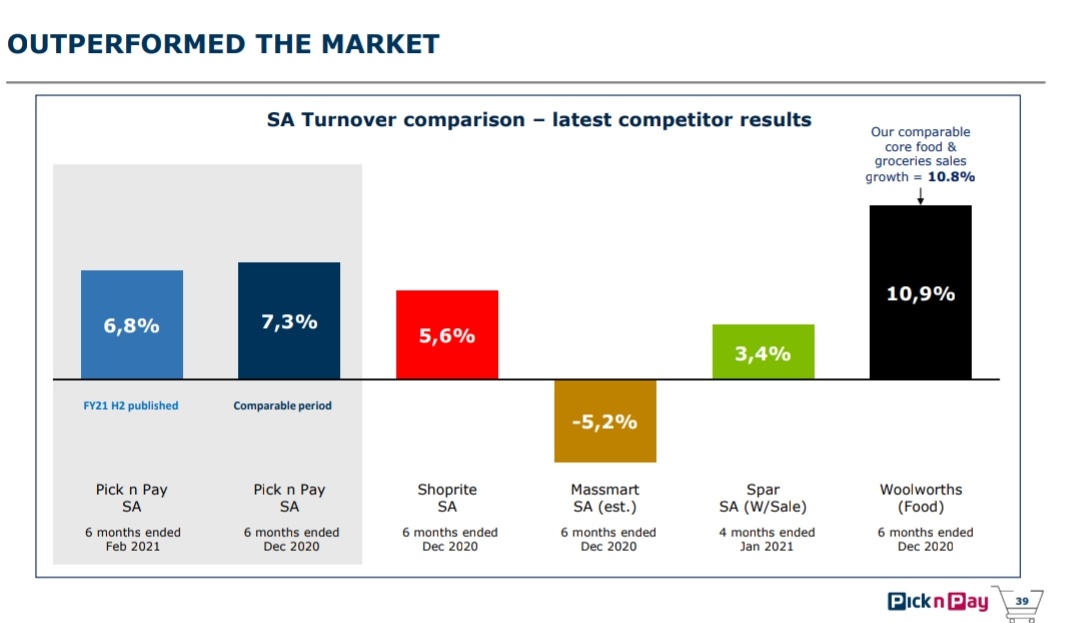

Former Pick n Pay CEO Richard Brasher stated that of the R200bn in sales growth expected in the South African grocery market to 2025, R140bn will come from the discount market where Pick n Pay is the least represented.

Shoprite Holdings has Usave.

Pick n Pay has Boxer.

Shoprite Holdings has Usave.

Pick n Pay has Boxer.

Pick n' Pay is open to the idea of buying Massmart’s Cambridge Food chain (63 Cambridge and Rhino stores).

This will enable it to compete aggressively in the discount market with Boxer and Cambridge Food against Shoprite uSave?

Boxer opened 44 stores in 2020.

This will enable it to compete aggressively in the discount market with Boxer and Cambridge Food against Shoprite uSave?

Boxer opened 44 stores in 2020.

Pick n' Pay already operates in this market via the ownership of Boxer.

It owns 342 Boxer stores. Boxer is South Africa’s leading limited-range discount supermarket.

Cambridge Food caters for the low- to middle-income shoppers which PnP is targeting.

It owns 342 Boxer stores. Boxer is South Africa’s leading limited-range discount supermarket.

Cambridge Food caters for the low- to middle-income shoppers which PnP is targeting.

Pick n Pay recently announced that Clicks plans to acquire the retail pharmacy business of Pick n' Pay, including 25 in-store pharmacies which will be rebranded to Clicks.

This is due to Pick n' Pay intending on streamlining its portfolio.

This is due to Pick n' Pay intending on streamlining its portfolio.

https://twitter.com/MaanoMadima/status/1391638966185701377?s=19

Is Massmart willing to sell?

Yes they are.

As part of Massmart’s restructuring, it announced that it would sell its Cambridge Food, Rhino and Massfresh businesses.

Massmart has appointed Barclays to facilitate the sale of the stores.

Yes they are.

As part of Massmart’s restructuring, it announced that it would sell its Cambridge Food, Rhino and Massfresh businesses.

Massmart has appointed Barclays to facilitate the sale of the stores.

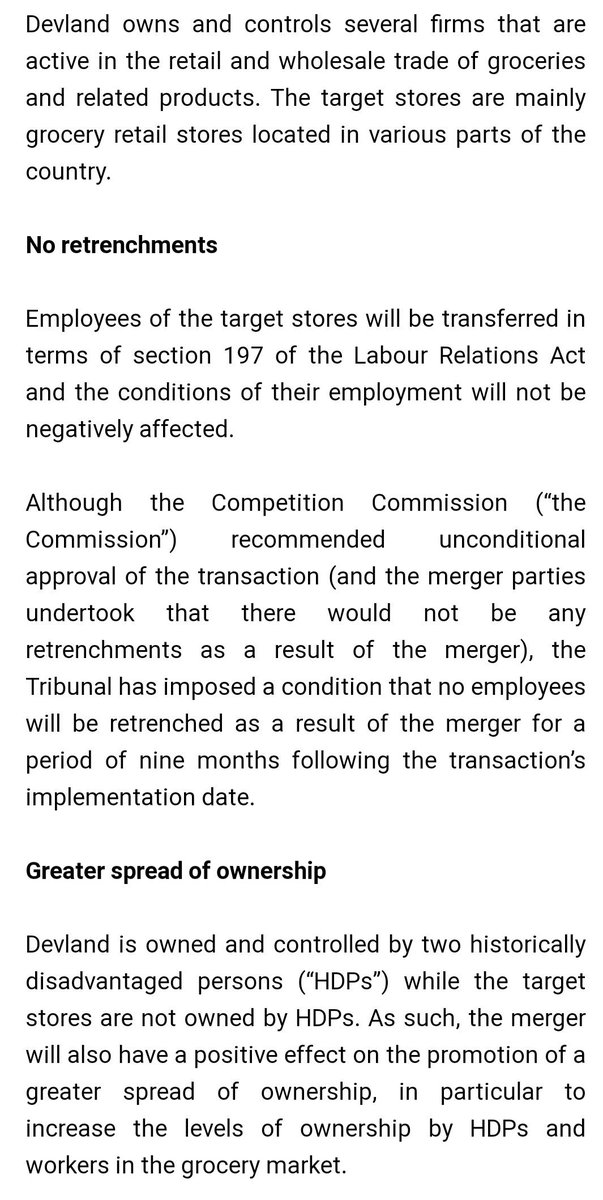

Earlier this year, The Competition Tribunal has approved Devland Cash and Carry's acquisition of 8 Masscash stores.

Masscash owns Jumbo, Cambridge Food and Rhino stores.

Massmart also announced that it is selling 14 additional Masscash stores.

Masscash owns Jumbo, Cambridge Food and Rhino stores.

Massmart also announced that it is selling 14 additional Masscash stores.

Massmart has destroyed so much shareholder wealth ever since Walmart paid ~R16.5bn for a controlling stake (51%)in Massmart.

A few months ago, Walmart gave its subsidiary Massmart a R4bn loan to be used to withstand the effects of Covid-19 after it suffered a R2.3bn revenue loss

A few months ago, Walmart gave its subsidiary Massmart a R4bn loan to be used to withstand the effects of Covid-19 after it suffered a R2.3bn revenue loss

The CEO of Massmart Mitchell Slape received a R24 million remuneration package for the year ended Dec 2020.

What were they rewarding him for?

What were they rewarding him for?

Massmart has been been struggling to make something pit of Game.

For the 26 weeks to end-June, Massmart impaired the Game chain stores by R570m.

Massmart recently introduced apparel in 60 Game stores and exited Fresh & Frozen in 51 stores.

For the 26 weeks to end-June, Massmart impaired the Game chain stores by R570m.

Massmart recently introduced apparel in 60 Game stores and exited Fresh & Frozen in 51 stores.

Many say Pick n' Pay should not purse Cambridge and focus its efforts on beefing up Boxer stores.

Will the Competition Commission approve this acquisition?

Are there any consequences for competition should this transaction go ahead?

Those are questions will need to answer.

Will the Competition Commission approve this acquisition?

Are there any consequences for competition should this transaction go ahead?

Those are questions will need to answer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh